To advisory group, ESD says (mystery) documents confirm that $349M in EB-5 funds were spent appropriately. Other evidence raises doubts.

This is the third of three articles about the Atlantic Yards Community Development Corporation (AY CDC) meeting March 26. The first concerned the project's murky future. The second concerned the issue of affordable housing.

Needless to say, $167.6 million is less than $249 million, so it doesn't look like they spent the full EB-5 funding on the railyard.

"So how do we account then," he asked, "for the lender apparently having implied to investors that some of the proceeds from the loan would be used for other buildings that weren’t part of the collateral?"

Joel Kolkmann, ESD's Senior Vice President, Real Estate, responded, "So when we asked the lender that question, they represented to us that that was all related to jobs reporting. That's as a requirement of the EB-5 loan financing, reporting on jobs for the entire project and not just... the Permitted Uses that the loans themselves were actually financing."

Nobody drilled down on that discrepancy, but Veconi sounded incredulous regarding the big picture: "They get credit to jobs created for parts of the project that the proceeds weren't used for. That’s OK under EB-5."

Kolkmann responded, "That's a representation that we received from the lender."

Sort of. As stated in a 2014 brochure aimed at potential investors:

So, were low-interest loans from immigrant investors, via the EB-5 investor visa program, received by project developer Greenland Forest City Partners (now, essentially, Greenland USA) spent appropriately, on helping move Atlantic Yards/Pacific Park forward?

Yes, said state officials. But documentation was not provided, and other evidence suggests otherwise.

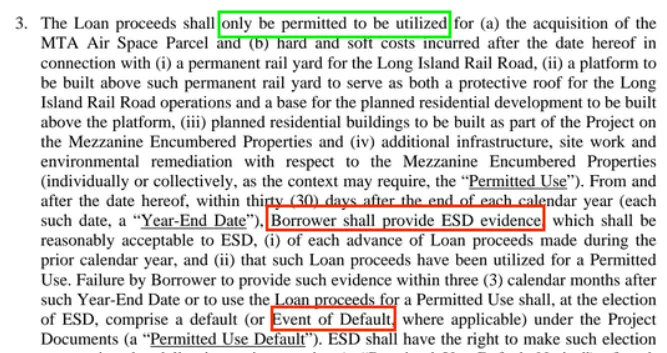

Anna Pycior, Senior Vice President, Community Relations at the parent Empire State Development (ESD), reported back on the AY CDC's previous request regarding whether the $349 million in EB-5 loans--tranches of $249 million and $100 million--adhered to what ESD had established as Permitted Uses.

I had reported, before the AY CDC meeting in January, that only in June 2019, well after the annual reports were supposed to begin in 2015, did developer Greenland USA, deliver an Expenditure Certificate, surely in response to my Freedom of Information Law request.

Given the delay, that meant ESD had no inkling whether its “Permitted Uses” were being met.

Also, despite the requirement to "provide ESD evidence," no such evidence—details, charts, receipts—was provided in the Expenditure Certificate. With better monitoring, ESD might have been more aware that the project was precarious; today, six development sites face a (twice-postponed) foreclosure auction.

Given the delay, that meant ESD had no inkling whether its “Permitted Uses” were being met.

Also, despite the requirement to "provide ESD evidence," no such evidence—details, charts, receipts—was provided in the Expenditure Certificate. With better monitoring, ESD might have been more aware that the project was precarious; today, six development sites face a (twice-postponed) foreclosure auction.

The official statement

Is there more evidence now?

"So we do believe," Pycior said, "based on invoices and documents from Greenland, that they've shared with our legal counsel, first off, that the total amount of the capital for the railyard and foundational work at the site exceeded the cost of the loan, to begin with. We don't have a full accounting for the spending of the loans. To the extent that we do, it was for Permitted Uses."

To build the arena, which is below-grade and partly within one block of the former three-block railyard, the Atlantic Yards developer agreed to move the tracks that store and service trains for the Long Island Rail Road.

During the process, the developer also installed "footings," or preliminary work on foundations for the future platform built above the railyard, to protect railyard functions while service as a base for six future residential towers.

No one asked for those "invoices and documents." I asked ESD, after the meeting, but was told to file a Freedom of Information Law request. That's pending.

However, other evidence, including a statement by an executive working on the railyard and a report provided by a consultant to the U.S. Immigration Fund (USIF, the "regional center" or EB-5 middleman that recruited investors), casts that assertion in significant doubt.

Executive says $200M+

As I wrote in 2019, the LinkedIn profile for Chengxu Yang, VP, Director of Construction at Greenland USA in New York, offered some intriguing clues about the progress and plans for Pacific Park Brooklyn.

