We all know that the term “affordable” when it comes to housing is “a relative thing,” to quote Brooklyn Assemblyman Vito Lopez, but that's ever so true when it comes to Atlantic Yards.

The fine print--and it is fine--in the Atlantic Yards Financial Projections document unearthed in the lawsuit by Assemblyman Jim Brennan and State Senator Velmanette Montgomery suggests something quite curious: affordable middle-income studio apartments in the Atlantic Yards project would cost more per square foot ($55.83, above) than market-rate studios ($51.62, below) in the same building.

The fine print--and it is fine--in the Atlantic Yards Financial Projections document unearthed in the lawsuit by Assemblyman Jim Brennan and State Senator Velmanette Montgomery suggests something quite curious: affordable middle-income studio apartments in the Atlantic Yards project would cost more per square foot ($55.83, above) than market-rate studios ($51.62, below) in the same building.

(Click to enlarge)

The document projects that phenomenon in every rental building. (See Tower 2, on p. 13 of the PDF.) The market-rate units would still cost a bit more on a monthly basis, $2151 vs. $1861, but that’s because they’d be 500 square feet, as opposed to 400 square feet.

The document projects that phenomenon in every rental building. (See Tower 2, on p. 13 of the PDF.) The market-rate units would still cost a bit more on a monthly basis, $2151 vs. $1861, but that’s because they’d be 500 square feet, as opposed to 400 square feet.

In rental apartments constructed later in the planned build-out, costs for both types of units would rise; in Towers 12/13 (see p. 43 of PDF), the market rent would be $53.33/sf, leading to a $2169 monthly rent (500 sf), while the rent for upper-tier affordable studios would be $57.83/sf, leading to a $1928 monthly rent (400 sf).

Given that rate increases for both market-rate and affordable units would be governed by rent stabilization, the difference in value between the market-rate and upper-income affordable studio seems negligible.

Top tier only

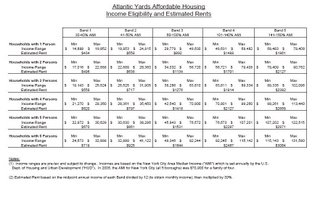

Note that this applies only to the most expensive of the affordable units, those available to households earning 141% to 160% of Area Median Income, or AMI. (There would be 450 such apartments, with perhaps 112--one out of four--studios.) A single person eligible for such a unit would earn $69,403 to $79,408, according to the developer's chart of estimated rents (right, click to enlarge).

Note that this applies only to the most expensive of the affordable units, those available to households earning 141% to 160% of Area Median Income, or AMI. (There would be 450 such apartments, with perhaps 112--one out of four--studios.) A single person eligible for such a unit would earn $69,403 to $79,408, according to the developer's chart of estimated rents (right, click to enlarge).

For the purposes of the document released to Brennan, there are four different income categories, as two low-income bands, up to 50% AMI, are conflated into one. (There are five income categories in the affordable housing Memorandum of Understanding.)

Staggering rents

The document suggests a significant inconsistency between market-rate and affordable units. In Tower 2, for example, the market-rate rentals—studios, 1 BR, 2 BR, and 3 BR—all would rent at $51.62/sf. The middle-income affordable rentals would range from $34.93/sf for the 3 BR to $55.83 for the studios.

Similar laddering is evident in all the affordable income bands--smaller units are significantly more expensive than larger ones. In fact, a studio apartment in the second-highest income band (101% to 140% of AMI) would rent for $44.67/sf, more expensive on a square foot basis than affordable units (except for studios) in the highest income band.

Explanation, please

Not all this is new. The projected monthly rents were revealed last year in the developer's housing chart and the size of the affordable apartments, governed by a New York City Housing Development Corporation (NYC HDC) program, was also publicized last year.

But the cost per square foot was not discussed until this document surfaced. Most crucially, the developer had not announced the projected costs and sizes of the market-rate apartments.

The laddering among the affordable units is apparently not triggered by the developer but by the NYC HDC , which would authorize bonds for the market and affordable rental housing. I asked for more details from NYC HDC spokesman Aaron Donovan, who responded, "Forest City Ratner has not applied for financing from us, so it would be premature to speculate about rent structures."

