Assemblyman Jim Brennan’s effort to get the Empire State Development Corporation (ESDC) to release the Atlantic Yards business plan provided by developer Forest City Ratner reaped some results yesterday, but not nearly enough to evaluate the project.

The ESDC released three pages dated 10/10/06 and 10/11/06, but with no explanation for the assumptions behind the numbers. I showed them to David A. Smith, an affordable housing expert in Boston, who’s paid close attention to the Atlantic Yards plan.

"These cash flow schedules are like a Japanese landscape watercolor; fascinating and evocative in their own right but only lightly drawn,” he wrote in response. “They make one hungry for more detail, without which it is impossible to have a properly informed opinion about either the expected profit the developer may make relative to the risk, or whether the public is receiving fair public benefit for the public resources contributed."

Thus, the documents would not help Brennan evaluate whether Atlantic Yards could be downsized without harming the financial viability of the project.

Thus, the documents would not help Brennan evaluate whether Atlantic Yards could be downsized without harming the financial viability of the project.

Brennan told the New York Sun, in an article today headlined Critics Deem Atlantic Yards Documents Insufficient, "We will deal with our attorneys, and not silly superfluous dribs and drabs that come through fax machines after press inquiries."

He said the document was not the complete business plan he'd sought through a Freedom of Information Law request. He and State Senator Velmanette Montgomery filed suit to get that document.

(The New York Post, in an article incorrectly dubbed an exclusive, oddly ignored all criticism of the documents. Metro acknowledged the controversy in a paragraph. The New York Daily News and the New York Times passed on the story.)

Paying for the arena/Nets

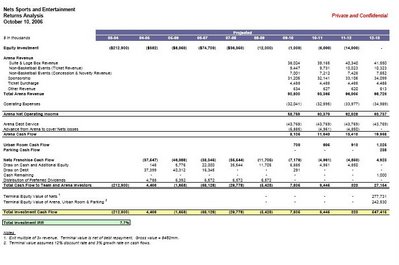

The documents do offer some tantalizing details, for example pegging revenue from suites in the suite-intensive arena at $38 million a year (beginning in 2009-10), with an annual increase of $1 million, slated within five years to surpass the annual arena debt service of $43.8 million. In other words, the suites alone could, as I’d predicted, pay for the arena, the most expensive ever in the country, at $637.2 million.

They also show that the new arena would easily pay for its operations; as sponsorship revenue, starting at $31.2 million annually, would nearly cover operating expenses. (That revenue would include $20 million a year from the Barclays Center naming rights deal.)

Thus, non-basketball events, ticket surcharges, and other revenue would help offset heavy losses currently experienced by the Nets. Develop Don’t Destroy Brooklyn called it “a publicly subsidized golden parachute.”

Beyond that, the documents seem to lowball the developer's revenues. There is no figure assigned to non-box/loge tickets to Nets games--seemingly a significant source of admission revenues. [Update: a reader suggests that that number would be subsumed into cash flow figures, so, while it may be missing information, it doesn't lowball revenues.]

Rubberstamped?

DDDB questioned whether the “ESDC has analyzed and verified the projections released today, or if they simply rubberstamped this submission, just as they have every other aspect” of the project. I asked if the agency analyzed or endorsed the documents. "FCR gave this to us and we released it as is," responded spokeswoman Jessica Copen.

DDDB spokeswoman Candace Carponter suggested that, “Given the vast public subsidies that this project is slated to receive, the public has the right to expect some assurance from the government that the developer's numbers are comprehensive and based upon valid business assumptions.”

IRR isn’t profit

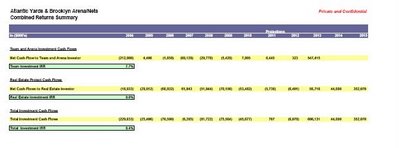

While the total “investment internal rate of return” (IRR) was pegged at 8.4%, that doesn’t mean that Forest City Ratner’s profit would remain, as a percentage, below two figures, since we don’t know how much of the money the developer would put up.

While the total “investment internal rate of return” (IRR) was pegged at 8.4%, that doesn’t mean that Forest City Ratner’s profit would remain, as a percentage, below two figures, since we don’t know how much of the money the developer would put up.

Indeed, as I wrote yesterday, the documents released differ greatly from the financing plan that the Metropolitan Transportation Authority required from bidders for the Vanderbilt Yard, and which Develop Don't Destroy Brooklyn and other organizations tried in vain to see.

