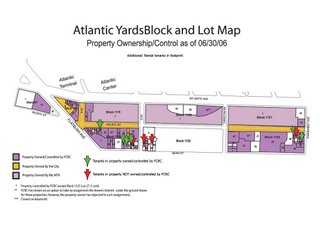

Forest City Ratner, according to the developer's web site, "now owns or controls 90 percent of the land needed for Atlantic Yards." And in May 2005, before City Council, FCR asserted in a presentation (right) that it had “substantially reduced the need for condemnation,” citing the large numbers of properties it owned or controlled.

Forest City Ratner, according to the developer's web site, "now owns or controls 90 percent of the land needed for Atlantic Yards." And in May 2005, before City Council, FCR asserted in a presentation (right) that it had “substantially reduced the need for condemnation,” citing the large numbers of properties it owned or controlled.But ownership and control aren't so simple. First, as a lawyer for several Forest City Ratner tenants has charged, ownership of a property with rent-regulated tenants means that the developer needs "friendly condemnations" by the Empire State Development Corporation (ESDC) to move the tenants out.

And controlling the property needed for the project does not necessarily mean that Forest City Ratner can demolish a building to construct a skyscraper. A contract to purchase, which is one definition of control, could indeed lead to demolition, but a lease for a property wouldn't provide that power--and Forest City Ratner claims to control at least three properties that are leased.

I queried Brooklyn Law School professor David Reiss, who explained, "The mere fact that FCR controls the lessee's interest in a ground lease... would not necessarily mean that the Empire State Development Corporation could avoid condemning that parcel. This is because ESDC might need to extinguish the owner's interest in the parcel as well. Thus, if the owner of the parcel chose not to sell the parcel, ESDC would need to bring a condemnation proceeding."

There might be exceptions, such as if the lessee had an option to purchase the parcel, but no such exceptions has been announced in ESDC documents, and there is no option to purchase three properties at issue. It seems that, by conflating ownership with (claimed) control, FCR’s presentation to City Council was misleading.

A dispute in court

The developer claims to control three properties near the corner of Pacific Street and Carlton Avenue, two parking lots and a six-story building. (The building and one lot are at right.) The properties are owned by company controlled by Henry Weinstein, who had leased them to a company controlled by Shaya Boymelgreen, the developer responsible for the nearby Newswalk renovation and several other Brooklyn projects.

The developer claims to control three properties near the corner of Pacific Street and Carlton Avenue, two parking lots and a six-story building. (The building and one lot are at right.) The properties are owned by company controlled by Henry Weinstein, who had leased them to a company controlled by Shaya Boymelgreen, the developer responsible for the nearby Newswalk renovation and several other Brooklyn projects. In turn, Boymelgreen assigned the leases to an affiliate of Forest City Ratner. Weinstein has objected, and their dispute is in court. That lawsuit is gingerly acknowledged in the Property Ownership and Control map, though the color purple indicates that the property is under FCR's control.

In turn, Boymelgreen assigned the leases to an affiliate of Forest City Ratner. Weinstein has objected, and their dispute is in court. That lawsuit is gingerly acknowledged in the Property Ownership and Control map, though the color purple indicates that the property is under FCR's control.Lots 5,6,13 of Block 1129 have asterixes that say "FCRC has closed on an option to take by assignment the lessee’s interest under the ground leases for these properties. However, the property owner has objected to such assignments." (Emphasis added)

The property owner has not merely objected, he has gone to court to challenge those assignments.

The property owner has not merely objected, he has gone to court to challenge those assignments.Were Weinstein to lose his dispute, and the lease assigned to the Forest City Ratner affiliate, that still doesn’t mean the leaseholder could tear down the building or build on the lots. Rather, the properties would have to be acquired by eminent domain. (Click on the map to enlarge.)

Is it 90%?

However, by proclaiming ownership and control over some 90% of the properties needed, Forest City Ratner and the ESDC suggest that only a small fraction of the properties would be subject to eminent domain.

Instead, that fraction is larger, because, as stated, ownership does not necessarily mean control, and control does not necessarily mean ownership. That subtlety can be lost in the public discourse. For example, the New York Times reported in April:

The company owns nearly 90 percent of the square footage it needs to build the development.

In March, NY 1 reported:

He now owns nearly 90 percent of the land he needs for his project.

Last November, Metro NY reported:

Ratner currently owns roughly 90 percent of the property in the footprint.

And last month, in my own error, the Brooklyn Downtown Star reported:

Developer Forest City Ratner owns about 90 percent of the property.

The conflation of ownership and control leads to an inaccurate figure, which can not only be used to pressure holdouts, it can be cited to assure the public that there is little need for eminent domain.

Looking at the document

The General Project Plan suggests that "control" means "contract to purpose," though it leaves room for an unspecified other explanation:

As indicated on the Site Plan, the Project Site is comprised of numerous parcels of land, (i) most of which are either currently owned by FCRC or under contract to purchase by FCRC, (ii) a significant portion of which is comprised of the Yard which is owned by LIRR and MTA, (iii) a small portion of which is currently privately owned and not under contract for sale to FCRC and (iv) a small portion of which is owned by the City.... Based upon the foregoing, FCRC currently owns or controls a very substantial portion of the Project Site. (Emphasis added)

In another paragraph, the GPP uses the word "control" once but doesn't follow up:

The current ownership and control of the parcels comprising the Project Site is illustrated on Exhibit E attached hereto. FCRC continues to negotiate to acquire the remaining private properties within the Project Site. Parcels that are not owned by MTA/LIRR or which FCRC is unable to purchase would be acquired by ESDC through the exercise of the power of eminent domain pursuant to the Eminent Domain Procedures Law. (Emphasis added)

So, even if the developer controls a parcel, it may not be able to purchase it. Weinstein and Forest City Ratner have not come to an agreement regarding the properties at issue.

So those properties that FCR “controls” via the disputed lease would be subject to eminent domain. For a less confusing ownership map, the properties that are merely controlled deserve something other than the color purple.

Comments

Post a Comment