Atlantic Yards meeting: as Related moves toward joint venture, who's obligated to build the affordable housing? What entities would be in project agreements?

This is the second of five articles about the Sept. 26 meeting of the advisory Atlantic Yards Community Development Corporation (AY CDC). The first concerned BSE Global's plans to use the closed Modell's store for a youth basketball program. The third concerned plans for a giant, two-tower project at Site 5. The fourth concerned the plan to make the arena plaza permanent. The fifth concerned plans for a Quality of Life meeting.

ESD, said Pycior, has gotten a request from the U.S. Immigration Fund (USIF), a regional center that recruits immigrant investors under the EB-5 program, and its partner Fortress Investment Group, "for a new developer for this portion of the project. We're asking them for more detailed information, which they're working on."

So the joint venture, Veconi asked, would be formed by the owners gaining development rights through foreclosure, and a developer they want to bring in?

"Generally speaking, yes," responded Joel Kolkmann, ESD's Senior VP, Real Estate, who noted that a permitted developer, as required by project documents, must be "a construction entity or a developer with ten years experience. The lender is proposing to bring in Related to meet that, to have that be met through a joint venture."

Veconi asked about vetting the joint venture. "Have you seen an operating agreement?"

Sokolow said they expected to see one, and must pass on that agreement.

Who exactly is responsible for that affordable housing? It's complicated. It needs an org chart, but was not made clear. Maybe it's all moot if a new deal gets done.

"But those entities are now going to be owned by USIF," mused Kummer. "Is that right?"

"Not all of the entities, to my understanding," responded Acocella. "The Atlantic Yards Venture LLC, I think, will not be part of the transition with the foreclosure."

In crosstalk, various parties called USIF the lender, or syndicator of the loans from Chinese investors seeking green cards. The EB-5 program offers green cards to investors who make loans--$500,000 at the time--that purportedly create ten jobs each.

"They're more of a middle, a middleman," observed Sokolow. Indeed, as I wrote, it's bad shorthand to consider the U.S. Immigration Fund, which is a recruiter (often misleadingly) of investors and a packager of loans, as the lender.

AY CDC Director Ron Shiffman asked, "Have any of them ever been convicted of crime or accused of a crime?"

Once ESD gets documents from the joint venture, "we are going to take a holistic look at it," Acocella said. "We are aware of news reports on USIF, but we still we don't have enough information yet to make a decision."

"I don't know how to respond to that question," Acocella said. "I don't think there's any obligation that the Attorney General has to review this."

"We went through this," Kolkmann responded a bit wearily. "We review everything holistically. And that certainly will be part of it."

That strikes me as a too neat an explanation. A “permitted developer," according to past project documents, is an entity that has at least ten years of experience—or retains a construction manager with that experience—in developing and building “high-rise residential office, hospitality and/or mixed use projects in an urban environment.”

Or, alternatively, an entity “reasonably acceptable” to ESD.

But that entity cannot be a “Prohibited Person,” defined as in default to obligations to the state or city; in default on taxes; convicted of a felony or a crime of moral turpitude or having organized crime connections; or controlled by a government that has violated certain federal regulations.

Acocella disagreed. "Our understanding is that there are three different entities who are parties to the Development Agreement, who are collectively responsible under the Development Agreement, and that at least one of those entities will be this new joint venture," he said.

"Maybe a better question would be can those failure-to-perform penalties be folded into a more augmented requirement for affordable housing," asked Tyus, "since they're skimming away and not ponying up with the work that they were supposed to do. They didn't do it. So time passed. Time is money."

"We are not adjusting the GPP [General Project Plan] as part of this permitted developer process," said Pycior, noting that any changes "would be part of a larger public process."

Veconi observed that, at a previous meeting, ESD attorney Richard Dorado said that the entities gaining development rights over the railyard also had the obligations to build affordable housing.

If the current process doesn't "result in a positive evaluation," asked Shiffman, is ESD looking at a Plan B?

"The lender would have the right to present a different permitted developer to us," Sokolow said. (Of course, the "lender" itself seems to be the problem.)

"There's a desperate need in the state for housing," Shiffman said, noting that "the state legislature is thinking about social housing programs," in which state funds help build housing owned outside the private market.

