Revealed: NYC's "agreed-upon discounts" for city properties and streets means $2.3 million valuation for five parcels (updated)

Update 6 pm 11/15/19: I received an appraisal that was originally omitted, for Pacific Street between Flatbush and Sixth avenues. I had estimated that the appraisal would be for no more than $500,000. Indeed, it was for $360,000. I have updated this article accordingly.

We finally have some answers to a tantalizing statement by Seth Pinsky, then president of the New York City Economic Development Corporation (NYC EDC), at a May 2009 state Senate oversight hearing on Atlantic Yards.

“Finally, the city has committed to contribute to the project at agreed-upon discounts certain real estate assets for which there are unlikely to be other opportunities for monetization," Pinsky said, without describing the discounts or the deal.

The adjusted price range of comps worked out to $105 per buildable square foot, or $1,155,000, less the cost of demolition, as of 9/24/09.

That significantly exceeded the $124,000 value cited by the IBO. But was it realistic?

After all, as I wrote in February 2011: a more modest structure down the block, an empty garage at 622 Pacific Street, purchased by a speculator in May 2003 for $382,000, was sold to Forest City Ratner by May 2006 for $3 million. That sale, however, took Atlantic Yards into account.

2009 appraisal: Flatbush near Atlantic

Another appraisal concerned 175 Flatbush Avenue (Block 1118, Lot 6), an irregular 13,292 square-foot site starting at the tip of Atlantic and Flatbush Avenues. The appraisal, below, did not address the site conditions, which likely had been cleared at the time.

According to the 2006 Blight Study conducted for ESDC, the lot contained a 3,625 gross square foot, one-story building and was otherwise vacant or occupied by containers storing hazardous materials. As of the Blight Study, it had at least two characteristics of blight: underutilization, and also "Unsanitary and Unsafe Conditions," including being "strewn with debris" and with a cracked surface and weeds.

The city-owned lot, according to the Blight Study, "appears to be used as a temporary storage facility for the MTA." Again, the responsibility for abating the blight belonged to public entities.

According to the appraisal:

Today, of course, "the only reasonable use" is as part of the plaza for the Barclays Center, a crucial place for arena crowds to gather. Also, as the Resorts World Casino NYC Plaza, its value has been enhanced by naming rights.

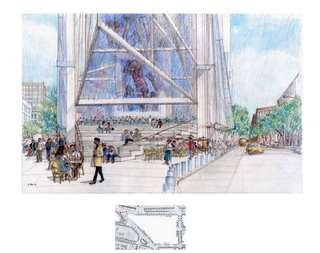

Not so long before the 11/6/09 appraisal, the "reasonable use" contemplated was as part of the "Urban Room," an atrium and arena entrance associated with the flagship "Miss Brooklyn" (B1) tower, as well as--as far as I can tell--the exterior "stoop" of that tower.

However, two months earlier, in September 2009, Forest City Ratner released the new arena design, with SHoP wrapping the "barn" with a rusted-metal facade, leaving space for that plaza.

2009 appraisal: Fifth Avenue between Pacific Street and Atlantic Avenue

Fifth Avenue between Atlantic Avenue and Pacific Street/Flatbush Avenue was demapped for the arena block.

The 19,891 square foot street had 68,425 buildable square feet, given adjacent zoning of C6-1 and an 3.44 FAR, according to the appraisal.

Based on comps--from Sunset Park, Boerum Hill, and two from Williamsburg, the value per buildable square foot was $90. Then a 95% discount was applied for a nonbuildable site. Hence a value of $4.50 per buildable square foot, or $310,000. The arena could not have been built without it.

2009 appraisal: Pacific Street between Fifth and Sixth avenues (updated)

Pacific Street between Fifth and Sixth avenues also was demapped for the arena block. The 40,250-square foot street had 97,808 buildable square feet, given adjacent zoning that offered a 2.43 FAR, according to the appraisal. (The zoning wasn't stated explicitly, but that FAR is consistent with R6/C2-3.)

The appraisal, not surprisingly, relied on the same comps for Fifth Avenue. So it's a little confusing that the the value per buildable square foot was was less.

The value was $3.70, given the 95% discount for a nonbuildable site. (While the actual value pre-discount wasn't mentioned, it would be $74 psf.) Hence a value of $360,000. Again, the arena could not have been built without it.

