It's not as bad as Assemblyman Jim Brennan warned, but the Atlantic Yards project would include a relatively small amount of affordable housing--some 17%--in the first phase and just 162 low-income rentals over four years.

Brennan raised suspicions at the Draft Environmental Impact Statement (DEIS) hearing August 23 that affordable housing would be limited to Phase II (scheduled completion date: 2016) of the Atlantic Yards project.

That's not true. Still, Forest City Ratner and its partner ACORN have offered no specifics regarding how much affordable housing would be built in Phase I, which would involve five towers (of 16 planned), plus the arena, scheduled for completion in 2010.

That's not true. Still, Forest City Ratner and its partner ACORN have offered no specifics regarding how much affordable housing would be built in Phase I, which would involve five towers (of 16 planned), plus the arena, scheduled for completion in 2010.

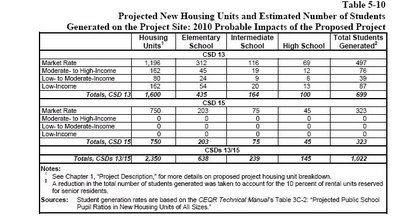

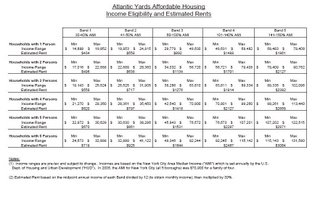

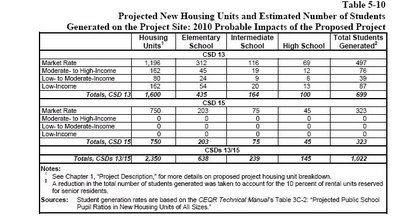

The DEIS, however, provides strong hints. In attempting to estimate the effect on community facilities such as schools, the DEIS in Chapter 5 offers these projections (above; click on all graphics to enlarge):

--1946 market-rate units, both rentals and condos

---162 moderate- to high-income rentals

----80 low-to-moderate income rentals

---162 low-income rentals

That makes for nearly 83% luxury, market-rate units. If you add the 162 moderate-to high-income rentals, which would easily rent for more than $2000 a unit for a four-person family, that makes 2108 units, or nearly 90% of 2350 total units.

That makes for nearly 83% luxury, market-rate units. If you add the 162 moderate-to high-income rentals, which would easily rent for more than $2000 a unit for a four-person family, that makes 2108 units, or nearly 90% of 2350 total units.

(Note that, in other contexts, the term "moderate- to middle-income" has been used by the Empire State Development Corporation instead of "moderate- to high-income.")

It provides strong evidence that, as Brennan and others have suggested, the financial success of the project as a whole--and the provision of most of the affordable housing--depends on the success of the market-rate units. Moreover, should the housing market change, Phase II--with most of the affordable units--could be delayed.

The 17% affordable housing represents about half of the onsite affordable housing promised (33%) and about one-third of the original 50/50 pledge.

Condos vs. rentals

Given that Forest City Ratner promises that half of the rentals would be affordable, the numbers suggest the following breakdown for the first phase:

Given that Forest City Ratner promises that half of the rentals would be affordable, the numbers suggest the following breakdown for the first phase:

--404 market-rate rentals

--404 affordable rentals

-1542 market-rate condos

As of now, the developer plans 4500 rentals and 2360 condos in the project as a whole. The numbers for Phase I represent 65% of the projected condos but only 18% of the rentals.

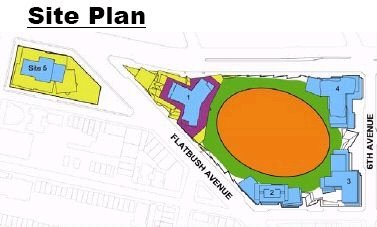

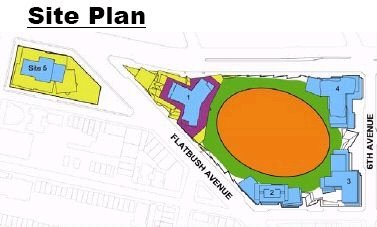

Remember that FCR initially promised that half of the entire project would be affordable, then, when Housing Memorandum of Understanding (MOU) was signed with ACORN, limited that pledge to the rentals. But the MOU doesn't require that the rentals and condos must be built at the same time. (Above: the five towers of Phase I, plus the arena.)

