IBO confirms that 421-a has disproportionately incentivized "affordable housing" for the middle-class

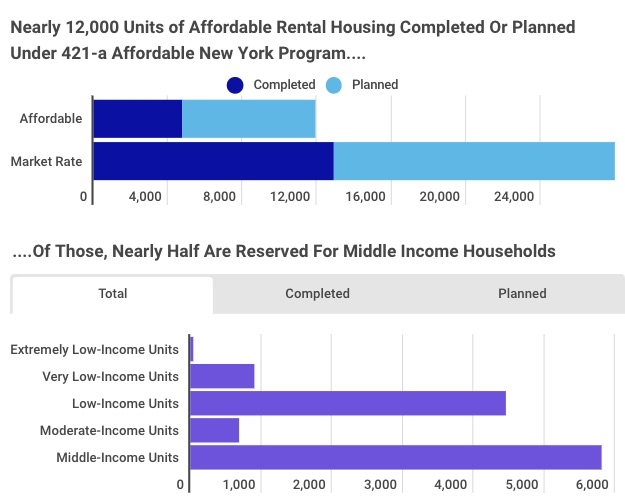

In a report last week, How Many Units of Affordable Housing Were Built or Are Underway Through the 421-a Affordable New York Tax Exemption Program? (also at bottom), the NYC Independent Budget Office confirmed what's been widely believed: the most recent iteration of the 421-a tax break has disproportionately incentivized not-so-affordable income-targeted housing, serving the middle-class.

The IBO notes:Most affordable units created under Affordable New York were part of projects where the developer received no additional public subsidies. But about 21 percent of units, spanning 23 buildings, not only received the 421-a exemption, but also subsidies in the form of city capital funds, loans, tax credits, grants, or public land. These were overwhelmingly the units serving the lowest income bands. In fact, all of the units for extremely low-income households also received other subsidies; almost half of the units for very low-income and more than a third of those for lowincome households received other subsidies.In other words, middle-income units don't need as much help.

Serving middle-income households

Those middle-income units serve households earning 130% of Area Median Income (AMI), a figure that is steadily rising. Which means 30% "affordable" is hardly helping the neediest, which is why Gov. Kathy Hochul's proposed (but failed, so far) replacement would've improved on that (but not enough for critics).

The upshot: buildings like B4 (18 Sixth Ave., aka Brooklyn Crossing) and B15 (662 Pacific St., aka Plank Road). The rents are as follows:

- studio: Brooklyn Crossing, $1,905; Plank Road, $1,547; allowable, $2,263

- 1-BR: Brooklyn Crossing, $2,390; Plank Road, $2,273; allowable, $2,838

- 2-BR: Brooklyn Crossing, $3,344; Plank Road, $3,219; allowable, $3,397

So IBO passage isn't quite right:

Most of the affordable completed or planned Affordable New York units are in boroughs other than Manhattan; outside of Manhattan the option to build only middle-income housing was available. In these boroughs, 67 percent of the affordable units generated by Affordable New York without other subsidies were middle-income units. Rents for middle-income affordable units can be comparable or more expensive than market-rate apartments outside of Manhattan. For example, in 2021, a middle-income 1-bedroom affordable unit under Affordable New York would rent for between $2,614 and $2,838 per month, while the average market-rate rent for a 1-bedroom in December 2021 was $1,965 in the Bronx, $2,977 in Brooklyn and $2,289 in Queens.(Emphasis added)

Not "would rent," but "could rent," but, as the examples above show, developers are wise enough to lower the rent to ensure their units would get leased.

The backstory & the future

The IBO's summary:

The 421-a property tax exemption expired on June 15 after the state legislature did not renew it during its most recent session. The exemption was created in 1971 as an as-of right incentive for developers to build market-rate housing in New York City. Later iterations of 421-a, however, have required developers to build at least some affordable housing in order to receive the tax break. Under Affordable New York, the most recent version of the program—created in 2017, but retroactive through 2016 when the program last expired—developers could choose from a menu of affordable housing options, with the share of units set aside as affordable and the affordability level of those units dependent upon the option chosen. In exchange, the projects received a 35-year property tax exemption.

...In fiscal year 2022, 421-a was the city’s single largest tax expenditure, totaling $1.8 billion in forgone property tax revenue.

The real estate industry argument is those units wouldn't be built without the tax exemption. One counter-argument is that the industry was behind Hochul's proposed 485-w replacement, which for larger buildings, at least, would've required much deeper affordability, a weighted average of 56% of AMI. So there's some slack in the system.

|

| From the Citizens Budget Commission |

Comments

Post a Comment