Here are the Empire State Development Corporation (ESDC) board members, who are expected to approve the Atlantic Yards project at a meeting tomorrow.

(One vacancy)

It’s a formality, most likely. If their past performance is any indication, the board members won't discuss the issue much.

Indeed, the ESDC is no legislative agency (an issue relevant to the eminent domain case). It is best seen as an extension of the office of Governor George Pataki.

Indeed, the ESDC is no legislative agency (an issue relevant to the eminent domain case). It is best seen as an extension of the office of Governor George Pataki.

Most of the board members, who are unpaid, have contributed heavily to Pataki or Republican causes. Several have ties to the real estate industry. Chairman Charles Gargano (right) was Pataki’s chief fund raiser; his office at the ESDC’s headquarters on Third Avenue near Grand Central Station is festooned with photos of Gargano and Pataki.

Here’s a profile praising Gargano; here's where Assembly Speaker Sheldon Silver called him corrupt.

(The project would then go to the Public Authorities Control Board, which is controlled by Pataki, Senate Majority Leader Joseph Bruno, and Silver. The latter might stall the project, as he's been lobbied by Brooklyn colleagues. An aide to incoming Governor Eliot Spitzer told the Times today that "If we thought it were a seriously flawed proposal, we would encourage people to hold it until we had an opportunity to make further review of it.")

Occasional criticism

When board members were first appointed, with the advice and consent of the Senate (which is Republican-controlled), some press outlets and Democratic legislators made an issue out of it. A 3/1/98 Newsday article headlined “Donors Deep Pockets Secured Jobs” put it plainly:

Over the past four years, David Feinberg, a wealthy New York City Realtor and construction executive, has contributed $66,000 to Gov. George Pataki's campaign and has worked as a fund raiser, soliciting additional donations.

In return, Feinberg said, Pataki appointed him to two influential boards - the Urban Development Corp., [aka ESDC] which can give tax breaks to businesses, and the Science and Technology Foundation, which doles out grants to high-technology firms.

"I think it is kind of logical. That's the way the system works," said Feinberg, adding that he genuinely believes in Pataki's agenda. "Look, it is a reward and punishment system."

A Pataki spokesman said individuals were chosen for their qualifications. Since then, the issue has died down, though it might re-emerge when incoming Gov. Eliot Spitzer puts his own stamp on state agencies and boards.

However many briefing books they get, members of the ESDC board have their own jobs, so they likely don’t spend much time with the details. That’s what the agency staff is for.

A warning

The chairpersons and boards of public authorities are more responsive to the governor than in the era of Robert Moses, who had his own power base. However, the longer a governor serves, the more that governor controls those boards, because he controls the appointments, according to former State Senator Seymour Lachman, author of Three Men in a Room.

Lachman offers an observation that likely applies to the ESDC and its posture toward the Atlantic Yards project:

At that point, there is a risk that an authority’s decisions will no longer be based on rational, dispassionate, nonpolitical assessments of the public’s interests, but on the political calculations of the person who appointed a majority of its board.

Who are they? (The following information was culled from the public record; the ESDC provided only a list of names and terms.)

Kevin S. Corbett

Kevin Corbett is an insider with direct experience. After all, until late 2004, he had served as the ESDC’s chief operating officer. Now he’s VP for Marine Business at global transportation and infrastructure company DMJM+HARRIS. He remains a member of several boards, including the Moynihan Station Development Corporation, the New York State Economic Development Power Allocation Board, and the board of the Regional Plan Association, which issued a qualified endorsement of the Atlantic Yards project.

Kevin Corbett is an insider with direct experience. After all, until late 2004, he had served as the ESDC’s chief operating officer. Now he’s VP for Marine Business at global transportation and infrastructure company DMJM+HARRIS. He remains a member of several boards, including the Moynihan Station Development Corporation, the New York State Economic Development Power Allocation Board, and the board of the Regional Plan Association, which issued a qualified endorsement of the Atlantic Yards project.

Corbett does not appear to have been a major donor to Republican causes, though he (apparently) gave $2000 to Pataki in 2002.

A 9/8/03 Times article headlined TWO YEARS LATER: THE MONEY; Downtown Grants Found To Favor Investment Field laid out a post-9/11 scenario:

More than a third of the emergency grant money intended to help small businesses in Lower Manhattan survive after the Sept. 11 terrorist attack went to investment firms, financial traders and lawyers, a result that some New York legislators who helped secure money for the program say they never envisioned.

