Did Forest City Ratner plan to add 470 Vanderbilt Avenue, a nine-story former tire plant turned telecom center just north of Atlantic Avenue, to the Atlantic Yards plan?

Did Forest City Ratner plan to add 470 Vanderbilt Avenue, a nine-story former tire plant turned telecom center just north of Atlantic Avenue, to the Atlantic Yards plan?That's what a 1/23/04 e-mail from Forest City executive Jane Marshall suggests, even though neither Forest City nor the firm that owns the Atlantic Technology Center at 470 Vanderbilt would confirm that. It's a reminder that Forest City Ratner seeks to expand further in Brooklyn; the developer also plans towers over the Atlantic Center mall (with more than 1.2 million square feet of development rights) and the conversion of a factory-turned-office building at 80 DeKalb Avenue into housing.

The addition of 470 Vanderbilt would have extended the far eastern segment of Atlantic Yards the project up one block, across a major avenue.

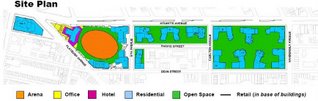

The Atlantic Technology Center is just above the northeast corner of the site map, where Building 10 is planned. See photo at bottom from the Atlantic Yards Final Environmental Impact Statement.

The Atlantic Technology Center is just above the northeast corner of the site map, where Building 10 is planned. See photo at bottom from the Atlantic Yards Final Environmental Impact Statement.Early 2004 musings

Marshall's e-mail to the Department of City Planning, which I acquired via a Freedom of Information Law request, was sent some six weeks after the Atlantic Yards plan was officially announced. In the message, Marshall stated that the developer was "exploring adding the vanderbuilt [sic] site to the masterplan as a residential site." (Click to enlarge)

The inclusion of this site would have added 1 million square feet to a plan then announced at about 8 million square feet. (It later rose to 9.1 million square feet and, after two strategic cuts, returned to nearly the same square footage as originally announced, albeit with the addition of Site 5, the P.C. Richard/Modell's location at the corner of Atlantic, Flatbush, and Fourth avenues.)

The inclusion of this site would have added 1 million square feet to a plan then announced at about 8 million square feet. (It later rose to 9.1 million square feet and, after two strategic cuts, returned to nearly the same square footage as originally announced, albeit with the addition of Site 5, the P.C. Richard/Modell's location at the corner of Atlantic, Flatbush, and Fourth avenues.)"I recognize that further discussions about block 2009 must be had re including it in the plan and its uses and density," Marshall wrote.

[Update: Block 2009 refers to the location of 470 Vanderbilt.]

An underutilized building?

Marshall's memo suggests that 1 million square feet would be a combination of converting the existing floor area and building an addition. While Property Shark indicates that the building already includes 1.1 million square feet, the building's web site states that it offers 750,000 square feet, of which 430,000 square feet (57.3%) is leased to tenants.

Given a more than 42% vacancy rate, the building's owners understandably might be considering alternatives, even the conversion of a recently converted building. Indeed, the vacancy rate less than three years ago was actually 70 percent, according to a 6/21/04 analysis of the projected fiscal impact of the Atlantic Yards plan, written by urban planner Jung Kim and economic historian Gustav Peebles.

In that analysis, written in response to the projections by Forest City Ratner's paid consultant Andrew Zimbalist, Kim and Peebles wrote that Zimbalist's optimism about Atlantic Yards office space was unfounded:

If the core of downtown Brooklyn is not a sure market, risks are even higher at the edges, including the [Atlantic Yards] site. Across from this site on Atlantic Avenue exists a high end Class B office property known as 470 Vanderbilt, owned by the Carlyle Group. Despite its $60 million renovation completed in 2000, this property has a vacancy rate of 43% listed on the company’s website. When we contacted the company, they admitted that it was actually 70%. What is astounding about this vacancy rate is that the company’s website informs prospective lessees of a host of tax subsidies that they will receive per worker if they move into the complex.

Indeed, a 6/13/00 Bloomberg News article on the building stated that "at least 300 people are expected to work at the building, and the figure could approach 1000." Given the vacancy rate, the number is likely lower.

No details

I tried to ask Marshall about the putative plan for 470 Vanderbilt. She directed me to contact a company spokesman, who didn't respond to my inquiry.

I queried Carlyle if they ever had discussions with Forest City about any deal for the property. The response I got was somewhat cryptic. "After checking our files I have found that we are unable to provide any information concerning your request below," emailed Thomas M. Ray, managing director.

Atlantic Yards is planned for two phases, with the arena block--five towers and an arena west of Sixth Avenue--the initial goal. The eastern segment, Phase 2, could last for 15 to 20 years. By that time, the Atlantic Technology Center could re-appear on the developer's radar screen.

An underutilized building?

Marshall's memo suggests that 1 million square feet would be a combination of converting the existing floor area and building an addition. While Property Shark indicates that the building already includes 1.1 million square feet, the building's web site states that it offers 750,000 square feet, of which 430,000 square feet (57.3%) is leased to tenants.

Given a more than 42% vacancy rate, the building's owners understandably might be considering alternatives, even the conversion of a recently converted building. Indeed, the vacancy rate less than three years ago was actually 70 percent, according to a 6/21/04 analysis of the projected fiscal impact of the Atlantic Yards plan, written by urban planner Jung Kim and economic historian Gustav Peebles.

In that analysis, written in response to the projections by Forest City Ratner's paid consultant Andrew Zimbalist, Kim and Peebles wrote that Zimbalist's optimism about Atlantic Yards office space was unfounded:

If the core of downtown Brooklyn is not a sure market, risks are even higher at the edges, including the [Atlantic Yards] site. Across from this site on Atlantic Avenue exists a high end Class B office property known as 470 Vanderbilt, owned by the Carlyle Group. Despite its $60 million renovation completed in 2000, this property has a vacancy rate of 43% listed on the company’s website. When we contacted the company, they admitted that it was actually 70%. What is astounding about this vacancy rate is that the company’s website informs prospective lessees of a host of tax subsidies that they will receive per worker if they move into the complex.

Indeed, a 6/13/00 Bloomberg News article on the building stated that "at least 300 people are expected to work at the building, and the figure could approach 1000." Given the vacancy rate, the number is likely lower.

No details

I tried to ask Marshall about the putative plan for 470 Vanderbilt. She directed me to contact a company spokesman, who didn't respond to my inquiry.

I queried Carlyle if they ever had discussions with Forest City about any deal for the property. The response I got was somewhat cryptic. "After checking our files I have found that we are unable to provide any information concerning your request below," emailed Thomas M. Ray, managing director.

Atlantic Yards is planned for two phases, with the arena block--five towers and an arena west of Sixth Avenue--the initial goal. The eastern segment, Phase 2, could last for 15 to 20 years. By that time, the Atlantic Technology Center could re-appear on the developer's radar screen.

Comments

Post a Comment