If Barclays exits (?) naming rights deal and building gets re-named, more money for arena operator, more confusion for MTA

There's something very interesting in the article posted Monday night, 7/1/19, by the New York Post's Josh Kosman, Why Nets’ deals for Durant, Irving are really going to pay off for Mikhail Prokhorov: a new arena naming rights sponsor:

Then again, we'd never been told the so-called "ironclad" 25-year deal for the New York Islanders to come to Brooklyn had an opt-out. And it did. Atlantic Yards/Pacific Park is a "never-say-never-project."

(By the way, if the arena operators want to boot Barclays, maybe they could invoke the fact that the bank, an admitted corporate felon, should be a "Prohibited Person" under state law, as I wrote in September 2015.)

Sourcing credibility

Note: the well-sourced Kosman is often right, but not always, and the use of anonymous sources makes things fuzzy. Consider: in September 2015, he reported on a deal in which majority owner Mikhail Prokhorov would buy the rest of the Brooklyn Nets from Forest City Enterprises for little cash beyond forgiving the $40 million he was owed to cover team losses, and a source said the team was valued at $700 million.

In December 2015, Prokhorov agreed to convey $285 million for Forest City's shares of the arena and team, with about 25% in cash--could that have just been for the arena?--and the team was valued at $875 million.

New name, new signage, new station?

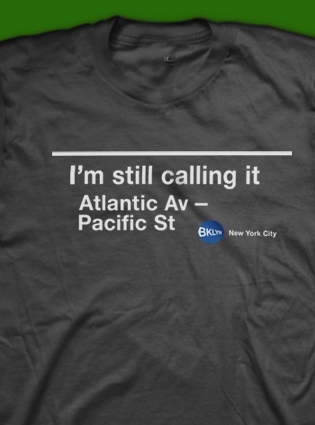

If/when the arena gets renamed, that obviously would change signage around the building and vindicate those, like t-shirt designer Deborah Goldstein (aka MissWit), who said they'd keep calling the station "Atlantic Av-Pacific St."

More importantly, it presumably would cause a change in the name of the adjacent subway hub, which was renamed Atlantic Av-Barclays Ctr after Forest City Ratner--remember, the arena builder, and original operator--bought naming rights for 20 years, matching the Barclays deal term.

Would a new sponsor--let's say Facebook, just for a test case--put their name on the arena? Sure.

Would we want the transit up to be renamed "Atlantic Av - Facebook Ctr"? I think everyone would be more wary.

That Times editorial

In June 2009, I criticized a New York Times editorial for failing to comment on the Metropolitan Transportation Authority's willingness to relax terms with Forest City to acquire development rights over the Vanderbilt Yard.

Not $20 million

I don't think newer arenas--as opposed to larger stadiums--are getting $20 million. For the Chase Center of the top-tier Golden State Warriors, the naming rights deal is $15 million a year over 20 years, according to the 10/9/17 Forbes, "the most expensive U.S. arena naming rights deal ever."

Still, even a 20% bump to $12 million a year would be good fiscal news for the arena operator in Brooklyn.

In Toronto, Scotiabank agreed to pay a reported $40M CDN a year over 20 years, CBC reported 9/4/17. Given that the Canadian dollar is worth about 76 cents, that translates as a little more than $30M USD a year. But Toronto is the only Canadian city with an NBA team, and it's the largest city, by far, in Canada.

A boon for the team owner

From the Post:

And it would help justify the sale of the team from Mikhail Prokhorov to Joe Tsai, who owns 49% and is expected to buy the rest, at a valuation of $2.3 billion.

Ticket prices are elastic

A comment on NetsDaily:

The current sponsor, Barclays, owns the rights through 2032, but is looking to end its contract early because it is no longer building a retail banking presence in the US, sources said. Barclays currently pays roughly $10 million a year, while newer arenas in big cities are getting closer to $20 million a year.Well, we'd never been told that the arena naming rights deal had an opt-out, and "a Nets insider says that’s wrong, that rights aren’t up for renewal until 2032," according to NetsDaily.

“There will be an opportunity in the not too distant future to increase the money from naming rights,” an insider said.

Then again, we'd never been told the so-called "ironclad" 25-year deal for the New York Islanders to come to Brooklyn had an opt-out. And it did. Atlantic Yards/Pacific Park is a "never-say-never-project."

(By the way, if the arena operators want to boot Barclays, maybe they could invoke the fact that the bank, an admitted corporate felon, should be a "Prohibited Person" under state law, as I wrote in September 2015.)