That work included "LIRR VD Yard (Infrastructure, construction costs >$200M, near completion)." Translated: the new and relocated Vanderbilt Yard would cost more than $200 million, and was nearly finished.

That work included "LIRR VD Yard (Infrastructure, construction costs >$200M, near completion)." Translated: the new and relocated Vanderbilt Yard would cost more than $200 million, and was nearly finished.

But not necessarily a whole lot more than $200 million. Sure, there's wiggle room for foundation work, but $149 million worth? Doubtful.

Consultant says $167.6M

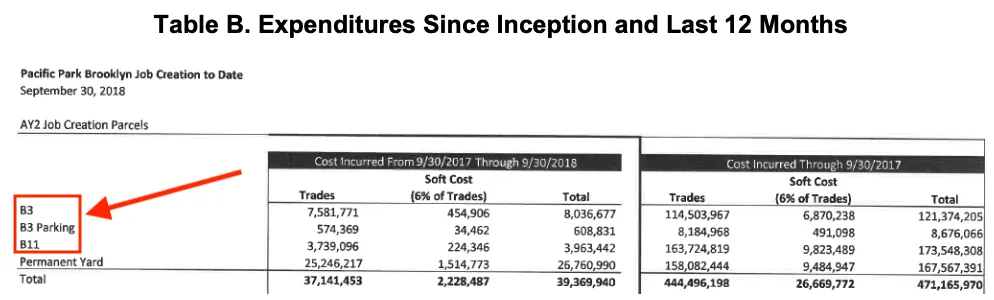

Consider: regarding "Atlantic Yards II," the first tranche of $249 million in EB-5 funding, economist Evans, Carroll, a USIF consultant, produced a job-creation report that attributed $167.6 million in spending to the railyard, with the rest--more than $300 million--attributed to other buildings.

Those other buildings, B3 and B11, had already been largely funded. The only towers considered Permitted Uses by ESD were future towers, to be built over the new railyard.

Needless to say, $167.6 million is less than $249 million, so it doesn't look like they spent the full EB-5 funding on the railyard.

If the railyard cost $200 million, perhaps the rest came from "Atlantic Yards III," the second tranche, which brought $100 million and was, according to the USIF, spent significantly on another ineligible tower, B14.

Of course, an EB-5 "project" is just an amorphous subset aggregated for marketing purposes and/or job-creation calculations. There was no discrete "Atlantic Yards II" or "Atlantic Yards III" project.

Asking questions

At the meeting, AY CDC Director Gib Veconi followed up on my later reporting that showed how the U.S. Immigration Fund has proudly cited how Atlantic Yards II and Atlantic Yards III fueled various towers, but none were for Permitted Uses.

"So how do we account then," he asked, "for the lender apparently having implied to investors that some of the proceeds from the loan would be used for other buildings that weren’t part of the collateral?"

Joel Kolkmann, ESD's Senior Vice President, Real Estate, responded, "So when we asked the lender that question, they represented to us that that was all related to jobs reporting. That's as a requirement of the EB-5 loan financing, reporting on jobs for the entire project and not just... the Permitted Uses that the loans themselves were actually financing."

Note that the term "the entire project" refers to the amorphous EB-5 subset, not the overall project.

But his statement pointed to the discrepancy between New York State's requirements regarding spending and federal government's more loose acceptance of a business plan.

Also note that the USIF, while representing those who lent the money, was not the actual lender.

Another deception?

Kolkmann's statement, in light of the document above, suggests the USIF and/or Greenland might have been lying in their jobs reporting, if they underreported the spending on the railyard.

In other words, if all $249 million from "Atlantic Yards II" did go to railyard work, why would they not say so?

Perhaps because the failure to mention residential towers would highlight the ridiculous claim, as shown below in the consultant's memo, that railyard work qualified as "residential construction."

And why would they claim that? Because, as I wrote, such construction generates more jobs, as it commands a higher "multiplier"--a formula applied to spending--when jobs are calculated, for EB-5 purposes.

EB-5's fundamental flaw

Nobody drilled down on that discrepancy, but Veconi sounded incredulous regarding the big picture: "They get credit to jobs created for parts of the project that the proceeds weren't used for. That’s OK under EB-5."

Kolkmann responded, "That's a representation that we received from the lender."

Again, the "project" was what they conjured up, for job-reporting requirement, yoking disparate elements.

"That seems hard to believe that that's OK," observed Veconi, who later, on Twitter, called the USIF "a shady lender." (My comment: they're not even a lender, they're a middleman. But yes, they're shady.)

AY CDC Chair Daniel Kummer intervened. "I don’t think it’s our role to appraise the efficacy of the EB-5 program," he said, "and to fill in the holes that exist that allow that kind of slippage and use of data for one purpose and then for another, especially since job creation is a bit of an alchemy science to begin with."

