Did the belated documentation disclosed by Empire State Development for the EB-5 loans confirm money was spent on Permitted Uses? Not quite.

Before the year is over, let's take a second look at some key questions about the EB-5 (investor visa) loans to Atlantic Yards/Pacific Park developer Greenland USA.

Was the money spent appropriately, on Permitted Uses?

Did documentation received by Empire State Development (ESD), the state authority that oversees/shepherds the project, jibe with previous information?

Had ESD received sufficient certification of the spending?

The answers: maybe not (despite ESD's later pronouncements), no, and no.

That means ESD did not sufficiently monitor the loans and may have been misled.

That points to a larger issue: ESD did not look closely enough at whether the process was legitimate, that the collateral for such loans was diluted to the point where it was insufficient to bolster the $349 million that Greenland--originally as Greenland Forest City Partners--borrowed from immigrant investors under the EB-5 program.

They each invested $500,000--forsaking interest for an expected five to seven years--for a short-term loan for a purportedly job-generating project. That money came in tranches of $249 million and $100 million.

They were only repaid a fraction, and the loan entered foreclosure; now a new joint venture, involving Related Companies, is expected to take over the collateral--rights to six towers (B5-B10) over the Vanderbilt Yard.

Let's back up.

My findings

I reported in January that only in June 2019, well after required annual reports were supposed to begin in 2015, did developer Greenland USA deliver an Expenditure Certificate, surely produced in response to my Freedom of Information Law request, certifying that EB-5 funds had been spent on Permitted Uses..

Despite the requirement to "provide ESD evidence," no such evidence—details, charts, receipts—was provided in the Expenditure Certificate. With better monitoring, ESD might have been more aware that the project was precarious.

|

Almost all the money was spent by the end of 2016, according to the Certificate:

During the period commencing on the Start Date and ending on December 31, 2016, the Borrowers received $341,050,000 in loan proceeds (of which, $9,500,000 were received in the calendar year of 2016) and applied all such Loan Proceeds to pay for costs incurred for the Permitted Uses.That means $331,550,000 had been received by 2015, with $9.5 million more in 2016, with all spent by the end of that year.

The Certificate also indicated that $7,025,000 was spent in 2017 and $650,000 was spent in $2018.

Asking for more

Later in January, the advisory Atlantic Yards Community Development Corporation (AY CDC) requested documentation on whether the EB-5 funds had in fact been spent on Permitted Uses, including:

- the permanent railyard for the Long Island Railroad

- a platform over the railyard to enable tower construction

- the acquisition of the MTA Air Space Parcel (the six tower sites over the Vanderbilt Yard)

- residential buildings on the "Mezzanine Encumbered Properties," or those six tower sites

- additional infrastructure, site work and environmental remediation with respect to those sites

March report

As I reported in March, ESD reported back that all was good.

Senior VP Anna Pycior stated, "So we do believe, based on invoices and documents from Greenland, that they've shared with our legal counsel, first off, that the total amount of the capital for the railyard and foundational work at the site exceeded the cost of the loan, to begin with. We don't have a full accounting for the spending of the loans. To the extent that we do, it was for Permitted Uses."

That elides an issue: while the total amount spent may exceed the loan proceeds, it doesn't address the timing.

|

| Emphasis added |

Those other buildings, B3 and B11, had already been largely funded. The only towers considered Permitted Uses by ESD were future towers, to be built over the new railyard.

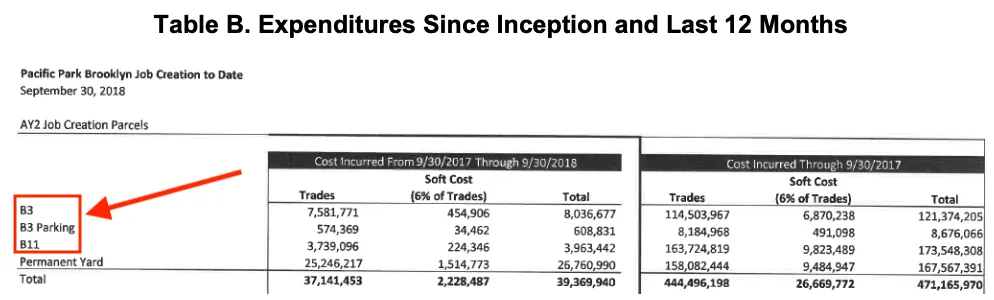

Needless to say, $167.6 million spent on the railyard by September 2018 is well below the purported $341 million spent by 2016.

At the March meeting, AY CDC Director Gib Veconi followed up on my later reporting that showed how the U.S. Immigration Fund has proudly cited how Atlantic Yards II and Atlantic Yards III fueled various towers, but none were for Permitted Uses.

"So how do we account then," he asked, "for the lender apparently having implied to investors that some of the proceeds from the loan would be used for other buildings that weren’t part of the collateral?"

Joel Kolkmann, ESD's Senior Vice President, Real Estate, responded, "So when we asked the lender that question, they represented to us that that was all related to jobs reporting. That's as a requirement of the EB-5 loan financing, reporting on jobs for the entire project and not just... the Permitted Uses that the loans themselves were actually financing."

(Note that the term "the entire project" refers to the amorphous EB-5 subset, not the overall project.)

But his statement pointed to the discrepancy between New York State's requirements regarding spending and federal government's more loose acceptance of a business plan.

Another deception

Kolkmann's statement, in light of the document above, suggests the USIF and/or Greenland might have been lying in their jobs reporting, if they underreported the spending on the railyard.

In other words, if all $249 million from "Atlantic Yards II" did go to railyard work, why would they not say so?

Perhaps because the failure to mention residential towers would highlight the ridiculous claim, in the consultant's memo, that railyard work qualified as "residential construction."

And why would they claim that? Because, as I wrote, such construction generates more jobs, as it commands a higher "multiplier"--a formula applied to spending--when jobs are calculated, for EB-5 purposes.

Nobody drilled down on that discrepancy, but Veconi sounded incredulous regarding the big picture: "They get credit to jobs created for parts of the project that the proceeds weren't used for. That’s OK under EB-5."

Kolkmann responded, "That's a representation that we received from the lender."

"That seems hard to believe that that's OK," observed Veconi, who later, on Twitter, called the USIF "a shady lender." (My comment: they're not even a lender, they're a middleman. But yes, they're shady.)

AY CDC Chair Daniel Kummer intervened. "I don’t think it’s our role to appraise the efficacy of the EB-5 program," he said, "and to fill in the holes that exist that allow that kind of slippage and use of data for one purpose and then for another, especially since job creation is a bit of an alchemy science to begin with."

"I think the important point here is that we have documentation," Kummer said, "that the funds were actually applied to where they were supposed to be."

As I wrote at the time: Not so. Not yet.

Comments

Post a Comment