Forest City Ratner recently announced that "Applications for low and middle income apartments will be available beginning in 2009, with occupancy beginning in 2010"--implying that the project will proceed on time, which is questionable.

That raises a question: would Atlantic Yards rental housing--the 2250 affordable units and the 2250 market-rate units--all be rent-stabilized, as has been promoted?

The answer: sort of, but in a confounding way that somehow would classify a market-rate apartment renting for $7313 as rent-stabilized.

And it would classify middle-income affordable units, some costing well more than $2000 a month, as rent-stabilized, even though such sums generated skepticism about affordability from potential renters last year and, indeed, $2000 is the trigger for decontrol of current rent-stabilized units.

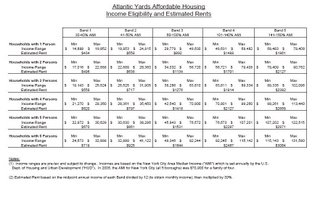

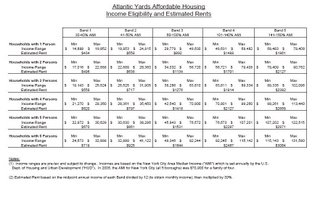

According to the developer's chart of estimated rents (click to enlarge), 450 of the 2250 affordable units would rent from $1861 to $3084 a month and another 450 would rent from $1488 to $2467.)

According to the developer's chart of estimated rents (click to enlarge), 450 of the 2250 affordable units would rent from $1861 to $3084 a month and another 450 would rent from $1488 to $2467.)

Previous rhetoric

Bertha Lewis of ACORN, in a 7/31/06 article in City Limits, described all 4500 Atlantic Yards rentals as rent-stabilized:

Beyond building new affordable units, all 4,500 rental units at Atlantic Yards will be rent-stabilized -- no small victory in an era where thousands of rent-stabilized units return to the free market every year.

(Emphasis added)

I criticized that at the time, contending (imprecisely) that market-rate units could not be rent-stabilized. A Forest City Ratner presentation earlier that month stated, in describing the affordable housing program, that "All rental units will be rent-stabilized."

In an 8/15/06 letter to the Village Voice, Lewis described it differently:

ACORN has worked with Forest City Ratner to guarantee that 50 percent of the 4,500 new units planned for Atlantic Yards will be rent stabilized and affordable to low, moderate, and middle-income families.

However, the Brooklyn Tomorrow supplement to the New York Post issued June 14 repeated the claim, stating:

Of the 6430 units of housing, 4500 will be rent-stablized rental apartments and the rest market-rate condos.

What does it mean?

The state Division of Housing & Community Renewal defines rent stabilization as covering apartments in buildings of six or more units built between Feb. 1, 1947 and Jan. 1, 1974 as well as tenants in buildings of six or more units built before Feb. 1, 1947, who moved in after June 30, 1971. A third category, which would apparently include Atlantic Yards, covers buildings with three or more apartments constructed or extensively renovated since 1974 with special tax benefits.

But rent stabilization implies a cap on rents; indeed in New York City, apartments can be deregulated when rents for vacant apartments reach $2000 (aka "vacancy decontrol") and also when existing tenants earn incomes of $175,000 or more and their rent hits $2000 (aka "luxury decontrol"). Housing advocates argue that the ceiling for decontrol should rise significantly, perhaps by 50%, given inflation and the cost of rent in Manhattan.

Working with HDC

The rules would be different for Atlantic Yards rental housing, which would be funded via the New York City Housing Development Corporation (NYC HDC). The term sheet for the agency 's mixed-income program--50% market, 30% middle-income, 20% low-income units--states:

Upon project stabilization, New HOP and Market rate rent increases will be governed by allowable rent stabilization increases with no vacancy decontrol.

So, indeed, there would be rent stabilization, but with a twist. For the 2250 market-rate rental units, it would come after the fact, after the developer works out the rent.

I asked Aaron Donovan, spokesman for the NYC HDC, who confirmed, "The market sets the initial rents and subsequent to that, rent increases are governed by rent stabilization. If Forest City Ratner were to apply for financing under our Mixed-Income Program, these terms would apply."

Rent-stabilized luxury

According to a Forest City Ratner planning document released in response to the lawsuit filed by Assemblyman Jim Brennan and State Senator Velmanette Montgomery, market-rate units in the first round of buildings would rent for $51.62 a square foot annually. The monthly rents would be:

Studios (500 sf): $2151

1 BR (630 sf): $2710

2 BR (950 sf): $4087

3 BR (1700 sf): $7313.

While rent-stabilization would govern future increase in rents, the 2250 market-rate units, with such hefty price tags, hardly embody the "no small victory" ACORN's Lewis claimed. Even the middle-income affordable units, however welcome to some, would be beyond the reach of ACORN's core constituency, most of whom would be eligible for only the 900 low-income affordable units.