Corbett defended the record:

"With the economic conditions and physical conditions we were faced with downtown, and the need to get the money out, we had to make decisions quickly," said Kevin S. Corbett, chief operating officer at Empire State Development, which is controlled by Gov. George E. Pataki. "We had no template at all for this kind of challenge."

Charles E. Dorkey

Charles E. (Trip) Dorkey III is U.S. chairman of Torys, a leading Canadian law firm, with 300 New York and Toronto lawyers. He’s been a major donor to Pataki.

Charles E. (Trip) Dorkey III is U.S. chairman of Torys, a leading Canadian law firm, with 300 New York and Toronto lawyers. He’s been a major donor to Pataki.

In 1995 he was nominated to the board of the Science and Technology Foundation. The Albany Times-Union reported, in a 10/12/95 article headlined “Pataki donors cash in on key positions”:

Charles Dorkey III, a partner in the Haythe & Curley law firm in New York City, is the third nominee to the Science and Technology Foundation. He and the firm contributed $26,800 to Pataki in the past two years. Dorkey also gave $10,000 to the state GOP committee, $3,500 to Vacco and $ 3,050 to other Republicans.

Dorkey gave Pataki more than $36,000 from 1999 to 2002.

In a 7/15/05 profile in the New York Sun, headlined This 'Trip' Straddles the Public and Private Sectors, Dorkey characterized himself as a non-ideologue who gets along with Democrats, and talked of his roles as a trustee of the New-York Historical Society and as chairman of the Hudson River Park Trust. He offered an evergreen quote:

"It's very important for everyday citizens to get involved in public issues," Mr. Dorkey said. "Good citizenship means participation in issues that matter."

Then again, an 8/5/97 article The Bond Buyer headlined “Bond lawyers' contributions to N.Y. GOP prompt plea to ABA” described how

State Sen. Franz S. Leichter has urged the American Bar Association to halt pay-to-play practices by municipal bond lawyers, in the wake of a new report by his staff claiming that 14 law firms won lucrative bond business in the state - four of them for the first time - after contributing more than $400,000 to state Republican committees and parties.

Among those four firms was Haythe & Curley, whose partners include Charles Dorkey 3d, a Pataki appointee and one of Pataki's top 10 contributors.

David H. Feinberg

In 2002, when he was appointed to the New York Olympic Games Commission, Feinberg was described as Partner, Feinberg Realty and Construction. He’s also self-reported as a principal of Laramie Dawson Corporation, which is described as one of the nation's largest commercial real-estate development companies. It apparently doesn't have a web site.

A 3/1/98 New York Times article headlined “State G.O.P. Gives Pataki Fund Cushion” explained how the Republican Party transferred nearly all of the $3.25 million it raised in the first half of 1997 to Pataki’s campaign, thus allowing major contributors—who had already maxed out what they could give Pataki—another opportunity to fund the campaing.

Among the six people who had given $25,000 to Pataki and $20,000 or more to the party was “real estate magnate” David H. Feinberg.

Feinberg apparently gave $30,700 to Pataki in 2000 and $105,000 to the Republican State Committee from 2000 to 2006. (I say apparently because the contributions come from two different addresses.)

The 10/12/95 Albany Times-Union article stated:

He and his wife contributed $ 43,000 to Pataki over the past two years. Since 1993, he's also donated $ 30,000 to the state Republican Committee.

A 10/13/95 article in the Times Union headlined “Democrats criticize Pataki's nominees” described how Democratic Sen. Franz Leichter tried unsuccessfully to stall the nomination of three Pataki appointees, including Dorkey and Feinberg, to the state Science and Technology Foundation, which funds research.

Mark E. Hamister

Mark E. Hamister is the only ESDC representative from upstate. He runs the Hamister Group, which manages assisted living and health care facilities, and also a hospitality management group and hotel acquisition company. Hamister is a member and/or officer of multiple boards and civic organizations.

Mark E. Hamister is the only ESDC representative from upstate. He runs the Hamister Group, which manages assisted living and health care facilities, and also a hospitality management group and hotel acquisition company. Hamister is a member and/or officer of multiple boards and civic organizations.

Indeed. A 1/3/03 profile in the Buffalo News was headlined “A Matter of Pull; As Mark E. Hamister seeks state and local aid to help buy the Buffalo Sabres, how much help will his political connections prove to be?”