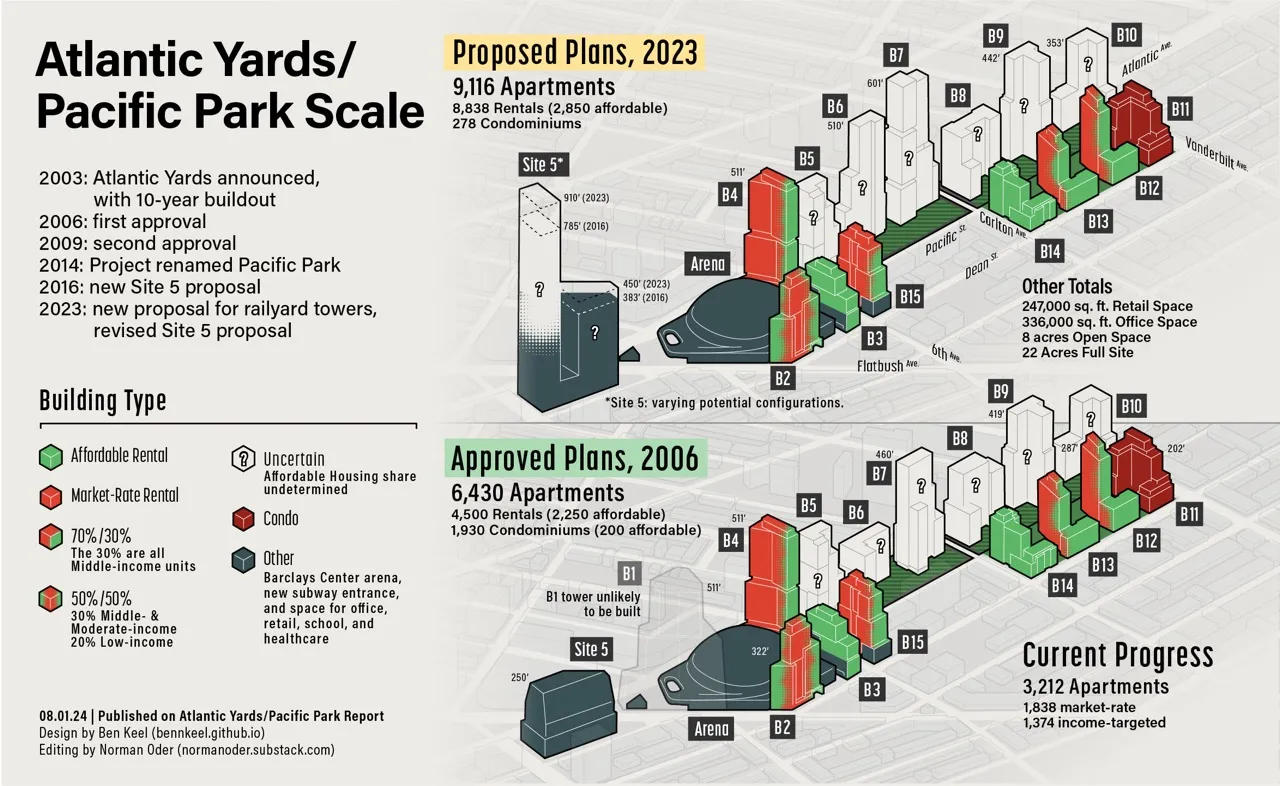

Something's happening with the six development parcels (B5-B10) over the Vanderbilt Yard, with rights to build at least 3.5 million square feet of housing (and maybe more), but just not yet.

At the meeting, representatives of Empire State Development (ESD), the state authority that oversees/shepherds the project, were cagey about some key details, saying all was premature.

What about the 876 affordable housing units due by May 2025, and the $2,000/month in liquidated damages for each unbuilt unit? Does the obligation transfer to a new developer? What entities would be party to project agreements?

What about the visa broker U.S. Immigration Fund, led by Nicholas Mastroianni, whose criminal record arguably should disqualify him from contracting with New York State (though he already has)?

|

| Unofficial image likely understates requested changes |

What about the future configuration of the project, involving potentially--as requested last year, by current master developer Greenland USA--an enormous increase in square footage, extended deadlines, and, in partial reciprocity, more affordable housing units?

All the uncertainty, of course, makes it tougher than ever for the AY CDC, an 11-member group with a couple of vacancies and a minority of engaged Directors, to pursue its assigned role to monitor the project.