2009 appraisal: Pacific Street between Carlton and Vanderbilt avenues

Pacific Street between Carlton and Vanderbilt avenues has been demapped and is currently used for construction staging.

It will ultimately become the heart of the Pacific Park open space and thus is crucial to the identity and future of the project, as well as enabling the relatively small amount of open space necessary to make the adjacent residential real estate marketable.

The 57,750 square foot street had the same amount of buildable square feet, given adjacent M-1 zoning.

Based on comps--from Kensington, Sunset Park, Borough Park, Prospect Heights--the valuation was then discounted 95% to $4 per buildable square foot and a valuation of $230,000.

Evolving commitments: 2005

The commitments to repay the city have evolved.

A 2/18/05 Memorandum of Understanding (MOU) between the city, state, and Forest City set a frame, as I wrote in 2013.

The "City Properties and the City Streets underlying the arena" were to be conveyed to ESDC for just $1, with the city property on the arena block underneath the adjacent "commercial office building sites" as well as other city properties conveyed at fair market value. The suggested that the arena-related properties would be free.

The IBO, in its first report on Atlantic Yards, in September 2005, low-balled the value of the property under the arena, valuing the streets at only $56,400, based on $20/sf Department of Finance values applied to adjacent land, applied to an underestimate of square footage.

The city also would transfer the Fire Department parcel, valued at $93,800 by the Department of Finance, according to the 2005 IBO report. The parcel along Flatbush Avenue "appears from the MOU maps to be outside the arena building footprint," said the IBO, implying it would be sold for fair market value but not estimating a value.

Evolving commitments: 2006 and beyond

According to the July 2006 Atlantic Yards Modified General Project Plan, as approved by ESDC, the equation changed somewhat. Property under "the Arena" apparently encompassed the entire arena block. Only other city property would be acquired "at their fair market appraised value.

But that wasn't all. A subtle but perhaps key change emerged three years later, in the June 2009 Modified General Project Plan.

No longer would the other city streets and properties necessarily be acquired "at their fair market appraised value." The payment also could be for "such other value as shall be agreed to" by the city and original developer Forest City Ratner Companies, or FCRC.

That change may not be so important, at least if the "fair market appraised value" is modest, as indicated in the valuations discussed.

In its September 2009 analysis, the IBO valued the streets under the arena at $3.7 million, with 61,625 square feet at $60/sf. It did not estimate a price for Pacific Street between Carlton and Vanderbilt avenues.

The IBO noted that the FDNY building was valued by the Department of Finance at $124,000 on the current tax roll, and the Flatbush Avenue parcel had a reported full market value of $5.8 million. Thus IBO estimated a $6 million value to the developer.

Notably, a 2009 Response to Comments document from Empire State Development critiqued the IBO's analysis:

|

| Pinsky photo: Adrian Kinloch |

“Finally, the city has committed to contribute to the project at agreed-upon discounts certain real estate assets for which there are unlikely to be other opportunities for monetization," Pinsky said, without describing the discounts or the deal.

It sounded like the city was desperate to dispose of those assets--a building, a piece of undeveloped land, and three streets, as far as we knew then--rather than use them as leverage. After all, they were key to original Forest City Ratner's ambitious plan for an arena and up to 16 towers.

The revelation: those "discounts" seem very generous, with five parcels--as shown in documents acquired via a Freedom of Information Law request--appraised later in 2009 at $2.275 million cumulatively, as described below.

Differing estimates

The appraisals are well below estimates made in 2009 by the New York City Independent Budget Office (IBO), which calculated savings of $9.7 million on the same parcels, omitting one. And the appraisals are enormously below my 2013 estimate of a $131 million valuation.

Would the developer save the entire amount in the appraisals? Unclear. It's possible, but by no means likely, that some of those modest valuations may ultimately be returned to the city, as I'll explain in a subsequent article.

But Pinsky's reference to "agreed-upon discounts" also may refer to the fact that, no matter the appraisals, some properties were conveyed without expectation of compensation.

Current zoning, or future development rights?

The key difference is between the appraisals and the IBO estimates is that, while both were premised on current zoning, the former applied a steep discount, implying property that was unbuildable.

