So, what’s the story regarding the commercial space at 487 Dean Street? The ground floor of the building, at the northeast corner of Sixth Avenue in Prospect Heights in the Atlantic Yards footprint (far left), is unoccupied, guarded by a metal roll-up door, but there’s a drama within.

So, what’s the story regarding the commercial space at 487 Dean Street? The ground floor of the building, at the northeast corner of Sixth Avenue in Prospect Heights in the Atlantic Yards footprint (far left), is unoccupied, guarded by a metal roll-up door, but there’s a drama within.As the New York Daily News reported yesterday, developer Forest City Ratner, which now owns the building, is evicting tenant Shirley Milligan for failing to pay back rent of $3000 a month. But her lawyer tells me the developer told Milligan not to pay that rent and has low-balled a settlement offer.

Milligan told the Daily News she’d signed the lease in 2004 not knowing the building was to be part of the Atlantic Yards footprint, and put money into renovations for a day care center. Forest City Ratner spokesman Loren Riegelhaupt gave a statement to the Daily News that sounded eminently reasonable: "Forest City offered to buy her out of her lease and to reimburse her for money she spent to fix up the space, along with forgiving back rent owed… For reasons unknown to us, she decided instead to continue to withhold rent.”

In dispute

Milligan’s attorney, Michael Rikon, disputes that statement. “She was specifically told by Forest City not to pay any rent," he told me, going beyond statements he made to the Daily News. "She was told that the developer would present a better offer to settle her potential condemnation claim and until that was done she should not pay rent."

"No new offer was forthcoming and the next thing she knew was a reporter from the News who lived on Dean Street calling to tell her she was being evicted. She was never served and went down to the premises for a copy of the pleadings. She is upset that there is an impression that she is a deadbeat.”

Bad faith?

As for Forest City Ratner’s reimbursement offer, he said it’s “best described as being so low that it was made in bad faith. There was no serious consideration of reimbursing her for the amount of cash she had invested in the premises. Our trade fixture appraiser made a preliminary estimate of more than five times Forest City’s offer.” Milligan apparently has invested some $150,000, which means the two sides are more than $100,000 apart.

By evicting Milligan, he said, the developer would get the premises vacant and would have no obligation to compensate her for a “trade fixture claim,” which includes improvements made, including capital expenditures, and potentially rent. He said Milligan aimed to pay back rent by Friday and avoid eviction--and thus remain eligible for more compensation when the state moves to condemn the lease.

Given that we don't have any further details from Forest City Ratner, which may be able to bolster its case, providing further twists to the story.

Who knew?

The project was announced on 12/10/03, with the current outline (except for the addition of Site 5, or Block 927, current home of P.C. Richard/Modell’s, west of Flatbush Avenue), but the map was not broadly publicized. It’s not clear that Milligan knew the precise outline of the Atlantic Yards footprint in 2004, when the lease was signed.

The project was announced on 12/10/03, with the current outline (except for the addition of Site 5, or Block 927, current home of P.C. Richard/Modell’s, west of Flatbush Avenue), but the map was not broadly publicized. It’s not clear that Milligan knew the precise outline of the Atlantic Yards footprint in 2004, when the lease was signed.Should Milligan have known of the coming project when the lease was signed, or should her then-landlord have warned her of the potential for condemnation? Rikon said the law is murky: “It's really up the tenant [to do due diligence], but if a landlord knows a property is being actively studied for condemnation, one could say a landlord is obligated to disclose that fact.” But he said Milligan has no dispute with her prior landlord or real estate agent.

History of blight?

The Empire State Development Corporation’s Blight Study (p. 163-165) says that the building suffers from graffiti on its side (Sixth Avenue) walls and from cracked sidewalks on its border.

The Empire State Development Corporation’s Blight Study (p. 163-165) says that the building suffers from graffiti on its side (Sixth Avenue) walls and from cracked sidewalks on its border.Develop Don’t Destroy Brooklyn’s blight response stated:

487 Dean is an attractive corner building that had had a ground floor speech therapy clinic as tenant for more than 10 years, with two apartments above it. The speech clinic was an early victim of the FCR Atlantic Yards real estate chill: it moved out in 2004. Two ophthalmologists were eager to open an eye clinic in the same space, but were scared away by FCR’s plans. Same for a pre-school that was interested in opening here. So, for two years the commercial space has remained vacant, while residential tenants live upstairs.

The 6th Avenue sidewalk around Lot 89 is in poor condition – cracked, crumbling, weedy –and has been for years. (Graffiti happens here, too.) Why hasn’t New York City bothered to enforce the sidewalk maintenance laws? Sidewalks are easily patched, weeds are easily pulled and graffiti is easily painted over. Not one of these conditions is indicative of everlasting blight, or a blight upon the hood.

The five buildings east of Sixth Avenue on the north side of Dean Street are part of the footprint. It seems likely, as I've written, they were included less for blight removal than because Forest City needs a plot of land for construction worker parking and staging for the construction of the arena block across Sixth Avenue.

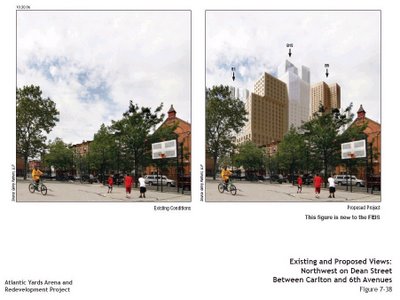

The five buildings east of Sixth Avenue on the north side of Dean Street are part of the footprint. It seems likely, as I've written, they were included less for blight removal than because Forest City needs a plot of land for construction worker parking and staging for the construction of the arena block across Sixth Avenue.Ultimately, a 272-foot building is planned at that corner.

Comments

Post a Comment