After Barclays Center quarterly results drop, Forest City again downgrades revenue expectations, to $55M; interest exceeds net operating income

The Barclays Center is facing reality, sort of: it has significantly downgraded expected profits in 2016 after the New York Islanders arrive, even as current Net Operating Income (NOI) points to difficulty in meeting even that lowered expectation.

The current NOI doesn't even meet quarterly interest expenses.

As I wrote in January, the arena's rankings--second nationally in 2014, according to several metrics--masked a significant decline in the Barclays Center's popularity compared to its slam-bang debut year: 27% in total tickets sold, and 28% in gross revenue.

That suggests that the arena's seemingly impressive statistics--near the top or at the top (while Madison Square Garden was under renovation) regarding tickets sold and overall revenues--were achieved thanks to not always wise practices, including high spending, deals meant to lure big-name acts, and booking lower-quality acts.

As I wrote in January, the arena's rankings--second nationally in 2014, according to several metrics--masked a significant decline in the Barclays Center's popularity compared to its slam-bang debut year: 27% in total tickets sold, and 28% in gross revenue.

Revising expectations, a second time

In a press release yesterday, Forest City Enterprises quoted CEO David LaRue:

"Results for the Barclays Center arena were down in the first quarter, compared with the same period in 2014, a function of the number and mix of events in the comparable quarters. Based on the ramp-up of the property and its performance to date, we are revising downward our estimate of annual arena NOI at full stabilization to $55 million ($30.3 million at our pro-rata share), from $65 million. While this is disappointing, Barclays Center continues to be a venue leader in ticket sales and revenues in the country, a vital anchor for our Pacific Park Brooklyn project, and an important economic driver for all of Brooklyn."

Remember, the Wall Street Journal in October 2013, after the arena's first year, quoted Forest City Ratner CEO MaryAnne Gilmartin as predicting annual NOI would be $70 million by 2016.

In December 2013, Forest City dialed back to $65 million. This is an even more significant step.

Tale of the numbers

Note how the operating FFO (funds from operations) was actually negative during the first quarter, compared to the first quarter of 2014.

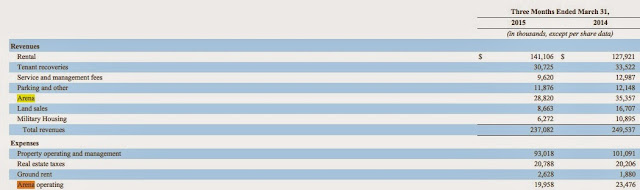

According to Forest City's 10-Q form to the Securities and Exchange Commission, total revenues in the first quarter of this year were $28,820,000, with operating expenses at $19,958,000. That leaves a profit at $8,862,000, notably before interest expenses. Projected annually, that suggests NOI at nearly $35.5 million.

Note that quarters are inconsistent, and that the Islanders are expected to have some positive impact, though the actual projection is unclear.

In 2014, the total first quarter revenues were $35,357,000, with operating expenses at $23,476,000. That leaves a profit of $11,881,000. Projected annually, that suggests NOI at $47.5 million.

In 2014, the total first quarter revenues were $35,357,000, with operating expenses at $23,476,000. That leaves a profit of $11,881,000. Projected annually, that suggests NOI at $47.5 million.

Also note that, with interest expense added, the arena revenues are essentially a wash, and depreciation takes the numbers into negative territory.

Comments

Post a Comment