Immigrant investor program reforms (higher minimum spend, no gerrymandering) could slow EB-5 program; dubious/generous job-creation calculations remain

The Trump Administration, to some surprise, has implemented (with revisions) a major Obama Administration-proposed change in the EB-5 Immigrant Investor Program, which had granted visas to wealthy foreigners in exchange for a minimum $500,000 investment in a purportedly job-creating investment.

Such investments are beloved by real-estate developers because of low-interest rates: the investors, caring far more about the green cards than return on their capital (though they do want return of their capital), are willing to accept negligible interest rates.

That means that even if the middleman packaging the loan, a so-called regional center, takes 3%-5%, the ultimate cost to the developer is far less than a mezzanine loan on the open market.

The new rules, from U.S. Citizenship and Immigration Services (USCIS), which is part of the Department of Homeland Security, raise the minimum investment from $500,000 to $900,000 (but not $1.35 million, as originally proposed), as long the project is in a Targeted Employment Area (TEA), which is a rural area or an area of high unemployment.

As the screenshot at right shows, some EB-5 packagers are promoting investments within the short window of opportunity before the rules change.

The non-TEA investment, generally ignored in recent years, will rise from $1 million to $1.8 million. That catches up with inflation.

(Actually, it's inflation-adjusted from the original 1990 law through 2015.) Now, the investment amounts will automatically adjust for inflation every five years.

TEAs have long been gamed--or gerrymandered--by states willing to designate a bizarrely shaped zone to qualify a project for the lower investment level, as in the designations I've dubbed for Atlantic Yards the "Bed-Stuy Boomerang" and the "Fort Greene Finger." Prominent coverage in the New York Times, the Wall Street Journal, and CityLab pointed to other egregious examples. (The DHS rule cites coverage in the former two publications.)

|

| The "Bed-Stuy Boomerang"/Abby Weissman Project in blue. Eligible census tracts in red |

Now the federal government, rather than states, will designate TEAs, and significantly restrict gerrymandering. The census tracts, with an average unemployment rate at least 150% of the national average, must be directly adjacent rather than merely connected in a chain.

A key benefit preserved

The changes have been met with concern and opposition from significant EB-5 players--the investment packagers and loan beneficiaries eager for cheap capital and investors unconcerned about interest payments.

But they do preserve a key element of the program: dubious and generous (to my mind) formulas for calculating job-creation, purportedly ten jobs per investor.

EB-5, via regional centers (an element of the law added in 1992, two years after EB-5 was enacted), requires no head count of workers, allows indirect jobs to be calculated, and gives immigrant investors job-creation credit for all the jobs said to be generated by the project, not merely their fraction of investment.

That's plausible only if the EB-5 money actually jump-starts a project that otherwise wouldn't go forward, a relatively rare situation. Rather, the EB-5 funds often substitute for more costly capital, thus fueling profits.

As Nicholas Mastroianni II, who heads the country's leading regional center, said in an unguarded moment, his company only looks for projects that don't need the EB-5 money. That essentially admits the funds don't create jobs.

So that, to my mind, must be considered in response to the understandable rhetoric that increased investment amounts mean fewer jobs would be created (assuming the same pots of money are assembled). That said, it would be easier to calculate ten jobs from a larger funding base, given standard "multipliers" used for various investment categories.

Indeed, from the DHS rules:

Because jobs created by non-EB-5 funding can be credited to EB-5 investors, and many projects could still be viable without EB-5 funding given that such funding makes up only a portion of overall funding, DHS does not believe it is reasonable to assume that a certain loss of EB-5 investment necessarily translates to a commensurate loss of jobs.The rules quote an expert:

“Many of such projects could easily have been financed on the private market, according to [New York University Stern School of Business scholar-in-residence] Gary Friedland. . . . `It's a profit enhancement. . . .The announcement

Here's the press release from USCIS, New Rulemaking Brings Significant Changes to EB-5 Program, "marking the first significant revision of the program’s regulations since 1993. The final rule will become effective on Nov. 21, 2019." (Here are the rules.)

