Greenland USA point man Solish leaves for The Brodsky Organization, which built B15 tower & partnered on B4. What's next? Greenland renegotiation with NY State?

Greenland USA's longtime Pacific Park point man, Scott Solish, who began overseeing development and operations of the project in August 2014 and has faced increasingly tough questions about the project's future, has left for The Brodsky Organization, a family-owned real estate firm that bought one Atlantic Yards development site from Greenland to build a tower and partnered with Greenland to build another.

"I'm incredibly proud of the progress and accomplishments realized at Pacific Park," Solish said in a statement in response to my inquiry, "and, although I am no longer involved, I look forward to seeing the next phases of the project be realized by my former colleagues and friends."

In Solish's 8.5 years, Atlantic Yards/Pacific Park's uneven progress included seven new towers, a new railyard for the Long Island Railyard, and plans announced--yet unrealized--for a crucial platform over that railyard to support six towers and deliver most of the project's open space, thus curing the purported "blight" that helped justify the state's use of eminent domain.

While nearly half of the approved 6,430 apartments have been built, the project is less than half finished, and a crucial May 2025 deadline for affordable housing surely won't not be met, with 877 (or 876) units yet to launch. In the midst of it all: a pandemic, rising interest rates, changing city/state tax policy, and a Shanghai-based parent that's faced financial troubles and a credit crunch.

|

| Scott Solish/LinkedIn |

Waiting for Greenland

A statement from the developer--part of Greenland Holdings Corp., a giant conglomerate that expanded rapidly outside of China, but has since pulled back--may clarify its continued commitment to Atlantic Yards/Pacific Park, its plans to build the platform, and its expected effort to renegotiate the $2,000/month fines for delayed affordable units.

My query to Greenland's p.r. firm late yesterday didn't get a response. (Greenland owns nearly all of Greenland Forest City Partners, a nominal joint venture.)

I was told--not by Solish--that Greenland USA Design Director Jen Kuang would now be a contact person for the project. While Kuang on her LinkedIn says she "[l]ed and managed the multiple projects in Pacific Park Brooklyn development," she likely can't be a full successor to Solish, as she hasn't made presentations to the public or government bodies.

Solish's new role as Brodsky's Director of Acquisitions and Development offers new opportunities with a firm he worked with while at Greenland, but his statement suggests that such work won't include Pacific Park. Brodsky, unlike Greenland, isn't publicly traded, and is focused on New York City, not part of a sprawling conglomerate.

Crunch time approaches

Solish, as Greenland's sole public presence in Brooklyn, in the past year has been unable to deflect questions about the unsteady future of Atlantic Yards/Pacific Park.

While Solish in May 2022 began sharing information about the developer's plan to finally build the first block of the two-block platform over the Metropolitan Transportation Authority's (MTA) Vanderbilt Yard, as well as plans for the first of three towers over that first block, B5 (700 Atlantic Ave.), the work never started, with no candid explanation why.

Though Solish had long said Greenland would meet its obligations, at the June 2022 meeting of the Atlantic Yards Community Development Corporation (AY CDC), he hinted that the developer might ask Empire State Development (ESD), the state authority that oversees/shepherds the project, for an extension or other accommodation to avoid the $2,000/month fines for each missing affordable unit.

"How do you envision that requirement to be met in three years?" Solish was asked by AY CDC Director Gib Veconi, the best-informed member of the purportedly advisory body.

"I think we're building as hard as we can," Solish responded, avoiding a direct answer.

While Greenland seemingly had decided to move ahead on the platform--including the selection of a contracting team--despite the impacts of the pandemic, recent rising interest rates and the state's failure to renew the 421-a tax break may have affected its financial calculations, making new construction more risky.

(Update: a reader suggests that geopolitical tensions between the United States and China, most recently centered on the latter's potential trade with the Russian military, also may make government-owned firms more wary of investment.)

In January 2018, Forest City New York (as the firm had become known) CEO MaryAnne Gilmartin and key team members left to form L&L MAG. At the same time, Greenland USA took all but 5% of Forest City's share going forward, thus leaving the original developer without any power.