Sourcing credibility

Note: the well-sourced Kosman is often right, but not always, and the use of anonymous sources makes things fuzzy. Consider: in September 2015, he reported on a deal in which majority owner Mikhail Prokhorov would buy the rest of the Brooklyn Nets from Forest City Enterprises for little cash beyond forgiving the $40 million he was owed to cover team losses, and a source said the team was valued at $700 million.

In December 2015, Prokhorov agreed to convey $285 million for Forest City's shares of the arena and team, with about 25% in cash--could that have just been for the arena?--and the team was valued at $875 million.

|

| T-shirt by MissWit |

If/when the arena gets renamed, that obviously would change signage around the building and vindicate those, like t-shirt designer Deborah Goldstein (aka MissWit), who said they'd keep calling the station "Atlantic Av-Pacific St."

More importantly, it presumably would cause a change in the name of the adjacent subway hub, which was renamed Atlantic Av-Barclays Ctr after Forest City Ratner--remember, the arena builder, and original operator--bought naming rights for 20 years, matching the Barclays deal term.

Would a new sponsor--let's say Facebook, just for a test case--put their name on the arena? Sure.

Would we want the transit up to be renamed "Atlantic Av - Facebook Ctr"? I think everyone would be more wary.

That Times editorial

In June 2009, I criticized a New York Times editorial for failing to comment on the Metropolitan Transportation Authority's willingness to relax terms with Forest City to acquire development rights over the Vanderbilt Yard.

I wrote that the Times "offered a critical but essentially tangential editorial opposing the deal to add the name 'Barclays Center' to the Atlantic Avenue/Pacific Street station."

Well, it was "essentially tangential" compared to the larger issue, but it could be a lot less tangential if Barclays is gone within ten years or within 20 years. In the editorial, Where Geography Matters, the Times opined:

When you get off the train at a subway station, you want to know where you are, not who your sponsor is. Names aren’t as easily changed as all that, especially when they correspond — as the names of subway stations do — to the actual geography of the city.I noted that naming rights deals tied to sports facilities--at least the sports facilities with corporate names versus team names --are inherently fragile, given that sports facility names often change.

The names of subway stations are beautifully utilitarian just as they are, shifting only as rapidly as the streets above them shift. The names of their sponsors are likely to shift with the economic climate, and somehow adding a name like Barclays to what is, after all, a public transit station — in Brooklyn — feels even more dissonant. So when it comes to selling naming rights, we’d like to urge the M.T.A. to take another approach: sell the naming rights to individual subway cars.

As to whether the reported $4 million deal was a "a goodly sum," as the Times wrote, Michael D.D. White pointed out that the present value was far less.

Not $20 million

I don't think newer arenas--as opposed to larger stadiums--are getting $20 million. For the Chase Center of the top-tier Golden State Warriors, the naming rights deal is $15 million a year over 20 years, according to the 10/9/17 Forbes, "the most expensive U.S. arena naming rights deal ever."

Still, even a 20% bump to $12 million a year would be good fiscal news for the arena operator in Brooklyn.

In Toronto, Scotiabank agreed to pay a reported $40M CDN a year over 20 years, CBC reported 9/4/17. Given that the Canadian dollar is worth about 76 cents, that translates as a little more than $30M USD a year. But Toronto is the only Canadian city with an NBA team, and it's the largest city, by far, in Canada.

A boon for the team owner

From the Post:

The Brooklyn team, which ranked among the worst in the NBA just two years ago, is projecting that revenue for the upcoming season will pop by 10 to 15% — and that’s before Durant, their biggest new star, even makes it on to the court, an insider told The Post.I'd take any specific number with a grain of salt, since the "inside source" chose not to be named, and the Nets--and the arena operator--have had financial struggles. But it's certainly plausible, as long as the team performs.

In the meantime, the mere hype around Durant and Irving, who is coming off two seasons with the Boston Celtics, should help the Brooklyn team generate an extra $29 million to $43.5 million through increased ticket sales, corporate sponsorships and merchandising deals, the inside source told The Post.

And it would help justify the sale of the team from Mikhail Prokhorov to Joe Tsai, who owns 49% and is expected to buy the rest, at a valuation of $2.3 billion.

Ticket prices are elastic

A comment on NetsDaily:

I called to ask about season tickets 2 weeks ago and decided I wanted to buy tickets for a half season planIn other words, prices more than doubled before the news about free agent signings came out (though surely the Nets had an inkling of their progress).

I was quoted $90 per game for 21 games for 1 seat. I had to buy 2 seats for me and my fiance, so this would come out to $3,780 for 2 half season tickets…I asked the rep to email me so we could finalize and he never did.

It got placed on the backburner and I called him on sunday morning before we learned about KD and the price for those same tickets jumped up to $3,900…. PER SEAT!!! AND THIS WAS BEFORE KD!!!

Comments

Post a Comment