The key difference between those two and my estimate is that the former assumed current zoning and attendant Floor Area Ratio (FAR), while I calculated the enormous increase in buildable square footage that Atlantic Yards would unlock.

My methodology wasn't crazy. After all, the Metropolitan Transportation Authority's Vanderbilt Yard development rights were appraised in 2005 at the expected future FAR of 10, as achieved nearby in the Downtown Brooklyn rezoning, rather than the existing manufacturing zoning, with an FAR of 1.

(I used more modest calculations, with an FAR of 8.6 for the arena block and 7.4 for the project site east of Sixth Avenue. Both included streetbeds; otherwise the FAR of each construction site would be much larger.)

The 2009 appraisals were commissioned by Empire State Development Corporation (ESDC, today ESD), the state authority overseeing and shepherding the project. Four of the five properties at issue, including two streets, were on the arena block.

The fifth was Pacific Street between Carlton and Vanderbilt avenues, currently used for construction staging but the future heart of the project's open space.

A sixth property, in retrospect, should have been part of the discussion. My 2013 estimate omitted the unused development rights at Site 5, retained by the city (as I just wrote), because, well, they hadn't been mentioned in city or state documents, nor by the IBO.

In a post tomorrow, I'll discuss the modest valuation of those Site 5 rights, and the likelihood of payment. (Here it is.)

Differing assumptions

In my 2013 calculations, I used $125 per buildable square foot, a relatively conservative assumption and not much more than the numbers assumed in separate appraisals cited below, all conducted in late 2009.

By contrast, the 2005 MTA appraisal was at $75 per buildable square foot. In December 2013, when the first deal for Greenland USA to buy into the project was announced, the average cost per buildable square foot was estimated at $180-$220.

However, as noted above, the appraisals valued the parcels at the previous zoning, rather than the increased buildable square footage enabled by the state override of city zoning.

Maintaining the fiction, city streets and one parcel were seen as unsuitable for development, contributing to a further discount in value. In reality, they were crucial to the overall Atlantic Yards plan, and should have thus been considered valuable.

2009 appraisal: Fire Department building

Consider the former firehouse at 648 Pacific Street, just west of Sixth Avenue, and at the time used by the city Fire Department as an equipment cleaning and storage facility (as per the Blight Study).

As the photo at right shows, the structure bordered the Spalding Building, a condo building converted from a factory. The photo further below shows more context.

The FDNY site, under then-current zoning on a 2,750 square-foot lot, had 11,000 square feet of buildable square footage under C4-4A mixed commercial/residential zoning (and an FAR of 4), but was underutilized at 3,750 square feet, the appraisal said.

The building was in poor condition. The appraisal stated:

The revelation: those "discounts" seem very generous, with five parcels--as shown in documents acquired via a Freedom of Information Law request--appraised later in 2009 at $2.275 million cumulatively, as described below.

Differing estimates

The appraisals are well below estimates made in 2009 by the New York City Independent Budget Office (IBO), which calculated savings of $9.7 million on the same parcels, omitting one. And the appraisals are enormously below my 2013 estimate of a $131 million valuation.

Would the developer save the entire amount in the appraisals? Unclear. It's possible, but by no means likely, that some of those modest valuations may ultimately be returned to the city, as I'll explain in a subsequent article.

But Pinsky's reference to "agreed-upon discounts" also may refer to the fact that, no matter the appraisals, some properties were conveyed without expectation of compensation.

Current zoning, or future development rights?

The key difference is between the appraisals and the IBO estimates is that, while both were premised on current zoning, the former applied a steep discount, implying property that was unbuildable.

The key difference between those two and my estimate is that the former assumed current zoning and attendant Floor Area Ratio (FAR), while I calculated the enormous increase in buildable square footage that Atlantic Yards would unlock.

My methodology wasn't crazy. After all, the Metropolitan Transportation Authority's Vanderbilt Yard development rights were appraised in 2005 at the expected future FAR of 10, as achieved nearby in the Downtown Brooklyn rezoning, rather than the existing manufacturing zoning, with an FAR of 1.

(I used more modest calculations, with an FAR of 8.6 for the arena block and 7.4 for the project site east of Sixth Avenue. Both included streetbeds; otherwise the FAR of each construction site would be much larger.)

The 2009 appraisals were commissioned by Empire State Development Corporation (ESDC, today ESD), the state authority overseeing and shepherding the project. Four of the five properties at issue, including two streets, were on the arena block.