That raises a question: would Atlantic Yards rental housing--the 2250 affordable units and the 2250 market-rate units--all be rent-stabilized, as has been promoted?

The answer: sort of, but in a confounding way that somehow would classify a market-rate apartment renting for $7313 as rent-stabilized.

And it would classify middle-income affordable units, some costing well more than $2000 a month, as rent-stabilized, even though such sums generated skepticism about affordability from potential renters last year and, indeed, $2000 is the trigger for decontrol of current rent-stabilized units.

According to the developer's chart of estimated rents (click to enlarge), 450 of the 2250 affordable units would rent from $1861 to $3084 a month and another 450 would rent from $1488 to $2467.)

According to the developer's chart of estimated rents (click to enlarge), 450 of the 2250 affordable units would rent from $1861 to $3084 a month and another 450 would rent from $1488 to $2467.)Previous rhetoric

Bertha Lewis of ACORN, in a 7/31/06 article in City Limits, described all 4500 Atlantic Yards rentals as rent-stabilized:

Beyond building new affordable units, all 4,500 rental units at Atlantic Yards will be rent-stabilized -- no small victory in an era where thousands of rent-stabilized units return to the free market every year.

(Emphasis added)

I criticized that at the time, contending (imprecisely) that market-rate units could not be rent-stabilized. A Forest City Ratner presentation earlier that month stated, in describing the affordable housing program, that "All rental units will be rent-stabilized."

In an 8/15/06 letter to the Village Voice, Lewis described it differently:

ACORN has worked with Forest City Ratner to guarantee that 50 percent of the 4,500 new units planned for Atlantic Yards will be rent stabilized and affordable to low, moderate, and middle-income families.

However, the Brooklyn Tomorrow supplement to the New York Post issued June 14 repeated the claim, stating:

Of the 6430 units of housing, 4500 will be rent-stablized rental apartments and the rest market-rate condos.

What does it mean?

The state Division of Housing & Community Renewal defines rent stabilization as covering apartments in buildings of six or more units built between Feb. 1, 1947 and Jan. 1, 1974 as well as tenants in buildings of six or more units built before Feb. 1, 1947, who moved in after June 30, 1971. A third category, which would apparently include Atlantic Yards, covers buildings with three or more apartments constructed or extensively renovated since 1974 with special tax benefits.

But rent stabilization implies a cap on rents; indeed in New York City, apartments can be deregulated when rents for vacant apartments reach $2000 (aka "vacancy decontrol") and also when existing tenants earn incomes of $175,000 or more and their rent hits $2000 (aka "luxury decontrol"). Housing advocates argue that the ceiling for decontrol should rise significantly, perhaps by 50%, given inflation and the cost of rent in Manhattan.

Working with HDC

The rules would be different for Atlantic Yards rental housing, which would be funded via the New York City Housing Development Corporation (NYC HDC). The term sheet for the agency 's mixed-income program--50% market, 30% middle-income, 20% low-income units--states:

Upon project stabilization, New HOP and Market rate rent increases will be governed by allowable rent stabilization increases with no vacancy decontrol.

So, indeed, there would be rent stabilization, but with a twist. For the 2250 market-rate rental units, it would come after the fact, after the developer works out the rent.

I asked Aaron Donovan, spokesman for the NYC HDC, who confirmed, "The market sets the initial rents and subsequent to that, rent increases are governed by rent stabilization. If Forest City Ratner were to apply for financing under our Mixed-Income Program, these terms would apply."

Rent-stabilized luxury

According to a Forest City Ratner planning document released in response to the lawsuit filed by Assemblyman Jim Brennan and State Senator Velmanette Montgomery, market-rate units in the first round of buildings would rent for $51.62 a square foot annually. The monthly rents would be:

Studios (500 sf): $2151

1 BR (630 sf): $2710

2 BR (950 sf): $4087

3 BR (1700 sf): $7313.

While rent-stabilization would govern future increase in rents, the 2250 market-rate units, with such hefty price tags, hardly embody the "no small victory" ACORN's Lewis claimed. Even the middle-income affordable units, however welcome to some, would be beyond the reach of ACORN's core constituency, most of whom would be eligible for only the 900 low-income affordable units.

no way he gets $7000+ for a 3/bed. a quick check of craigslist shows that would be the most expensive 3 bed rental in the borough save for a dumbo penthouse. although who knows what the market will do a few years from now.

ReplyDeletewhatever price he does get, someone will think it's worth their $$ and will have an apartment that while expensive, won't be subject to massive rate increases.

At lest there will be more stabilized units in the city. If the manhattan institute had their way there would be none.

ReplyDeleteI'd rather see some kind of program, though that gave low income folks the chance to buy in to a co-op rather than just rent, the fact that there are so many renters is part of the reason that developemnt, even when it might improve the neighborhood causes so much trouble.