Maybe the Empire State Development Corporation (ESDC) and developer Forest City Ratner aren't as collaborative as an agency lawyer described in a 2/14/06 court hearing. A look at the agency's Final Scope of Analysis for the Atlantic Yards project shows that the ESDC, unlike Forest City Ratner, won't try to count the income taxes of new residents to inflate the potential fiscal benefits of the project. (Then again, the ESDC won't try to estimate the full costs of the project.)

Those income taxes account for about half of the city/state revenue FCR projects--$6 billion over 30 years, or about $2 billion in current dollars, or present value. In other words, the ESDC analysis wouldn't come close to the overstated estimates made by Forest City Ratner's paid consultant, sports economist Andrew Zimbalist.

This further confirms what James Parrott of the Fiscal Policy Institute told me: "I don't know of any serious cost-benefit analyses of mixed-used economic development projects that count the taxes of residents. That's why we said it was a methodological flaw."

What ESDC counts

The ESDC's Final Scope, a prelude to a Draft Environmental Impact Statement (Draft EIS), the agency, on p. 22 (or p. 30 of the PDF) states that "the socioeconomic analysis will assess the fiscal and economic benefits of the proposed project to the City and State economies." It will estimate the following benefits:

The ESDC's Final Scope, a prelude to a Draft Environmental Impact Statement (Draft EIS), the agency, on p. 22 (or p. 30 of the PDF) states that "the socioeconomic analysis will assess the fiscal and economic benefits of the proposed project to the City and State economies." It will estimate the following benefits:

--employment, direct and indirect

--wates and salaries generated by employment

--direct taxes generated by the commercial, institutional, and/or residential development, including retail sales tax, hotel occupancy tax, payroll taxes, corporate and business taxes, and miscellaneous taxes

--taxes generated by indrect economic activity

--the total economic output created by the operation of the project.

Missing: the income taxes of new residents.

State support

Meanwhile, state Assembly members have allocated $33 million toward infrastructure improvements in the $387-million 2006-2007 Education, Labor and Family Assistance budget. According to a 4/1/06 Brooklyn Papers article headlined State gives Ratner $33M, the rest of the $100 million Forest City Ratner seeks from the state might soon come from other economic development budgets controlled by the governor and the Senate.

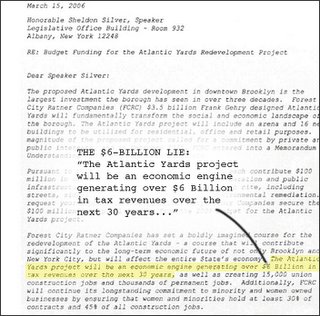

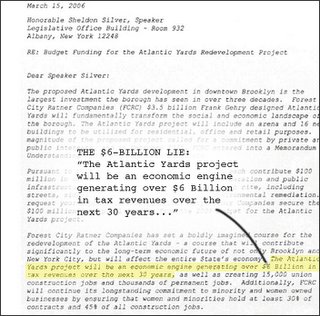

Assembly members--who were lobbied by the developer with a letter claiming $6 billion in revenue--obviously didn't debate the issue. Assemblyman Jim Brennan (D-Park Slope), a critic of the project, told the Brooklyn Papers, “The [Ratner allocation] wasn’t our desk until it had already been [put into the education bill]."

Assembly members--who were lobbied by the developer with a letter claiming $6 billion in revenue--obviously didn't debate the issue. Assemblyman Jim Brennan (D-Park Slope), a critic of the project, told the Brooklyn Papers, “The [Ratner allocation] wasn’t our desk until it had already been [put into the education bill]."

Project opponents Develop Don't Destroy Brooklyn said the allocation was premature, charging that the "giveaway has been made without any knowledge of the proposed development’s: cost-benefit analysis, scale, density, design, environmental impact, cost of mitigation, financial viability, and security measures." DDDB is asking Governor Pataki to line-item veto the provision.

Cost-benefit analysis?

That's not to say that the Draft EIS will contain an actual cost-benefit analysis. It will mostly attempt to estimate revenues. Take, for example, the Final EIS for the Downtown Brooklyn Redevelopment, issued 4/30/04 by the New York City Economic Development Corporation. (Yes, Atlantic Yards is a state project, but both the city and state agencies use the same economic model, known as RIMS II, to analyze fiscal benefits.)

In the chapter on Socioeconomic Conditions, revenue generated by the new economic activity, including employment, is analyzed, but it's not offset by the costs of such things as traffic improvements. Then again, there's no attempt to calculate tax revenues from new residents in buildings constructed as part of the Downtown Brooklyn redevelopment.

