The three pages of cash flow documents regarding Atlantic Yards, drawn up by Forest City Ratner and released last week by the Empire State Development Corporation (ESDC), contain some significant gaps compared to a yet-unreleased review conducted for the ESDC by the firm KPMG.

Notably, the documents released by the state agency omit millions of dollars in revenue that the developer would receive from ownership of the Nets basketball team and also omit millions in subsidies not enumerated.

Neither set of documents provides a clear sense of the project bottom line; for that, we’d need a full accounting of “sources and uses” of the funds. However, the unreleased document—which I and some other reporters have acquired, though not via the ESDC—goes much farther than the document publicly released.

The three pages released by the ESDC were dated 10/10/06 and 10/11/06; the 24-page KPMG report was dated December 2006, with the notation that its statistics were as of 12/19/06.that it referred to “certain cash flows and assumptions” in connection with Atlantic Yards. In other words, the latter document is more current.

More Nets gains

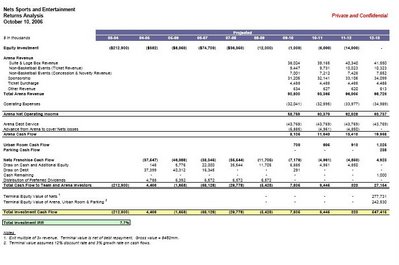

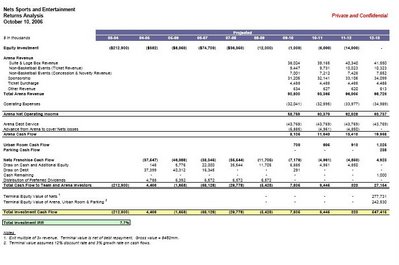

Regarding the Nets, the document released last week (right) has some gaps. The KPMG document includes $33.5 million in annual TV revenue and $27 million in “other Nets-related revenue,” figures that do not appear explicitly on the document at right.

Regarding the Nets, the document released last week (right) has some gaps. The KPMG document includes $33.5 million in annual TV revenue and $27 million in “other Nets-related revenue,” figures that do not appear explicitly on the document at right.

That suggests more than $60 million annually should be added to the bottom line—a significant gain, given that the developer’s obligation to pay for the arena would be less than $44 million a year. That sum refers to debt service on tax-exempt bonds; it would be higher if the state required Forest City Ratner to pay for the arena directly rather than have it be “publicly-owned” by a state subsidiary.

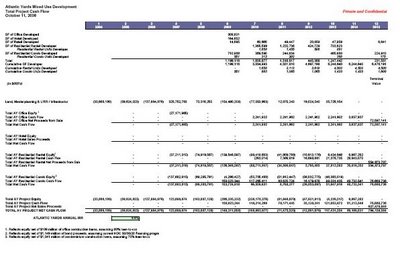

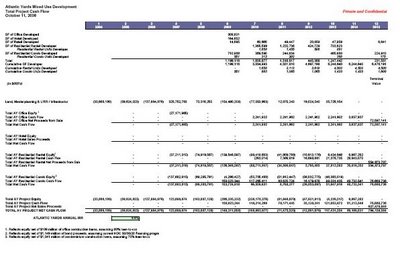

Condos nearly $1M, reaping $1.5B

The KPMG document shows that the price for condos would be $850/square foot, a sum surely to go up when constructed by 2009 or later. Given condo sizes ranging from 1008 to 1072 square feet, the cost would be from $856,800 to $911,200, with an average of $884,000.

There would be 1930 condos, but 200 would be subsidized, so let’s put them aside for now. At $884,000, 1730 condos would result in $1.53 billion in revenues. (The project would cost $4 billion, but it’s hardly clear how much the developer is putting up.)

Smaller rentals

Note that the market-rate and affordable rentals would be significantly smaller than the condos. The 2250 market-rate rentals would average 714 square feet. The 2250 affordable rentals would average 665 square feet. (See my report on apartment sizes.)

Housing (and other) subsidies

A big mystery regarding the Atlantic Yards project regards housing subsidies. City officials have refused to make them public and, indeed, Forest City Enterprises executive Chuck Ratner indicated on Tuesday that the numbers remain under negotiation.

A big mystery regarding the Atlantic Yards project regards housing subsidies. City officials have refused to make them public and, indeed, Forest City Enterprises executive Chuck Ratner indicated on Tuesday that the numbers remain under negotiation.

However, the document last week, in a footnote (right), indicates $1.15 billion in tax-exempt bonds, based on the Housing Development Corporation’s (HDC) 50/30/20 mixed-income program.