“Nearly 30 years ago, Congress created the EB-5 program to benefit U.S. workers, boost the economy, and aid distressed communities by providing an incentive for foreign capital investment in the United States,” said USCIS Acting Director Ken Cuccinelli. “Since its inception, the EB-5 program has drifted away from Congress’s intent. Our reforms increase the investment level to account for inflation over the past three decades and substantially restrict the possibility of gerrymandering to ensure that the reduced investment amount is reserved for rural and high-unemployment areas most in need. This final rule strengthens the EB-5 program by returning it to its Congressional intent.”

Other changes will clarifying federal procedures for investors, for example, allowing immigrant investors who have a previously approved EB-5 immigrant petition to retain a priority date if they have to file a new EB-5 petition.

Some industry takes

The law firm Seyfarth Shaw, in a post on Lexology, USCIS Publishes EB-5 Modernization Rule: The Impact on the EB-5 Program, suggested that the changes would spur a flood "of EB-5 applications in an attempt to be grandfathered under the current rules," which could lead to delays.

The firm warned investors to do due diligence, including the possibility that investment capital might slow once the thresholds are increased. The firm suggested that Congress might be pressured to make changes, but Rep. Bill Goodlatte (R-VA) no longer chairs the Judiciary Committee, while Rep. Jerry Nadler (D-NY) "has other priorities attracting his attention at this time."

While the major coalition of regional centers, Invest In the USA, has not issued a statement beyond an analysis (see below), the EB-5 Investment Coalition, which the Wall Street Journal in September 2015 described as an "advocacy group backed by developers" (like Related, in New York City), issued a statement 7/24/19 calling for DHS to withdraw the regulations and let Congress pursue reform.

"[T]he regulations will crush foreign investment in communities across the U.S. and put hundreds of thousands of American jobs at risk, without addressing the fraud and national security concerns, which all parties agree are pressing," said Angelique Brunner, the EB-5 Investment Coalition’s Industry Membership Chair and Spokesperson.

Before the ruling, the New York Observer published a 7/14/19 column by Brian Darling, Real Estate Developers’ Plea to Trump: Don’t Roll Out New EB-5 Regulation, citing a report by the EB-5 Coalition (actually jointly released with IIUSA) that called the program a great job-creator.

The U.S. Immigration Fund, in a post, quoted a warning from Mastroianni: “It is important for investors to understand that the projects they are used to seeing qualify for TEA investments and the lower investment threshold will most likely not qualify under these new regulations... it is very possible that EB-5 project offerings requiring a $500,000 investment under the current regulations will require a $1.8 million investment under the new regulations in the final rule.”

The post noted that EB-5 will sunset September 30, before the rule goes into effect, unless Congress renews the program (and possibly overrides the new rule).

IIUSA, in 2017 commented that increasing the then-proposed minimum investment amounts would "result in the virtual elimination of the EB-5 Program," saying the proposed increase should not track the inflation rate since 1990 because supply exceeded demand until at least 2011. (That constraint was not merely the investment level, but rather the ability to use regional centers to finance construction projects, and DHS says that other factors impeded involvement in the program.) The new rule is still more than what IIUSA recommended, though less than proposed.

Reaction in Congress

Sen. Chuck Grassley (R-IA), who had pushed for changes, issued a 7/24/19 press release, President Trump’s EB-5 Rule Scores Big Win For Rural America, citing floor remarks regarding "needed reforms" to "this fraud-laden program."

"Unfortunately, since that time, big moneyed interests have been able to gerrymander EB-5 targeted employment areas in a way that redirected investment away from our rural and economically depressed communities and towards major development projects in Manhattan and other large cities," he said.

"It’s ridiculous that our country’s major green card program for investors has been operating with investment amounts that haven’t been adjusted a single time in 30 years," Grassley said, decrying the "power and influence that the big-moneyed EB-5 interests have historically had in Washington."

Axios reported that "Acting U.S. Citizenship and Immigration Services director Ken Cuccinelli played an important role in ultimately persuading Trump to let the regulation go through," with the White House "especially alert to Grassley's concerns."

Grassley made no mention that the changes came from the previous administration. Other legislators previously prominent in EB-5 efforts, including Sen. Chuck Schumer (D-NY) and Sen. John Cornyn (R-TX), were silent, perhaps because there's little upside for them. Sen. Tom Cotton (R-AR) did issue a brief statement supporting the changes.