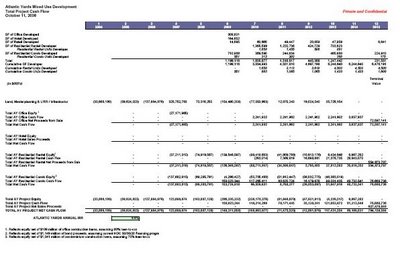

The MTA required a 20-year analysis, not little more than a decade—which ends just as the revenues start climbing. (Indeed, even project landscape architect Laurie Olin says it would take 20 years to build.) The MTA also required the developer to account for "sources and uses" of funds.

Smith confirmed that: “The schedules omit nearly all of the financing and operating assumptions. They omit any sketch as to how the equity will be raised from five different legal and financial entities (team/arena, condo, rental, hotel, and office), without which one cannot tell what is the cost of external capital versus developer capital. They omit a sources and uses of funds, without which it is impossible to tell what fees (however proper they might be!) the developer and its affiliates may be charging the venture ('off the top', as it were). They do not tell us where the $230 million (and counting) of equity that has already been contributed came from, nor at what current or future cost."

Why fees are important

Smith likened the issue of fees to affiliates—and Forest City has created several corporate entities for this project—to the financing for Hollywood films, where the net revenues are significantly lower than the gross revenues because of fees charged by the studio. “Knowing the net cash flows without knowing the fees is like learning that the Nets scored 89 points last night, without knowing who they were playing, what the other team's score was, and whether they won or lost,” he said.

Smith said that the record-setting recent deal for Stuyvesant Town/Peter Cooper Village was equivalent to a 5% IRR if it's presumed that the net operating income (NOI) won’t rise. Obviously, that NOI will rise, he said, “but I doubt that the unvarnished Stuy Town IRR (before considering debt financing) would be as high as 9.6%.”

A long process

In other words, Atlantic Yards might offer dramatic returns—and for good reason. “At the same time, large-scale investors may well find a project like Atlantic Yards more risky, so the premium over a safe rate that they would demand could well be higher,” Smith said. “In short, I don't know whether 9.6% is a rich or poor rate even for the raw equity capital considered in the abstract, much less what equity could be raised from outside, nor how the deal pencils for the sponsor.”

Forest City Ratner has already invested $230 million. "The $230 million of capital already invested is a jaw-dropping sum, especially since we are four years into the transaction and it has not closed,” Smith observed. “Very few entities could put up that much capital for that long. Setting aside whether one likes or dislikes the process or the property, no one should underestimate how few sponsors could attempt it, nor how many fewer would attempt it.”

(The city and state have pledged at least $305 million in direct subsidies for infrastructure and other costs, and the state has agreed to override zoning and take property by eminent domain, significant boosts for the developer.)

Smith called the lag between first outflow of capital, in 2004, to net inflow, in 2013, a dramatic one. “A tremendous amount is riding on expected residual value in a decade,” he said. “I cannot imagine the developer will not have tried to lay a large portion of that off on outside capital sources."

Affordable units faster?

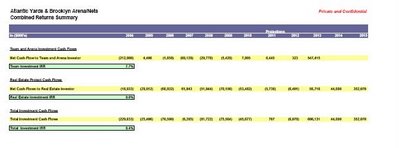

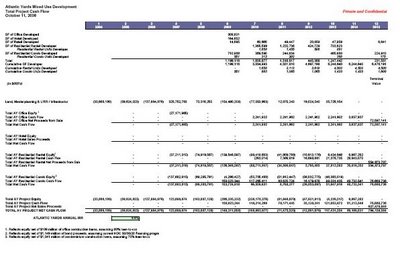

The documents also show that the developer expects $1.15 billion in subsidized loans, via the New York City Housing Development Corporation (HDC), for the rental housing, in accordance with HDC’s 50/30/20 plan: 50% market rate, 30% moderate/middle income, and 20% low income. And the developer expects $1.04 billion in condominium construction loans.

The documents also show that the developer expects $1.15 billion in subsidized loans, via the New York City Housing Development Corporation (HDC), for the rental housing, in accordance with HDC’s 50/30/20 plan: 50% market rate, 30% moderate/middle income, and 20% low income. And the developer expects $1.04 billion in condominium construction loans.