Railyard payments

First, said Anna Pycior, ESD's Senior VP, Community Relations, "we understand that the MTA [Metropolitan Transportation] has been paid for the outstanding air rights obligation for the platform portion of the project." (See video here, or below, starting at 20:40.)

That means that an $11 million annual payment, due June 1, finally came through, after a delay.

It's unclear who paid the MTA. Was it master developer Greenland USA, which has lost rights to the six railyard parcels in a foreclosure? (It borrowed $349 million, in two tranches, from EB-5 investors, and has about $286 million delinquent.)

They don't have much money, but they still aim to build--or make a deal with another company--at Site 5, catercorner to the arena, and thus likely wish to stay in the good grace of state agencies.

Could it be Related Companies, the giant developer, known for building Hudson Yards in Manhattan, that's part of a pending joint venture to develop the six railyard sites? That seems unlikely, given that they're not formally part of the project yet.

The discussion

Enter Related

ESD, said Pycior, has gotten a request from the U.S. Immigration Fund (USIF), a regional center that recruits immigrant investors under the EB-5 program, and its partner Fortress Investment Group, "for a new developer for this portion of the project. We're asking them for more detailed information, which they're working on."

AY CDC Director Gib Veconi cited a recent Wall Street Journal article that confirmed that the joint venture involves those two firms and Related: "Is that ESD's understanding as well?"

"That is what they're what they're saying to us," responded Arden Sokolow, ESD's Executive VP, Real Estate Development and Planning. "We're waiting for detailed information about the joint venture."

So the joint venture, Veconi asked, would be formed by the owners gaining development rights through foreclosure, and a developer they want to bring in?

Veconi asked about vetting the joint venture. "Have you seen an operating agreement?"

Sokolow said they expected to see one, and must pass on that agreement.

"When do you expect it?" asked AY CDC Director Ethel Tyus.

"Imminently," responded Sokolow, indicating the "next week or so." In other words, it could be today.

"Imminently," responded Sokolow, indicating the "next week or so." In other words, it could be today.

Affordable housing

Veconi noted that the investors took on risks when they entered the transaction: "I really believe it's appropriate that they retain responsibility for the affordable housing deadline and liquidated damages that are associated with it."

Veconi noted that the investors took on risks when they entered the transaction: "I really believe it's appropriate that they retain responsibility for the affordable housing deadline and liquidated damages that are associated with it."

"They certainly were sophisticated enough to know that that provision was part of the agreement and was binding on the collateral that they sought to acquire if the loan wasn't repaid," added Veconi, who as a leader of the BrooklynSpeaks coalition helped negotiate the 2014 settlement agreement that established the new 2025 deadline and the penalties.

"So I see every reason to expect them to be responsible for those obligations," he said.

Sokolow and Kolkmann looked stoic, rather than welcoming. I suspect that's because they've already discussed, at least with Greenland, a project reconfiguration that would extend the deadline and thus not enforce the penalties.

Corporate shell game?

Who exactly is responsible for that affordable housing? It's complicated. It needs an org chart, but was not made clear. Maybe it's all moot if a new deal gets done.

By acquiring the development rights through foreclosure, observed AY CDC Chair Daniel Kummer, USIF is "taking on the interests of the two Greenland subsidiaries that were holding those development rights, and therefore essentially stepping into the shoes of whatever obligations those entities had."

Those were AY Phase II Mezzanine, which borrowed the EB-5 funds in 2014, and AY Phase III Mezzanine, which borrowed funds in 2015, according to consent agreements with ESD.

The loans were secured by a pledge of all the membership interests--the collateral--held by borrowers in AY Phase II Development Company, LLC, aka "Owner."

Let's back up and recognize the role of the Atlantic Yards Development Company (AYDC), LLC, owned by original developer Forest City Ratner and one of three entities in 2010 considered the "developer," along with affiliates AYDC Interim Developer, LLC, and the Brooklyn Arena, LLC, according to the Development Agreement, at right.

Greenland entered the project in 2014 as a 70% owner of the remaining project.

To provide the collateral and induce the loan disbursement, the AYDC caused an assignment of its rights and obligations regarding the six railyard sites from Atlantic Yards Venture, LLC, an affiliate of AYDC, to AY Phase II Development Company ("Owner"), meaning the entity supplying the collateral.

So Atlantic Yards Venture replaced the AYDC--apparently. And AY Phase II Development Company is now the Interim Developer, according to the first EB-5 document, below.