Advocacy group silence, except from CIS

I haven't seen much comment from organizations without pro-EB-5 financial skin in the game, except for analyst David North of the Center for Immigration Studies, which advocates for less immigration.

("CIS’s much-touted tagline is 'low immigration, pro-immigrant,' but the organization has a decades-long history of circulating racist writers, while also associating with white nationalists," says the Southern Poverty Law Center. In the case of EB-5, though, I think CIS is mostly right.)

In New EB-5 Rules Make Gerrymandering More Difficult, Not Impossible, North wrote 7/26/19:

I haven't seen much comment from organizations without pro-EB-5 financial skin in the game, except for analyst David North of the Center for Immigration Studies, which advocates for less immigration.

("CIS’s much-touted tagline is 'low immigration, pro-immigrant,' but the organization has a decades-long history of circulating racist writers, while also associating with white nationalists," says the Southern Poverty Law Center. In the case of EB-5, though, I think CIS is mostly right.)

In New EB-5 Rules Make Gerrymandering More Difficult, Not Impossible, North wrote 7/26/19:

I interpret this to mean that the TEA can be the single census tract in which the money is to be invested, or the multiple tracts that can be tied directly to the investment, plus one or more adjacent tracts chosen by the developer. This gives some room for manipulation on the part of the developer, but not the unlimited room currently available.

He added:

Buried on the same page in the Federal Register, and in turgid prose, is a bit of agency analysis of how its new rules would have impacted a sampling of the EB-5 projects on the books in 2016; it seems to say that of some $13 billion in projects under way at the time more than $7 billion of them would be "potentially affected by the rule".

By this I think they mean negatively affected; and that would mean that most of the then current projects would, potentially, have been ruled ineligible

Some coverage

News coverage generally quoted industry players Bar Raised for Green Cards Popular With New York Builders, the Wall Street Journal reported 7/28/19 ominously:

News coverage generally quoted industry players Bar Raised for Green Cards Popular With New York Builders, the Wall Street Journal reported 7/28/19 ominously:

EB-5 is already plagued by long waiting lists and falling demand from China, and now some worry that it could cease to be a viable form of real-estate financing.Interestingly enough:

"It's the nail in the coffin," said Nicholas Mastroianni II, the chief executive of the EB-5 regional center U.S. Immigration Fund.

Gary Friedland, a scholar-in-residence at New York University Stern School of Business who has studied the EB-5 program, said he was surprised that an administration with ties to the real-estate industry is changing the program. "Since Trump took office, we've been predicting that the regulations would be buried in regulatory purgatory, never completed," he said.

The Washington Post, in a 7/23/19 article, had an interesting quote:

“This was never intended to be government-sanctioned welfare to the high-profile real estate industry in the major cities of America, but it evolved into that after the meltdown of 2008,” said William Cook, former general counsel of the U.S. Immigration and Naturalization Service under George H.W. Bush when the EB-5 program was created. “This is money developers were able to raise that didn’t come by the normal process."

Industry analysis

In an analysis published in the IIUSA blog, attorney Robert Divine predicted a surged:

In an analysis published in the IIUSA blog, attorney Robert Divine predicted a surged:

Absent legislation to provide additional visa numbers, the next four months may be the last great days for entering and subscribing investments under the EB-5 Program for the foreseeable future.

He warned of delays:

According to the regulation’s preamble, EB-5 investments already made appear likely to use up at least seven years’ worth of the 10,000 visa numbers available to investors and family members each year. In fact, the nationalities of the heaviest usage face even longer waits due to a 7% per-country limit, and those born in lower volume countries face much shorter or zero waits. The new rush of filings in the next four months will extend the existing waits for high volume countries by many years. (Oft-proposed but yet unpassed legislation could eliminate the per-country cap and make all new investors wait the same regardless of nationality.) The combination of nearly doubled minimum investment amounts and expanded wait time for visa numbers will pose huge disincentives for investors filing under the new rule. Thus, now begins the last great four-month EB-5 investment rush unless Congress allocates additional visa numbers to the program.He warned:

