Forest City's dual-class structure tested by hangover from "value destructive transactions" in Brooklyn

|

| Screenshot of Forest City Realty Trust from Yahoo Finance |

This may renew the push by activist investors to change the company's unusual dual-class stock structure, which is blamed for a stock price that trails the underlying value of company assets.

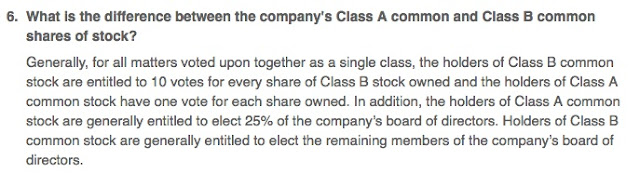

That A/B structure gives controlling power to the extended family--relatives of the founding Cleveland-based Ratners--though they own only a fraction of total shares. See screenshot below.

|

| From Forest City Realty Trust Investor FAQ |

For years that A/B structure was not highlighted as a drag on the company's value.

More recently, one "activist investor" firm, hoping to spur a rise in stock price (and thus boost its investment), has argued forcefully that, not only is that structure not a best practice, it leads to higher costs, thus devaluing shares relative to peer companies.

Though surely Ratner family members don't seek to lower the value of their holdings, the implication is that family control has led to unwise decisions.

|

| From August 2016 Scopia Capital presentation |

The criticism surfaced well before the results announced earlier this month.

So, even though in October Forest City announced that negotiations to collapse the dual-class structure led to a stalemate, those discussions are likely not over.

After all, an investment analyst--part of a cohort generally far more gentle in their questioning than journalists--even asked during the 11/4/16 earnings conference call if the board would consider some "clawback" from a 2006 deal with Bruce Ratner, then CEO of the company's Brooklyn-based arm, Forest City Ratner, thus recovering for shareholders some of the losses in the Brooklyn portfolio. (Answer: no.)

The push surfaces

The hedge fund said Forest City has made “meaningful changes” but said the dual-class structure “clearly harms the company,” according to a presentation to Forest City directors reviewed by The Wall Street Journal.The Journal reported that Forest City, according to analysts, trades at a significant discount, some 25%. And while Forest City executives, according to sources quoted by the Journal, had started talking about changes to the dual-class structure, they told investment analysts they were focusing on other ways to boost asset value.

Scopia, which has a 7.4% stake in Forest City, plans to make its presentation public Wednesday. The Ratner family’s voting control would block any effort to unseat Forest City’s board, a common activist tactic, but Scopia could call for a nonbinding vote on the structure.

Scopia's take

Scopia titled its presentation "The ABCs Of the Dual-Class Structure at Forest City: Towing an Anchor," saying the company underperforms the REIT (Real Estate Investment Trust) index and trades at a discount to net asset value (NAV), while other REITs trade at a premium.

The firm said "there is no credible debate as to whether a dual-class stock structure harms value and is bad corporate governance," pointing to the hither cost of equity versus peers.

Anticipating Forest City's response that it planned to enhance value by selling "non-core assets," as it did with its shares of the Barclays Center operating company and the Brooklyn Nets, as well as properties in non-core markets, Scopia stated, "Forest City is running low on non-core assets. Wouldn't it be better to have an appropriate cost of equity so we don't have to sell core assets, and pay taxes, in order to grow?" (Emphasis in original)

"We believe you have recently polled shareholders, and the vast majority told you that the A/B stock structure is an impediment to value," Scopia said in the presentation. It criticized management's "wait-and-see approach," saying past business moves "far outweigh those to come, but have not improved valuation."

"Whether fair or unfair, the A/B structure nurtures the perception that Forest City exists to serve the B-shareholders, and not all its owners," Scopia said. "Now is the time for the board and B-shareholders to prove they are true stewards and fiduciaries of the A-shareholders' capital by collapsing the share classes."

Family-driven decisions in Cleveland?

There is evidence that Forest City, in its long-time home base of Cleveland, made decisions reflective of civic commitment rather than a relentless bottom line.

Cleveland magazine 11/1/16 published an article headlined Tower Struggle, regarding the Terminal Tower, a long-time symbol of the city, subtitled "The September sale of the iconic skyscraper marks the end of an era and raises questions about what new ownership means for our city."

Forest City's partial tower purchase in 1980, and full purchase in 1983, was not primarily a business decision, according to Dick Pogue, a lawyer described as close with former Forest City co-chairman Albert Ratner.

While the company could have put money in faster-growing real-estate markets, it made the investment, Pogue said, "because of their long-standing relationship with and fondness for Cleveland.” (Executives are also involved in local philanthropy.)

Curiously enough, no one from Forest City would comment to Cleveland magazine regarding the company's decision "to sell most of its Tower City properties." The magazine also raised the question of the dual-class stock structure, quoting one consultant: “I don’t understand how publicly traded companies allow an individual family to exert that much control."

Family-driven decisions in Brooklyn?

One lingering question: were the "value destructive transactions" in New York the result of Ratner family control? After all, New York is not a secondary market like Cleveland, and other Forest City projects in New York--like MetroTech, the 8 Spruce Street tower designed by Frank Gehry, or the New York Times building designed by Renzo Piano--have done fine.

New York City and New York State, as well as outside consultants, all predicted success for Atlantic Yards/Pacific Park.

While Forest City executives now say one lesson is that they must control land without buying it--and thus paying off loans for property that has not yet delivered revenue--we should remember that the one rival bidder for the railyard, Extell, was willing to offer more cash than Forest City (though it had not yet fully developed its bid and scoped out infrastructure costs).

In other words, in the heady days of 2005 and 2006, when Atlantic Yards was under consideration, a fair competition for the public property, not to mention an upzoning for the private property that Forest City bought under the threat of eminent domain (and paid big sums to avoid the state invoking eminent domain), might have generated equally large commitments to pay for land.

That's not the same as an eleemosynary Cleveland purchase. But Forest City's Atlantic Yards decisions--as well as those by government entities--deserve further examination.

Forest City holds steady--for now

Nothing's happening, for now, regarding that A/B stock structure.

In a 10/26/16 press release blandly headlined Forest City Concludes Initial Evaluation of Dual-Class Structure, with the subheading "Company Reaffirms Commitment to Strategic Plan," the company announced that an Independent Committee of Class A directors evaluated a change to the structure, and approached RMS, Limited Partnership (RMS), the umbrella shareholder for the controlling family.

Despite "good faith negotiations, [they] ultimately were unable to reach an agreement at this time on mutually acceptable terms," so Forest City "will not be submitting a proposal to shareholders to eliminate the dual-class structure at this time," the press release said. That language leaves open the possibility of a future change.

FCRT Chairman Charles Ratner (a cousin of Bruce), a General Partner of RMS, commented, "We remain open to continuing discussion around the Company's dual-class structure and to finding a way forward that is fair to all shareholders.... This team has taken significant steps to work towards closing the gap between the net asset value and the share trading price by executing on the Company's strategic plan to build a strong sustainable capital structure, focus on core markets and products, and achieve operational excellence. We believe that this work has established a strong foundation for further progress and future growth."

That was before the stock plummeted. So stay tuned.

Comments

Post a Comment