The value of the Brooklyn Nets nearly doubled in the past year (from $780 million to $1.5 billion), according to Forbes, after a nearly 50% increase in the value a year earlier.

And that's from a team that's losing nearly $100 million a year--the only team to lose money last year--thanks to enormous contracts aimed to lure players.

Part of that is due simply to the league's well-positioned luck, since the Nets actually went down a notch, from the fifth most-valuable team to the sixth.

As Forbes reports:

What do you get when you combine a massive new $24 billion television contract, a nearly six-year bull market in equities creating tremendous wealth, and cheap credit? You get a massive rise in sports franchise values, with the NBA serving as ground zero for the current boom. The average NBA team is now worth $1.1 billion, 74% more than last year. It is the biggest one-year gain since Forbes began valuing teams in the four major U.S. sports leagues in 1998.The shared league revenue contributes $298 million of the value of the Nets today, up hugely from $141 million, which itself was way down from $292 million a year earlier.

The New York/Brooklyn market contributes $543 million of value, a huge jump from last year's $297 million. The building ("stadium," though actually an arena) contributes $512 million, again up hugely from $257 million. And the Brooklyn Nets brand rose significantly, to $154 million from $91 million.

Maybe it doesn't matter that they lose money?

How much are they worth?

The Nets present an even trickier valuation proposition. Mikhail Prokhorov paid $365 million in 2010 for 80% of the team and 45% of the operating rights to its home arena, Barclays Center. The club lost an NBA-record $99 million last season thanks to $206 million in player costs from salaries, benefits and $91 million luxury tax bill, another NBA record. The Barclays Center was the busiest arena in North America in 2013 and the first half of 2014, but the new owners would be on the hook for $50 million annually in bond payments, plus another $15 million to operate the building. Even so, the Nets will be valued like a trophy asset, as the rare sports property put up for auction in the biggest market in the U.S. We value the Nets and the operating lease to Barclays at $1.5 billion, sixth among NBA franchises.(Emphasis added)

Those numbers are not correct, nor does that paragraph fully make sense to me.

Prokhorov can sell the Nets without selling his share of the arena.

Prokhorov can sell the Nets without selling his share of the arena.

The bond debt service on the arena doesn't hit $50 million until 2038, as noted in the graphic at right, from the Official Statement for the bonds.

And it costs well more than $15 million a year to operate the building, even if that $15 million was meant to represent only 45% of the cost.

The Nets' value depends, as Badenhausen rightly suggests, on the competition for a trophy asset. They need not make money, because, as he writes, there are always deductions:

Paying $1.5 billion or more for a business losing $100 million a year doesn’t make a lot of economic sense. But in addition to joining an ultra-exclusive club, new NBA owners also benefit from hefty tax breaks. Owners can deduct the value of the intangible assets in the deal over 15 years after a transaction. This deduction can offset earnings for the NBA franchise or other businesses the owner may control. This part of the U.S. tax code applies to all business and not just sports. But the NBA and sports teams reap significant benefits because 90% or more of the purchase price can typically be deemed an intangible asset with a sports team. It is a major factor as hedge fund titans and billionaires swirl around the Nets in the coming months.On the Nets

The Forbes page on the Brooklyn Nets states:

Russian billionaire Mikhail Prokhorov hired investment bank Evercore Partners in January to sell his majority interest in the Nets. Forest City Ratner Companies enlisted Evercore last year to sell its 20% stake in the team. The team is bleeding red ink due to its high payroll, enormous debt and low local television deal. Some of the Nets losses should be alleviated when the NHL's New York Islanders move into the Barclays Center for the 2015-16 season. The Nets' luxury tax bill last season was a record $90.6 million leading to the biggest operating loss in NBA history.(Emphasis added)

I have no idea why the Nets losses would be alleviated once the Islanders move in. It may be that Prokhorov's revenues from his stake in the arena would rise.

(Here's an odd Crain's piece that draws on last year's valuation of the Nets but extrapolates from the seemingly overinflated $2 billion price paid for the Los Angeles Clippers, and suggests the nets would be worth more.)

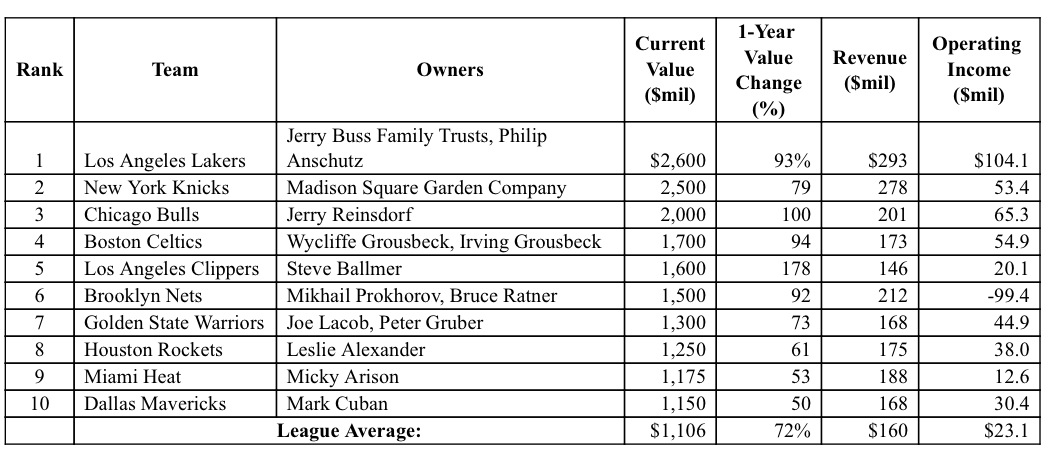

The most valuable teams

|

| Via NetsDaily |

Comments

Post a Comment