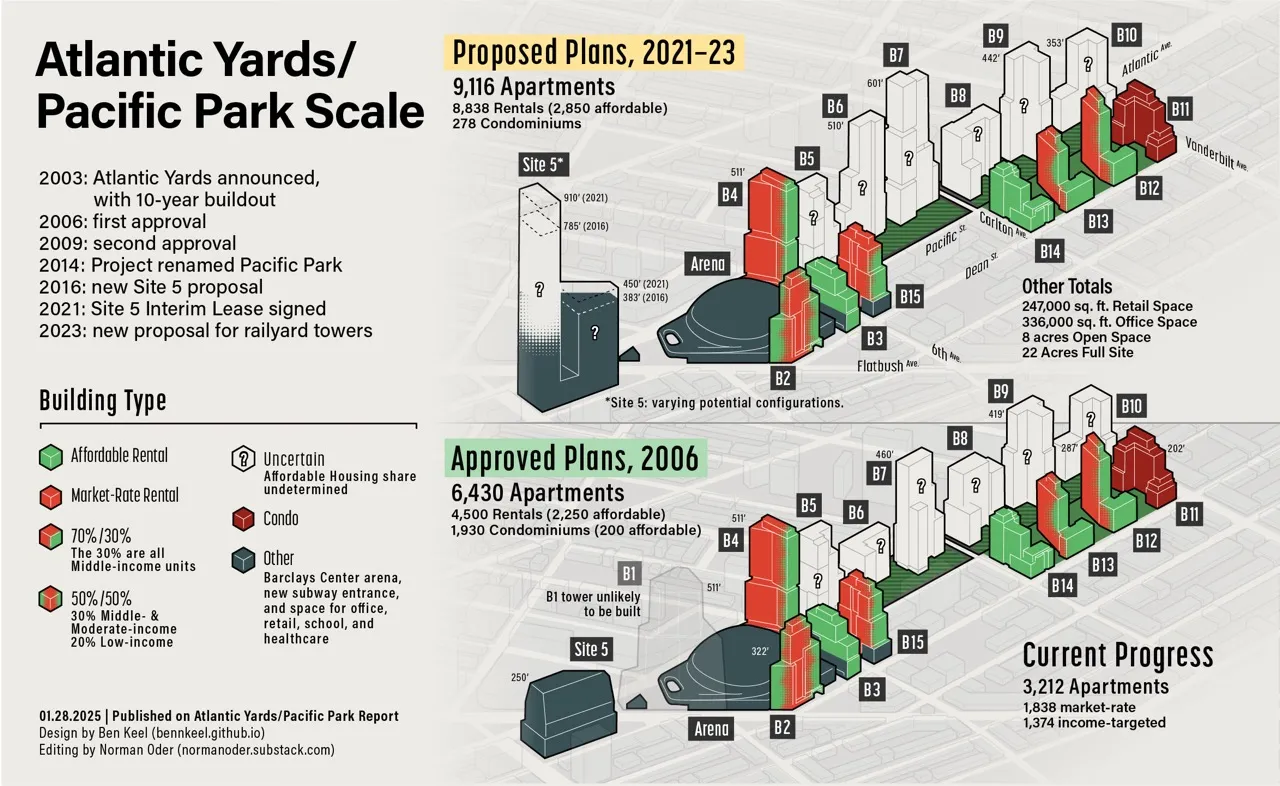

TRD: Related pulls out of Atlantic Yards joint venture. Cirrus enters, but can't yet qualify as permitted developer. Affordability and scale unclear.

Yesterday had not one but two twists in the 14-month foreclosure saga around Atlantic Yards/Pacific Park.

First, we learned that Related Companies, developer of Hudson Yards, was no longer pursuing a joint venture to develop most of the remaining share of the project: six tower sites (B5-B10) over the Metropolitan Transportation Authority's (MTA) Vanderbilt Yard, which require an expensive platform before vertical construction.

Also note: while the USIF was described by The Real Deal as the "lender," it's not.

Related's path

Last August 27, the Wall Street Journal, relying on the self-interested source Mastroianni, published Related Closes In on Deal to Rescue Notoriously Stalled Massive Housing Project. At a meeting last Nov. 14, ESD SVP Anna Pycior said they were “completing our review of their documents, and once the review is satisfactory… we would proceed with the new joint venture. We don't anticipate issues moving forward.”