It described how he chaired the Buffalo Niagara Partnership, Western New York’s “most influential business organization,” which “threw the organization's considerable weight behind the re-election efforts of Gov. George E. Pataki,” even as the Partnership’s president “introduced Hamister as ‘the next owner of the Buffalo Sabres.’” (He eventually withdrew from the effort.)

The article outlined Hamister’s clout:

Hamister ranks as a major donor to area politicians -- Democrat as well as Republican -- dropping about $45,000 on local and state candidates over the past several years. That includes $6,000 to Pataki and more than $13,000 to County Executive Joel A. Giambra. Both will play major roles in determining whether Hamister receives public money to support his bid.

Hamister and his companies have continued to make significant campaign contributions.

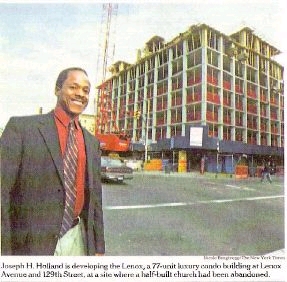

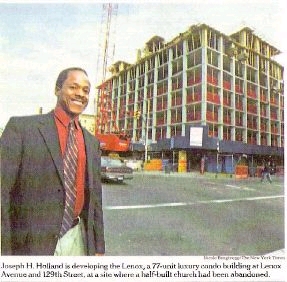

Joseph H. Holland

Joseph H. Holland is the managing member of Uptown Partners, which develops market-rate, multi-family housing in New York City, notably Harlem. He is also of counsel with the law firm of Van Lierop, Burns & Bassett, focusing on the development of affordable housing projects.

Joseph H. Holland is the managing member of Uptown Partners, which develops market-rate, multi-family housing in New York City, notably Harlem. He is also of counsel with the law firm of Van Lierop, Burns & Bassett, focusing on the development of affordable housing projects.

Holland is also a Director, Municipal Assistance Corporation of the City of New York, gubernatorial appointee since 1998 and a Member, Board of Trustees, Cornell University since 1998.

He was formerly Commissioner of the New York State Division of Housing and Community Renewal, Pataki’s most prominent black appointee. A 5/24/95 profile in Real Estate Weekly quoted Holland as saying, "To the extent that the system was tilted in the past in favor of tenants, that's just going to stop. Our message is not real popular with certain groups, but it's one that has to be put out there."

An 11/6/05 New York Times article headlined A Developer's Rocky Quest to Revitalize Harlem described Holland’s struggles and successes nearly a decade earlier. His investments had floundered. Some in the Pataki administration didn’t support his efforts to support housing. And some in the African-American community targeted Holland as way of criticizing Pataki. (Photo from the Times)

He was described as an idealist whose activism (starting business staffed by homeless-shelter residents) was tempered by experience (the residents weren’t that responsible.). He tried to find wealthy African-Americans to fund investments in Harlem, but wound up with more traditional investors for projects Holland describes as “gentrification without displacement," since they’re built on vacant land in Harlem.

Then again, his company has also sought to play the political game. An October 2003 article in Gotham Gazette described Uptown’s effort to get a variance, and the local opposition it generated:

In their first proposal Uptown Partners claimed that they had to have at least 24 stories in order to make the project economically feasible. The residents look back at this claim and say that it was false because now the developer is willing to settle for 14 stories while at the same time saying they now need at least 14 stories to make the numbers work. This proves, they say, that the motive is more profit.

Sounds like… Atlantic Yards?

Diana Taylor

Taylor, an investment banker, was named Superintendent of Banks for the State of New York by Pataki in 2003.

Taylor, an investment banker, was named Superintendent of Banks for the State of New York by Pataki in 2003.

According to a 12/8/03 profile in Newsday:

In 1996, Taylor went to work for Pataki, becoming his deputy secretary for finance and housing, and a member of his inner circle. She left to become chief financial officer for the Long Island Power Authority and then vice president at KeySpan Energy, only to return to the Pataki administration in 2002. Pataki named Taylor banking superintendent in June.

She’s also been Mayor Michael Bloomberg’s companion since 2000, so we might suspect she shares Bloomberg’s support for Atlantic Yards. (She's given relatively small contributions to state races.)

