In CityLab, a return focus on gerrymandering high-unemployment zones to enable EB-5 loans; is NY Times fix for investor visas adequate?

|

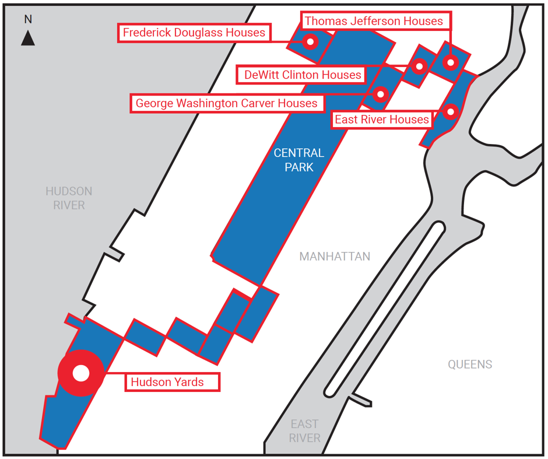

| Map by CityLab/Mark Byrnes |

(Why the focus now? Well, Hudson Yards just had a high-profile opening, so various journalists are looking more closely.)

It explains how developer Related Companies--using a common tactic--took advantage of loose federal rules to draw a zone of high unemployment snaking up to Harlem. That qualifies a project for a $500,000 threshold in the investor visa program, rather than the official $1 million requirement.

The investors accept a lower interest rate because they want green cards for themselves and their families. Each $500,000 investment is supposed to create at least ten jobs--though that's dubious.

Capps followed up 4/16/19 in an online-only New York Times op-ed, Another Reason to Hate Hudson Yards, citing the distorted map and the role played by states in drawing such boundaries. He wrote:

But Capps suggested, "Ultimately, the best road forward for EB-5 may be to maintain investment levels where they are, to maximize capital for distressed areas — meaning single census tracts." That would be something of a gift to the EB-5 industry.

Though Capps thinks "the program could work elegantly," I'm far more skeptical, as explained below.

Some debates

The investors accept a lower interest rate because they want green cards for themselves and their families. Each $500,000 investment is supposed to create at least ten jobs--though that's dubious.

This was hardly the first account of such rule-stretching. I wrote about this in 2011 regarding Atlantic Yards and what I dubbed the "Bed-Stuy Boomerang," connecting the prosperous area around the project to poorer Bedford-Stuyvesant.

The New York Times soon covered a broader range of issues; the Wall Street Journal's Eliot Brown put it on the front page in September 2015. In May 2017, writing in City & State, I pointed out such distortions in a Jersey City project by Kushner Companies. (The Washington Post did, too.)

EB-5 is back

But the recently-opened Hudson Yards has been in the news, so EB-5 is again having its moment. It's patently bogus--mostly--and the state draws the map, because (of course) state officials want local developers get low-interest loans.

In the wake of the CityLab coverage, and a New York Times op-ed (below), Public Advocate Jumaane Williams called a press conference:

Capps suggests that part of the project was worthy:

As noted below, I'm not as sanguine. I think there are many other things wrong with EB-5, including too loose standards for job-creation credit.

Reform has been stalled by a group of strange bedfellows, notably Sen. Charles Schumer (D-NY), who wants to help his corporate constituents.

An op-ed in the Times

The New York Times soon covered a broader range of issues; the Wall Street Journal's Eliot Brown put it on the front page in September 2015. In May 2017, writing in City & State, I pointed out such distortions in a Jersey City project by Kushner Companies. (The Washington Post did, too.)

EB-5 is back

But the recently-opened Hudson Yards has been in the news, so EB-5 is again having its moment. It's patently bogus--mostly--and the state draws the map, because (of course) state officials want local developers get low-interest loans.

In the wake of the CityLab coverage, and a New York Times op-ed (below), Public Advocate Jumaane Williams called a press conference:

A spox for developer, Related Company, said #EB5 program "was no cost 2the American taxpayer."— Norman Oder (@AYReport) April 16, 2019

That's industry rhetoric.

It's no direct cost, but that ignores “opportunity cost," the benefit the public could get from an alternative policy. https://t.co/RX7ghFvipF#EB5IsARacket

Another useless politician in a useless position that can do nothing except issue news releases.— Young Ideas (@DickYoungsGhost) April 17, 2019

Some of it justified?We can disagree on/debate the value of a bully pulpit...— Norman Oder (@AYReport) April 17, 2019

Sure it's opportunistic for JW to seize on this issue, prominently highlighted by @CityLab

Still, *no elected official* previously saw fit to criticize #EB5 gerrymandering, tho it was highlighted yrs ago by me/others

Capps suggests that part of the project was worthy:

Gerrymandering aside, certain aspects of this 28-acre development were deserving subjects for EB-5 financing, according to Gary Friedland, scholar-in-residence at the Stern Center, who has tracked the EB-5 program and its impact on real estate with NYU professor Jeanne Calderon.(Is that an argument for EB-5 funding for the deck related to Atlantic Yards/Pacific Park?)

