Was ESD “asleep at the watch”? At Atlantic Yards CDC meeting, directors ask for reports on EB-5 spending. Muddy discussion of "over-leveraged" loans.

This is the third of three articles on the Jan. 23, 2024 meeting of the (purportedly) advisory Atlantic Yards Community Development Corporation (AY CDC). The first concerned the project's stalled progress. The second concerned questions about Site 5 and the plan for a proactive new board subcommittee.

Director Gib Veconi brought up an article I published the day before, Asleep at the Watch on the EB-5 Loans, which, based on Freedom of Information Law requests, argued that Empire State Development (ESD), the state authority that oversees Atlantic Yards/Pacific Park, did not do due diligence on the EB-5 loans now in foreclosure.Spending reports?

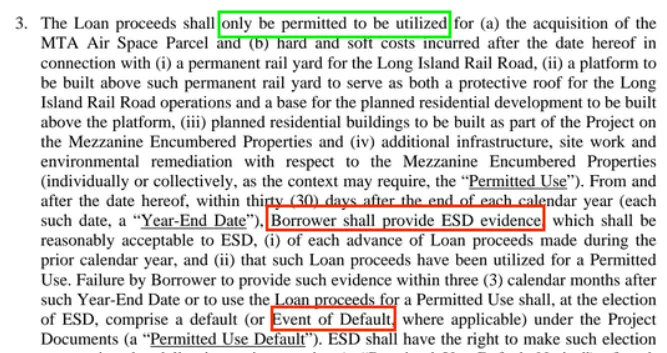

As I reported, my April 18, 2019 request for such documents produced an Expenditure Certificate signed by Greenland dated June 24, 2019, almost surely produced in response to my request.

Because the Lender is not a Lending Institution (as defined in the Interim Lease), the Equity Pledge contemplated by the Loan Agreement constitutes a Transfer (as defined in the Interim Lease) under the Interim Lease requiring the prior written consent of ESD, which may be given or withheld by ESD in its sole discretion. Accordingly, AYDC, Owner and Borrower have requested ESD’s consent to the Equity Pledge.

After I filed a FOIL request on April 18, 2019. I got a response from ESD dated July 3, 2019, which included an Expenditure Certificate, signed by Greenland USA's Gang Hu, dated June 24, 2019—after the date of my inquiry. It appears to have been created in response to my insquiry.

The Expenditure Certificate asserted, without the "evidence" required, that the money had been spent on Permitted Uses.

“Is it possible that the proceeds of the loan were used for something that was not a Permitted Use?” Veconi asked. “Do you know that that's not the case?”

“During the period after the loan proceeds were dispersed, there was a massive amount of construction in the railyard,” ESD attorney Richard Dorado responded. “That railyard construction seems to be complete.”

Beyond that, he said, “the foundations for I believe, perhaps two of the buildings, at least one of the buildings, are in place in the railyard.” (I don’t think the full foundations have been placed, but part of the foundations.)

Such construction is complex and expensive, he said, with the overall value “hundreds of millions of dollars.”

Compliance issues

Veconi agreed that the railyard work had been done. “Money is fungible,” he said. “But just for the sake of compliance with the loan agreements, do we have any backup that shows what the proceeds of the loan were used for? Has that ever been received?”

“We don't have it,” said Joel Kolkmann, ESD’s Senior VP, Real Estate and Planning. “Currently, I can't say that we have it in our possession. But we should be—we saw the inquiry and we would have to look into that.”

He didn’t reference the Expenditure Certificate, which merely asserted—rather than provided evidence—that the loan proceeds had been spent for permitted uses. And I'm not sure what he meant by "the inquiry."

Getting some proof

AY CDC Chair Daniel Kummer then moved that the board request that ESD get such documentation related to how the loan proceeds were used.

The motion passed, with a request for delivery before the next AY CDC board meeting. The body is supposed to meet quarterly, but has typically not met that schedule. The previous meeting was Aug. 2, nearly six months ago.

Over-leveraging or over-collateralization?

At another part of the meeting, Veconi expressed skepticism of the authority’s oversight of a new plan.

ESD lawyer Dorado suggested there was confusion on the latter issue. “There’s constant confusion on this. The over-collateralization did not occur. What happened was the developer arranged an additional equity investment into the project.”

(I think he misspoke, first muddling overleveraging with over-collateralization. According to Investopedia, "Over-collateralization (OC) is the provision of collateral that is worth more than enough to cover potential losses in cases of default." That's what should've happened. Instead, as I wrote, evidence suggested the loan was over-leveraged, as the collateral was insufficient to cover the loan.)

“With the same collateral?” Veconi continued.

"No,” Dorado said. “The article that appeared—and there seems to be a constant confusion—people use the word collateral, and they think in terms of the fee interest in real estate"--full ownership--"and that's not what happened. What happened was there was a mezzanine financing, which allowed for additional injection of capital to advance the project. That capital came in, in the form of this loan."

"People who invested in these two entities that own the platform developer took the risk of putting in more capital into this project," he said. "They bought in to a set of obligations to ESD. They still have to meet those obligations, if they find somebody who is a permitted developer that is satisfactory to ESD."

I don't follow that. The two borrowers, AY Phase II Mezzanine and AY Phase III Mezzanine, are affiliates of Greenland USA. What keeps them from just walking away? They lose the right and obligation to build.