That could happen “within weeks,” added her colleague Joel Kolkmann, Senior VP, Real Estate and Planning. That didn't happen, but it didn't stop me from speculating, in my 2025 preview, that Related would move in.

It's unclear why Related left. There could be a myriad of reasons, such as the desire to focus on other projects, a new assessment of the challenges of building, tensions with state agencies, or even tensions with the planned joint venture partners.

Perhaps Related--despite its track record building a platform over railyards to support vertical construction--recognized that, as original developer Forest City Ratner and successor Greenland USA discovered too late, the project is inherently risky?

However, there was a clue: I wrote Jan. 16 that Related had not reported lobbying on Atlantic Yards/Pacific Park in November/December 2024, which caused me to wonder if the deal was already cooked or if it was a lapse. That was unwise.

Cirrus's record

|

| Unofficial rendering |

A partial replacement, Cirrus Real Estate Partners, was later announced yesterday by Nicholas Mastroianni II’s U.S. Immigration Fund, the investment packager that controls the $286 million loan from EB-5 investors that's in foreclosure.

Those tower sites were provided as collateral by Greenland USA, which since 2014 has been the project's lead developer, but at this point retains the rights to build only at Site 5, across from the arena, and the B1 tower once slated to be built over the arena. (Greenland seeks to build a two-tower project at Site 5.)

The Real Deal, which last year had the scoop on Related's potential involvement, yesterday reported Related backs out of Pacific Park project in Prospect Heights, then later reported Related is out, Cirrus is in: New co-developer pitched for Pacific Park.

Who else?

However, Cirrus, a self-described "real estate investment management firm," lacks the track record to qualify as a "permitted developer," which has--or retains as Construction Manager--a decade of experience in "the development and construction of high-rise residential office, hospitality and/or mixed use projects... in an urban environment."

However, Cirrus, a self-described "real estate investment management firm," lacks the track record to qualify as a "permitted developer," which has--or retains as Construction Manager--a decade of experience in "the development and construction of high-rise residential office, hospitality and/or mixed use projects... in an urban environment."

Alternative, the permitted developer must be "reasonably acceptable" to Empire State Development (ESD), the state authority that oversees/shepherds the project and surely wants to see the project progress.

Cirrus hasn't built anything from the ground up and was founded, as far as I can tell, no earlier than 2020. One of its principals formerly worked for the private equity fund Fortress Investment Group, which has periodically partnered with the U.S. Immigration Fund and has somehow invested in the Atlantic Yards EB-5 debt.

Other partners are expected to enter, The Real Deal reported. Any joint venture would have to reckon with the May 2025 deadline to deliver 876 more affordable units, with $2,000/month penalties for each missing unit.

ESD is expected to renegotiate that obligation, despite pressure from local elected officials and the coalition BrooklynSpeaks to maintain the penalties, negotiated in 2014 by BrooklynSpeaks, to be deposited in a housing trust fund.

That could come with a promise of more (and deeper?) affordability, at least if ESD and the MTA grant significantly more development rights, essentially giving away free land that the original project developer had to bid on--as Greenland had sought in 2023, as I reported.

|

| Unofficial rendering |

I couldn't find any evidence that Cirrus had reported lobbying state entities, as had Related, so this all may be in the early stages.

Also note: while the USIF was described by The Real Deal as the "lender," it's not.

However, thanks to dubious contract language that gives the manager enormous sway, controls the loan: $286 million (out of an initial $349 million) that hasn't been repaid by developer Greenland USA to immigrant investors under the EB-5 investor visa program, which trades green cards for purportedly job-creating investments.

The City of New York said it had signed "a historic memorandum of understanding" with Cirrus and the Building and Construction Trades Council of Greater New York and Vicinity (BCTC) "to facilitate the development of affordable housing, including workforce housing, to meet the crisis of undersupply."

A new entity

Involved is a Cirrus entity, Cirrus Workforce Housing Advisors, announced last March as part of a partnership to build "workforce housing," using $100 million raised from Cirrus and from pension funds affiliated with building trades unions, with a goal of $400 million.

The City of New York said it had signed "a historic memorandum of understanding" with Cirrus and the Building and Construction Trades Council of Greater New York and Vicinity (BCTC) "to facilitate the development of affordable housing, including workforce housing, to meet the crisis of undersupply."

