As plans for Site 5 loom, 2021 lease suggests Modell's/P.C. Richard property valued at $19.1M (?!). But that didn't mean NY State got paid.

I wrote last October how a legal settlement between retailer P.C. Richard and an affiliate of developer Greenland Forest City Partners (GFCP) unlocked the process to shift bulk from the unbuilt "Miss Brooklyn" (aka B1) tower, once slated to loom over the arena, across Flatbush Ave. to Site 5, to enable a giant project.

The contours and cost of that agreement remain unpublicized, so we don't know whether P.C. Richard will get replacement space, as it alleged was promised, and/or otherwise participate in the new tower complex. The contract (bottom) is called a Purchase and Sale Agreement and Development Agreement; the latter implies a broader role.

Another look at the city's ACRIS database shows a separate transaction, filed 11/15/21, related to both the P.C. Richard and Modell's parcels, with a dollar figure attached: $19.1 million.

Another look at the city's ACRIS database shows a separate transaction, filed 11/15/21, related to both the P.C. Richard and Modell's parcels, with a dollar figure attached: $19.1 million.

Is that the cost of the interim lease (below) between landlord Empire State Development, the state authority that oversees/shepherds the project, and Pacific Park Site 5 developer, an affiliate of GFCP? (GFCP is owned 95% by Greenland USA.)

No, Empire State Development tells me: “As part of the resolution of Site 5, ESD will be issuing a development lease to the developer for a future project on the site, which triggered the assessment of transfer taxes and required a valuation for the portion of the site covered by this lease.”So it's a valuation, but not necessarily a transfer of $19.1 million. Note that the city's real property tax rate for commercial transactions is 2.625%, and the tax listed in the lease, $501,375, is indeed 2.625% of $19.1 million. The state's tax rate is .65%, and the tax listed in the lease, $124,151.25, is 0.65% of $19.1 million.

How was $19.1 million calculated?

The calculation of the valuation is a mystery to me.

The value of the lease likely does not reflect of the cost to compensate P.C. Richard for the condemnation of its property.

The developer has to reimburse ESD for compensation costs, which are either negotiated privately or set by a condemnation judge. (It seems as though that's been settled privately.)

Note that, in a 2012 appraisal assessing conditions as of 2010, the cost of P.C. Richard's property was valued at $13.7 million, which was supposed to reflect the market at the time, not counting the additional development rights unlocked by ESD's override of zoning.

That was part of a market valuation of $35.6 million for the land, diminished by the costs to buy out P.C. Richard and Modell's.

Keep in mind that TF Cornerstone and The Brodsky Organization paid far more money, $199 million, in total, for leases of three other project sites. But they were paying GFCP; this transaction involves ESD and GFCP, and no payment.

Presumably, if and when ESD approves some version of the proposed bulk transfer--described below--to create a much larger development site, GFCP could market the development lease to another developer for a significant sum. (And Greenland USA likely needs money, given the parent company's financial precarity, facing downgrades of its credit rating.)

As I wrote, ESD in February 2016 offered to pay P.C. Richard $15.1 million, which the retailer considered inadequate, especially since it also sought space to operate in the future building.

Site 5 was said to have 323,598 square feet of development rights overall, given a 1.24 acre parcel (53,933 square feet) and a buildable Floor Area Ratio (FAR) of 6, meaning a multiple of a fully built-out parcel.

The appraisal calculated the costs to achieve the exit of the two retailers, and subtracted that from the overall value of the then unencumbered buildable square footage. The price was about $110 per buildable square foot, far less than the cost today.

What's proposed

Of course the volume of the building approved in 2006 was more than the zoning allowed, as the state can override city zoning. Site 5 was approved at 439,050 square feet.

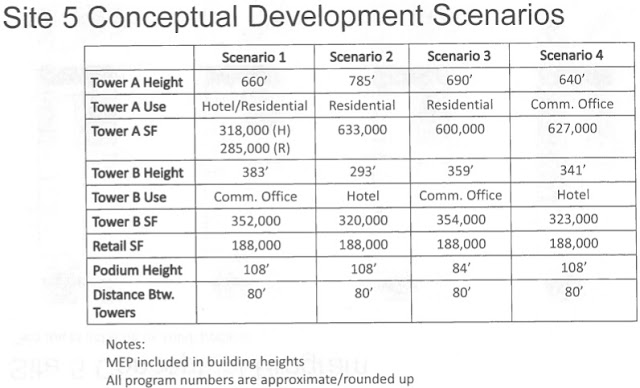

But if the bulk of Miss Brooklyn were moved there, the total could easily exceed 1.1 million square feet. That would mean a potential Floor Area Ratio of 23.5, nearly double that of the Downtown Brooklyn rezoning, and 25% more than the unusually large 80 Flatbush project.

The bulk would preserve the arena plaza; after all, construction there would severely impact arena operations.Of course those 2016 projections may have changed, with an even larger project contemplated. But that also means

|

| Slides from 2016 presentation |

Comments

Post a Comment