The fifth was Pacific Street between Carlton and Vanderbilt avenues, currently used for construction staging but the future heart of the project's open space.

A sixth property, in retrospect, should have been part of the discussion. My 2013 estimate omitted the unused development rights at Site 5, retained by the city (as I just wrote), because, well, they hadn't been mentioned in city or state documents, nor by the IBO.

In a post tomorrow, I'll discuss the modest valuation of those Site 5 rights, and the likelihood of payment. (Here it is.)

Differing assumptions

In my 2013 calculations, I used $125 per buildable square foot, a relatively conservative assumption and not much more than the numbers assumed in separate appraisals cited below, all conducted in late 2009.

By contrast, the 2005 MTA appraisal was at $75 per buildable square foot. In December 2013, when the first deal for Greenland USA to buy into the project was announced, the average cost per buildable square foot was estimated at $180-$220.

However, as noted above, the appraisals valued the parcels at the previous zoning, rather than the increased buildable square footage enabled by the state override of city zoning.

Maintaining the fiction, city streets and one parcel were seen as unsuitable for development, contributing to a further discount in value. In reality, they were crucial to the overall Atlantic Yards plan, and should have thus been considered valuable.

2009 appraisal: Fire Department building

Consider the former firehouse at 648 Pacific Street, just west of Sixth Avenue, and at the time used by the city Fire Department as an equipment cleaning and storage facility (as per the Blight Study).

As the photo at right shows, the structure bordered the Spalding Building, a condo building converted from a factory. The photo further below shows more context.

The FDNY site, under then-current zoning on a 2,750 square-foot lot, had 11,000 square feet of buildable square footage under C4-4A mixed commercial/residential zoning (and an FAR of 4), but was underutilized at 3,750 square feet, the appraisal said.

The building was in poor condition. The appraisal stated:

Taking into account these deficiencies, and the significant factors and forces noted in “As Vacant,” it is our opinion that the highest and best use of this site would be residential (Quality Housing) when conventional mortgages again become available.The appraisal cited land sales comparables--two from Boerum Hill/Downtown Brooklyn, two from Williamsburg--and stated those comps were "in superior residential locations and have been adjusted downward." That, of course, was made plausible only by ignoring the Atlantic Yards plans.

|

| August 2006 photo by Jonathan Barkey |

That significantly exceeded the $124,000 value cited by the IBO. But was it realistic?

After all, as I wrote in February 2011: a more modest structure down the block, an empty garage at 622 Pacific Street, purchased by a speculator in May 2003 for $382,000, was sold to Forest City Ratner by May 2006 for $3 million. That sale, however, took Atlantic Yards into account.

2009 appraisal: Flatbush near Atlantic

|

| From 2006 Blight Study |

According to the 2006 Blight Study conducted for ESDC, the lot contained a 3,625 gross square foot, one-story building and was otherwise vacant or occupied by containers storing hazardous materials. As of the Blight Study, it had at least two characteristics of blight: underutilization, and also "Unsanitary and Unsafe Conditions," including being "strewn with debris" and with a cracked surface and weeds.

The city-owned lot, according to the Blight Study, "appears to be used as a temporary storage facility for the MTA." Again, the responsibility for abating the blight belonged to public entities.

|

| From 2006 Blight Study |

The site is zoned C6-1, but because this appraisal accepts the assumption that it is not developable due to below-ground adversities (tunnels, transit easements, and other subterranean conditions), it is my opinion that the only reasonable use to which it can be put would be parking.In other words, though even the pre-Atlantic Yards zoning allowed a much larger structure, a 95% discount on a $90 psf valuation for a non-buildable site meant the site was appraised at $195,000 to $220,000. Let's call it $220,000.

Today, of course, "the only reasonable use" is as part of the plaza for the Barclays Center, a crucial place for arena crowds to gather. Also, as the Resorts World Casino NYC Plaza, its value has been enhanced by naming rights.

|

| Urban Room and stoop |

Not so long before the 11/6/09 appraisal, the "reasonable use" contemplated was as part of the "Urban Room," an atrium and arena entrance associated with the flagship "Miss Brooklyn" (B1) tower, as well as--as far as I can tell--the exterior "stoop" of that tower.

