Mastroianni moves in: funds steered by EB-5 middleman, not struggling developer Greenland, made $11M annual Vanderbilt Yard air rights payment to MTA.

At a meeting last Sept. 26, a representative of Empire State Development, the state authority that oversees/shepherds the project, said something curious.

"We understand that the MTA [Metropolitan Transportation] has been paid for the outstanding air rights obligation for the platform portion of the project," said Anna Pycior, ESD's Senior VP, Community Relations.

"We understand that the MTA [Metropolitan Transportation] has been paid for the outstanding air rights obligation for the platform portion of the project," said Anna Pycior, ESD's Senior VP, Community Relations.

Who paid went unspecified.

Was it master developer Greenland USA, which was losing rights to build giant towers at the six railyard parcels in a foreclosure? (It borrowed $349 million, in two tranches, from immigrant investors in the EB-5 investor visa program, and has about $286 million delinquent.)

|

Was it Related Companies, the giant developer, known for building Hudson Yards in Manhattan, that's part of a pending joint venture to develop the six railyard sites, which require an expensive platform?

That seemed unlikely, given that they weren't formally part of the project yet. (Nor are they formally part of it today.)

The EB-5 middleman

The answer neither. According to the MTA, the payment was made by DBD AYB Funding LLC, and DBD AYB Funding II LLC.

Those are administrative agents for the investment funds AYB Funding 100 and AYB Funding 200, organized by the U.S. Immigration Fund (USIF), that lent money--from immigrant investors under the EB-5 program--to Greenland.

(EB-5 is justified because the investments purportedly create jobs, but the numbers are dubious.)

As I've written, the USIF, a private company known as a regional center and founded by Nicholas Mastroianni II, who even supporters acknowledge has a "checkered past," now plays a key role in the future of Atlantic Yards.

Thanks to a contract that disadvantages the investors, all from China (as far as I know), the USIF has control over the deal. As stated in the Private Placement Memorandum:

The Manager will control the Company, subject to certain rights granted to the Members. As a result, the Manager will have the power to approve transactions and agreements between the Company and the Manager, the USIF New York Regional Center and their affiliates. Such transactions and agreements may involve actual or potential conflicts of interest due to the financial relationships between the parties and the common ownership of the Manager and the USIF New York Regional Center.

|

| From 2022 USIF video |

So the money to the MTA didn't come from the Chinese investors themselves. After all, they haven't been repaid.

It came from the USIF and, perhaps, Fortress Investment Fund, a private equity fund that already has a piece of the EB-5 debt.

Could Related, expected to enter as the key player in the joint venture, have paid as well? Maybe. But Mastroianni's companies surely have enough money to be able to swing the payment.

The backstory

Original developer Forest City Ratner bid $100 million cash--increased from a $50 million bid after a rival bid $150 million, sans arena--for development rights at/over the MTA's three-block Vanderbilt Yard, used to store and service Long Island Rail Road trains.

Per a schedule outlined in 2009, when Forest City Ratner renegotiated the deal, it paid $20 million for the rights to use the western block as part of the parcel containing the arena, plaza, and three towers.(The payment schedule implied a 6.5% interest rate, which one analyst called "a real coup.")

To acquire the right to build six towers, the project developer then had to pay $2 million a year from 2012 through 2015, toward the air rights, then about $11 million a year. Note that Greenland entered the scene as a 70% partner in 2014, and by 2018 had essentially taken over.

Payments from Greenland (and, earlier, Forest City) to the MTA cumulatively totaled $96 million by June 2023, with an additional $77 million due, in annual $11 million increments, by June 1, 2030.

Only after the air rights are paid for can construction start. By my calculation, that means the rights to build the three western towers (B5-B7) have already been acquired.

Only after the air rights are paid for can construction start. By my calculation, that means the rights to build the three western towers (B5-B7) have already been acquired.

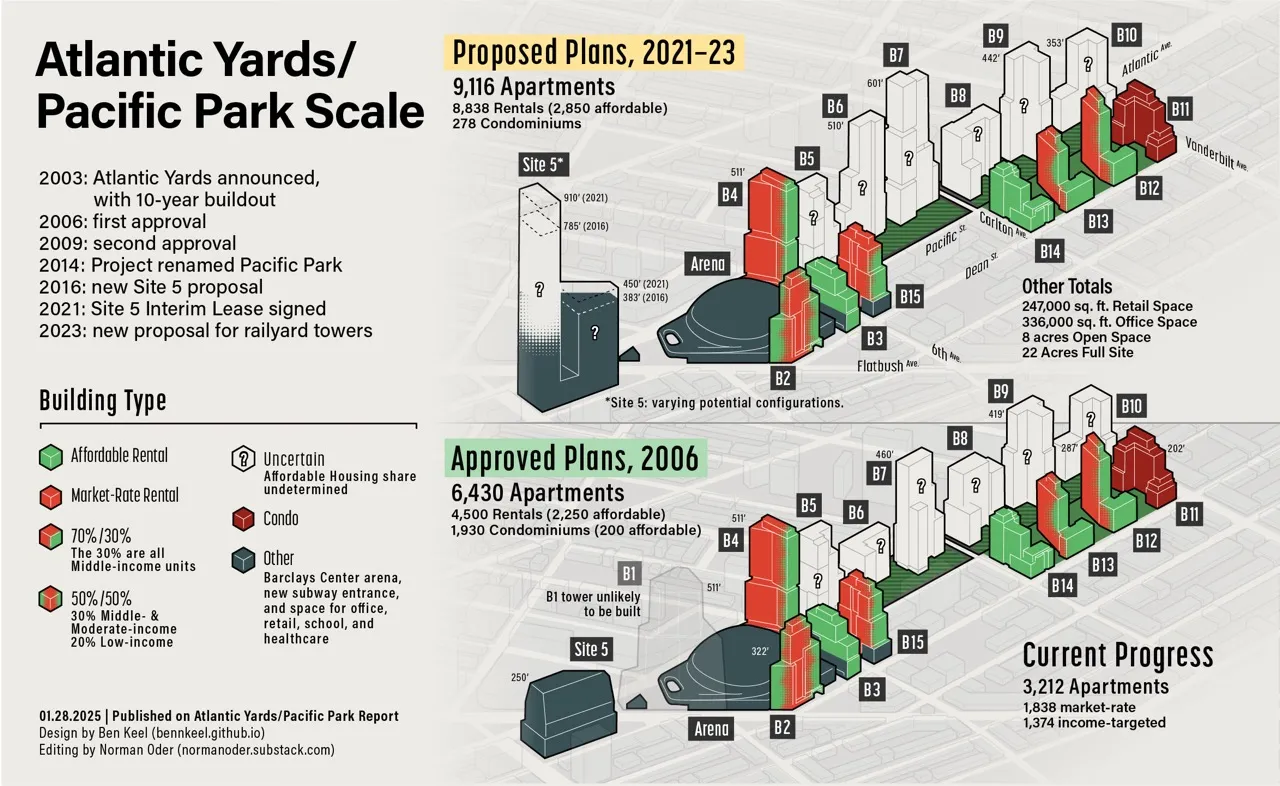

But construction requires MTA approvals and a platform. It's also likely that the new joint venture will seek to build even larger buildings, thus gaining valuable buildable square feet, as Greenland had proposed in 2023, indicated in the graphic below.

Comments

Post a Comment