Who controls the Atlantic Yards collateral? More evidence that Fortress has key role, which New York State should clarify.

On March 18, I published (on my Substack newsletter, you can subscribe!) an informed speculation aimed to prompt belated some public candor.

Who Really Controls the Six Railyard Sites? Maybe Fortress is in the Driver's Seat. The subheading: "The private investment firm (owned mainly by Abu Dhabi!) may now control the EB-5 collateral. Can Empire State Development clarify this at meeting tomorrow?"

Well, the meeting of the Atlantic Yards Community Development Corporation (AY CDC) referenced was postponed to Tuesday, but, in the meantime, I got more information that both confirmed the speculation but left more to clarify.

Beyond the Chinese-language document I cited earlier, I've seen an English-language document that similarly claims that Fortress was expected to control the two investment funds that control the collateral for two loans: six development parcels over the Metropolitan Transportation Authority's Vanderbilt Yard.

The recap

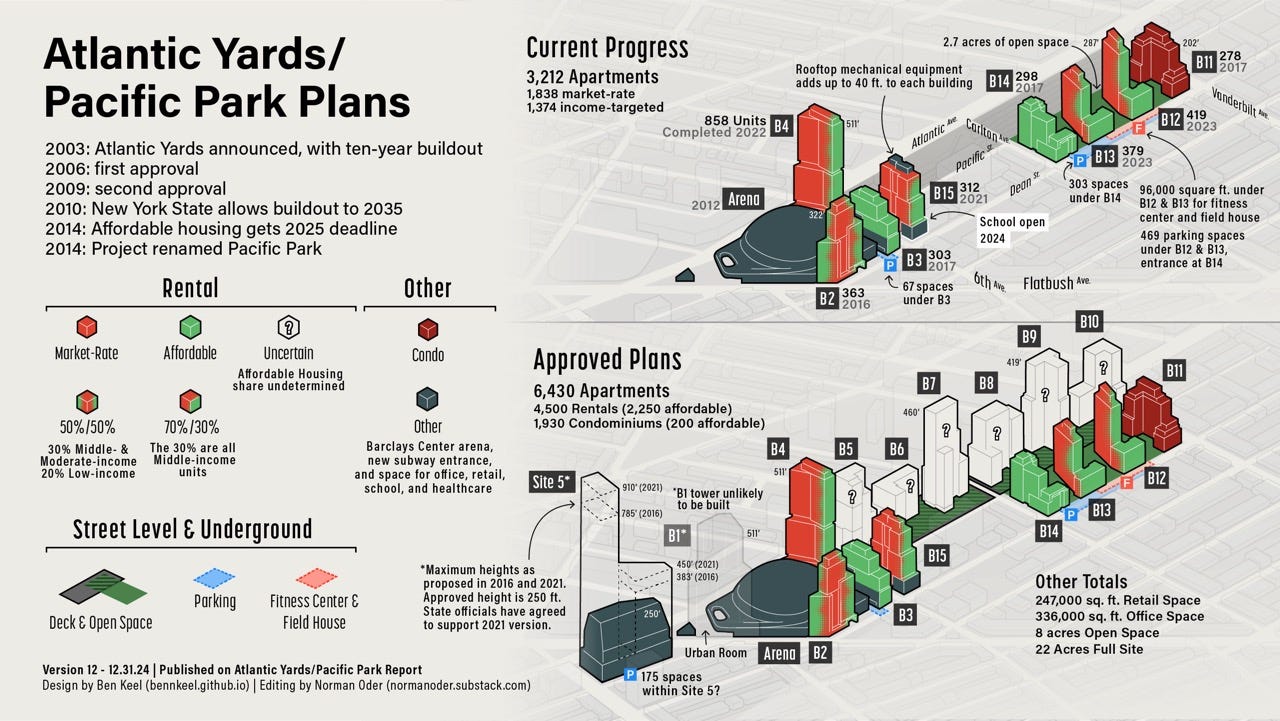

As I wrote, Atlantic Yards/Pacific Park faces a foreclosure auction, oft postponed, initiated by the manager of the entities that lent $349 million to the project, with money raised from immigrant investors under the EB-5 investor visa program.

That foreclosure ultimately regards transfer of the collateral from developer Greenland USA: six development parcels (B5-B10) over the railyard, which require an expensive deck to activate.

