Madison International buys remaining share of Forest City's NYC malls; considers roof deck and more opposite arena

Well, in January, the Real Deal reported that Madison International, already a 49% owner of Forest City Realty Trust's New York City retail portfolio, was aiming to buy the remainder of the property, and now it's official.

The agreement announced today (press releases at bottom) values Forest City's interest at about $1 billion; we'll see if that's deemed a good price or a sale from weakness.

Not only is Madison buying Atlantic Terminal and Atlantic Center malls, across from the Barclays Center, it is "considering the potential redevelopment" of both. Crain's adds detail:

Also, redevelopment could mean exploiting unused development rights.

Also, redevelopment could mean exploiting unused development rights.

I'm not sure if Atlantic Terminal--which already has an office tower--has any such development rights, but Atlantic Center sure does.

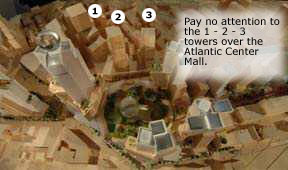

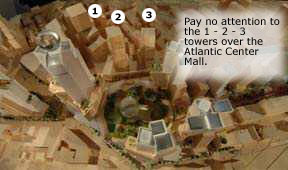

Models for three towers over that mall even appeared in early models (right) from the initial project architect, Frank Gehry. One resident has described four potential towers of the mall.

A MOU trading development rights--does it matter?

A nonpublicized 2/18/05 Memorandum of Understanding (MOU) between the city, state, and original developer Forest City Ratner, discovered later that year by Develop Don't Destroy Brooklyn, would

transferred development rights from the Atlantic Center mall to Site 5, the home of the seemingly doomed P.C. Richard and Modell's, thus allowing the Atlantic Yards developer to construct a building more than twice as big as previously possible

The document discusses:

The MOU indicated Forest City would develop up to 875,000 square feet of commercial space and up to 711,000 square feet of residential space at Atlantic Center, minus, if the Atlantic Yards project proceeded, that 328,272 square feet.

The MOU would, if binding, presumably thus limit the Site 5 building to 636,272 square feet (plus the existing retail). That would preclude the giant two-tower project floated, but not yet proceeded, at Site 5, with more than 1.1 million square feet. But, remember, that MOU, like others with the project, was nonbinding.

The press release from Madison

The agreement announced today (press releases at bottom) values Forest City's interest at about $1 billion; we'll see if that's deemed a good price or a sale from weakness.

Not only is Madison buying Atlantic Terminal and Atlantic Center malls, across from the Barclays Center, it is "considering the potential redevelopment" of both. Crain's adds detail:

[Madison's Ronald] Dickerman said his firm plans to invest "ten of millions of dollars" repositioning the two adjacent Downtown Brooklyn properties to bring in new tenants and make the complex a hipper destination. Included in the plans are an increased number of food options and the installation of a roof deck that Dickerman said would lure larger crowds from the Barclays Center.Beyond that plan

"I think there are tenants in the spaces that are a little more reflective of shopping in the 1990s," Dickerman said. "That's fine, but it doesn't speak to the experiential retail that patrons are looking for today. We want guests at Barclays to look across the street and be drawn in by what they see."

Also, redevelopment could mean exploiting unused development rights.

Also, redevelopment could mean exploiting unused development rights.I'm not sure if Atlantic Terminal--which already has an office tower--has any such development rights, but Atlantic Center sure does.

Models for three towers over that mall even appeared in early models (right) from the initial project architect, Frank Gehry. One resident has described four potential towers of the mall.

A MOU trading development rights--does it matter?

A nonpublicized 2/18/05 Memorandum of Understanding (MOU) between the city, state, and original developer Forest City Ratner, discovered later that year by Develop Don't Destroy Brooklyn, would

transferred development rights from the Atlantic Center mall to Site 5, the home of the seemingly doomed P.C. Richard and Modell's, thus allowing the Atlantic Yards developer to construct a building more than twice as big as previously possible

The document discusses:

unused development rights...attributable to... (i) Atlantic Center (Block 2002, Lot 1) (including the rights attributable to the demapped portion of Fort Greene Place), which FCRC and the City Parties believe consist of approximately 1.586 million zoning square feet... and (ii) Site 5 (the entirety of Block 927, excluding the community garden parcel thereon, as currently configured) in the Atlantic Terminal Urban Renewal Area ("ATURA"), Brooklyn, New York ("Site 5"), which FCRC and the City Parties believe consist of approximately 308,000 zoning square feet (in addition to existing retail) under applicable zoning.If the arena and mixed-use development project went forward, as it has, Empire State Development Corporation (aka ESD, as it's known today) would "provide for up to an additional 328,272 zoning square feet in development rights... added to Site 5, on the condition that FCRC concurrently agree to an equivalent reduction in the allowable density available under its City ground lease for Atlantic Center Site."

The MOU indicated Forest City would develop up to 875,000 square feet of commercial space and up to 711,000 square feet of residential space at Atlantic Center, minus, if the Atlantic Yards project proceeded, that 328,272 square feet.

The MOU would, if binding, presumably thus limit the Site 5 building to 636,272 square feet (plus the existing retail). That would preclude the giant two-tower project floated, but not yet proceeded, at Site 5, with more than 1.1 million square feet. But, remember, that MOU, like others with the project, was nonbinding.

