As "affordable" project in Greenpoint offers six-figure earners a free month, plus a $1,000 rebate. Another reason why some call the nomenclature "nonsensical."

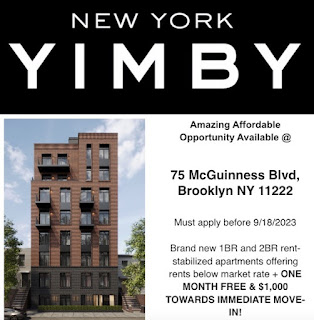

A recent advertisment from New York YIMBY claimed an "Amazing Affordable Opportunity Available" at 75 McGuinness Boulevard in Greenpoint, between Nassau and Norman avenues.

Not only are the "Brand new 1BR and 2BR rent-stabilized apartments offering rents below market rate," the developers are offering bonuses of one-month free on a lease, plus a $1,000 bonus.

That 130% of AMI level is the common option chosen by developers using the now-expired 421-a tax break, including the developers of the four most recent towers built in Atlantic Yards/Pacific Park.

So why aren't the developers seeking the maximum? Because they're not crazy, and know that middle income households have other options on the market

So it's worth taking a look at a 7/26/23 article from Crain's New York Business, How New York sets the price for affordable housing, which notes that rising rents, significantly outpacing wage growth, have stimulated rising income limits for income-linked "affordable housing."

Writer Eddie Small gets a juicy quote from a former city employee who worked on affordable housing: "The concept is correct in doing it by rent. It's just the terms that are used are nonsensical."

Not only are the "Brand new 1BR and 2BR rent-stabilized apartments offering rents below market rate," the developers are offering bonuses of one-month free on a lease, plus a $1,000 bonus.

The application deadline is tomorrow. (The location, by the way, is on a boulevard busy with traffic, albeit near very walkable blocks.)

While the advertisement notes the income targets--middle-income households earning $107,178 to $198,215, depending on family size, it omits the rents sought: $3,126 for one-bedroom apartments and $3,733 two-bedroom units.

"Affordable" ceilings

That, amazingly enough, is below the potential maximum rent levels for households earning 130% of Area Median Income (AMI): $3,443 and $4,130, according to the New York City Department of Housing Preservation and Development, as shown in the chart below.

|

| Chart from HPD |

That 130% of AMI level is the common option chosen by developers using the now-expired 421-a tax break, including the developers of the four most recent towers built in Atlantic Yards/Pacific Park.

So why aren't the developers seeking the maximum? Because they're not crazy, and know that middle income households have other options on the market

|

| From Housing Connect |

Yes, these rents--however unaffordable to most Brooklynites--are below market. According to StreetEasy, the building is now offering two-bedrooms renting for $5,500 to $6,000 a month, and three-bedrooms from $7,400 to $7,600, though units at slightly lower price points have already been rented.

About affordable housing

Writer Eddie Small gets a juicy quote from a former city employee who worked on affordable housing: "The concept is correct in doing it by rent. It's just the terms that are used are nonsensical."

That said, the city could build housing a lower price points and set eligibility at a lower percentage of AMI. It's just that more subsidies would be required.

The article notes that, while one common complaint--as I've written--is that the regional AMI statistic is distorted by the inclusion by higher-income suburban counties, that's a far lesser factor than overall rent levels in computing the statistics.

Comments

Post a Comment