[Update: A year ago, I reported that I had received from NYC HDC Resolutions of Declarations of Intent, passed between July 20, 2004 and July 19, 2006, passed by the HDC board, which do not assure tax-exempt bonds for a measure of affordable housing; they simply mean that a developer may apply for such financing.]

The fine print--and it is fine--in the Atlantic Yards Financial Projections document unearthed in the lawsuit by Assemblyman Jim Brennan and State Senator Velmanette Montgomery suggests something quite curious: affordable middle-income studio apartments in the Atlantic Yards project would cost more per square foot ($55.83, above) than market-rate studios ($51.62, below) in the same building.

The fine print--and it is fine--in the Atlantic Yards Financial Projections document unearthed in the lawsuit by Assemblyman Jim Brennan and State Senator Velmanette Montgomery suggests something quite curious: affordable middle-income studio apartments in the Atlantic Yards project would cost more per square foot ($55.83, above) than market-rate studios ($51.62, below) in the same building.(Click to enlarge)

The document projects that phenomenon in every rental building. (See Tower 2, on p. 13 of the PDF.) The market-rate units would still cost a bit more on a monthly basis, $2151 vs. $1861, but that’s because they’d be 500 square feet, as opposed to 400 square feet.

The document projects that phenomenon in every rental building. (See Tower 2, on p. 13 of the PDF.) The market-rate units would still cost a bit more on a monthly basis, $2151 vs. $1861, but that’s because they’d be 500 square feet, as opposed to 400 square feet.In rental apartments constructed later in the planned build-out, costs for both types of units would rise; in Towers 12/13 (see p. 43 of PDF), the market rent would be $53.33/sf, leading to a $2169 monthly rent (500 sf), while the rent for upper-tier affordable studios would be $57.83/sf, leading to a $1928 monthly rent (400 sf).

Given that rate increases for both market-rate and affordable units would be governed by rent stabilization, the difference in value between the market-rate and upper-income affordable studio seems negligible.

Top tier only

Note that this applies only to the most expensive of the affordable units, those available to households earning 141% to 160% of Area Median Income, or AMI. (There would be 450 such apartments, with perhaps 112--one out of four--studios.) A single person eligible for such a unit would earn $69,403 to $79,408, according to the developer's chart of estimated rents (right, click to enlarge).

Note that this applies only to the most expensive of the affordable units, those available to households earning 141% to 160% of Area Median Income, or AMI. (There would be 450 such apartments, with perhaps 112--one out of four--studios.) A single person eligible for such a unit would earn $69,403 to $79,408, according to the developer's chart of estimated rents (right, click to enlarge).For the purposes of the document released to Brennan, there are four different income categories, as two low-income bands, up to 50% AMI, are conflated into one. (There are five income categories in the affordable housing Memorandum of Understanding.)

Staggering rents

The document suggests a significant inconsistency between market-rate and affordable units. In Tower 2, for example, the market-rate rentals—studios, 1 BR, 2 BR, and 3 BR—all would rent at $51.62/sf. The middle-income affordable rentals would range from $34.93/sf for the 3 BR to $55.83 for the studios.

Similar laddering is evident in all the affordable income bands--smaller units are significantly more expensive than larger ones. In fact, a studio apartment in the second-highest income band (101% to 140% of AMI) would rent for $44.67/sf, more expensive on a square foot basis than affordable units (except for studios) in the highest income band.

Explanation, please

Not all this is new. The projected monthly rents were revealed last year in the developer's housing chart and the size of the affordable apartments, governed by a New York City Housing Development Corporation (NYC HDC) program, was also publicized last year.

But the cost per square foot was not discussed until this document surfaced. Most crucially, the developer had not announced the projected costs and sizes of the market-rate apartments.

The laddering among the affordable units is apparently not triggered by the developer but by the NYC HDC , which would authorize bonds for the market and affordable rental housing. I asked for more details from NYC HDC spokesman Aaron Donovan, who responded, "Forest City Ratner has not applied for financing from us, so it would be premature to speculate about rent structures."

[Update: A year ago, I reported that I had received from NYC HDC Resolutions of Declarations of Intent, passed between July 20, 2004 and July 19, 2006, passed by the HDC board, which do not assure tax-exempt bonds for a measure of affordable housing; they simply mean that a developer may apply for such financing.]

Comments

Post a Comment