Where they'd go

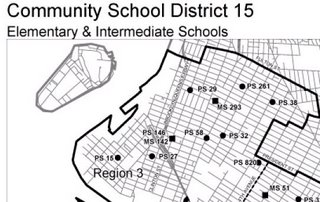

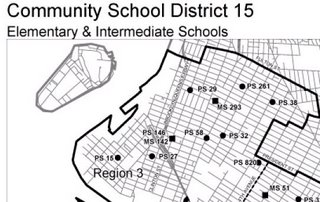

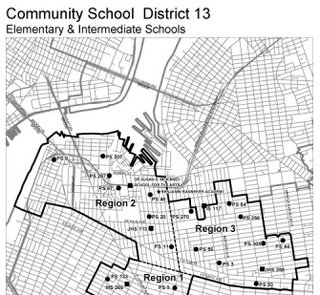

The DEIS also suggests that the two westernmost buildings in the project--at the corner of Atlantic and Flatbush avenues--would be condo-only. The document assigns 750 market-rate units to Community School District 15, which would encompass the project west of Fifth Avenue. (Look to the top right of the district boundaries, just below the wedge that encompasses the Atlantic Center and Atlantic Terminal malls.)

The DEIS also suggests that the two westernmost buildings in the project--at the corner of Atlantic and Flatbush avenues--would be condo-only. The document assigns 750 market-rate units to Community School District 15, which would encompass the project west of Fifth Avenue. (Look to the top right of the district boundaries, just below the wedge that encompasses the Atlantic Center and Atlantic Terminal malls.)

The absence of affordable units in CSD 15 suggests that the market-rate units would be condos.

The two buildings west of Fifth Avenue, as shown in the graphic above, would be the flagship "Miss Brooklyn" (or Building 1), as well as the building at Site 5, the current location of P.C. Richard and Modell's.

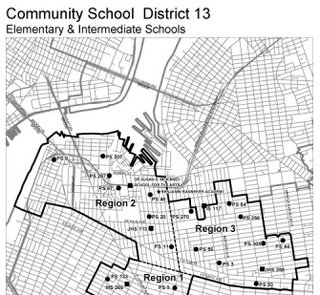

The buildings east of Fifth Avenue would be in Community School District 13. Three buildings in Phase I would be built around the arena and east of Fifth Avenue. (Look toward the bottom center of the graphic.) School district boundaries are here.

The buildings east of Fifth Avenue would be in Community School District 13. Three buildings in Phase I would be built around the arena and east of Fifth Avenue. (Look toward the bottom center of the graphic.) School district boundaries are here.

The vague GPP

On the other hand, the Empire State Development Corporation's General Project Plan leaves the issue unclear:

Residential development in Phase I would be a mixture of rental and condominium housing. Between approximately 1,275 and 2,350 residential units would be created, and 50% of the rental units in Phase I would be affordable. All rental buildings would be mixed-income buildings with a combination of low-, moderate- and middle-income and market-rate units integrated throughout the building.

The larger number of residential units would be built if Forest City Ratner chose the residential variation--currently the one under the most discussion--while the smaller number would be built if the project included more office space.

While the document doesn't specify the mix between condos and rentals, the term "all rental buildings" suggests that some buildings would be exclusively condos.

Bottom line

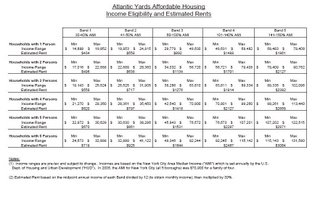

As noted, 2108 of the 2350 units would rent for more than $2000 a month, or be market-rate condos that likely would cost more. Another 80 units would be assigned to moderate-income people earning 60 to 100% of the Area Median Income. The rent would be $1418 for a four-person family.

As noted, 2108 of the 2350 units would rent for more than $2000 a month, or be market-rate condos that likely would cost more. Another 80 units would be assigned to moderate-income people earning 60 to 100% of the Area Median Income. The rent would be $1418 for a four-person family.

Low-income families would find 162 units available, with three-quarters of the units assigned to families earning 41-50% of AMI, and one-quarter of the units going to families earning 30-40% of AMI. For four-person families earning $28,361 to $35,450, the rent would be $797. For families earning $21,270 to $28,360, the rent would be $620.

