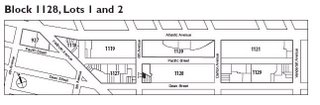

For some mental whiplash regarding the issue of blight, check out conflicting descriptions of two small lots, approximately 70' x 40' combined, on 6th Avenue in Prospect Heights, between Dean and Pacific streets.

For some mental whiplash regarding the issue of blight, check out conflicting descriptions of two small lots, approximately 70' x 40' combined, on 6th Avenue in Prospect Heights, between Dean and Pacific streets. The sunnier description comes from real estate brokers Massey-Knakal, whose advertisement states:

This prime development site of approximately 2520 square feet is situated on 6th Avenue between Dean and Pacific streets. This residential development site allows for approximately 5,880 square feet. This site is located half a block from Forest City Ratner’s Atlantic Yards project. This is a great residential development opportunity.

(Emphasis added)

The price tag : $2.25 million.

The location is off

The location is offThe site, however, would not be located half a block from the Atlantic Yards project, it would be within the project footprint. When I pointed that out to broker Chad Castle of Massey-Knakal last Thursday, he responded that they would update the listing. (It hasn't been updated yet.) The property, he said, has been on the market "for a few months."

Note that the property has not been purchased by Forest City Ratner. That suggests that the owner may still be in negotiations with the developer—or that the lots would be subject to condemnation by the Empire State Development Corporation (ESDC), which must pay fair compensation.

Note that the property has not been purchased by Forest City Ratner. That suggests that the owner may still be in negotiations with the developer—or that the lots would be subject to condemnation by the Empire State Development Corporation (ESDC), which must pay fair compensation. Is the ad simply an error? Or, more likely, is the sales effort an attempt to test the value of the property--which could aid in negotiations?

Lots of potential

Lots of potentialStill, empty lots in that area do have valuable development potential. A block east, on the southeast corner of Dean Street and Carlton Avenue, a new residential building is under construction on a 2000-square-foot site.

Up the block from the new construction at Dean Street and Carlton Avenue, a row house is being built on a 1600-square-foot lot on Carlton one building below Pacific Street (below, behind trees).

Though both new buildings would be across the street from the Atlantic Yards project, the potential construction nearby has not deterred development in the hot real estate market. The project excludes most of Dean Street between 6th and Carlton avenues; a Village Voice article suggested that it would've been too expensive to buy out the condo owners in the luxury Newswalk building, which dominates the block.

Though both new buildings would be across the street from the Atlantic Yards project, the potential construction nearby has not deterred development in the hot real estate market. The project excludes most of Dean Street between 6th and Carlton avenues; a Village Voice article suggested that it would've been too expensive to buy out the condo owners in the luxury Newswalk building, which dominates the block.Challenging the blight study

These new developments challenge the opening sentence of the ESDC's blight study:

This report finds that the 22-acre area proposed for the Atlantic Yards Arena and Redevelopment Project (“project site”) is characterized by blighted conditions that are unlikely to be removed without public action.

But it's blighted

But it's blightedTo the ESDC, which conducted a blight study, the lots on Sixth Avenue represent a textbook definition of blight. The study states, in part:

Both properties are small, vacant, irregularly shaped lots. They are partially paved, and appear to be used for parking and to store broken down automobiles

Unsanitary and Unsafe Conditions

As shown in Photograph B, lots 1 and 2 are surrounded by a chain-link fence topped with barbed wire.

Weeds grow on both the inside and outside of the fence. The weeds on the outside of the fence encroach onto the sidewalk. As shown in Photograph C, the lots themselves are partially paved with weeds growing in unpaved areas and through cracks in the pavement. The sidewalk bordering lots 1 and 2 is cracked in many places, and weeds grow along the curb and through some of the sidewalk cracks.

Underutilization

UnderutilizationAs indicated above, lots 1 and 2 are in R6B and a C4-4A zoning districts, respectively. Current zoning permits 1,800 zsf to be built on the 900 sf lot 1 and 8,160 zsf to be built on the 2,040 sf lot 2. The lots are currently vacant, utilizing none of this development potential.

Current conditions

While these properties are underutilized, it's hardly clear that public action is needed. The real estate listing, along with the examples of market-rate development down the block, suggests that a blight determination is not required to spur development--only the Atlantic Yards development, which would lead to a tower (No. 15) of 272 feet, some five to seven times taller than current zoning allows.

Also, the photographs and description portray the lots in a less flattering light than than their current condition. While the study states that the lots appear to be used to “store broken down automobiles,” and the pictures do back that up, when I stopped by last Wednesday morning, there was only one car inside the fence, on the right side of the photo, near the back of a building.

Also, the photographs and description portray the lots in a less flattering light than than their current condition. While the study states that the lots appear to be used to “store broken down automobiles,” and the pictures do back that up, when I stopped by last Wednesday morning, there was only one car inside the fence, on the right side of the photo, near the back of a building.

Comments

Post a Comment