As I wrote, the immigrant investors may no longer own a controlling stake in AYB Funding 100 and AYB Funding 200, the investment pools that in 2014-15 loaned $249 million and $100 million, respectively, to the Atlantic Yards/Pacific Park, at below-market interest rates.

That now may be owned by the firm Fortress Investment Group, a longtime collaborator with the U.S. Immigration Fund

(USIF), a "regional center" or private firm that recruits EB-5

investors and manages the loans, and which has been erroneously described as "the lender." No representative of either firm has

ever spoken at a public meeting about the project.

|

Evidence mounts

My assessment was based on the machine translation of a Chinese-language document sent investors in the second loan, AYB Funding 200. Now I've seen English-language test regarding the first loan, AYB Funding 100, which has similar language.

Less than a year into the pandemic, in late 2020, the USIF encouraged shareholders in the second Atlantic Yards EB-5 loan to move up to half their money--$50 million--to TSX Broadway, a project in which Fortress was involved.

Around the same time, the first round of EB-5 investors, in AYB Funding 100, were similarly asked to sell up to $150 million of their remaining EB-5 loan, I've learned. (After repayment of $63 million, about $186 million remained of the original $249 million.)

They were similarly told that, based on economic conditions and risks, the move to TSX Broadway was in the best interest of the Company" and negotiated at par to a Fortress affiliate. They were told:

On the purchase and sale of a portion of the EB-5 Loan, Fortress Capital and the Company will enter into a co-Lender Agreement. Pursuant to that Agreement, Fortress Capital, would be the majority owner of the EB-5 Loan and therefore would control all major decisions affecting the EB-5 Loan and the collateral pursuant to which the EB-5 Loan is secured. Fortress Capital may, in the future, make certain decisions that materially adversely affect that portion of the Loan owned by the Company. This means that the investor who elects to retain his or her investment in the Loan to the EB-5 Project could be subject to certain risks, including but not limited to losing some or all of his or her investment in a default, restructuring or foreclosure scenario.

(Emphases added)

We don't know how much was actually sold.

However, this leaves the impression that, even if just a portion--not a majority--of the loan were sold, Fortress would become the majority owner, controlling the loan and the collateral.

The roles of these opaque entities, the USIF and Fortress, should be understood by the public. Perhaps Empire State Development (ESD), the state authority that oversees/shepherds the project, can be queried, and explain, at the meeting Tuesday of the AY CDC.

Who owns, and controls, various slices of AYB Funding 100 and AYB Funding 200? What's the role of Fortress? Can Fortress control those entities even if it doesn't own a majority?

Are other entities involved?

For example, below is a chart regarding a different EB-5 project, known as 29th and 5th, an office building in NoMad, with an investment organized by the U.S. Immigration Fund.

In 2019, the USIF encouraged investors in AYB Funding 100, who had to redeploy that $63 million into other investments, to move the funds to multiple options, including TSX Broadway and 29th and 5th. They moved only about $2.5 million to the latter project.

That project wound up in court. One document that surfaced is the org chart below. (AYB is in the bottom of the right column.)

It's doubtful that the Atlantic Yards deal structure is this complicated, because it's likely there are fewer parties.

Still, it's worth getting some clarity on who owns, and controls, what, among the USIF (and its affiliates), Fortress, and the funds to which the immigrant investors contributed--plus the role of Greenland USA, which still formally has not lost control.

As I wrote, neither Fortress nor the USIF, whatever their stake, can develop the railyard sites on their own. New York State requires a “permitted developer,” a firm or construction manager with at least ten years of experience in large project.

Fortress was omitted, but its role may be crucial. (Related bowed out, and a new permitted developer is needed.)

Incentives for Fortress?

When I assumed that the USIF as manager controlled the EB-5 loans, thanks to advantageous contract language, I observed that, because the firm didn't put any money up, delays in resolving the foreclosure didn't harm its interests.

(Meanwhile, a May 31 deadline to deliver 876 more affordable housing units looms, with $2,000/month penalties. It’s unclear whether ESD will enforce that obligation, and on whom.)

Would delays bother Fortress, which pursues “opportunistic strategies” on behalf of institutional investors? Maybe, maybe not, especially if it could control the EB-5 investments at a fraction of the value.

Comments

Post a Comment