"The entities that are currently responsible for the affordable housing liquidated damages will technically remain the same entities that will be responsible for those damages after the foreclosure," observed ESD attorney Matthew Acocella.

"But those entities are now going to be owned by USIF," mused Kummer. "Is that right?"

"Not all of the entities, to my understanding," responded Acocella. "The Atlantic Yards Venture LLC, I think, will not be part of the transition with the foreclosure."

(Unmentioned: Atlantic Yards Venture after foreclosure may only have rights to develop Site 5 and B1, the tower over the arena. Greenland has proposed moving the unused bulk from B1 across Flatbush Avenue to Site 5. But AY Phase II, as Interim Developer, would presumably still be responsible.)

"We need to be very careful here," Kummer observed. "Because we don't want to have the mechanism through which USIF suddenly takes on these two other Greenland subsidiaries, but doesn't take on the obligations with respect to the housing."

"We're very cognizant of that," said Acocella. That's why an org chart would be helpful.

"We need to be very careful here," Kummer observed. "Because we don't want to have the mechanism through which USIF suddenly takes on these two other Greenland subsidiaries, but doesn't take on the obligations with respect to the housing."

"We're very cognizant of that," said Acocella. That's why an org chart would be helpful.

Who's USIF?

AY CDC Director Shiffman asked state officials to explain who USIF is and what their responsibilities are.

AY CDC Director Shiffman asked state officials to explain who USIF is and what their responsibilities are.

Acocella noted that they didn't yet have a document regarding the proposed joint venture. "I think other people can speak to you know what USIF's role has been thus far," he said.

In crosstalk, various parties called USIF the lender, or syndicator of the loans from Chinese investors seeking green cards. The EB-5 program offers green cards to investors who make loans--$500,000 at the time--that purportedly create ten jobs each.

The investors accept little or no interest, because they care more about green cards, but they do expect their money back. The developer gets below-market interest, which is why one finance broker called EB-5 "legalized crack cocaine" and I call it a racket. The regional center keeps most if not all of that interest.

"They're more of a middle, a middleman," observed Sokolow. Indeed, as I wrote, it's bad shorthand to consider the U.S. Immigration Fund, which is a recruiter (often misleadingly) of investors and a packager of loans, as the lender.

Which raises the question as to why the USIF is in control of the collateral, which apparently it is, thanks to clauses in its contracts that leave the manager, which didn't take the risk, in charge.

A criminal record

AY CDC Director Ron Shiffman asked, "Have any of them ever been convicted of crime or accused of a crime?"

[Updated] As I wrote, Fortune reported that Mastroianni had been arrested four times for felony possession of a controlled substance. He was charged with a felony and pleaded no contest, but it's not clear if he pled to a reduced charge. If he pleaded no contest to a felony (rather than a reduced charge), it's still a conviction and should make Mastroianni a Prohibited Person under ESD guidelines.

|

| Screenshot from Fortune |

Once ESD gets documents from the joint venture, "we are going to take a holistic look at it," Acocella said. "We are aware of news reports on USIF, but we still we don't have enough information yet to make a decision."

The problem is that, if he's a felon, they shouldn’t have done business with him in the first place. The October 2014 Fortune article came out just after the first EB-5 deal involving USIF, while the second deal came in June 2015.]

Shiffman suggested a referral to the "Attorney General or to some legal source to vet them properly to make sure we're not getting into another scheme" in which foreign investors are "taken on a ride economically."

Shiffman suggested a referral to the "Attorney General or to some legal source to vet them properly to make sure we're not getting into another scheme" in which foreign investors are "taken on a ride economically."

"I don't know how to respond to that question," Acocella said. "I don't think there's any obligation that the Attorney General has to review this."

Indeed, it's not New York State's job, apparently, to ensure its partners behave ethically. If so, that might also require it to step in regarding Related, as described below.

Does USIF's role matter?

Later, Prospect Heights resident Robert Puca, during the public comment period (video here), noted that "a permitted developer excludes felons. Am I correct?"

"We went through this," Kolkmann responded a bit wearily. "We review everything holistically. And that certainly will be part of it."

"I don't think a felon like Mastroianni," Puca said, "should be considered a permitted developer." (Note: while the charges were felonies, it's not clear whether the pleas were.)

"I understand that he's an officer of USIF, which is not going to be the developer," Kummer said. "They are bringing in a developer, And that is the entity that's being reviewed for potential approval as a permitted developer."

