As market-rate apartment inventory increases, maybe it makes sense to wait to build luxury condos.

The Wall Street Journal reported 7/24/16, New York City’s Market-Rate Rental Inventory Set to Swell:

The 8/11/16 Wall Street Journal followed on the same theme, As Rental Supply Grows, Landlords Negotiate, subtitled "Manhattan vacancy rates are up, as are deals that include concessions." That also affects Brooklyn:

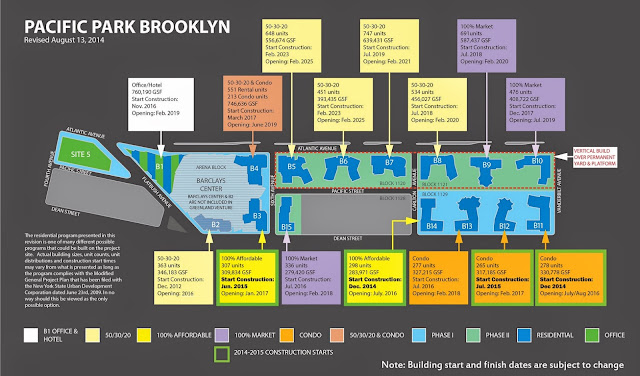

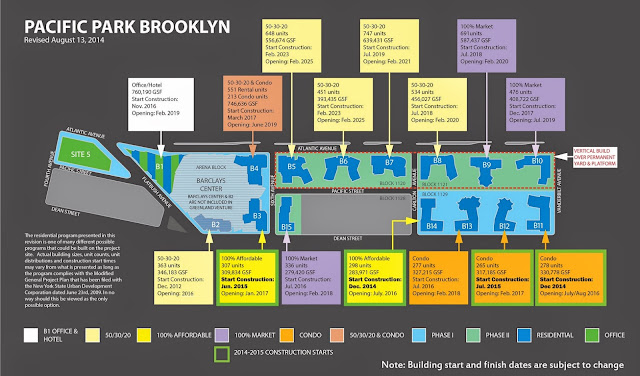

As I wrote in June, the overall tentative Pacific Park schedule, as of 2014, has already proven to be over-optimistic, as the next two buildings, B11 (550 Vanderbilt) and B14 (535 Carlton), won't open in July 2016 as once predicted but perhaps six months later.

The B12 (aka 615 Dean) condo building, one of three sites being marketed to outside investors by the joint venture Greenland Forest City Partners, was supposed to be finished by February 2017 but hasn't gotten off the ground, though the design was unveiled last September.

The developer has no forecast for that building or the adjacent B13 condo, which, according to that 2014 schedule, was expected to break ground in July 2016. (It doesn't have an address yet, as far as I know.)

The giant B4 building on the northeast flank of the arena, once planned to contain both mixed rental and condo apartments, was once expected to break ground in March 2017. (It doesn't have an address yet, as far as I know.)

However, Greenland Forest City Partners now wants to convert the use to office space, which will require a public process. That will presumably be coupled with the approvals needed to move the bulk of the permitted B1 tower over the arena plaza across Flatbush Avenue to Site 5, currently occupied by Modell's and P.C. Richard. That's been stalled by a court case involving P.C. Richard.

Thad Young's condo sale

Note that, for unique buildings, perhaps the sky's the limit. The Real Deal reported yesterday that the only Brooklyn Net to move to Brooklyn is selling:

It's also a reminder that, no matter the contract, unless there's a no-trade clause, a player is expendable, a chess piece for a future roster.

The Wall Street Journal reported 7/24/16, New York City’s Market-Rate Rental Inventory Set to Swell:

Over the next three years, more than 38,000 market-rate rental apartments—mostly in Brooklyn and Queens—are expected to be completed, with 14,686 of them added this year, according to Ten-X, an online real-estate company. The company estimates another 17,044 new apartments will be completed in 2017, marking a new high. The last peak came in 2001 when about 5,500 units were added.So, waiting to time the market may be (one of the reasons) why some Pacific Park buildings are delayed?

The 8/11/16 Wall Street Journal followed on the same theme, As Rental Supply Grows, Landlords Negotiate, subtitled "Manhattan vacancy rates are up, as are deals that include concessions." That also affects Brooklyn:

For example, [marketing consultant Nancy Packes] said, several large rental buildings have recently opened in Downtown Brooklyn, all of them offering at least one month of free rent. Some Manhattan neighborhoods are seeing similar booms, she said.A report by Douglas Elliman prepared by appraiser Jonathan Miller "found that median rents in Brooklyn slipped 0.8% to $2,826 from July 2015."

The Pacific Park impact

The first Journal article suggested that rents might flatten--which has happened--but would be balanced out as this supply increase dissipates.

That's apparently what Forest City executives are thinking. During a conference call last Friday, David LaRue, CEO of parent Forest City Realty Trust, said that, even given favorable demographics and steady demand, such new units "will take time to absorb,"

That's apparently what Forest City executives are thinking. During a conference call last Friday, David LaRue, CEO of parent Forest City Realty Trust, said that, even given favorable demographics and steady demand, such new units "will take time to absorb,"

Still, he said, mixed-used projects such as Pacific Park Brooklyn offer assets and, given that the peak of delivery will be this year, additional supply will be absorbed, and the balance will "return to the norm."

Most of the units, in fact, coming in the first four residential buildings are below-market apartments, though it will be interesting to see how easy it is to rent the most expensive ones, such as two-bedroom units for $3,223 and three-bedroom ones for $3,713, which make up half of the available "affordable" units of those sizes at 535 Carlton and 38 Sixth.

Delayed schedule

The B12 (aka 615 Dean) condo building, one of three sites being marketed to outside investors by the joint venture Greenland Forest City Partners, was supposed to be finished by February 2017 but hasn't gotten off the ground, though the design was unveiled last September.

The developer has no forecast for that building or the adjacent B13 condo, which, according to that 2014 schedule, was expected to break ground in July 2016. (It doesn't have an address yet, as far as I know.)

The giant B4 building on the northeast flank of the arena, once planned to contain both mixed rental and condo apartments, was once expected to break ground in March 2017. (It doesn't have an address yet, as far as I know.)

However, Greenland Forest City Partners now wants to convert the use to office space, which will require a public process. That will presumably be coupled with the approvals needed to move the bulk of the permitted B1 tower over the arena plaza across Flatbush Avenue to Site 5, currently occupied by Modell's and P.C. Richard. That's been stalled by a court case involving P.C. Richard.

Thad Young's condo sale

Note that, for unique buildings, perhaps the sky's the limit. The Real Deal reported yesterday that the only Brooklyn Net to move to Brooklyn is selling:

Hoops star Thaddeus Young isn’t just trading in his Brooklyn Nets jersey now that he’s an Indiana Pacer. Not surprisingly, the forward is also putting his Brooklyn condominium unit on the market for $6.3 million.Young paid $5.325 million last year, so maybe--even with the transaction costs involved in the sale--he'll make a profit. I suspect other Nets with lower salaries--Young had a four-year $52 million contract--will choose to rent.

Located at Robert Levine’s One Brooklyn Bridge Park, the 2,764-square-foot pad has three bedrooms, a wood-burning fireplace, bar and terrace. It’s asking $2,279 per square foot...

It's also a reminder that, no matter the contract, unless there's a no-trade clause, a player is expendable, a chess piece for a future roster.

Comments

Post a Comment