“The first capital raise—for the platform that serves as the base for the buildings in the first phase of [Hudson Yards] over the eastern railyard—was an excellent use of EB-5 capital,” Friedland says in an email. “This funding of horizontal infrastructure at the beginning of a multiphase, long-term real-estate development project requires patient capital, since the project will not generate cash flow to support debt service payments on the mortgage until after the vertical buildings are completed and occupied. This type of capital is not readily available from many conventional sources.”

Friedland adds: “In contrast, the inexpensive EB-5 capital for the funding of the two buildings merely enhanced the returns of Related, as the capital would have been readily available from conventional sources.”

As noted below, I'm not as sanguine. I think there are many other things wrong with EB-5, including too loose standards for job-creation credit.

Reform has been stalled by a group of strange bedfellows, notably Sen. Charles Schumer (D-NY), who wants to help his corporate constituents.

An op-ed in the Times

Capps followed up 4/16/19 in an online-only New York Times op-ed, Another Reason to Hate Hudson Yards, citing the distorted map and the role played by states in drawing such boundaries. He wrote:

Gerrymandering is only one thing that needs to change. The cash-for-visas program has garnered an impressive record of lawsuits and indictments for fraud and dozens of possible breaches of national security. While the program falls under the purview of the Department of Homeland Security, oversight is lax, and real estate is not its explicit domain. Reforming EB-5 is a vital priority, but legislation to fix this program is most likely just as doomed as any other immigration bill. According to New York University’s Stern Center for Real Estate Finance Research, no proposal for a fix in Congress has reached a vote in committee.He noted that proposed regulations would increase the minimum investment and eliminate gerrymandering. (Here's a list of the reforms.)

Still, the case for reform is urgent. It is not just that scammers are gaming the system. Or that it heaps risk on foreign investors, mostly Chinese nationals who face yearslong waiting lists to participate in the program (and few safeguards against fraud when they do). The EB-5 program could be putting money to work across America. Instead, mega-developers are skillfully redirecting the rewards. There’s a maximum of 10,000 visas available annually through EB-5, which also limits how much money the program can create. Hudson Yards garnered so many investors that the visas it generated alone probably maxed out an entire year’s quota.

But Capps suggested, "Ultimately, the best road forward for EB-5 may be to maintain investment levels where they are, to maximize capital for distressed areas — meaning single census tracts." That would be something of a gift to the EB-5 industry.

Though Capps thinks "the program could work elegantly," I'm far more skeptical, as explained below.

Some debates

Even fixes proposed don't address numerous other problems w/#EB5, such as giving the investors job-creation credit for the *entire* amount of money spent, rather than their fraction. https://t.co/RX7ghFvipF— Norman Oder (@AYReport) April 17, 2019

Consider John Vogel's proposal: auction them off (+maybe target funds) pic.twitter.com/ARN9jePUMc

Friedland: "Crediting > the proportionate share represented by the#EB5 capital is economically justified only if development & construction of the project would not proceed w/o #EB5 capital, a position that few project developers could likely demonstrate" https://t.co/AvodS5AL6C— Norman Oder (@AYReport) April 17, 2019

Leading fundraiser: "Projects that don't typically need the capital Rthe projects that we look 2lend money on. If a project can't be developed w/o the #EB5 capital, it's not a project that u shouldB looking2 invest in, bc you've got a desperate situation." https://t.co/TyqhmVMu43— Norman Oder (@AYReport) April 17, 2019

"Just giving to govt" sounds flawed, sure.— Norman Oder (@AYReport) April 17, 2019

But "just giving large shares of $" to migration agencies, regional centers, and immigration attorneys also kinda flawed

The guy I was arguing with, Dillon Colucci, happens to be an immigration lawyer. Of course he likes the status quo. More of my argument here in a December 2015 op-ed.Nah. There's clearly a value to investor visas. A good part of that value is captured by intermediaries, inc. RCs.— Norman Oder (@AYReport) April 17, 2019

Also r.e. developers, of course.

Then investors--*if* they get their green cards.

The public? Not so clear.

EB5 = "no cost to the public"?

Nah. #opportunitycosts

Comments

Post a Comment