After demise of Forest City, two teams of Ratner family members have started new real-estate companies, based in Shaker Heights, OH, and Washington, DC

|

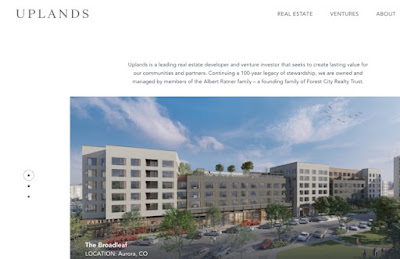

| The 370-unit Broadleaf is a collaboration between Uplands and The Max Collaborative |

(Bruce Ratner's children didn't go into real estate, and his longtime deputy and successor as Forest City Ratner/Forest City New York CEO, MaryAnne Gilmartin, formed her own company, MAG Partners, with several former colleagues.)

The two firms have completed projects together in Shaker Heights, outside Cleveland, and are working on others in Shaker Heights and around Denver.

About the firms

Among TMC's Directors are brothers Chuck Ratner, Forest City's former Chair and CEO; Jim Ratner, Forest City's former Chair and Commercial Group CEO; and Ronald A. Ratner, Forest City's former Chief Development Officer. But they're not running the show.

The descendants of Max Ratner, one of the first-generation members of the clan in Cleveland, have formed Shaker Heights, OH-based The Max Collaborative, while the progeny of second-generation Albert Ratner (still serving!) have formed Washington, DC-based Uplands, a real-estate developer and venture investor.

|

| From Forest City Enterprises |

TMC, which also has an office in Santa Monica, is also pursuing projects in Los Angeles, and has a greater purview.

Neither company, however, has pursued multi-year, multi-stage megaprojects that both brought Forest City significant success and also undemined the company so much that hedge funds targeted poor governance, forced board changes, and ultimately led to the company's highly contentious 2018 absorption by Brookfield Asset Management.

Rather, as explained below, they've been very strategic, pursuing projects in Opportunity Zones.

About the firms

|

| From The Max Collaborative |

TMC's co-founders are CEO Jon Ratner and Chief Development Officer Kevin Ratner, both sons of Chuck Ratner and former Forest City exeuctives themselves, along with COO Luke Palmisano, who formerly was President of RMS Investment Corporation—a commercial real estate company managing the private real estate of the Ratner family, which started developing the Van Aken District in Shaker Heights, which the two new firms continue to pursue.

Uplands' Principals include Deborah Ratner Salzberg, formerly President of Forest City Washington (and later Washington, DC Region Chairman for Brookfield Properties); her son-in-law Josh Hoffman, who held Development and Investment Management roles at EDENS, a $6.5 billion private REIT headquartered in Washington; and her brother Brian Ratner, formerly President of Forest City Texas. The siblings' father Albert Ratner, former CEO and Chairman of Forest City, serves as Chairman of Uplands.

Deploying new cash

As explained in an 11/21/21 Crain's Cleveland Business article by Michelle Jarboe (who's long followed Forest City, previously at The Plain Dealer), the 2018 sale to Brookfield left the Ratners with "a lot of cash — just as the U.S. government was rolling out a program that offers significant tax benefits to investors with capital gains," deploying assets in Opportunity Zones (OZ).

TMC CEO Jon Ratner told Jarboe they had bigger goals: "It's not just to deploy this OZ capital and be done. It's to start and build and grow another great company — and headquarter it here in Shaker Heights."

From the article:

The Ratners won't say how much money they made on the deal with Brookfield, which paid $25.35 per share for Forest City. Regulatory filings show that the family controlled more than 11.3 million shares in autumn of 2018.

My math is that that translates to $286.455 million, which does not translate completely to profit and surely encompasses family members who are not part of the two new companies.

Jarboe found public records that showed TMC spent more than $50 million in 2019-20 in OZs--"developing, but arguably distressed, locations." (Note: arguably.)

OZs offer both tax deferrals and tax breaks, especially for those holding investments for at least ten years. (The Van Aken District is not in an OZ, but it's in the family's home suburb.)

Not only are the two firms working in cities where Forest City had a presence, they're in some cases working with partners led by former Forest City employees, according to Jarboe.

Update: Negotiating with Shaker Heights

The Plain Dealer, Cleveland's main newspaper, hasn't produced an overarching story on TMC, but a succession of headlines from Cleveland.com, which encompasses not just the Plain Dealder but also the Sun Press surburban news enterprise, last year show that the Ratners--not unlike others in the real estate field--haven't forgotten how to renegotiate deals, citing rising interest rates and inflation:

- 6/28/22: Van Aken District developer seeks $4 million forgivable loan from Shaker Heights

- 7/12/22: Shaker council answers a ‘big ask’ on Van Aken District Phase II with $4M ‘conditional grant’ for Farnsleigh Apartments

- 7/13/22: Shaker school board OKs additional tax breaks for Van Aken District Phase II apartment project (Updated)

Comments

Post a Comment