That it is. And the state rules on Permitted Uses did not match the looser federal EB-5 program guidelines.

"I think the important point here is that we have documentation," Kummer said, "that the funds were actually applied to where they were supposed to be."

That it is. And the state rules on Permitted Uses did not match the looser federal EB-5 program guidelines.

"I think the important point here is that we have documentation," Kummer said, "that the funds were actually applied to where they were supposed to be."

ESD staff alluded to statements it received. But we have no opportunity to judge the credibility of such statements.

Given the business ethics and practices of the USIF--for example, promoting the Barclays Center to investors whose money would not go into the arena, as well as CEO Nick Mastroianni's dubious track record, generating a Fortune investigation--a little skepticism is in order.

A bigger question

AY CDC Director Ron Shiffman, a veteran advocacy planner, commented, "The agreement"--I assume he meant the overall project agreement--"was to provide both affordable housing and jobs. It was up to this entity to make sure that was occurring, no matter how it was financed. And so that kind of oversight really has to exist. There was laxity--"

Kummer responded, "That's a different kind of oversight than specifically... analyzing compliance with the EB-5 program."

Kummer was right, in the sense that Shiffman had moved off the EB-5 compliance issue. But the bigger picture, as Shiffman suggested, was that ESD's job was not to simply enable the developer's acquisition of cheap capital but rather to make decisions that furthered the public interest.

A shaky enterprise

If the cost of the railyard development exceeded the proceeds from the EB-5 loans, Veconi asked, "how in the world was it imagined that the loans were going get paid off, because they were being used to pay for something that wasn't going to generate any revenue?"

A shaky enterprise

If the cost of the railyard development exceeded the proceeds from the EB-5 loans, Veconi asked, "how in the world was it imagined that the loans were going get paid off, because they were being used to pay for something that wasn't going to generate any revenue?"

"What does the lender say to that? Or what do we say to that?" he continued. "Y'know, a construction loan gets paid off with permanent financing because it supports a building that has revenue, but this doesn't have any revenue. So how was the loan going to be repaid?"

"I can't speak to the financial structures at the time," said Pycior, who like her colleagues was not present when the deals were made.

"I can't speak to the financial structures at the time," said Pycior, who like her colleagues was not present when the deals were made.

"I assume they had a solution where, when they were actually going to develop housing, there'd be proceeds to pay off this loan," Kolkmann observed.

Sort of. As stated in a 2014 brochure aimed at potential investors:

[Original developer] Forest City Ratner Companies anticipates that upon completion and stabilization of the project, the residential components will generate substantial cash flow from sales activities and rental income, which will allow them to successfully refinance and repay the senior and EB-5 loan. These projections are based upon the Developer’s many years of experience with similar projects developed, managed and owned.

Later, in an update to investors, the USIF stated, as indicated in the highlighted section at right, that “construction spending activities” on B3, B11, B12, and B15 satisfied job-creation requirements, as did "the infrastructure of the permanent rail yard and platforms."

The first problem: there was no actual spending on B12 or B15, nor the platform, unless you count the foundation work. (Remember, the USIF is not necessarily reliable.)

The second is that B3 and B11 were not Permitted Uses.

The joint venture Greenland Forest City Partners did, ultimately, sell through the condos at B11, 550 Vanderbilt Avenue. But funds received may not have done more than cover construction cost.

The joint venture did, ultimately, sell B3 (38 Sixth Ave.) and B14 (550 Carlton Ave.), but did not, apparently, apply those revenues to repay EB-5 investors. Now it's all the responsibility of Greenland USA.

No records

Somebody at ESD, Veconi observed, would've signed off on the loan and "I would think would have been interested in what would have happened if there weren't funds available to pay off the loan when it was due. Because that would’ve clearly lead to the exact situation we're in right now," he said, referencing the foreclosure. "Would it not? But I mean, since we're there, I guess we know the answer."

"And then again, we weren't here at the time," Kolkmann said.

"I know," said Veconi. "But I just wondered... maybe there's something in the file that explains what was intended. But, I mean, it must have been known for some time that there weren't going to be buildings appearing above the railyard in time to start generating income that could be used to take out the EB-5 investors with some permanent financing."

"In our search for clarity on this," Kolkmann said, "we had we did not come across anything."

"I know," said Veconi. "But I just wondered... maybe there's something in the file that explains what was intended. But, I mean, it must have been known for some time that there weren't going to be buildings appearing above the railyard in time to start generating income that could be used to take out the EB-5 investors with some permanent financing."

"In our search for clarity on this," Kolkmann said, "we had we did not come across anything."

Perhaps that sequence might have been remedied had, in fact, ESD had enforced the requirement that the developer deliver the annual reports.

Comments

Post a Comment