Is the MTA deal for railyard development rights being renegotiated, in cost and/or timing? Just transferred? Or what?

Something is cooking, contractually, regarding the development rights for the six towers (B5-B10) over the Metropolitan Transportation Authority's (MTA) Vanderbilt Yard.

As I reported, the MTA told me the payment was instead made by DBD AYB Funding LLC, and DBD AYB Funding II LLC.

Those are administrative agents for the investment funds AYB Funding 100 and AYB Funding 200, organized by the U.S. Immigration Fund (USIF), that lent money--from immigrant investors under the EB-5 program--to Greenland.

The new entity paid?

"We understand that the MTA [Metropolitan Transportation] has been paid for the outstanding air rights obligation for the platform portion of the project," said Anna Pycior, ESD's Senior VP, Community Relations.

Who paid went unspecified.

As I reported, according to the MTA, the payment was made by DBD AYB Funding LLC, and DBD AYB Funding II LLC. No further explanation has been supplied, and the issue has not come up, for example, at meetings of the advisory Atlantic Yards Community Development Corporation.

In shorthand, I and others have typically described them as being held by the project's master developer, for now Greenland USA, which has since November 2023 seemed on the brink of losing them in foreclosure.

That's because the Greenland entity that controls those development rights has failed to pay back $286 million in loans from immigrant investors under the EB-5 investor visa program, and the creditors for those loans were given those development rights as collateral.

Indeed, Empire State Development (ESD), the state authority, said last month, "Greenland USA has and as of today remains to be the developer of the Atlantic Yards project pursuant to the project documents."

That raises a question, yet unresolved: will ESD enforce the project documents that require Greenland to pay $2,000/month for each of the 876 affordable units not built by the end of the month? Will ESD extend the deadline?

Or would that be extended pursuant to a renegotiation and transfer of development rights?

The railyard payments

Also, that ESD statement of Greenland's role doesn't explain why Greenland last year did not make a required $11 million payment last June to the Metropolitan Transportation Authority for railyard development rights.

That was of an annual requirement--after $20 million down and four smaller payments--that started in 2016 and lasts through 2030, with the overall payments for the 8.5-acre, three-block railyard, as renegotiated in 2009, adding up to the equivalent of $100 million, albeit with a generous interest rate, as opposed to $100 million up front.

As I reported, the MTA told me the payment was instead made by DBD AYB Funding LLC, and DBD AYB Funding II LLC.

Those are administrative agents for the investment funds AYB Funding 100 and AYB Funding 200, organized by the U.S. Immigration Fund (USIF), that lent money--from immigrant investors under the EB-5 program--to Greenland.

Those DBD entities apparently are among--or at least control--the creditors, though the deal, as described speculatively in the flowchart above (and this article), has not been publicly explained.

The new entity paid?

At a meeting last Sept. 26, a representative of Empire State Development (ESD), the state authority that oversees/shepherds the project, said something curious, as I wrote.

"We understand that the MTA [Metropolitan Transportation] has been paid for the outstanding air rights obligation for the platform portion of the project," said Anna Pycior, ESD's Senior VP, Community Relations.

Who paid went unspecified.

As I reported, according to the MTA, the payment was made by DBD AYB Funding LLC, and DBD AYB Funding II LLC. No further explanation has been supplied, and the issue has not come up, for example, at meetings of the advisory Atlantic Yards Community Development Corporation.

Why does MTA stonewall?

So I filed a Freedom of Information Law requires with the MTA, asking for documents that explained the role of DBD AYB Funding and DBD AYB Funding II.

So I filed a Freedom of Information Law requires with the MTA, asking for documents that explained the role of DBD AYB Funding and DBD AYB Funding II.

I was told that responsive records were being withheld, with the MTA citing a law that states that an agency may deny access to records that “if disclosed would impair present or imminent contract awards or collective bargaining negotiations.”

"Due to the active status of this procurement, and the relevance of the requested records to the procurement process, the release of these records would inhibit 'the interests of [the agency] in achieving the optimum result in awarding a contract to a supplier of goods or services,'" I was told, with the internal quotes referring to a legal case, Matter Verizon N.Y., Inc. v. Bradbury.

That doesn't quite make sense. Let's assume a new master developer, involving the current creditors, along with Cirrus Workforce Housing and perhaps others, is negotiating with Empire State Development, as Cirrus has acknowledged.

What might it mean?