ESDC won't look at "true value"

Indeed, in the opening section of the Final Scope, the ESDC observes that members of the public requested analyses beyond the scope of the requirements on the State Environmental Quality Review Act (SEQRA). The ESDC was asked:

The DEIS should include (1) an assessment of the project’s financial viability, (2) a pro forma for the project, and (3) information on the “true value” of the project accounting for costs related to displacement, replacement costs of affordable housing, direct and indirect subsidies to the developer, net job gains or losses, and intangible costs.

The agency responded:

An assessment of a project’s financial viability is not subject to SEQRA, nor is a pro forma required as part of the environmental review. The EIS will contain a description of the project’s potential economic and fiscal benefits; this analysis will account for fiscal incentives and will disclose, to the extent known, the public funding for the project. The EIS will also include an analysis of the project’s potential to result in both direct and indirect residential and business displacement and will also provide information on the project’s affordable housing component.

That doesn't add up. If the EIS will describe the potential fiscal benefits, how can they be evaluated without a look at all the costs, not merely the public funding directed at the project? That's another argument for another look at the guidelines for such projects.

A mainstream request

The New York Times, in an article, headlined Arena Complex Shrinks by 5% in Latest Plan, cited increases in the study area and the number of intersections to be analyzed in the DEIS, and observed, "But the changes are unlikely to mollify the project's harshest critics."

It's not just the project's harshest critics who made requests of the ESDC. The three community boards offered extensive testimony. Regarding the cost issue, Craig Hammerman, District Manager of Community Board 6, made the point during his testimony at the 10/18/05 hearing on the Draft Scope of Analysis:

If the project sponsor intends to detail the extent to which the city and state economies will benefit from the project, then what about the other side of the balance ledger? The project sponsor must similarly detail the economic and fiscal costs of the project as well. It’s only fair that if the project sponsor gets to introduce the project benefits, that they provide us with the costs as well.

We need to know the construction-related costs such as the loss of mobility to commuters, the loss of access for local businesses, the increasing demand on public safety resources as experienced with the construction of MetroTech, the cost of traffic control agents and other temporary traffic mitigation plans, the loss or diversion of public transit access, and the actual construction costs for the arena, housing units, commercial office space, retail space and other components of the project. Full disclosure of these costs is necessary so the public can determine the rate of return for the public investments called for in this project.

Beyond the construction costs, the operating period costs must also be disclosed. These costs will include the maintenance of the arena, housing units, commercial office space, retail space, open space including any related amenities, the need for additional emergency and uniformed municipal services, infrastructure maintenance, the development and maintenance of additional municipal facilities that might include schools, libraries, daycare centers and other facilities, and the cost of relocating the fire department facility at 648 Pacific Street.

(Emphasis added)

Those income taxes account for about half of the city/state revenue FCR projects--$6 billion over 30 years, or about $2 billion in current dollars, or present value. In other words, the ESDC analysis wouldn't come close to the overstated estimates made by Forest City Ratner's paid consultant, sports economist Andrew Zimbalist.

This further confirms what James Parrott of the Fiscal Policy Institute told me: "I don't know of any serious cost-benefit analyses of mixed-used economic development projects that count the taxes of residents. That's why we said it was a methodological flaw."

What ESDC counts

The ESDC's Final Scope, a prelude to a Draft Environmental Impact Statement (Draft EIS), the agency, on p. 22 (or p. 30 of the PDF) states that "the socioeconomic analysis will assess the fiscal and economic benefits of the proposed project to the City and State economies." It will estimate the following benefits:

The ESDC's Final Scope, a prelude to a Draft Environmental Impact Statement (Draft EIS), the agency, on p. 22 (or p. 30 of the PDF) states that "the socioeconomic analysis will assess the fiscal and economic benefits of the proposed project to the City and State economies." It will estimate the following benefits:--employment, direct and indirect

--wates and salaries generated by employment

--direct taxes generated by the commercial, institutional, and/or residential development, including retail sales tax, hotel occupancy tax, payroll taxes, corporate and business taxes, and miscellaneous taxes

--taxes generated by indrect economic activity

--the total economic output created by the operation of the project.

Missing: the income taxes of new residents.

State support

Meanwhile, state Assembly members have allocated $33 million toward infrastructure improvements in the $387-million 2006-2007 Education, Labor and Family Assistance budget. According to a 4/1/06 Brooklyn Papers article headlined State gives Ratner $33M, the rest of the $100 million Forest City Ratner seeks from the state might soon come from other economic development budgets controlled by the governor and the Senate.