According to a 10/17/06 article in the Daily News headlined “MIKE'S GAL DID 'GREAT' WORK: ELIOT,” Governor-elect Eliot Spitzer, who has otherwise promised to clean house in Albany - said Taylor would be welcome to stay.

| Name | Appointed By | Term Expires | Charles A. Gargano (Chair) | Governor | Pleasure of Governor |

| Kevin S. Corbett | Governor | Pleasure of Governor |

| Charles E. (Trip) Dorkey | Governor | Pleasure of Governor |

| David H. Feinberg | Governor | 1/1/2007 |

| Mark E. Hamister | Governor | 1/1/2009 |

| Joseph H. Holland | Governor | 1/1/2001 (holdover) |

| Diana Taylor | Governor | Ex Officio |

(One vacancy)

It’s a formality, most likely. If their past performance is any indication, the board members won't discuss the issue much.

Indeed, the ESDC is no legislative agency (an issue relevant to the eminent domain case). It is best seen as an extension of the office of Governor George Pataki.

Indeed, the ESDC is no legislative agency (an issue relevant to the eminent domain case). It is best seen as an extension of the office of Governor George Pataki.Most of the board members, who are unpaid, have contributed heavily to Pataki or Republican causes. Several have ties to the real estate industry. Chairman Charles Gargano (right) was Pataki’s chief fund raiser; his office at the ESDC’s headquarters on Third Avenue near Grand Central Station is festooned with photos of Gargano and Pataki.

Here’s a profile praising Gargano; here's where Assembly Speaker Sheldon Silver called him corrupt.

(The project would then go to the Public Authorities Control Board, which is controlled by Pataki, Senate Majority Leader Joseph Bruno, and Silver. The latter might stall the project, as he's been lobbied by Brooklyn colleagues. An aide to incoming Governor Eliot Spitzer told the Times today that "If we thought it were a seriously flawed proposal, we would encourage people to hold it until we had an opportunity to make further review of it.")

Occasional criticism

When board members were first appointed, with the advice and consent of the Senate (which is Republican-controlled), some press outlets and Democratic legislators made an issue out of it. A 3/1/98 Newsday article headlined “Donors Deep Pockets Secured Jobs” put it plainly:

Over the past four years, David Feinberg, a wealthy New York City Realtor and construction executive, has contributed $66,000 to Gov. George Pataki's campaign and has worked as a fund raiser, soliciting additional donations.

In return, Feinberg said, Pataki appointed him to two influential boards - the Urban Development Corp., [aka ESDC] which can give tax breaks to businesses, and the Science and Technology Foundation, which doles out grants to high-technology firms.

"I think it is kind of logical. That's the way the system works," said Feinberg, adding that he genuinely believes in Pataki's agenda. "Look, it is a reward and punishment system."

A Pataki spokesman said individuals were chosen for their qualifications. Since then, the issue has died down, though it might re-emerge when incoming Gov. Eliot Spitzer puts his own stamp on state agencies and boards.

However many briefing books they get, members of the ESDC board have their own jobs, so they likely don’t spend much time with the details. That’s what the agency staff is for.

A warning

The chairpersons and boards of public authorities are more responsive to the governor than in the era of Robert Moses, who had his own power base. However, the longer a governor serves, the more that governor controls those boards, because he controls the appointments, according to former State Senator Seymour Lachman, author of Three Men in a Room.

Lachman offers an observation that likely applies to the ESDC and its posture toward the Atlantic Yards project:

At that point, there is a risk that an authority’s decisions will no longer be based on rational, dispassionate, nonpolitical assessments of the public’s interests, but on the political calculations of the person who appointed a majority of its board.

Who are they? (The following information was culled from the public record; the ESDC provided only a list of names and terms.)

Kevin S. Corbett

Kevin Corbett is an insider with direct experience. After all, until late 2004, he had served as the ESDC’s chief operating officer. Now he’s VP for Marine Business at global transportation and infrastructure company DMJM+HARRIS. He remains a member of several boards, including the Moynihan Station Development Corporation, the New York State Economic Development Power Allocation Board, and the board of the Regional Plan Association, which issued a qualified endorsement of the Atlantic Yards project.

Kevin Corbett is an insider with direct experience. After all, until late 2004, he had served as the ESDC’s chief operating officer. Now he’s VP for Marine Business at global transportation and infrastructure company DMJM+HARRIS. He remains a member of several boards, including the Moynihan Station Development Corporation, the New York State Economic Development Power Allocation Board, and the board of the Regional Plan Association, which issued a qualified endorsement of the Atlantic Yards project.Corbett does not appear to have been a major donor to Republican causes, though he (apparently) gave $2000 to Pataki in 2002.