The first housing units built, in 2009, would be 551 condos. In the next year, another 312 condos would open, along with 1658 rental apartments. If half of the rentals are affordable as pledged, that suggests 829 affordable units in Phase 1, a significantly larger number than the 550 cited in a letter from the City Planning Commission last September.

Given that there has been no public promise of 829 affordable units, the numbers seem, as stated at the bottom of the Combined Returns Summary released yesterday, “For discussion purposes only. Actual results may vary.”

Unexplained gaps

There are several unexplained gaps in the documents. For example, there’s no cost and value assigned to the retail space developed. Nor are there numbers for the hotel. Smith speculated that the hotel might be “fully net-leased to an outside party,” but noted the absence of any terms explaining that.

Also, there’s no revenue assigned to parking until the 2012-13 season, even though the arena is expected to open three years earlier. Even if the interim surface parking, rather than underground garages, would supply parking over that stretch, surely there would be revenues. The projected revenue of $238,000 for the 2012-13 year is paltry. Smith conjectured that it might come from a contemplated lease/operator agreement.

The ESDC released three pages dated 10/10/06 and 10/11/06, but with no explanation for the assumptions behind the numbers. I showed them to David A. Smith, an affordable housing expert in Boston, who’s paid close attention to the Atlantic Yards plan.

"These cash flow schedules are like a Japanese landscape watercolor; fascinating and evocative in their own right but only lightly drawn,” he wrote in response. “They make one hungry for more detail, without which it is impossible to have a properly informed opinion about either the expected profit the developer may make relative to the risk, or whether the public is receiving fair public benefit for the public resources contributed."

Thus, the documents would not help Brennan evaluate whether Atlantic Yards could be downsized without harming the financial viability of the project.

Thus, the documents would not help Brennan evaluate whether Atlantic Yards could be downsized without harming the financial viability of the project. Brennan told the New York Sun, in an article today headlined Critics Deem Atlantic Yards Documents Insufficient, "We will deal with our attorneys, and not silly superfluous dribs and drabs that come through fax machines after press inquiries."

He said the document was not the complete business plan he'd sought through a Freedom of Information Law request. He and State Senator Velmanette Montgomery filed suit to get that document.

(The New York Post, in an article incorrectly dubbed an exclusive, oddly ignored all criticism of the documents. Metro acknowledged the controversy in a paragraph. The New York Daily News and the New York Times passed on the story.)

Paying for the arena/Nets

The documents do offer some tantalizing details, for example pegging revenue from suites in the suite-intensive arena at $38 million a year (beginning in 2009-10), with an annual increase of $1 million, slated within five years to surpass the annual arena debt service of $43.8 million. In other words, the suites alone could, as I’d predicted, pay for the arena, the most expensive ever in the country, at $637.2 million.

They also show that the new arena would easily pay for its operations; as sponsorship revenue, starting at $31.2 million annually, would nearly cover operating expenses. (That revenue would include $20 million a year from the Barclays Center naming rights deal.)

Thus, non-basketball events, ticket surcharges, and other revenue would help offset heavy losses currently experienced by the Nets. Develop Don’t Destroy Brooklyn called it “a publicly subsidized golden parachute.”

Beyond that, the documents seem to lowball the developer's revenues. There is no figure assigned to non-box/loge tickets to Nets games--seemingly a significant source of admission revenues. [Update: a reader suggests that that number would be subsumed into cash flow figures, so, while it may be missing information, it doesn't lowball revenues.]

Rubberstamped?

DDDB questioned whether the “ESDC has analyzed and verified the projections released today, or if they simply rubberstamped this submission, just as they have every other aspect” of the project. I asked if the agency analyzed or endorsed the documents. "FCR gave this to us and we released it as is," responded spokeswoman Jessica Copen.

DDDB spokeswoman Candace Carponter suggested that, “Given the vast public subsidies that this project is slated to receive, the public has the right to expect some assurance from the government that the developer's numbers are comprehensive and based upon valid business assumptions.”

IRR isn’t profit

While the total “investment internal rate of return” (IRR) was pegged at 8.4%, that doesn’t mean that Forest City Ratner’s profit would remain, as a percentage, below two figures, since we don’t know how much of the money the developer would put up.

While the total “investment internal rate of return” (IRR) was pegged at 8.4%, that doesn’t mean that Forest City Ratner’s profit would remain, as a percentage, below two figures, since we don’t know how much of the money the developer would put up.Indeed, as I wrote yesterday, the documents released differ greatly from the financing plan that the Metropolitan Transportation Authority required from bidders for the Vanderbilt Yard, and which Develop Don't Destroy Brooklyn and other organizations tried in vain to see.