Assembly members--who were lobbied by the developer with a letter claiming $6 billion in revenue--obviously didn't debate the issue. Assemblyman Jim Brennan (D-Park Slope), a critic of the project, told the Brooklyn Papers, “The [Ratner allocation] wasn’t our desk until it had already been [put into the education bill]."

Assembly members--who were lobbied by the developer with a letter claiming $6 billion in revenue--obviously didn't debate the issue. Assemblyman Jim Brennan (D-Park Slope), a critic of the project, told the Brooklyn Papers, “The [Ratner allocation] wasn’t our desk until it had already been [put into the education bill]."Project opponents Develop Don't Destroy Brooklyn said the allocation was premature, charging that the "giveaway has been made without any knowledge of the proposed development’s: cost-benefit analysis, scale, density, design, environmental impact, cost of mitigation, financial viability, and security measures." DDDB is asking Governor Pataki to line-item veto the provision.

Cost-benefit analysis?

That's not to say that the Draft EIS will contain an actual cost-benefit analysis. It will mostly attempt to estimate revenues. Take, for example, the Final EIS for the Downtown Brooklyn Redevelopment, issued 4/30/04 by the New York City Economic Development Corporation. (Yes, Atlantic Yards is a state project, but both the city and state agencies use the same economic model, known as RIMS II, to analyze fiscal benefits.)

In the chapter on Socioeconomic Conditions, revenue generated by the new economic activity, including employment, is analyzed, but it's not offset by the costs of such things as traffic improvements. Then again, there's no attempt to calculate tax revenues from new residents in buildings constructed as part of the Downtown Brooklyn redevelopment.

ESDC won't look at "true value"

Indeed, in the opening section of the Final Scope, the ESDC observes that members of the public requested analyses beyond the scope of the requirements on the State Environmental Quality Review Act (SEQRA). The ESDC was asked:

The DEIS should include (1) an assessment of the project’s financial viability, (2) a pro forma for the project, and (3) information on the “true value” of the project accounting for costs related to displacement, replacement costs of affordable housing, direct and indirect subsidies to the developer, net job gains or losses, and intangible costs.

The agency responded:

An assessment of a project’s financial viability is not subject to SEQRA, nor is a pro forma required as part of the environmental review. The EIS will contain a description of the project’s potential economic and fiscal benefits; this analysis will account for fiscal incentives and will disclose, to the extent known, the public funding for the project. The EIS will also include an analysis of the project’s potential to result in both direct and indirect residential and business displacement and will also provide information on the project’s affordable housing component.

That doesn't add up. If the EIS will describe the potential fiscal benefits, how can they be evaluated without a look at all the costs, not merely the public funding directed at the project? That's another argument for another look at the guidelines for such projects.

A mainstream request

The New York Times, in an article, headlined Arena Complex Shrinks by 5% in Latest Plan, cited increases in the study area and the number of intersections to be analyzed in the DEIS, and observed, "But the changes are unlikely to mollify the project's harshest critics."

It's not just the project's harshest critics who made requests of the ESDC. The three community boards offered extensive testimony. Regarding the cost issue, Craig Hammerman, District Manager of Community Board 6, made the point during his testimony at the 10/18/05 hearing on the Draft Scope of Analysis:

If the project sponsor intends to detail the extent to which the city and state economies will benefit from the project, then what about the other side of the balance ledger? The project sponsor must similarly detail the economic and fiscal costs of the project as well. It’s only fair that if the project sponsor gets to introduce the project benefits, that they provide us with the costs as well.

We need to know the construction-related costs such as the loss of mobility to commuters, the loss of access for local businesses, the increasing demand on public safety resources as experienced with the construction of MetroTech, the cost of traffic control agents and other temporary traffic mitigation plans, the loss or diversion of public transit access, and the actual construction costs for the arena, housing units, commercial office space, retail space and other components of the project. Full disclosure of these costs is necessary so the public can determine the rate of return for the public investments called for in this project.

Beyond the construction costs, the operating period costs must also be disclosed. These costs will include the maintenance of the arena, housing units, commercial office space, retail space, open space including any related amenities, the need for additional emergency and uniformed municipal services, infrastructure maintenance, the development and maintenance of additional municipal facilities that might include schools, libraries, daycare centers and other facilities, and the cost of relocating the fire department facility at 648 Pacific Street.

(Emphasis added)

Comments

Post a Comment