One key to sales at the 550 Vanderbilt condo is the connection to China, thanks to Shanghai-based developer Greenland Holdings.

One key to sales at the 550 Vanderbilt condo is the connection to China, thanks to Shanghai-based developer Greenland Holdings.It's the parent of Greenland USA, which as part of Greenland Forest City Partners owns 70% of Pacific Park (except 461 Dean and the arena).

And sales in China may help explain how the developer was able to claim early momentum.

"Since 550 Vanderbilt launched pre-sales in June [2015], more than 80 residences have gone into contract, representing over 30% of the building’s 278 total residences," the developer said in a 9/25/15 press release announcing the opening of a sales gallery in Brooklyn. "The strong response from the marketplace indicates the high level of demand for well-designed new luxury homes in Brooklyn..."

Also, as I can report exclusively, a significant portion (all?) of the pre-sales were focused on Chinese buyers, given the marketing materials cited here: a 6/3/15 presentation (bottom) in English and Chinese, explaining the nuts and bolts of purchasing, including the 421-a tax abatement.

Also, as I can report exclusively, a significant portion (all?) of the pre-sales were focused on Chinese buyers, given the marketing materials cited here: a 6/3/15 presentation (bottom) in English and Chinese, explaining the nuts and bolts of purchasing, including the 421-a tax abatement.

Some 38% of the apartments were designated as "international units," aimed at buyers from China. (In a Los Angeles project, Greenland was reportedly aiming at 30% Chinese buyers.)

Today, many of those apartments designated as "international units" are listed as sold, but the identity of the buyers is not yet clear. Nor are international buyers limited to those apartments. Indeed, the first two buyers from Shanghai bought apartments not designated as "international units."

It's a free market, so people from anywhere can buy condos, right?

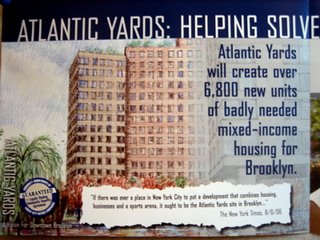

Sure, but it's worth remembering that Atlantic Yards was once supposed to "create over 6,800 new units of badly needed mixed-income housing for Brooklyn," thus "helping solve Brooklyn's housing crisis," as developer Forest City Ratner professed in an October 2006 flier. (The plan later became 6,430 apartments.)

The project, renamed Pacific Park, was said--at a marketing event for 550 Vanderbilt--to be "the new heart and soul of Brooklyn."

Like other condo buildings, 550 Vanderbilt also can be a place for the world's wealthy to stash their cash. One new twist: it's now much tougher for buyers from China to get their cash out of the country, so more creative financing is necessary, the Real Deal reported. Stay tuned.

Maybe. Or maybe it just meant a decent initial pipeline to Chinese buyers.

As lawyer Jay Neveloff, who represents Forest City, told the Real Deal in 2015, a project involving a Chinese firm "creates a huge market for potential sales" and that Chinese buyers "accept a lower rate of return for being in the New York market, which gives them an advantage."

After all, as we just learned, two of the first five announced buyers at the building are from Shanghai and nearly half the confirmed sales needed for the condo plan to become effective came in the third quarter of 2015. (That was 21 sales.)

550 and the "International Units"

As lawyer Jay Neveloff, who represents Forest City, told the Real Deal in 2015, a project involving a Chinese firm "creates a huge market for potential sales" and that Chinese buyers "accept a lower rate of return for being in the New York market, which gives them an advantage."

After all, as we just learned, two of the first five announced buyers at the building are from Shanghai and nearly half the confirmed sales needed for the condo plan to become effective came in the third quarter of 2015. (That was 21 sales.)

550 and the "International Units"

Also, as I can report exclusively, a significant portion (all?) of the pre-sales were focused on Chinese buyers, given the marketing materials cited here: a 6/3/15 presentation (bottom) in English and Chinese, explaining the nuts and bolts of purchasing, including the 421-a tax abatement.

Also, as I can report exclusively, a significant portion (all?) of the pre-sales were focused on Chinese buyers, given the marketing materials cited here: a 6/3/15 presentation (bottom) in English and Chinese, explaining the nuts and bolts of purchasing, including the 421-a tax abatement.Some 38% of the apartments were designated as "international units," aimed at buyers from China. (In a Los Angeles project, Greenland was reportedly aiming at 30% Chinese buyers.)

Today, many of those apartments designated as "international units" are listed as sold, but the identity of the buyers is not yet clear. Nor are international buyers limited to those apartments. Indeed, the first two buyers from Shanghai bought apartments not designated as "international units."

And what makes an "international unit"?

Unclear. They don't boast different pricing; nor are particular perks or fixtures promised. That said, none of those units were on the north side of the building--maybe a feng shui issue or, simply, shielded from future construction noise.

(The document was sent to me by an outside source and contains information consistent with the 550 Vanderbilt offering plan. I asked a developer's rep in 2015 about "international units" but didn't get a response.)

The document, in Chinese, warned that prices would rise after the first 61 went on sale and, indeed, they did. The New York Post reported in September 2015 that prices for a studio--previously $540,000--started at $625,000.

Then again, pricing in real estate can be flexible. Let's see what incentives there might be to move unsold units, given that sales have since slowed.

Unclear. They don't boast different pricing; nor are particular perks or fixtures promised. That said, none of those units were on the north side of the building--maybe a feng shui issue or, simply, shielded from future construction noise.

(The document was sent to me by an outside source and contains information consistent with the 550 Vanderbilt offering plan. I asked a developer's rep in 2015 about "international units" but didn't get a response.)

The document, in Chinese, warned that prices would rise after the first 61 went on sale and, indeed, they did. The New York Post reported in September 2015 that prices for a studio--previously $540,000--started at $625,000.

Then again, pricing in real estate can be flexible. Let's see what incentives there might be to move unsold units, given that sales have since slowed.

Housing for Brooklyn?

Sure, but it's worth remembering that Atlantic Yards was once supposed to "create over 6,800 new units of badly needed mixed-income housing for Brooklyn," thus "helping solve Brooklyn's housing crisis," as developer Forest City Ratner professed in an October 2006 flier. (The plan later became 6,430 apartments.)

The project, renamed Pacific Park, was said--at a marketing event for 550 Vanderbilt--to be "the new heart and soul of Brooklyn."

Like other condo buildings, 550 Vanderbilt also can be a place for the world's wealthy to stash their cash. One new twist: it's now much tougher for buyers from China to get their cash out of the country, so more creative financing is necessary, the Real Deal reported. Stay tuned.

Comments

Post a Comment