Such projects should be located near transit, advance sustainable building goals, and built under a project agreement that offers union jobs and benefits. Atlantic Yards/Pacific Park presumably qualifies.

Affordability questions

However, Atlantic Yards/Pacific Park, at least as promised, would not meet the partnership's announced goal to invest in developments with units from 80% to 140% Area Median Income (AMI). Under 2024 calculations, that could mean two-person households earning from $99,440 to $174,020 and paying from $2,330 to more than $3,800 for a one-bedroom apartment.

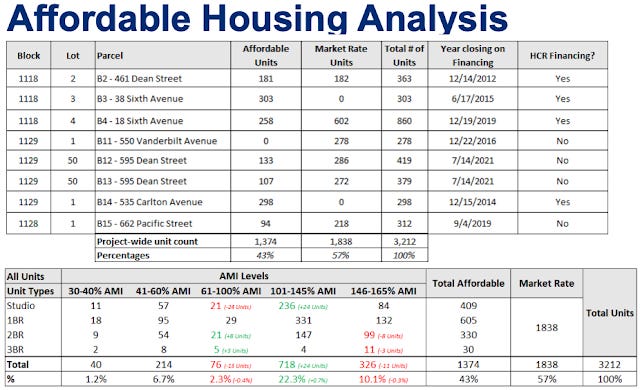

That AMI range, unless modified, would exclude the lower-income units long promised for Atlantic Yards, which has been skewed to middle-income households, delivering 76% of the 1,374 affordable units built so far, rather than 40%, as promised.

Only 254 such apartments have been built for households up to 60% of AMI, though 900 were promised, while 718 middle-income apartments (in the lower of two ranges) have been delivered, far more than the 450 promised.

|

| Chart from Empire State Development |

How affordable?

The Real Deal cited a press release in which Cirrus and USIF said they seek “greater affordability than originally proposed” for Atlantic Yards, but wouldn't provide details, as the affordability levels and unit count would result from negotiations with New York State.

That hints at the plan floated by Greenland USA in 2023, as I reported, to extend the deadline to deliver a required 876 more units of affordable housing, due by May 2025, while promising some 600 more affordable units, at least if the state granted additional bulk to allow 2,686 more apartments, bringing the project's total to 9,116. (See graphic above.)

In other words, additional bulk provides the value that could trickle down to affordability. That said, it's likely they would seek additional direct subsidies and lower-cost financing, as indicated in last year's announcement.

“This project is about delivering real results — affordable and workforce housing built with union labor to support New York’s working families,” Mastroianni II said in a statement to The Real Deal. Note that "affordable" and "workforce" may have divergent definitions.

Original proposal

|

| From 2005 Housing MOU |

The term "originally proposed" is questionable, since no developer has met the original proposal, memorialized in a 2005 non-binding Affordable Housing Memorandum of Understanding with the advocacy group New York ACORN, to deliver, among 2,250 total affordable units:

- 225 (10%) low-income housing units up to 40% of Area Median Income (AMI)

- 675 (30%) low-income housing units up to 50% of AMI

- 450 (20%) moderate-income units up to 100% of AMI

- 450 (20%) middle-income units up to 140% of AMI

- 450 (20%) middle-income units up to 160% of AMI

Not only have the income ceilings been stretched, the delivery has been skewed, thanks to ESD's long leash and changing tax policies.

Again, last year's Cirrus announcement setting an 80% AMI floor means rents, as of last year, potentially starting at $2,330 for a one-bedroom and going up past $3,800. Unless AMI calculations change, those numbers will rise.

|

| Annotation added |

However, landlords have recognized that such rents are untenable and have set the rents lower than the allowed ceiling.

Related's path

Last August 27, the Wall Street Journal, relying on the self-interested source Mastroianni, published Related Closes In on Deal to Rescue Notoriously Stalled Massive Housing Project. At a meeting last Nov. 14, ESD SVP Anna Pycior said they were “completing our review of their documents, and once the review is satisfactory… we would proceed with the new joint venture. We don't anticipate issues moving forward.”

That could happen “within weeks,” added her colleague Joel Kolkmann, Senior VP, Real Estate and Planning. That didn't happen, but it didn't stop me from speculating, in my 2025 preview, that Related would move in.

It's unclear why Related left. There could be a myriad of reasons, such as the desire to focus on other projects, a new assessment of the challenges of building, tensions with state agencies, or even tensions with the planned joint venture partners.

