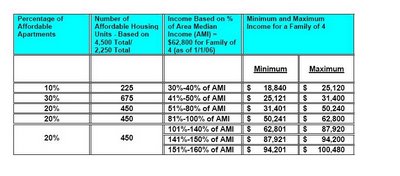

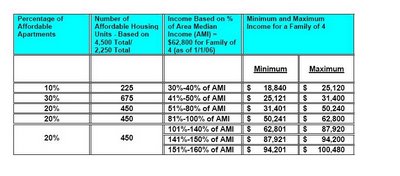

There's been a small but significant switch within the allotment of affordable housing promised for the Atlantic Yards project. No longer would 900 of the 2250 affordable apartments be promised to moderate-income households earning 60%-100% of the Area Median Income, or AMI.

Rather, only 450 units would go to moderate-income people, and 900 would be aimed to the middle-class, earning above the AMI. Thus, some 40% of the units in the affordable allotment would have relatively high rent; a family of four would pay more than than $2000 a month.

The scenario currently proposed was, in fact, one of three anticipated in the Housing Memorandum of Understanding (MOU) that the advocacy group ACORN negotiated with developer Forest City Ratner in May 2005.

However, this scenario, which would reap the highest rent, was not the one the developer promoted on its web site for three months. No wonder some of the attendees at the affordable housing information session on 7/11/06 looked askance at the rents being discussed.

No matter the scenario, each unit would be rented at 30% of the tenants' family income, which is the definition of affordable. Each of the three scenarios would reserve 900 of the affordable units to low-income households earning 50% or less of the AMI.

This conforms with the New York City Housing Development Corporation's New Housing Opportunities (HOP) program, which supports developments with 50% market-rate units, 30% moderate- and middle-income units, and 20% low income units. The New HOP program would involve only the 4500 rental units proposed for Atlantic Yards, not the additional 2360 market-rate condos.

It should be acknowledged that any of the three scenarios negotiated by ACORN would in some ways improve on the New HOP program. (I'll discuss that in greater detail below.) It's just that the current scenario would offer the least improvement.

Best deal

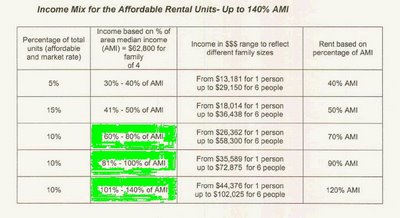

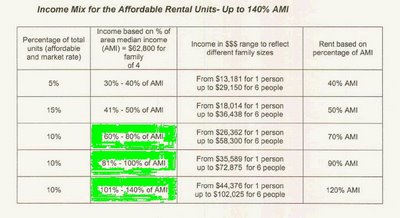

The first scenario in Housing MOU set the income limit at 140% of the AMI. (When the agreement was signed last year, the AMI was $62,800.)

The scenario included five categories, or "bands," in which the third-highest band (450 units) would encompass people earning 61%-80% of the AMI, the fourth-highest band (450 units) would be for those earning 81%-100% of the AMI, and the highest band (450 units) would be for those earning 101%-140% of the AMI.

Next deal

The second scenario set the income limit at 150% of the AMI. The third-highest band would encompass people earning 60%-90% of the AMI, the fourth-highest band would be for those earning 91%-110% of the AMI, and the highest band would be for those earning 111%-150% of the AMI.

Highest rent

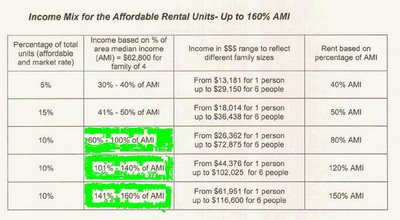

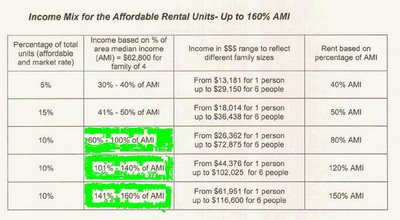

The third scenario was for an income limit of 160% of the AMI. Of the five"bands," the third-highest band would encompass people earning 60-100% of the AMI, the fourth-highest band would be for those earning 101%-140% of the AMI, and the highest band would be for those earning 141%-160% of the AMI.

In short, those earning 60%-100% of the AMI would gain access to 450 units, rather than 900 units, as anticipated in the first scenario.

Best deal promoted

When Forest City Ratner debuted the new AtlanticYards.com web site in April, the housing chart promised a version of the first scenario, with 900 units offered to moderate-income renters. This was actually slightly better than the first scenario, since the third band encompassed those earning 51%-80%, not 60%-80% of the AMI.

(Note that the chart below is no longer on the AtlanticYards.com web site.)

Best deal shelved

When it came time for the affordable housing information session on 7/11/06, however, Forest City Ratner had replaced the first scenario with the third scenario.