A 9/8/03 Times article headlined TWO YEARS LATER: THE MONEY; Downtown Grants Found To Favor Investment Field laid out a post-9/11 scenario:

More than a third of the emergency grant money intended to help small businesses in Lower Manhattan survive after the Sept. 11 terrorist attack went to investment firms, financial traders and lawyers, a result that some New York legislators who helped secure money for the program say they never envisioned.

Corbett defended the record:

"With the economic conditions and physical conditions we were faced with downtown, and the need to get the money out, we had to make decisions quickly," said Kevin S. Corbett, chief operating officer at Empire State Development, which is controlled by Gov. George E. Pataki. "We had no template at all for this kind of challenge."

Charles E. Dorkey

Charles E. (Trip) Dorkey III is U.S. chairman of Torys, a leading Canadian law firm, with 300 New York and Toronto lawyers. He’s been a major donor to Pataki.

Charles E. (Trip) Dorkey III is U.S. chairman of Torys, a leading Canadian law firm, with 300 New York and Toronto lawyers. He’s been a major donor to Pataki.In 1995 he was nominated to the board of the Science and Technology Foundation. The Albany Times-Union reported, in a 10/12/95 article headlined “Pataki donors cash in on key positions”:

Charles Dorkey III, a partner in the Haythe & Curley law firm in New York City, is the third nominee to the Science and Technology Foundation. He and the firm contributed $26,800 to Pataki in the past two years. Dorkey also gave $10,000 to the state GOP committee, $3,500 to Vacco and $ 3,050 to other Republicans.

Dorkey gave Pataki more than $36,000 from 1999 to 2002.

In a 7/15/05 profile in the New York Sun, headlined This 'Trip' Straddles the Public and Private Sectors, Dorkey characterized himself as a non-ideologue who gets along with Democrats, and talked of his roles as a trustee of the New-York Historical Society and as chairman of the Hudson River Park Trust. He offered an evergreen quote:

"It's very important for everyday citizens to get involved in public issues," Mr. Dorkey said. "Good citizenship means participation in issues that matter."

Then again, an 8/5/97 article The Bond Buyer headlined “Bond lawyers' contributions to N.Y. GOP prompt plea to ABA” described how

State Sen. Franz S. Leichter has urged the American Bar Association to halt pay-to-play practices by municipal bond lawyers, in the wake of a new report by his staff claiming that 14 law firms won lucrative bond business in the state - four of them for the first time - after contributing more than $400,000 to state Republican committees and parties.

Among those four firms was Haythe & Curley, whose partners include Charles Dorkey 3d, a Pataki appointee and one of Pataki's top 10 contributors.

David H. Feinberg

In 2002, when he was appointed to the New York Olympic Games Commission, Feinberg was described as Partner, Feinberg Realty and Construction. He’s also self-reported as a principal of Laramie Dawson Corporation, which is described as one of the nation's largest commercial real-estate development companies. It apparently doesn't have a web site.

A 3/1/98 New York Times article headlined “State G.O.P. Gives Pataki Fund Cushion” explained how the Republican Party transferred nearly all of the $3.25 million it raised in the first half of 1997 to Pataki’s campaign, thus allowing major contributors—who had already maxed out what they could give Pataki—another opportunity to fund the campaing.

Among the six people who had given $25,000 to Pataki and $20,000 or more to the party was “real estate magnate” David H. Feinberg.

Feinberg apparently gave $30,700 to Pataki in 2000 and $105,000 to the Republican State Committee from 2000 to 2006. (I say apparently because the contributions come from two different addresses.)

The 10/12/95 Albany Times-Union article stated:

He and his wife contributed $ 43,000 to Pataki over the past two years. Since 1993, he's also donated $ 30,000 to the state Republican Committee.

A 10/13/95 article in the Times Union headlined “Democrats criticize Pataki's nominees” described how Democratic Sen. Franz Leichter tried unsuccessfully to stall the nomination of three Pataki appointees, including Dorkey and Feinberg, to the state Science and Technology Foundation, which funds research.

Mark E. Hamister

Mark E. Hamister is the only ESDC representative from upstate. He runs the Hamister Group, which manages assisted living and health care facilities, and also a hospitality management group and hotel acquisition company. Hamister is a member and/or officer of multiple boards and civic organizations.