However, two months earlier, in September 2009, Forest City Ratner released the new arena design, with SHoP wrapping the "barn" with a rusted-metal facade, leaving space for that plaza.

2009 appraisal: Fifth Avenue between Pacific Street and Atlantic Avenue

Fifth Avenue between Atlantic Avenue and Pacific Street/Flatbush Avenue was demapped for the arena block.

The 19,891 square foot street had 68,425 buildable square feet, given adjacent zoning of C6-1 and an 3.44 FAR, according to the appraisal.

Based on comps--from Sunset Park, Boerum Hill, and two from Williamsburg, the value per buildable square foot was $90. Then a 95% discount was applied for a nonbuildable site. Hence a value of $4.50 per buildable square foot, or $310,000. The arena could not have been built without it.

2009 appraisal: Pacific Street between Fifth and Sixth avenues (updated)

Pacific Street between Fifth and Sixth avenues also was demapped for the arena block. The 40,250-square foot street had 97,808 buildable square feet, given adjacent zoning that offered a 2.43 FAR, according to the appraisal. (The zoning wasn't stated explicitly, but that FAR is consistent with R6/C2-3.)

The appraisal, not surprisingly, relied on the same comps for Fifth Avenue. So it's a little confusing that the the value per buildable square foot was was less.

The value was $3.70, given the 95% discount for a nonbuildable site. (While the actual value pre-discount wasn't mentioned, it would be $74 psf.) Hence a value of $360,000. Again, the arena could not have been built without it.

2009 appraisal: Pacific Street between Carlton and Vanderbilt avenues

Pacific Street between Carlton and Vanderbilt avenues has been demapped and is currently used for construction staging.

It will ultimately become the heart of the Pacific Park open space and thus is crucial to the identity and future of the project, as well as enabling the relatively small amount of open space necessary to make the adjacent residential real estate marketable.

The 57,750 square foot street had the same amount of buildable square feet, given adjacent M-1 zoning.

Based on comps--from Kensington, Sunset Park, Borough Park, Prospect Heights--the valuation was then discounted 95% to $4 per buildable square foot and a valuation of $230,000.

|

| 2005 MOU |

The commitments to repay the city have evolved.

A 2/18/05 Memorandum of Understanding (MOU) between the city, state, and Forest City set a frame, as I wrote in 2013.

The "City Properties and the City Streets underlying the arena" were to be conveyed to ESDC for just $1, with the city property on the arena block underneath the adjacent "commercial office building sites" as well as other city properties conveyed at fair market value. The suggested that the arena-related properties would be free.

The IBO, in its first report on Atlantic Yards, in September 2005, low-balled the value of the property under the arena, valuing the streets at only $56,400, based on $20/sf Department of Finance values applied to adjacent land, applied to an underestimate of square footage.

The city also would transfer the Fire Department parcel, valued at $93,800 by the Department of Finance, according to the 2005 IBO report. The parcel along Flatbush Avenue "appears from the MOU maps to be outside the arena building footprint," said the IBO, implying it would be sold for fair market value but not estimating a value.

Evolving commitments: 2006 and beyond

|

| 2006 Modified General Project Plan |

But that wasn't all. A subtle but perhaps key change emerged three years later, in the June 2009 Modified General Project Plan.

|

| 2009 Modified General Project Plan |

That change may not be so important, at least if the "fair market appraised value" is modest, as indicated in the valuations discussed.

In its September 2009 analysis, the IBO valued the streets under the arena at $3.7 million, with 61,625 square feet at $60/sf. It did not estimate a price for Pacific Street between Carlton and Vanderbilt avenues.

The IBO noted that the FDNY building was valued by the Department of Finance at $124,000 on the current tax roll, and the Flatbush Avenue parcel had a reported full market value of $5.8 million. Thus IBO estimated a $6 million value to the developer.

Notably, a 2009 Response to Comments document from Empire State Development critiqued the IBO's analysis:

It also attributes a value of $3.7 million to the City streets contributed to the Project based on $60 per square foot; however, the streets do not have development rights and therefore should not be valued according to other land comparables.That implies, but does not state definitively, that the streets were worthless. That remains enormously debatable.

Block 1118 Lot 6 Appraisal ... by Norman Oder on Scribd

Comments

Post a Comment