Instead of having 900 (40%) of the 2250 affordable units go to people earning between 61%-100% of the AMI, only 450 units would go to those in that category, and 900 units would go to those earning more than the AMI.

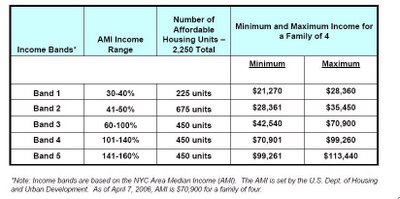

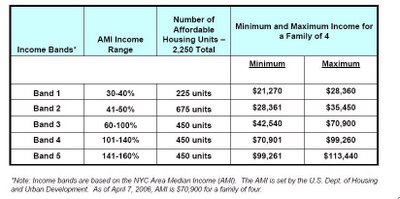

Moreover, the AMI in the past year has risen from $62,800 to $70,900, thus raising rents all around.

Still an improvement

This actually remains an improvement over some other affordable housing configurations. As City Limits reported last year:

What ACORN won was a commitment to devote most of the middle-income units to households earning significantly less than the maximum HDC allows, and to limit rents to 30 percent of household income. Usually, HDC New Housing Opportunity Program [HOP] apartments are open to renters earning up to 175 percent of area median income, or, averaging for household size, about $94,500. Ratner agreed to lower the cap to 160 percent, and possibly as low as 140 percent, depending on project financing and market conditions as the new towers get built.

So project financing and market conditions now seem to be driving a cap of 160 percent, not 140 percent.

Low-income boundaries

(Updated) The Atlantic Yards program would be within the typical income ranges for low- and moderate-income households.

(Updated) The Atlantic Yards program would be within the typical income ranges for low- and moderate-income households.

The New York City Housing Development Corporation (HDC) says that 20 percent of the units in the New HOP program should be affordable to those earning at or below 50% of the AMI, and gives examples of 40% and 50%.

The Atlantic Yards program would go down to 30% of the AMI--though that "band" is typically 30-40% of AMI.

Moderate-income levels

Also, HDC says that 30% of the units would have to be affordable to those earning at or below 130% of the AMI. The three examples provided are 80%, 100%, and 130%.

The "band" for the Atlantic Yards project involving those earning 60%-80% of AMI would not have been atypical for the range,.

What would the rent be?

It's unclear, however, how much the Atlantic Yards affordable housing would do for the middle-income people who need a boost. Yes, only those earning up to 160% of the AMI would be eligible for Atlantic Yards, while the standard New HOP cap is 175% of the AMI.

On the other hand, the rents may not be lower. Affordable rents proposed for Atlantic Yards would range past $3000 for a family of six, and to $2658 for a family of four. (Click to enlarge.)

However, the June 2006 term sheet for the New Housing Opportunities Program sets maximum rent levels at $2334, or 130% of AMI. (My assumption is that would be for a family of four.)

Note that, in the third scenario of the Atlantic Yards Housing MOU, the rents would go up to 150% of AMI.

Bottom-line issues

So what does it all mean? These adjustments within the proposed affordable housing scenarios likely are linked to the available financing for affordable housing and the overall cost of the project.

Does the presence of the arena and high infrastructure costs mean that Forest City Ratner can only promise the third, rather than the first, scenario regarding affordable housing?

Does the presence of affordable housing drive political support for a project far more dense than any other in the country?

Would the rent for the higher-end affordable units be above the New HOP guidelines?

How much would the public pay for the affordable housing, and what is Forest City Ratner's contribution?

Is there a justification for a greater public investment?

Or how might the same public investment in affordable housing play out in a different project?

All these are unknowns until more figures are on the table for public discussion.

What is clear is that affordable housing means a rent set at 30% of a family's income. It does not mean low-income housing, and it does not mean moderate-income housing. The details matter.

Rather, only 450 units would go to moderate-income people, and 900 would be aimed to the middle-class, earning above the AMI. Thus, some 40% of the units in the affordable allotment would have relatively high rent; a family of four would pay more than than $2000 a month.

The scenario currently proposed was, in fact, one of three anticipated in the Housing Memorandum of Understanding (MOU) that the advocacy group ACORN negotiated with developer Forest City Ratner in May 2005.

However, this scenario, which would reap the highest rent, was not the one the developer promoted on its web site for three months. No wonder some of the attendees at the affordable housing information session on 7/11/06 looked askance at the rents being discussed.

No matter the scenario, each unit would be rented at 30% of the tenants' family income, which is the definition of affordable. Each of the three scenarios would reserve 900 of the affordable units to low-income households earning 50% or less of the AMI.

This conforms with the New York City Housing Development Corporation's New Housing Opportunities (HOP) program, which supports developments with 50% market-rate units, 30% moderate- and middle-income units, and 20% low income units. The New HOP program would involve only the 4500 rental units proposed for Atlantic Yards, not the additional 2360 market-rate condos.