However, putting more capital in doesn't necessarily mean it's sufficient capital. That said, that helps explain why ESD welcomed and--especially in the first round, in 2010--encouraged EB-5 financing, since it helps developers complete their projects.

“The expense of having somebody come through and do an estimation on what would be a speculative real estate project would be gigantic and would probably be useless,” Dorado said.

They left the issue there, but it deserves more scrutiny.

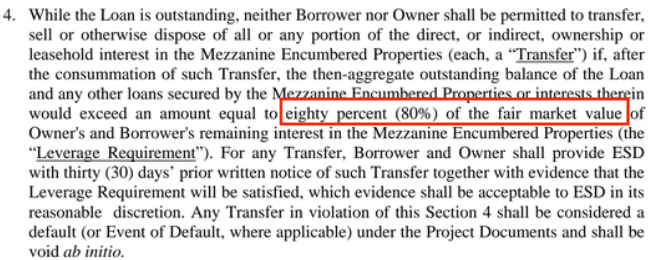

For any transfer, the borrower and owner had to provide ESD 30 days’ prior notice of such Transfer, plus evidence that the Leverage Requirement would be satisfied.

I filed a FOIL request seeking documents that confirm such written evidence had been provided. ESD told me it had no responsive records. So it seems they ignored the requirement.

When the second loan was issued, the collateral was diluted, not augmented. There’s no evidence that ESD was presented with evidence that the diluted collateral was sufficient.

What was the collateral?

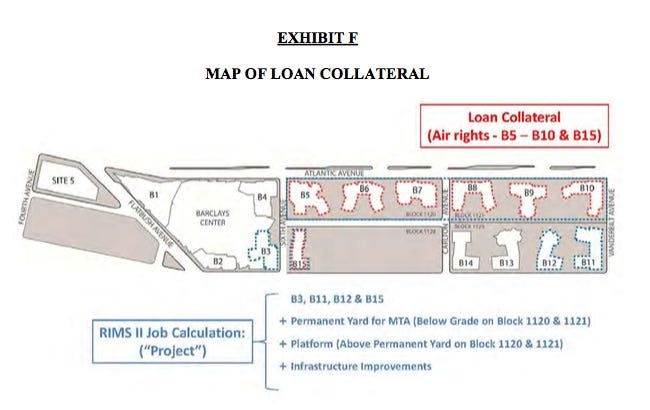

That collateral constituted the B15 site just east of Sixth Avenue between Dean and Pacific streets, now home to the 662 Pacific Street tower, and the sites B5 through B10 over the two blocks of the Metropolitan Transportation Authority's (MTA) Vanderbilt Yard.

|

| From the “Atlantic Yards II” Private Placement Memorandum |

The latter six sites require an expensive platform before construction, as well as payment to the MTA for development rights. At an 80% LTV ratio, the minimum appraised value of the collateral should’ve been $311.25 million.

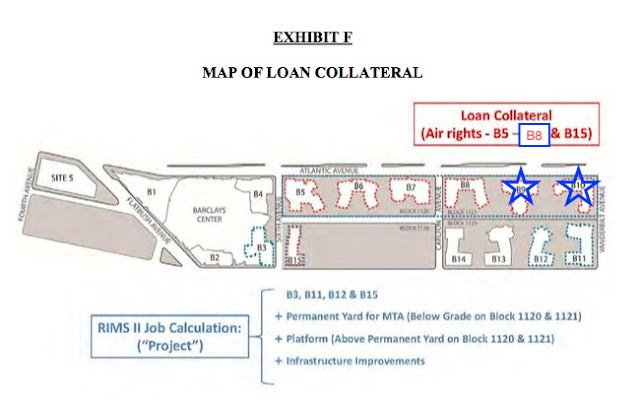

For the second loan, worth $100 million, the collateral was divided, and diluted. The initial $249 million would now be backed by parcels B5-B8, plus B15. The second loan, $100 million, would be collateralized by parcels B9 and B10.

|

| My annotation of the original collateral map, now excluding B9 and B10 |

Later, the EB-5 middleman, the USIF, took its own responsibility to maintain the Leverage Requirement and, in doing so, undermined—by my reading—the value of the collateral.

In December 2018, Greenland USA, by then owner of nearly all the project, sold the B15 lease to another developer, The Brodsky Organization, for $55,830,000, according to city records.

To do so, the borrower requested release of the lien on that parcel, according to a USIF message to investors. So a USIF affiliate looked into whether the sale would bring the borrower out of compliance with that 80% Leverage Requirement.

"The appraisal," investors were told, "confirmed that the proposed sale of B15 would require that the borrower partially repay the EB-5 loan, in an amount equal to the appraised value of the released parcels, equal to $63,160,000."

The red flag

That, in retrospect, should have been a red flag for Empire State Development. The $55.83 million value of the collateral, in this case, was less than the $63.16 million appraised value. (In other words, the appraised value should’ve been matched by reality, but wasn't.)

The borrower apparently had to repay investors with additional funds, beyond the sales transaction.

If the sale value of the remaining collateral was similarly less than the appraised value, the loan shouldn't have been approved in the first place. After all, with an 80% Leverage Requirement, the sale of collateral should deliver extra cash, rather than—as in this case—insufficient funds.

That suggested that the loan, rather than 80% of the collateral's value, instead exceeded that value—a sign of risk.

Comments

Post a Comment