Note that the 2005 median income for Brooklyn was just reported as $37,332. That means that no one earning 50% of the Brooklyn median income would have a chance at Atlantic Yards.

Many in ACORN shut out

Most members of ACORN who responded to a survey on the Atlantic Yards project earn under $30,000 a year. That means they'd be eligible for only a fraction of the 162 low-income units in Phase I.

Also, half of all affordable housing units would be reserved for those in the three Community Board districts bordering the project site. So those cheering for Atlantic Yards at the recent hearing would have a long shot at the 2010 housing lottery.

Atlantic Yards proponents say it's also important as a model. But the project build pattern would diverge from that established in the Greenpoint-Williamsburg rezoning last year. For the latter rezoning, negotiated by the City Council, Affordable units used to earn the [inclusionary zoning] bonus must be created no later than the development receiving the bonus.

Atlantic Yards proponents say it's also important as a model. But the project build pattern would diverge from that established in the Greenpoint-Williamsburg rezoning last year. For the latter rezoning, negotiated by the City Council, Affordable units used to earn the [inclusionary zoning] bonus must be created no later than the development receiving the bonus.

I've described the Atlantic Yards project as a privately-negotiated affordable housing bonus. Forest City Ratner gained political support for an out-of-scale project by agreeing to affordable housing, but the negotiator was ACORN rather than any publicly accountable body.

The example in Greenpoint-Williamsburg suggests that publicly-negotiated inclusionary zoning plan may better ensure the public interest.

Brennan raised suspicions at the Draft Environmental Impact Statement (DEIS) hearing August 23 that affordable housing would be limited to Phase II (scheduled completion date: 2016) of the Atlantic Yards project.

That's not true. Still, Forest City Ratner and its partner ACORN have offered no specifics regarding how much affordable housing would be built in Phase I, which would involve five towers (of 16 planned), plus the arena, scheduled for completion in 2010.

That's not true. Still, Forest City Ratner and its partner ACORN have offered no specifics regarding how much affordable housing would be built in Phase I, which would involve five towers (of 16 planned), plus the arena, scheduled for completion in 2010.The DEIS, however, provides strong hints. In attempting to estimate the effect on community facilities such as schools, the DEIS in Chapter 5 offers these projections (above; click on all graphics to enlarge):

--1946 market-rate units, both rentals and condos

---162 moderate- to high-income rentals

----80 low-to-moderate income rentals

---162 low-income rentals

That makes for nearly 83% luxury, market-rate units. If you add the 162 moderate-to high-income rentals, which would easily rent for more than $2000 a unit for a four-person family, that makes 2108 units, or nearly 90% of 2350 total units.

That makes for nearly 83% luxury, market-rate units. If you add the 162 moderate-to high-income rentals, which would easily rent for more than $2000 a unit for a four-person family, that makes 2108 units, or nearly 90% of 2350 total units.(Note that, in other contexts, the term "moderate- to middle-income" has been used by the Empire State Development Corporation instead of "moderate- to high-income.")

It provides strong evidence that, as Brennan and others have suggested, the financial success of the project as a whole--and the provision of most of the affordable housing--depends on the success of the market-rate units. Moreover, should the housing market change, Phase II--with most of the affordable units--could be delayed.

The 17% affordable housing represents about half of the onsite affordable housing promised (33%) and about one-third of the original 50/50 pledge.

Condos vs. rentals

Given that Forest City Ratner promises that half of the rentals would be affordable, the numbers suggest the following breakdown for the first phase:

Given that Forest City Ratner promises that half of the rentals would be affordable, the numbers suggest the following breakdown for the first phase:--404 market-rate rentals

--404 affordable rentals

-1542 market-rate condos

As of now, the developer plans 4500 rentals and 2360 condos in the project as a whole. The numbers for Phase I represent 65% of the projected condos but only 18% of the rentals.

Remember that FCR initially promised that half of the entire project would be affordable, then, when Housing Memorandum of Understanding (MOU) was signed with ACORN, limited that pledge to the rentals. But the MOU doesn't require that the rentals and condos must be built at the same time. (Above: the five towers of Phase I, plus the arena.)