Both buildings contain 30% below-market units, albeit geared to middle-income households earning 130% of Area Median Income (AMI), who are hardly those who marched for the project's much-touted "affordable housing."

The AY CDC is supposed to meet quarterly, with Solish typically making a presentation, but has not met since June. Further news about the status of Pacific Park might surface at the body's next meeting, expected this month.

The failure to start the platform--whether the cause is permitting/design problems and/or financial reticence from Greenland USA's parent--has been a glaring sign that the project has bogged down and, perhaps, nudged Solish to consider a new opportunity.

History of changes

Atlantic Yards has a history of over-optimistic projections by the developers, aided by accommodating government oversight.

It was announced in 2003, approved in 2006 and then, after delays caused by lawsuits and the global recession, re-approved in 2009, with original developer Forest City Ratner renegotiating more favorable terms with ESD and also the MTA, allowing 22 years to pay (at a gentle interest rate) for rights to build over the railyard, rather than paying $100 million on closing.

At each juncture, the project was supposed to take ten years to build, though ESD, after that 2009 vote, allowed a 25-year buildout, until 2035.

To raise cash, Forest City, which had bought the New Jersey Nets to leverage the project, sold most of the basketball team, and a minority share in the arena operating company, to Russian oligarch Mikhail Prokhorov. He later bought the rest, and in 2017 announced the sale of the team to Alibaba billionaire Joe Tsai, who in 2019 bought the rest of the team and the arena company.

Forest City embarked on a risky venture to build a new product line via modular construction. However, the B2 tower, 461 Dean Street, which Forest City launched in 2012, bogged down with leaks, delays, and conflict with then-partner Skanska.

In 2013, facing looming losses, Forest City sought a new investor, and found Greenland, eager to expand in markets beyond China. Its chairman proclaimed, unwisely, that the project could be completed in eight years.

Upon entering Brooklyn in 2014, Greenland bought 70% of the project going forward from Forest City, excluding the arena operating company and 461 Dean, which Forest City in March 2018 sold to Principal Global Investors.

Greenland then changed the project's name to Pacific Park Brooklyn, purportedly to focus on the (yet unbuilt) open space or, as I contended, to distance the project from past controversies.

Greenland and Forest City, as 70/30 partners, built by 2017 the condo tower 550 Vanderbilt (B11) and the two "100% affordable" towers, 535 Carlton Ave. (B14) and 38 Sixth Ave. (B3), with the latter containing predominantly middle-income units, a departure from the original developer's promises (but allowed by generous state regulators).

But rising costs, the loss of a special 421-a tax break regarding the project, and competition from Downtown Brooklyn towers led junior partner Forest City in November 2016 to declare a unilateral stall in Pacific Park, presaging a reconfiguration announced more than a year later.

|

| Plank Road (B15) at left. Brooklyn Crossing (B4) at right. In center are 38 Sixth and 461 Dean. Photo by Norman Oder Jan. 10, 2023, looking south from Atlantic Ave. |

New developers enlisted

The departure of Forest City, which had taken the public-facing lead on the project even as minority partner, elevated the public profile of Solish, an urban planner who had previously worked as a Vice President of the New York City Economic Development Corporation.

He began at Greenland USA in 2014 as Director of Development and in January 2020 was elevated to Executive VP.

Whether it be rising infrastructure costs, including the cost of the railyard and (future) platform or the parent company's financial needs, Greenland more recently has raised money by selling development rights and completed buildings, rather than launching towers on its own.

Brodsky, which has a long history of building luxury apartments in Manhattan, has recently branched out recently to Brooklyn. It bought from Greenland development rights to the B15 parcel and built the 312-unit 662 Pacific St., aka Plank Road. The market-rate units have been fully leased, according to Brodsky.