Issuers of investments should consider amending their offerings now to include disclosure of risks posed by the new regulations' higher investment amounts, including the prospect that any EB-5 capital not raised for the project before November 21 might be much more difficult to raise, necessitating other sources for any funding gaps. Many projects that are in state-designated TEAs today may not qualify under the new rules, making post-November subscriptions of EB-5 capital practically impossible.A prominent industry blogger and consultant, Suzanne Lazicki, wrote 7/24/19:

I do not think that EB-5 will die entirely, unless changes to visa allocations make the visa wait unacceptably long for all countries. But certainly, demand has not been and will not be remotely close to the numbers in Figure 1 and Table 3 of the final rule. And new EB-5 investors will want to consider the likelihood that the project they’re investing in will be able to successfully complete the capital raise before November 21, or risk a very tough market after November.In her Q&A, she suggests:

The discussion in the final rule shows that DHS did indeed read the hundreds of public comments submitted on the NPRM [proposal] in 2017, and engaged seriously with them. I can judge this because I also read all the comments. Most of the final rule consists of methodical response to the specific points made by the public. Sadly DHS dismissed many good ideas just for lack of supporting data and analysis, but at least they recognized the ideas. The content of the final rule shows that DHS was not manipulated by the much-maligned “powerful moneyed interests”. For example, Related NYC Metro Regional Center submitted over a hundred pages of comments personally and through proxies and had two in-person meetings with OMB about the regulations. The final rule acknowledges the arguments but does not soften any of the TEA restrictions or incentives opposed by Related. On the other hand, the final rule makes a major change from the NPRM – changing the TEA investment amount from $1.35 million to $900,000 – based on good input from someone of no importance. I can judge this, because I wrote the four-page comment that’s extensively cited in the final rule’s discussion of investment differential. (If only I’d written as compellingly about TEA designation! I didn’t occur to me DHS might decide to eliminate both itself and states from the designation business, and just leave petitioners and adjudicators with individual unguided judgment regarding which unemployment data and methodology make most sense.)

Forbes contributor Andy J. Semotiuk observed:

Lazicki, on her blog, posted a graphic showing the frequent reauthorization of the regional center program, which is the main "flavor" of EB-5, since it's much easier to pool money in a fund for an investment than to invest directly in a project.

Future regulations?

According to the federal Office of Management and Budget, other potential changes are being considered. One regards EB-5 Immigrant Investor Regional Center Program:

Now that could be interesting.