The MTA required a 20-year analysis, not little more than a decade—which ends just as the revenues start climbing. (Indeed, even project landscape architect Laurie Olin says it would take 20 years to build.) The MTA also required the developer to account for "sources and uses" of funds.

Smith confirmed that: “The schedules omit nearly all of the financing and operating assumptions. They omit any sketch as to how the equity will be raised from five different legal and financial entities (team/arena, condo, rental, hotel, and office), without which one cannot tell what is the cost of external capital versus developer capital. They omit a sources and uses of funds, without which it is impossible to tell what fees (however proper they might be!) the developer and its affiliates may be charging the venture ('off the top', as it were). They do not tell us where the $230 million (and counting) of equity that has already been contributed came from, nor at what current or future cost."

Why fees are important

Smith likened the issue of fees to affiliates—and Forest City has created several corporate entities for this project—to the financing for Hollywood films, where the net revenues are significantly lower than the gross revenues because of fees charged by the studio. “Knowing the net cash flows without knowing the fees is like learning that the Nets scored 89 points last night, without knowing who they were playing, what the other team's score was, and whether they won or lost,” he said.

Smith said that the record-setting recent deal for Stuyvesant Town/Peter Cooper Village was equivalent to a 5% IRR if it's presumed that the net operating income (NOI) won’t rise. Obviously, that NOI will rise, he said, “but I doubt that the unvarnished Stuy Town IRR (before considering debt financing) would be as high as 9.6%.”

A long process

In other words, Atlantic Yards might offer dramatic returns—and for good reason. “At the same time, large-scale investors may well find a project like Atlantic Yards more risky, so the premium over a safe rate that they would demand could well be higher,” Smith said. “In short, I don't know whether 9.6% is a rich or poor rate even for the raw equity capital considered in the abstract, much less what equity could be raised from outside, nor how the deal pencils for the sponsor.”

Forest City Ratner has already invested $230 million. "The $230 million of capital already invested is a jaw-dropping sum, especially since we are four years into the transaction and it has not closed,” Smith observed. “Very few entities could put up that much capital for that long. Setting aside whether one likes or dislikes the process or the property, no one should underestimate how few sponsors could attempt it, nor how many fewer would attempt it.”

(The city and state have pledged at least $305 million in direct subsidies for infrastructure and other costs, and the state has agreed to override zoning and take property by eminent domain, significant boosts for the developer.)

Smith called the lag between first outflow of capital, in 2004, to net inflow, in 2013, a dramatic one. “A tremendous amount is riding on expected residual value in a decade,” he said. “I cannot imagine the developer will not have tried to lay a large portion of that off on outside capital sources."

Affordable units faster?

The documents also show that the developer expects $1.15 billion in subsidized loans, via the New York City Housing Development Corporation (HDC), for the rental housing, in accordance with HDC’s 50/30/20 plan: 50% market rate, 30% moderate/middle income, and 20% low income. And the developer expects $1.04 billion in condominium construction loans.

The documents also show that the developer expects $1.15 billion in subsidized loans, via the New York City Housing Development Corporation (HDC), for the rental housing, in accordance with HDC’s 50/30/20 plan: 50% market rate, 30% moderate/middle income, and 20% low income. And the developer expects $1.04 billion in condominium construction loans. The first housing units built, in 2009, would be 551 condos. In the next year, another 312 condos would open, along with 1658 rental apartments. If half of the rentals are affordable as pledged, that suggests 829 affordable units in Phase 1, a significantly larger number than the 550 cited in a letter from the City Planning Commission last September.

Given that there has been no public promise of 829 affordable units, the numbers seem, as stated at the bottom of the Combined Returns Summary released yesterday, “For discussion purposes only. Actual results may vary.”

Unexplained gaps

There are several unexplained gaps in the documents. For example, there’s no cost and value assigned to the retail space developed. Nor are there numbers for the hotel. Smith speculated that the hotel might be “fully net-leased to an outside party,” but noted the absence of any terms explaining that.

Also, there’s no revenue assigned to parking until the 2012-13 season, even though the arena is expected to open three years earlier. Even if the interim surface parking, rather than underground garages, would supply parking over that stretch, surely there would be revenues. The projected revenue of $238,000 for the 2012-13 year is paltry. Smith conjectured that it might come from a contemplated lease/operator agreement.

Comments

Post a Comment