The press release from Madison

Madison International Realty and Forest City Enter Definitive Agreement For Prime New York City Retail Portfolio

NEW YORK, Sept. 20, 2017 /PRNewswire/ -- Madison International Realty and Forest City Realty Trust (NYSE: FCE-A) announced the signing of definitive agreements for Madison's acquisition of Forest City's 51% interest in a 2.1 million square foot, 12 asset, prime retail portfolio located throughout Manhattan, Brooklyn, Queens, the Bronx, Staten Island and Northern New Jersey (collectively the "NYC Portfolio"), for a gross value of approximately $1.0 billion. The acquisition is consistent with Forest City's announcement in August 2016 that it intended to explore strategic alternatives for its regional mall and urban infill retail portfolios. The NYC Portfolio, in which Madison holds a 49% stake, represents a material portion of Forest City's overall retail platform that it has been successfully exiting since its 2016 announcement.

The acquisition of the 95% leased NYC Portfolio represents an opportunity for Madison to become one of the largest retail landlords in New York City with a portfolio that has exhibited prolonged stability due to the dense demographic composition of its location and proximity to extraordinary demand drivers such as Barclays Center. The acquisition is consistent with Madison's view that brick and mortar stores located in high density growth areas in gateway markets will continue to play a critical role in the evolution of retail.

"This transaction is strategic for both Madison and Forest City, and fits well with our investment strategy of executing large scale equity investments to create 'win/win' outcomes for our partners and investors. The retail centers in the NYC Portfolio are in densely-populated, well-trafficked areas that offer significant opportunity for continued value creation," said Ronald Dickerman, President and Founder of Madison. Dickerman continues, "We are pleased to have assisted our partner, Forest City, in accomplishing this important milestone."

Madison will engage Cushman & Wakefield as the third-party property management and leasing team for the NYC Portfolio. Madison is considering the potential redevelopment of Atlantic Terminal Mall and Atlantic Center, two properties located directly across Atlantic Avenue from the Barclays Center Arena and on top of New York City's third largest transportation hub - Atlantic Terminal.

The 51% acquisition will be capitalized with significant follow-on investment from the existing NYC Portfolio investors. Final transaction closing is expected to be completed in Q4 2017.

About Madison International RealtyThe press release from Forest City

Madison International Realty (www.madisonint.com) is a leading liquidity provider to real estate investors worldwide. Madison provides equity capital for real estate owners and investors seeking to monetize embedded equity, to replace capital partners seeking an exit and to recapitalize balance sheets. The firm provides equity for recapitalizations, partner buyouts and capital infusions; and acquires joint venture, limited partner and co-investment interests as principals. Madison invests only in secondary transactions and focuses solely on existing properties and portfolios in the U.S., U.K., and Western Europe. Madison has offices in New York, London and Frankfurt, Germany, where the firm operates under the name of Madison Real Estate Beteiligungsgesellschaft mbH.

Forest City and Madison International Enter Definitive Agreement for New York City Specialty Retail Portfolio

CLEVELAND, Sept. 20, 2017 /PRNewswire/ -- Forest City Realty Trust (NYSE: FCEA) and Madison International Realty today announced the signing of definitive agreements for Madison's acquisition of Forest City's 51 percent interest in a 2.1-million-square-foot, 12-asset, specialty retail portfolio located throughout Manhattan, Brooklyn, Queens, the Bronx, Staten Island and Northern New Jersey, for a gross value of approximately $1.0 billion. Final closing is expected in the fourth quarter of 2017.

The transaction is in line with Forest City's strategy of focusing its portfolio on apartment, office and mixed-use assets in core urban markets. The company announced in August 2016 that it would explore strategic alternatives for its regional mall and New York specialty retail portfolios. Forest City and Madison have been joint venture partners in the specialty portfolio, in which Madison has a 49 percent ownership stake, since 2011.

"Today's announcement is an important step in the ongoing execution of our strategic plan and is another example of delivering on our commitment to create value," said David J. LaRue, Forest City president and chief executive officer. "Madison International has been a great partner for the past six-plus years in these high-quality assets, and I salute the teams on both sides for bringing this large and complex transaction to fruition."

"This transaction fits well with our strategy of executing large-scale equity investments to create 'win/win' outcomes for our partners and investors," said Ronald Dickerman, president and founder of Madison. "The retail centers in this portfolio are in densely populated, well-trafficked areas that offer significant opportunity for continued value creation. We are pleased to have assisted our partner, Forest City, in accomplishing this important milestone."

The 12 retail centers that are part of the transaction are Shops at Gun Hill Road (Waring), Shops at Gun Hill Road (Ely) and Castle Center in the Bronx, Harlem Center in Manhattan, Shops at Northern Boulevard and Queens Place in Queens, The Heights, Atlantic Terminal Mall and Atlantic Center in Brooklyn, Forest Avenue and Shops at Richmond Avenue in Staten Island, and Columbia Park Center in North Bergen, New Jersey.

About Forest City

Forest City Realty Trust, Inc. is a NYSE-listed national real estate company with $8.2 billion in consolidated assets. The Company is principally engaged in the ownership, development, management and acquisition of commercial, residential and mixed-use real estate in key urban markets in the United States. For more information, visit www.forestcity.net.

Comments

Post a Comment