Mark E. Hamister is the only ESDC representative from upstate. He runs the Hamister Group, which manages assisted living and health care facilities, and also a hospitality management group and hotel acquisition company. Hamister is a member and/or officer of multiple boards and civic organizations. Indeed. A 1/3/03 profile in the Buffalo News was headlined “A Matter of Pull; As Mark E. Hamister seeks state and local aid to help buy the Buffalo Sabres, how much help will his political connections prove to be?”

It described how he chaired the Buffalo Niagara Partnership, Western New York’s “most influential business organization,” which “threw the organization's considerable weight behind the re-election efforts of Gov. George E. Pataki,” even as the Partnership’s president “introduced Hamister as ‘the next owner of the Buffalo Sabres.’” (He eventually withdrew from the effort.)

The article outlined Hamister’s clout:

Hamister ranks as a major donor to area politicians -- Democrat as well as Republican -- dropping about $45,000 on local and state candidates over the past several years. That includes $6,000 to Pataki and more than $13,000 to County Executive Joel A. Giambra. Both will play major roles in determining whether Hamister receives public money to support his bid.

Hamister and his companies have continued to make significant campaign contributions.

Joseph H. Holland

Joseph H. Holland is the managing member of Uptown Partners, which develops market-rate, multi-family housing in New York City, notably Harlem. He is also of counsel with the law firm of Van Lierop, Burns & Bassett, focusing on the development of affordable housing projects.

Joseph H. Holland is the managing member of Uptown Partners, which develops market-rate, multi-family housing in New York City, notably Harlem. He is also of counsel with the law firm of Van Lierop, Burns & Bassett, focusing on the development of affordable housing projects. Holland is also a Director, Municipal Assistance Corporation of the City of New York, gubernatorial appointee since 1998 and a Member, Board of Trustees, Cornell University since 1998.

He was formerly Commissioner of the New York State Division of Housing and Community Renewal, Pataki’s most prominent black appointee. A 5/24/95 profile in Real Estate Weekly quoted Holland as saying, "To the extent that the system was tilted in the past in favor of tenants, that's just going to stop. Our message is not real popular with certain groups, but it's one that has to be put out there."

An 11/6/05 New York Times article headlined A Developer's Rocky Quest to Revitalize Harlem described Holland’s struggles and successes nearly a decade earlier. His investments had floundered. Some in the Pataki administration didn’t support his efforts to support housing. And some in the African-American community targeted Holland as way of criticizing Pataki. (Photo from the Times)

He was described as an idealist whose activism (starting business staffed by homeless-shelter residents) was tempered by experience (the residents weren’t that responsible.). He tried to find wealthy African-Americans to fund investments in Harlem, but wound up with more traditional investors for projects Holland describes as “gentrification without displacement," since they’re built on vacant land in Harlem.

Then again, his company has also sought to play the political game. An October 2003 article in Gotham Gazette described Uptown’s effort to get a variance, and the local opposition it generated:

In their first proposal Uptown Partners claimed that they had to have at least 24 stories in order to make the project economically feasible. The residents look back at this claim and say that it was false because now the developer is willing to settle for 14 stories while at the same time saying they now need at least 14 stories to make the numbers work. This proves, they say, that the motive is more profit.

Sounds like… Atlantic Yards?

Diana Taylor

Taylor, an investment banker, was named Superintendent of Banks for the State of New York by Pataki in 2003.

Taylor, an investment banker, was named Superintendent of Banks for the State of New York by Pataki in 2003.According to a 12/8/03 profile in Newsday:

In 1996, Taylor went to work for Pataki, becoming his deputy secretary for finance and housing, and a member of his inner circle. She left to become chief financial officer for the Long Island Power Authority and then vice president at KeySpan Energy, only to return to the Pataki administration in 2002. Pataki named Taylor banking superintendent in June.

She’s also been Mayor Michael Bloomberg’s companion since 2000, so we might suspect she shares Bloomberg’s support for Atlantic Yards. (She's given relatively small contributions to state races.)

According to a 10/17/06 article in the Daily News headlined “MIKE'S GAL DID 'GREAT' WORK: ELIOT,” Governor-elect Eliot Spitzer, who has otherwise promised to clean house in Albany - said Taylor would be welcome to stay.

Comments

Post a Comment