Perhaps Related--despite its track record building a platform over railyards to support vertical construction--recognized that, as original developer Forest City Ratner and successor Greenland USA discovered too late, the project is inherently risky?

However, there was a clue: I wrote Jan. 16 that Related had not reported lobbying on Atlantic Yards/Pacific Park in November/December 2024, which caused me to wonder if the deal was already cooked or if it was a lapse. That was unwise.

Cirrus's record

"It is not clear to what extent Cirrus — through a fund dubbed Cirrus Workforce Housing Advisors — will serve as co-developer, though a press release indicates that it would lead capitalization of the project," the Real Deal reported.

In other words, it's another money partner.

Though a spokesperson told the publication that Cirrus heads Joseph McDonnell and Tony Tufariello had, collectively, overseen “$150 billion in real estate finance transactions, $10 billion in real estate equity investments and more than 10,000 multifamily units," that's not the same as navigating the twists and turns of development.

Its website states:

Cirrus’ value-based investment approach is grounded in a deep and granular understanding of the base factors which drive real estate performance generated through the 25+ year average commercial real estate and capital markets experience of its partners.

This experience spans multiple cycles and includes the origination of over $150 billion of commercial real estate credit products and the investment of over $10 billion of commercial real estate equity. While firmly anchored in long-term real estate fundamentals, Cirrus’ approach is purposefully designed to adapt to the unique characteristics of each investment cycle.

That's verbiage aimed at investors and partners, not communities wondering about the reliability and civic obligations of a developer.

Who's in charge?

The USIF controls, the debt, in which Fortress also has invested. Entities controlled by the USIF, I reported, made the $11 million annual payment in 2024 to the MTA for railyard development rights.

A "permitted developer" cannot be a "Prohibited Person," which, according to the project's Development Agreement, includes those in breach of obligations to the state or city, those who've committed felonies or crimes of moral turpitude,

I and others have questioned whether USIF's Mastroianni II, whose criminal record includes an arrest on felony drug charges, disqualifies the joint venture from qualifying as “permitted developer.” Felons are barred. (It’s unclear whether he pleaded “no contest” to a reduced charge.)

“We're still looking at it,” said ESD lawyer Matthew Acocella in November. “But based on the information we've gotten and based on the structure of the [joint venture], we don't see any any bar to proceeding with this joint venture as the permitted developer with Related and USIF.”

Did that, I wondered, mean that Mastroianni is not a felon? Or if he is, it doesn’t count? Could it be that that only the company that builds the project, not any financial partners, gets evaluated as a permitted developer?

A "permitted developer" cannot be a "Prohibited Person," which, according to the project's Development Agreement, includes those in breach of obligations to the state or city, those who've committed felonies or crimes of moral turpitude,

I and others have questioned whether USIF's Mastroianni II, whose criminal record includes an arrest on felony drug charges, disqualifies the joint venture from qualifying as “permitted developer.” Felons are barred. (It’s unclear whether he pleaded “no contest” to a reduced charge.)

“We're still looking at it,” said ESD lawyer Matthew Acocella in November. “But based on the information we've gotten and based on the structure of the [joint venture], we don't see any any bar to proceeding with this joint venture as the permitted developer with Related and USIF.”

Did that, I wondered, mean that Mastroianni is not a felon? Or if he is, it doesn’t count? Could it be that that only the company that builds the project, not any financial partners, gets evaluated as a permitted developer?

Or, as I wrote last week, might Mastroianni have stepped back, letting his son take the reins?

Who's got leverage?

What's unclear is what leverage ESD has over Mastroianni as Manager of the EB-5 loan. Presumably a new deal would earn his company fees, and perhaps he already has an equity share.

The Chinese investors who put up $500,000 each (plus fees), foregoing interest, presumably would be eager to engage a developer and ensure they get paid back. As far as I can tell, however, they have no say in the structure of the deal.

Who's got leverage?

What's unclear is what leverage ESD has over Mastroianni as Manager of the EB-5 loan. Presumably a new deal would earn his company fees, and perhaps he already has an equity share.

The Chinese investors who put up $500,000 each (plus fees), foregoing interest, presumably would be eager to engage a developer and ensure they get paid back. As far as I can tell, however, they have no say in the structure of the deal.

Comments

Post a Comment