That doesn't quite make sense. Let's assume a new master developer, involving the current creditors, along with Cirrus Workforce Housing and perhaps others, is negotiating with Empire State Development, as Cirrus has acknowledged.

If that means taking over the obligation to pay the MTA for development rights, that would seem relatively straightforward.

If the procurement process is active, does that mean a negotiation involves a change in terms? If so, what?

I could imagine that, given the delays in development (COVID! interest rates! foreclosure!), a new developer might argue for an attenuated timetable, urging the MTA to allow smaller payments over a longer period, lasting past 2030.

Keep in mind that the next payment is due June 1.

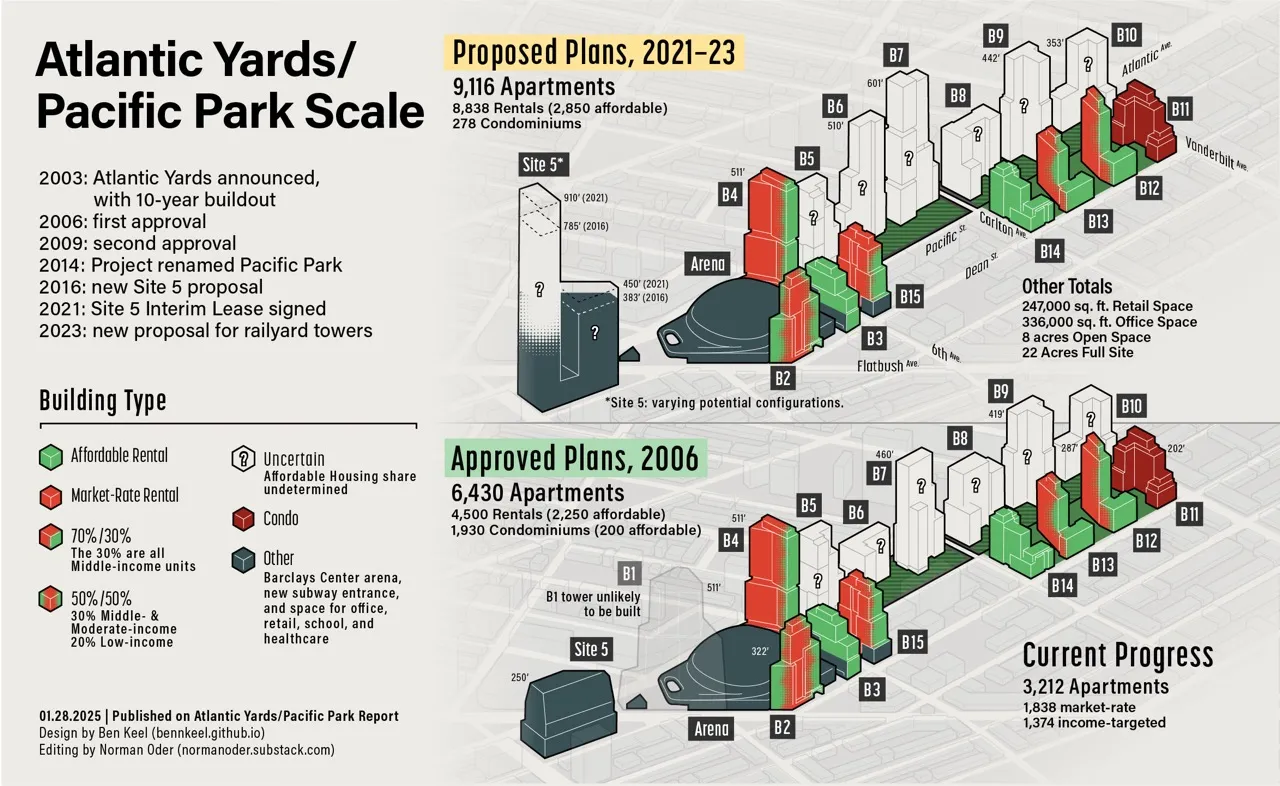

Beyond that, a new developer might be asking--as Greenland USA had in 2023--for a significant increase in development rights, allowing for larger buildings at the six railyard sites, as I wrote.

I've described that request for larger buildings as the equivalent of a request for free (vertical) land, which deserves payment, just as there was an RFP process, albeit wired, for the original development rights.

So, could the MTA be negotiating for additional payment for additional development rights? If so, shouldn't that be a more public process?

Comments

Post a Comment