Documents confirm (duh) that, despite developer's lack of candor, 240 "affordable" units at 595 Dean will be at 130% AMI, which means six-figure earners. All units > $3,000?

For quite a while, representatives of developer TF Cornerstone and master developer Greenland Forest City Partners have been coy or vague regarding the level of affordability planned at the 240 units (of 798) in the two towers at 595 Dean, B12 and B13.

Of course the developers had decided on the affordability level, based on their financial projections, and of course they'd choose the option with the most return.

Of course the developers had decided on the affordability level, based on their financial projections, and of course they'd choose the option with the most return.

I predicted that TF Cornerstone, recognizing reality, won't market the "affordable" units for the maximum levels allowable, which under elevated 2022 guidelines could mean studios for $3,035, 1-BRs for $3,253, and 2-BRs for $3,903.

"Yeah, it's somewhere between 25 and 30% of the total units will be affordable," stated Greenland USA's Scott Solish.

Director Gib Veconi, the AY CDC's best-informed (and pretty much only informed) member, interjected, noting Solish's reference to a range between 25% to 30%.

"Does that mean they have not yet elected which option of Affordable New York they're going to take?" Veconi asked. That refers to the updated (and now expired) 421-a tax break, which has options for 25% affordability, including a majority of low-income units, and 30% affordability, in two scenarios: one with 10% low-income units, and one with only middle-income units, at 130% of AMI.

Consider, as I wrote 1/26/22, TF Cornerstone's Amir Stein told attendees at the bi-monthly Atlantic Yards/Pacific Quality of Life meeting that they had no information about the affordability of the 30% affordable units at those towers.

As I wrote, all indications--based on the track record with similar towers, Plank Road (662 Pacific St., B15) and Brooklyn Crossing (18 Sixth Ave., B4)--were that they’d be aimed at middle-income households, with an income target of 130% of Area Median Income (AMI)--generally people earning six figures.

Of course, the developers were obfuscating, just as Greenland did regarding B4, even in the face of published evidence (by their lender!) that the units would be at 130% of AMI, as I wrote.

Published proof

Of course the developers had decided on the affordability level, based on their financial projections, and of course they'd choose the option with the most return.

Of course the developers had decided on the affordability level, based on their financial projections, and of course they'd choose the option with the most return.As shown in documents (and excerpt) below, on 10/26/21, TF Cornerstone, in the form of 595 Dean LLC, submitted to the state Public Service commission, stating that the affordable units would be at 130% AMI.

The subsequent 6/22/22 Order from the PSC stated, "The Notice of Intent states that 558 units will be rented at fair market value, and 240 units will be reserved for individuals earning 130 percent of the Area Median Income (AMI)."

As I wrote in November, they're not promoting "affordable housing" but rather "rent stabilized luxury," because the 240 "affordable" units, however below market, surely won't be cheap.

I predicted that TF Cornerstone, recognizing reality, won't market the "affordable" units for the maximum levels allowable, which under elevated 2022 guidelines could mean studios for $3,035, 1-BRs for $3,253, and 2-BRs for $3,903.

Rather, they'll offer a discount, perhaps even off 2021 guidelines, as did Plank Road and Brooklyn Crossing:

- studio: Brooklyn Crossing: $1,905, Plank Road: $1,547; allowable: $2,263

- 1-BR: Brooklyn Crossing, $2,390; Plank Road: $2,273; allowable: $2,838

- 2-BR: Brooklyn Crossing, $3,344; Plank Road: $3,219; allowable: $3,397

Six-figure earners?

Note that the 2022 income limits (below) for those at 130% of AMI range from $121,420 for a one-person household to $173,420 for a four-person one, but we don't know--and this has varied--what the floor might be.

A lower floor means more applicants, but, depending on how much the developer actually seeks in rent, it could mean that the total rent would exceed the "affordable" guideline of 30% of income.

Misleading discussions

At the June meeting of the purportedly advisory Atlantic Yards Community Development Corporation (AY CDC), one director asked, innocently enough, about the affordable percentages at the two under-construction towers.

At the June meeting of the purportedly advisory Atlantic Yards Community Development Corporation (AY CDC), one director asked, innocently enough, about the affordable percentages at the two under-construction towers.

"Yeah, it's somewhere between 25 and 30% of the total units will be affordable," stated Greenland USA's Scott Solish.

Director Gib Veconi, the AY CDC's best-informed (and pretty much only informed) member, interjected, noting Solish's reference to a range between 25% to 30%.

"Does that mean they have not yet elected which option of Affordable New York they're going to take?" Veconi asked. That refers to the updated (and now expired) 421-a tax break, which has options for 25% affordability, including a majority of low-income units, and 30% affordability, in two scenarios: one with 10% low-income units, and one with only middle-income units, at 130% of AMI.

"I don't want to speak for the TF Cornerstone team but I believe that's the case," Solish said. " So they weren't able to join this afternoon. But I will certainly share that question with them and we'll get the directors an answer from the TF [Cornerstone] development team."

Well, the AY CDC hasn't met since, so there's no public documentation of a response.

What we knew

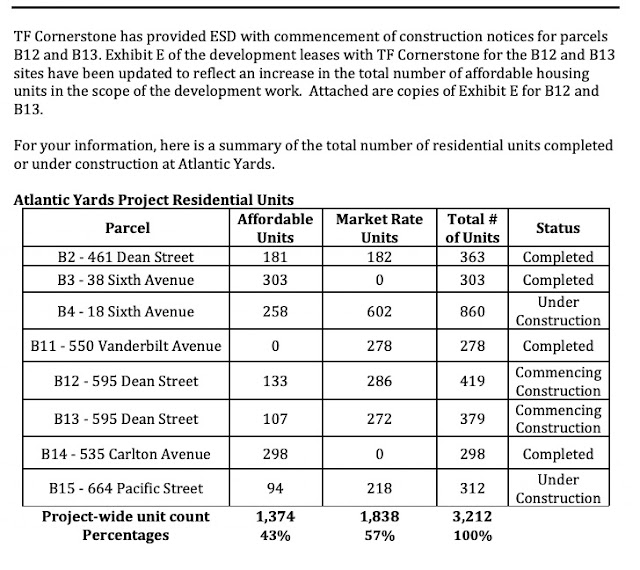

Of course, as I wrote at the time, the 30% percentage had in July 2020 already been provided--see excerpt below--by Empire State Development (ESD), the state authority overseeing/shepherding the project, which the AY CDC is supposed to advise.

Of course, as I wrote at the time, the 30% percentage had in July 2020 already been provided--see excerpt below--by Empire State Development (ESD), the state authority overseeing/shepherding the project, which the AY CDC is supposed to advise.

Which meant Solish's response, I observed, was strategic befuddlement. It's all part of a strategy to avoid transparency. It's the kind of thing a moderately responsible state authority would try to pin down. But it hasn't.

Comments

Post a Comment