Or, alternatively, an entity “reasonably acceptable” to ESD.

But that entity cannot be a “Prohibited Person,” defined as in default to obligations to the state or city; in default on taxes; convicted of a felony or a crime of moral turpitude or having organized crime connections; or controlled by a government that has violated certain federal regulations.

If the joint venture brings in a partner that makes it collectively a "permitted developer," how can that joint venture shed the other partners while being evaluated by ESD as a "Prohibited Person"?

Back to responsibility

Back in the main sequence, Tyus again asked about the penalties. Kummer said he's worried about the piece "that may be left behind."

Acocella said he didn't want to speak about the "kind of organizational chart." (OK, but when will they do so?)

"It sounds like certain obligations are going to remain with an entity that USIF is not taking over, and as to which there may be little recourse against," Kummer said.

Acocella disagreed. "Our understanding is that there are three different entities who are parties to the Development Agreement, who are collectively responsible under the Development Agreement, and that at least one of those entities will be this new joint venture," he said.

Maybe, but that deserves more clarity. Again, Atlantic Yards Venture is an affiliate of the AYDC, according to 2014 documents, while AY Phase II Development Company, now the Interim Developer, is an affiliate of Atlantic Yards Venture. The original signatories were the AYDC, Brooklyn Arena LLC, and AYDC Interim Developer LLC.

"They're all going have the obligations with respect to the affordable housing delivery?" Veconi asked.

"Well, we're looking at that," Acocella said, "but that's our understanding that there are three entities today that are responsible, and post-foreclosure, it will be the three same entities that are responsible."

"It sounds like you're on top of it," Kummer said. Maybe, but to my eyes, that requires an org chart first.

"Well, we're looking at that," Acocella said, "but that's our understanding that there are three entities today that are responsible, and post-foreclosure, it will be the three same entities that are responsible."

"It sounds like you're on top of it," Kummer said. Maybe, but to my eyes, that requires an org chart first.

What next?

Tyus noted she didn't get an answer regarding the question of penalties.

Sokolow put her off. She noted that "we are in the permitted developer phase," but a second phase will address the guiding General Project Plan, and "all of the obligations."

As I wrote, last year Greenland proposed a giant revision of the project, including 600 more affordable units, albeit on an extended timetable, while gaining 1 million square feet of new development rights over the railyard.

In other words, all the current deadlines and obligations could be revamped in a new deal.

"Maybe a better question would be can those failure-to-perform penalties be folded into a more augmented requirement for affordable housing," asked Tyus, "since they're skimming away and not ponying up with the work that they were supposed to do. They didn't do it. So time passed. Time is money."

Indeed, Tyus seemed to be referencing a proposal perhaps akin to what was proposed last year. The question is whether the augmented requirements would be accompanied by the gift of augmented square footage, as requested by the developer.

"We are not adjusting the GPP [General Project Plan] as part of this permitted developer process," said Pycior, noting that any changes "would be part of a larger public process."

Veconi observed that, at a previous meeting, ESD attorney Richard Dorado said that the entities gaining development rights over the railyard also had the obligations to build affordable housing.

ESD staff assented, if not with full certainty. It still struck me as murky. But maybe it's all moot if a new deal is coming.

Is there a Plan B?

If the current process doesn't "result in a positive evaluation," asked Shiffman, is ESD looking at a Plan B?

"The lender would have the right to present a different permitted developer to us," Sokolow said. (Of course, the "lender" itself seems to be the problem.)

"There's a desperate need in the state for housing," Shiffman said, noting that "the state legislature is thinking about social housing programs," in which state funds help build housing owned outside the private market.

More on Related

Later, Puca pugnaciously, if erroneously, suggested that Related should not qualify as a permitted developer because it's "being sued by a bunch of EB-5 investors who have never gotten paid back their original $500,000 investment."

Later, Puca pugnaciously, if erroneously, suggested that Related should not qualify as a permitted developer because it's "being sued by a bunch of EB-5 investors who have never gotten paid back their original $500,000 investment."

Actually, a Related executive, as I wrote, is suing some investors for harassment, given their aggressive picketing and messages. That seems indefensible, but Related's business ethics also seem suspect.

Indeed, as I wrote, if Greenland had only structured its EB-5 investment the way Related did--as equity, not loan--it might not have ever been required to repay the money advanced, and would not be in foreclosure.

Comments

Post a Comment