The KPMG indicates that program and more. Along with HDC’s program, it delineates $95,000 to $165,000 in low income housing credits per unit. It includes a 25-year tax abatement for the condos, based on the city’s 421- program, which has been used to finance luxury construction around the city.

It includes tax abatements for the commercial space, value unspecified, and $10 million in commercial rent subsidies. As for city and state infrastructure support, it cites $200 million. Now we know that’s up to $305 million, and $100 million includes land acquisition costs.

Retail and laundry revenues

Omitted in the documents released last week was any indication of retail income. The KPMG document indicates 200,000 square feet of retail at $30/square foot, or $6 million a year in rent.

The KPMG document even estimates laundry revenue at $10 monthly per housing unit. Let’s assume that all 6430 units would spend $10 a month (though the condos might include washers and dryers). That would reap $771,600 annually.

The bottom line

The bottom line is simple. We still need a more accurate accounting of the sources of funds and subsidies for this project, and the potential revenues.

Notably, the documents released by the state agency omit millions of dollars in revenue that the developer would receive from ownership of the Nets basketball team and also omit millions in subsidies not enumerated.

Neither set of documents provides a clear sense of the project bottom line; for that, we’d need a full accounting of “sources and uses” of the funds. However, the unreleased document—which I and some other reporters have acquired, though not via the ESDC—goes much farther than the document publicly released.

The three pages released by the ESDC were dated 10/10/06 and 10/11/06; the 24-page KPMG report was dated December 2006, with the notation that its statistics were as of 12/19/06.that it referred to “certain cash flows and assumptions” in connection with Atlantic Yards. In other words, the latter document is more current.

More Nets gains

Regarding the Nets, the document released last week (right) has some gaps. The KPMG document includes $33.5 million in annual TV revenue and $27 million in “other Nets-related revenue,” figures that do not appear explicitly on the document at right.

Regarding the Nets, the document released last week (right) has some gaps. The KPMG document includes $33.5 million in annual TV revenue and $27 million in “other Nets-related revenue,” figures that do not appear explicitly on the document at right.That suggests more than $60 million annually should be added to the bottom line—a significant gain, given that the developer’s obligation to pay for the arena would be less than $44 million a year. That sum refers to debt service on tax-exempt bonds; it would be higher if the state required Forest City Ratner to pay for the arena directly rather than have it be “publicly-owned” by a state subsidiary.

Condos nearly $1M, reaping $1.5B

The KPMG document shows that the price for condos would be $850/square foot, a sum surely to go up when constructed by 2009 or later. Given condo sizes ranging from 1008 to 1072 square feet, the cost would be from $856,800 to $911,200, with an average of $884,000.

There would be 1930 condos, but 200 would be subsidized, so let’s put them aside for now. At $884,000, 1730 condos would result in $1.53 billion in revenues. (The project would cost $4 billion, but it’s hardly clear how much the developer is putting up.)

Smaller rentals

Note that the market-rate and affordable rentals would be significantly smaller than the condos. The 2250 market-rate rentals would average 714 square feet. The 2250 affordable rentals would average 665 square feet. (See my report on apartment sizes.)

Housing (and other) subsidies

A big mystery regarding the Atlantic Yards project regards housing subsidies. City officials have refused to make them public and, indeed, Forest City Enterprises executive Chuck Ratner indicated on Tuesday that the numbers remain under negotiation.

A big mystery regarding the Atlantic Yards project regards housing subsidies. City officials have refused to make them public and, indeed, Forest City Enterprises executive Chuck Ratner indicated on Tuesday that the numbers remain under negotiation.However, the document last week, in a footnote (right), indicates $1.15 billion in tax-exempt bonds, based on the Housing Development Corporation’s (HDC) 50/30/20 mixed-income program.

The KPMG indicates that program and more. Along with HDC’s program, it delineates $95,000 to $165,000 in low income housing credits per unit. It includes a 25-year tax abatement for the condos, based on the city’s 421- program, which has been used to finance luxury construction around the city.

It includes tax abatements for the commercial space, value unspecified, and $10 million in commercial rent subsidies. As for city and state infrastructure support, it cites $200 million. Now we know that’s up to $305 million, and $100 million includes land acquisition costs.

Retail and laundry revenues

Omitted in the documents released last week was any indication of retail income. The KPMG document indicates 200,000 square feet of retail at $30/square foot, or $6 million a year in rent.

The KPMG document even estimates laundry revenue at $10 monthly per housing unit. Let’s assume that all 6430 units would spend $10 a month (though the condos might include washers and dryers). That would reap $771,600 annually.

The bottom line

The bottom line is simple. We still need a more accurate accounting of the sources of funds and subsidies for this project, and the potential revenues.

Comments

Post a Comment