Brodsky joined Greenland in building the 858-unit B4 tower, 18 Sixth Ave. (aka Brooklyn Crossing), the project's largest tower so far, and has been responsible for marketing the units. (The building's website is attributed to Brodsky, not the joint venture.)

|

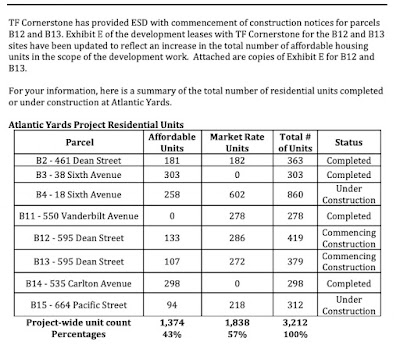

| All on this ESD-provided chart are now complete, except for B12 & B13, which should open soon. Note: the B4 tower has 858 apartments, not 860. |

Greenland Forest City also sold development rights to the B12/B13 sites, now known collectively as 595 Dean Street, to TF Cornerstone, another New York-based, family-owned development company.

Those residential towers, with a total of 798 apartments and 30% middle-income affordable units, are expected to open in the next few months.

By the end of 2018, Forest City was no more, as its parent company, Forest City Realty Trust (formerly Forest City Enterprises) had been absorbed by Brookfield Asset Management.

Last May, Greenland and Brookfield/Forest City sold the two "100% affordable" towers built as 70/30 partners, 535 Carlton Ave. and 38 Sixth Ave., to Avanath Capital Management.

It's unclear whether the money was meant to support platform construction or to bolster Greenland USA's coffers. The firm has pulled back from its other major project, Metropolis in Los Angeles, selling two towers last year at a $200 million loss.

A delay, then a renegotation?

Solish's departure may help explain why ESD failed to schedule the regular bi-monthly Quality of Life meetings as expected in November 2022 and January 2023, and why, unusually, Solish was absent from the 2/7/23 meeting.

ESD's Atlantic Yards Project Director, Tobi Jaiyesimi, at that meeting, hinted at the state's willingness to renegotiate the 2025 affordable housing deadline, saying that "the developer may face a penalty of $2,000 per unit," rather than treating that obligation as contractually bound.

It was negotiated in 2014, with the coalition BrooklynSpeaks, as part of a settlement to avoid a potential fair-housing lawsuit, on the premise that delays in the project--given the completion date of 2035--would disproportionately affect Black residents, who'd be displaced from neighborhoods near the project site before they could take advantage of locals' preference in the city's affordable housing lottery.

(That preference only applies to city-subsidized units, not those incentivized only by the updated version of the state's now-expired 421-a break, which has fueled the exclusively middle-income "affordable" units at B4, B15, and the upcoming B12/B13. The preference did apply to units subsidized by the tax break as of 2014.)

My recent Freedom of Information Law (FOIL) request regarding the progress of the platform was denied by ESD on the grounds that records sought would "contain information that 'if disclosed would impair present or imminent contract awards.'"

A reconfiguration of the project might involve more than the timetable for the housing and platform. Greenland Forest City in 2015-16 started floating plans to move the unbuilt bulk of the B1 tower (aka "Miss Brooklyn"), once slated to loom over the arena, across Flatbush Avenue to Site 5, longtime home to the big-box stores Modell's (now closed) and P.C. Richard.

|

| Plan for Site 5 project floated in 2016 |

Site 5 has already been approved for a significant, 250-foot, 440,000 square foot tower. However, the earlier plans proposed a two-tower project with more than 1.1 million square feet. But that requires a public process and a vote by the gubernatorially controlled ESD.

That site, the last piece of terra firma in Atlantic Yards/Pacific Park, does not depend on a platform.

If and when Greenland gets permission to transfer the bulk, Site 5 could be--depending on how much affordable housing is included, and how deeply affordable it is--worth $300 million, I speculated, a valuable parcel to sell. (Or, perhaps, to find a joint-venture partner like a Brodsky or TF Cornerstone.)

But the affordable housing deadline and the future of Site 5 now depend on the Greenland team in place after Solish's departure, the posture of Gov. Kathy Hochul and the state authority she controls, and the efforts by local advocates and elected officials to keep the public interest in focus.

Comments

Post a Comment