How a ethically dubious Emirati sheikh and the investment fund he chairs own, via Fortress, a slice of Atlantic Yards

The Emirati vice president is best known as the owner of Manchester City, a top English soccer team. Behind the scenes, he has been described as the “handler” guiding his country’s secret foreign wars.More on that:

Yet in interviews with more than a dozen American, African and Arab officials, he is described as being at the sharp end of his country’s aggressive push to expand its influence across Africa and the Middle East.The Fortress connection

In places like Libya and Sudan, they say, Sheikh Mansour has coddled warlords and autocrats as part of a sweeping Emirati drive to acquire ports and strategic minerals, counter Islamist movements and establish the Gulf nation as a heavyweight regional power.

From the Times:

As deputy prime minister and vice president, he controls key institutions, including the Emirati central bank, the national oil company and the Abu Dhabi criminal authority. He chairs Mubadala, a fast-growing $330 billion sovereign wealth fund with investments in artificial intelligence, semiconductors and space tourism.Yes, he chairs Mubadala, which in May 2024, as I reported, led a consortium acquiring (see press release) 68% of equity in New York-based Fortress Investment Group, though Fortress management, which owns 32%, can still control the board.

The USIF offered both a carrot and a stick. The carrot was a purportedly better investment, based on economic conditions and risks.

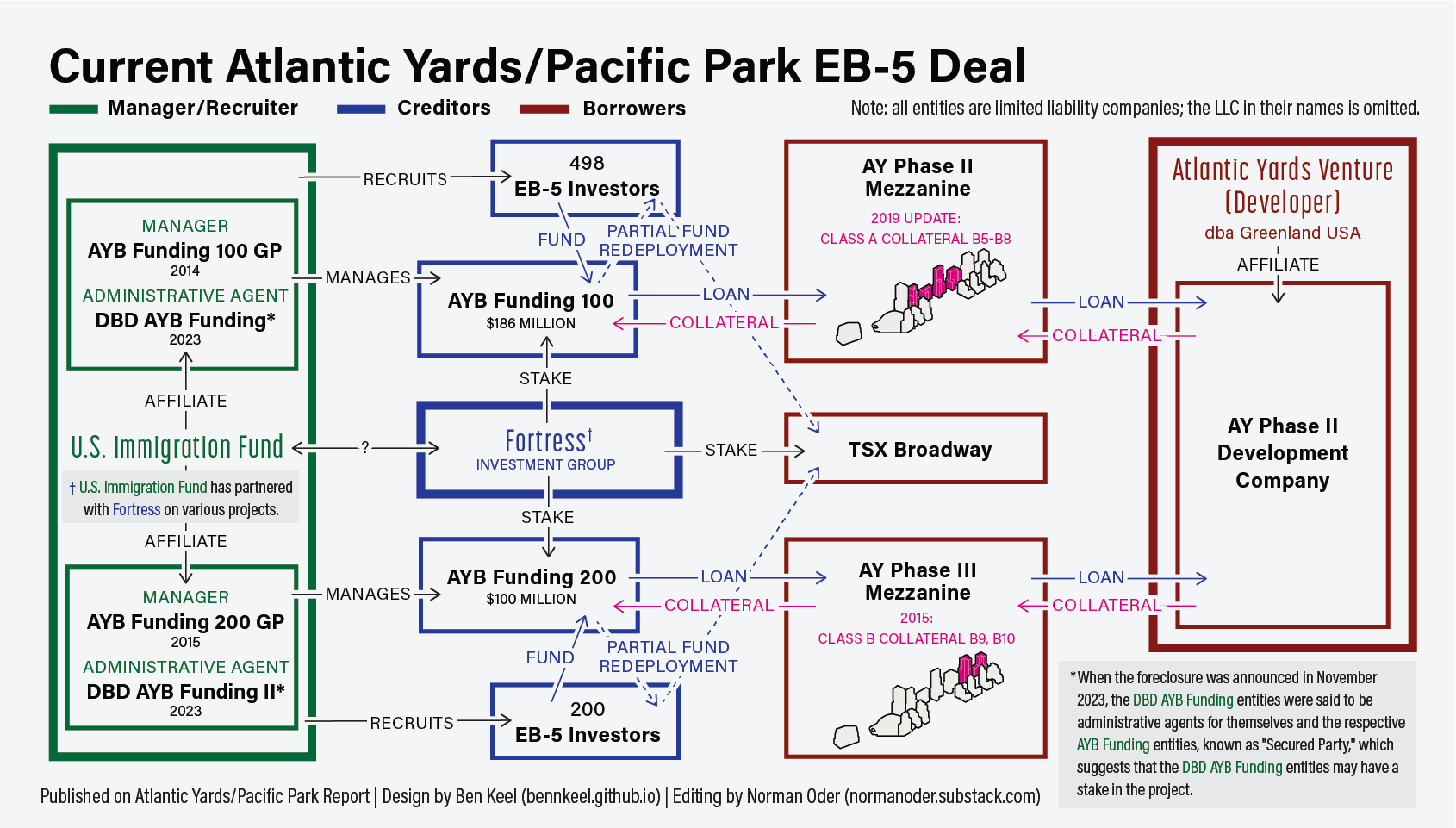

The stick was a warning that Fortress would be in control. For example, the AYB Funding 100 investors were told that, on the purchase and sale of “a portion” of the loan, Fortress would be the “majority owner” and would “control all major decisions affecting the EB-5 Loan and the collateral,” which could means the original investors would lose their investment “in a default, restructuring or foreclosure scenario.”

It’s unclear how Fortress could become the majority owner of each loan without acquiring a majority, though that might reflect contract language crafted by the USIF.

|

| This chart is speculative |

It’s also unclear whether Fortress purchased portions of each loan by investing cash in each LLC, or whether it acquired its stake via a swap of obligations or a more convoluted deal.

That brings us to today. The flowchart above shows where things might stand, with considerable uncertainty regarding how much of the AYB Funding entities are owned by Fortress, the original investors, or a USIF affiliate.

In March 2022, I cited a True Hoop podcast, BRING IT IN: Sportswashing and the NBA, which describes a very tangled trail:

Today, TrueHoop’s Henry Abbott and David Thorpe discuss:

Don’t you wish it was just about sports? One NBA powerbroker (Ari Emanuel of Endeavor) cut a deal face to face with Vladimir Putin, another (Joe Ravitch of the Raine Group) is helping Kremlin-connected oligarch Roman Abramovich sell Chelsea F.C. right now.

Endeavor and the Raine Group both reportedly raised a ton of money from the Emirates-based Mubadala Investment Company. Mubadala is also the biggest outside investor in Apollo Global. Apollo Global’s founder, Leon Black, funded Jeffrey Epstein.

It should be noted that Ravitch, son of the estimable "wise man" Richard Ravitch, worked on the Nets sale to Mikhail Prokhorov. And that, I suspect, helped keep his father, a lonely critic of the West Side Stadium, from being a critic of Atlantic Yards.

Comments

Post a Comment