It should be acknowledged that any of the three scenarios negotiated by ACORN would in some ways improve on the New HOP program. (I'll discuss that in greater detail below.) It's just that the current scenario would offer the least improvement.

Best deal

The first scenario in Housing MOU set the income limit at 140% of the AMI. (When the agreement was signed last year, the AMI was $62,800.)

The scenario included five categories, or "bands," in which the third-highest band (450 units) would encompass people earning 61%-80% of the AMI, the fourth-highest band (450 units) would be for those earning 81%-100% of the AMI, and the highest band (450 units) would be for those earning 101%-140% of the AMI.

Next deal

The second scenario set the income limit at 150% of the AMI. The third-highest band would encompass people earning 60%-90% of the AMI, the fourth-highest band would be for those earning 91%-110% of the AMI, and the highest band would be for those earning 111%-150% of the AMI.

Highest rent

The third scenario was for an income limit of 160% of the AMI. Of the five"bands," the third-highest band would encompass people earning 60-100% of the AMI, the fourth-highest band would be for those earning 101%-140% of the AMI, and the highest band would be for those earning 141%-160% of the AMI.

In short, those earning 60%-100% of the AMI would gain access to 450 units, rather than 900 units, as anticipated in the first scenario.

Best deal promoted

When Forest City Ratner debuted the new AtlanticYards.com web site in April, the housing chart promised a version of the first scenario, with 900 units offered to moderate-income renters. This was actually slightly better than the first scenario, since the third band encompassed those earning 51%-80%, not 60%-80% of the AMI.

(Note that the chart below is no longer on the AtlanticYards.com web site.)

Best deal shelved

When it came time for the affordable housing information session on 7/11/06, however, Forest City Ratner had replaced the first scenario with the third scenario.

Instead of having 900 (40%) of the 2250 affordable units go to people earning between 61%-100% of the AMI, only 450 units would go to those in that category, and 900 units would go to those earning more than the AMI.

Moreover, the AMI in the past year has risen from $62,800 to $70,900, thus raising rents all around.

Still an improvement

This actually remains an improvement over some other affordable housing configurations. As City Limits reported last year:

What ACORN won was a commitment to devote most of the middle-income units to households earning significantly less than the maximum HDC allows, and to limit rents to 30 percent of household income. Usually, HDC New Housing Opportunity Program [HOP] apartments are open to renters earning up to 175 percent of area median income, or, averaging for household size, about $94,500. Ratner agreed to lower the cap to 160 percent, and possibly as low as 140 percent, depending on project financing and market conditions as the new towers get built.

So project financing and market conditions now seem to be driving a cap of 160 percent, not 140 percent.

Low-income boundaries

(Updated) The Atlantic Yards program would be within the typical income ranges for low- and moderate-income households.

(Updated) The Atlantic Yards program would be within the typical income ranges for low- and moderate-income households.The New York City Housing Development Corporation (HDC) says that 20 percent of the units in the New HOP program should be affordable to those earning at or below 50% of the AMI, and gives examples of 40% and 50%.

The Atlantic Yards program would go down to 30% of the AMI--though that "band" is typically 30-40% of AMI.

Moderate-income levels

Also, HDC says that 30% of the units would have to be affordable to those earning at or below 130% of the AMI. The three examples provided are 80%, 100%, and 130%.

The "band" for the Atlantic Yards project involving those earning 60%-80% of AMI would not have been atypical for the range,.

What would the rent be?

It's unclear, however, how much the Atlantic Yards affordable housing would do for the middle-income people who need a boost. Yes, only those earning up to 160% of the AMI would be eligible for Atlantic Yards, while the standard New HOP cap is 175% of the AMI.

On the other hand, the rents may not be lower. Affordable rents proposed for Atlantic Yards would range past $3000 for a family of six, and to $2658 for a family of four. (Click to enlarge.)

However, the June 2006 term sheet for the New Housing Opportunities Program sets maximum rent levels at $2334, or 130% of AMI. (My assumption is that would be for a family of four.)

Note that, in the third scenario of the Atlantic Yards Housing MOU, the rents would go up to 150% of AMI.

Bottom-line issues

So what does it all mean? These adjustments within the proposed affordable housing scenarios likely are linked to the available financing for affordable housing and the overall cost of the project.

Does the presence of the arena and high infrastructure costs mean that Forest City Ratner can only promise the third, rather than the first, scenario regarding affordable housing?

Does the presence of affordable housing drive political support for a project far more dense than any other in the country?

Would the rent for the higher-end affordable units be above the New HOP guidelines?

How much would the public pay for the affordable housing, and what is Forest City Ratner's contribution?

Is there a justification for a greater public investment?

Or how might the same public investment in affordable housing play out in a different project?

All these are unknowns until more figures are on the table for public discussion.

What is clear is that affordable housing means a rent set at 30% of a family's income. It does not mean low-income housing, and it does not mean moderate-income housing. The details matter.

Comments

Post a Comment