Where they'd go

The DEIS also suggests that the two westernmost buildings in the project--at the corner of Atlantic and Flatbush avenues--would be condo-only. The document assigns 750 market-rate units to Community School District 15, which would encompass the project west of Fifth Avenue. (Look to the top right of the district boundaries, just below the wedge that encompasses the Atlantic Center and Atlantic Terminal malls.)

The DEIS also suggests that the two westernmost buildings in the project--at the corner of Atlantic and Flatbush avenues--would be condo-only. The document assigns 750 market-rate units to Community School District 15, which would encompass the project west of Fifth Avenue. (Look to the top right of the district boundaries, just below the wedge that encompasses the Atlantic Center and Atlantic Terminal malls.)The absence of affordable units in CSD 15 suggests that the market-rate units would be condos.

The two buildings west of Fifth Avenue, as shown in the graphic above, would be the flagship "Miss Brooklyn" (or Building 1), as well as the building at Site 5, the current location of P.C. Richard and Modell's.

The buildings east of Fifth Avenue would be in Community School District 13. Three buildings in Phase I would be built around the arena and east of Fifth Avenue. (Look toward the bottom center of the graphic.) School district boundaries are here.

The buildings east of Fifth Avenue would be in Community School District 13. Three buildings in Phase I would be built around the arena and east of Fifth Avenue. (Look toward the bottom center of the graphic.) School district boundaries are here.The vague GPP

On the other hand, the Empire State Development Corporation's General Project Plan leaves the issue unclear:

Residential development in Phase I would be a mixture of rental and condominium housing. Between approximately 1,275 and 2,350 residential units would be created, and 50% of the rental units in Phase I would be affordable. All rental buildings would be mixed-income buildings with a combination of low-, moderate- and middle-income and market-rate units integrated throughout the building.

The larger number of residential units would be built if Forest City Ratner chose the residential variation--currently the one under the most discussion--while the smaller number would be built if the project included more office space.

While the document doesn't specify the mix between condos and rentals, the term "all rental buildings" suggests that some buildings would be exclusively condos.

Bottom line

As noted, 2108 of the 2350 units would rent for more than $2000 a month, or be market-rate condos that likely would cost more. Another 80 units would be assigned to moderate-income people earning 60 to 100% of the Area Median Income. The rent would be $1418 for a four-person family.

As noted, 2108 of the 2350 units would rent for more than $2000 a month, or be market-rate condos that likely would cost more. Another 80 units would be assigned to moderate-income people earning 60 to 100% of the Area Median Income. The rent would be $1418 for a four-person family.Low-income families would find 162 units available, with three-quarters of the units assigned to families earning 41-50% of AMI, and one-quarter of the units going to families earning 30-40% of AMI. For four-person families earning $28,361 to $35,450, the rent would be $797. For families earning $21,270 to $28,360, the rent would be $620.

Note that the 2005 median income for Brooklyn was just reported as $37,332. That means that no one earning 50% of the Brooklyn median income would have a chance at Atlantic Yards.

Many in ACORN shut out

Most members of ACORN who responded to a survey on the Atlantic Yards project earn under $30,000 a year. That means they'd be eligible for only a fraction of the 162 low-income units in Phase I.

Also, half of all affordable housing units would be reserved for those in the three Community Board districts bordering the project site. So those cheering for Atlantic Yards at the recent hearing would have a long shot at the 2010 housing lottery.

Atlantic Yards proponents say it's also important as a model. But the project build pattern would diverge from that established in the Greenpoint-Williamsburg rezoning last year. For the latter rezoning, negotiated by the City Council, Affordable units used to earn the [inclusionary zoning] bonus must be created no later than the development receiving the bonus.

Atlantic Yards proponents say it's also important as a model. But the project build pattern would diverge from that established in the Greenpoint-Williamsburg rezoning last year. For the latter rezoning, negotiated by the City Council, Affordable units used to earn the [inclusionary zoning] bonus must be created no later than the development receiving the bonus.I've described the Atlantic Yards project as a privately-negotiated affordable housing bonus. Forest City Ratner gained political support for an out-of-scale project by agreeing to affordable housing, but the negotiator was ACORN rather than any publicly accountable body.

The example in Greenpoint-Williamsburg suggests that publicly-negotiated inclusionary zoning plan may better ensure the public interest.

Comments

Post a Comment