Redeployment issues

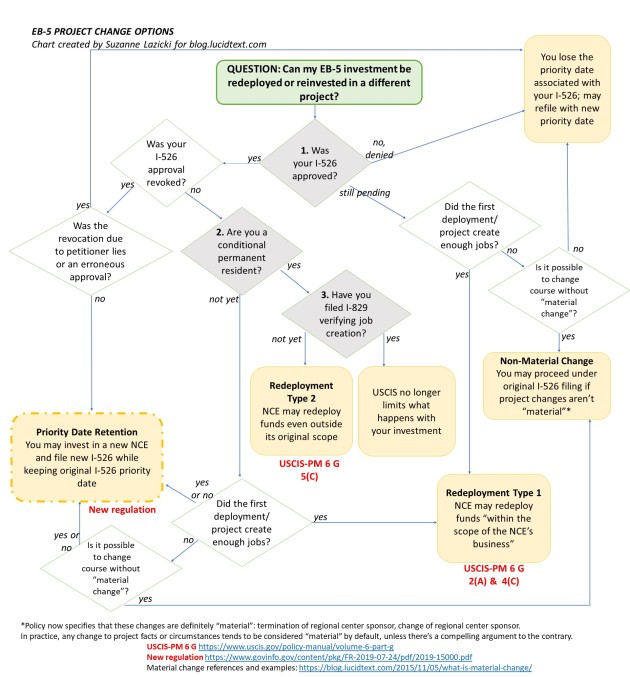

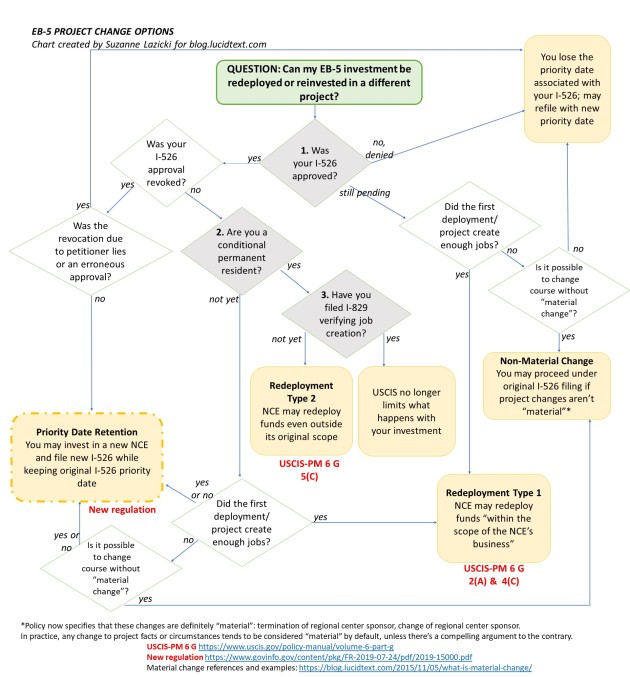

Lazicki on 7/29/19 also addressed Priority date retention and redeployment, with flow chart

One of the biggest problems the EB5 program faces is retrogression. Investors from China and more recently India, for example, are stuck in long waiting lines due to country limits placed on them by the U.S immigration program. The new regulation is not expected to bring improvements in this area. Nor is it likely that the regulation will have any impact on already filed applications that are awaiting adjudication. In other words, it will not likely be retroactive. Other integrity-related proposals will not be introduced by the regulation and are also being delayed until Congress addresses the program. Finally, the regulation will have no impact on the fact that the EB-5 program is not a permanent visa program. Rather, it is a program that has to be renewed every year or so and is expected to sunset again in September. Normally the program is extended by Congress by its inclusion in omnibus budget bills. This is not expected to change through the publication of this regulation and thus the fate of the EB5 program will once again be tested in September of this year. Most likely, however, judging by experience, the program will be extended again at that time.Reauthorization coming?

Lazicki, on her blog, posted a graphic showing the frequent reauthorization of the regional center program, which is the main "flavor" of EB-5, since it's much easier to pool money in a fund for an investment than to invest directly in a project.

Future regulations?

According to the federal Office of Management and Budget, other potential changes are being considered. One regards EB-5 Immigrant Investor Regional Center Program:

The Department of Homeland Security (DHS) is considering making regulatory changes to the EB-5 Immigrant Investor Regional Center Program. DHS issued an Advance Notice of Proposed Rulemaking (ANPRM) to seek comment from all interested stakeholders on several topics, including: (1) The process for initially designating entities as regional centers, (2) a potential requirement for regional centers to utilize an exemplar filing process, (3) continued participation requirements for maintaining regional center designation, and (4) the process for terminating regional center designation.Another regards EB-5 Immigrant Investor Program Realignment:

The Department of Homeland Security (DHS) plans to publish an advanced notice of proposed rulemaking to solicit public input on proposals that would increase monitoring and oversight of the EB-5 program as well as encourage investment in rural areas. DHS would solicit feedback on proposals associated with redefining components of the job creation requirement, and defining conditions for regional center designations and operations.(Emphasis added)

Now that could be interesting.

Redeployment issues

Lazicki on 7/29/19 also addressed Priority date retention and redeployment, with flow chart

The EB-5 at-risk policy and material change policy depend on a relatively short EB-5 process. An enterprise can be expected to sustain itself and keep EB-5 capital deployed for five years or so, and to closely mirror the original business plan predictions for a year or two.She noted confusing policies regarding redeployment of funds, and has produced her unofficial analysis in the flow chart below:

But reality, for many investors, is a protracted EB-5 process with years upon years in which changes will inevitably occur. Projects will finish, loans will get repaid, plans may evolve, and problems may occur. The at-risk and material change policies are not flexible to accommodate such business developments over time. The longer the immigration process, the more vulnerable investors become to prohibited project-level changes or to difficulty in sustaining the investment at risk – and that despite having created jobs as required. A decade-long wait for a visa becomes particularly problematic when the visa depends on no material changes occurring with the investment over that period. Thus the need for options for good-faith investors who may find themselves, at some point over the years, needing their funds to be moved from one project to another.

Comments

Post a Comment