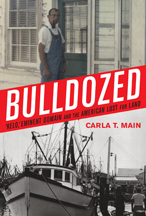

Despite the title, Carla T. Main’s recent book Bulldozed: “Kelo,” Eminent Domain, and the American Lust for Land tells the story of eminent domain by focusing on a particularly heavy-handed (but little-known) case in Freeport, TX (population approx. 13,000), a Gulf Coast city some 50 miles south of Houston. Freeport officials wanted to take waterfront property from the salt-of-the-earth Gore family operating a longtime shrimp business to create a low-risk deal for a wealthy developer to build a private marina. The Gores fought back, fiercely, with more resources than the typical eminent domain plaintiff, and the story includes numerous twists and turns.

Despite the title, Carla T. Main’s recent book Bulldozed: “Kelo,” Eminent Domain, and the American Lust for Land tells the story of eminent domain by focusing on a particularly heavy-handed (but little-known) case in Freeport, TX (population approx. 13,000), a Gulf Coast city some 50 miles south of Houston. Freeport officials wanted to take waterfront property from the salt-of-the-earth Gore family operating a longtime shrimp business to create a low-risk deal for a wealthy developer to build a private marina. The Gores fought back, fiercely, with more resources than the typical eminent domain plaintiff, and the story includes numerous twists and turns.The case is striking enough that even the liberal/populist Texas Observer, which, in its review says Main "relentlessly hawks her mantra" against eminent domain and criticizes her for black-and-white portrayals of the antagonists, considers the Gores are sympathetic characters, albeit unusual among those faced with eminent domain, since they could afford to fight back. The Wall Street Journal review is mostly approving.

The battle in Freeport is ongoing, but the aftermath includes the election in May of a new mayor who opposes eminent domain; he survived a recall vote in November.

The background

In other chapters, Main also explains the background of eminent domain, and even mentions Atlantic Yards. She suggests that eminent domain law in the 20th century “is largely the story of idealism gone haywire;” the law broadened with the 1954 Berman v. Parker case, allowing the razing of both rundown housing and solid businesses in Washington, DC, but producing far less housing than was replaced.

(As I noted, Justice William O. Douglas wrote with eloquent outrage about a situation that didn't sound much like Prospect Heights:

Miserable and disreputable housing conditions may do more than spread disease and crime and immorality. They may also suffocate the spirit by reducing the people who live there to the status of cattle. They may also be an ugly sore, a blight on the community which robs it of charm, which makes it a place from which men turn.)

She tells the story of the controversial 2005 Kelo v. New London case as well as bookend cases in Michigan, Poletown, which in 1981 expanded eminent domain in the state, and Hathcock, which in 2004 narrowed it. While state governments have responded to the post-Kelo backlash, she, as do conservative scholars like Ilya Somin, remain skeptical that eminent domain abuse will be reined in.

The evolution of eminent domain

Main suggests how eminent domain has evolved:

Nominally, the term “highest and best use’ is employed in determining the value of land for purposes of compensating the owner when the land is taken from him. But the words also describe a change in American culture, the tendency of courts and communities to think about property in a different way. The modern approach to eminent domain in the mid-twentieth century essentially evaluates whether owners are deserving or undeserving of their land, based on factors such as tax revenue and the physical appearance of the property… The current owner is viewed in comparison with another potential owner and found deficient, because the property is not being put to its “highest and best use.” This is wholly different from taking a property, with regrets—no matter what its conditions—because it stands in the way of a necessary public project.

…The municipality can make the owner out to be a slacker by measuring the current real estate taxes (and, if the land is occupied by a business, payroll taxes and other secondary economic benefits to the community) against the limitless dreams served up on a platter by the white-knight developer or big-box retailer.

Timothy Sandefur of the libertarian Pacific Legal Foundation, who filed a friend-of-the-court brief supporting the Gores, reviewed the book in the Recorder and suggested that Main should have tracked "the Progressive origins of eminent domain abuse." In other words, the evolution of the concept of “public use,” while it has roots in the antebellum era, more properly dates back to judges like Louis Brandeis and the New Deal.

He wrote:

One problem with Progressivism is that it assumed that government can allocate property more justly than the market. Yet the power to redistribute wealth and opportunity will invariably fall into the hands of politically sophisticated lobbyists who stand to make a buck by exploiting that power. This is why wealthy, white neighborhoods are rarely condemned, while blue-collar or minority towns frequently are.

Sketching the debate

Encounter Books has a conservative bent, thus indisposed to eminent domain--though Kelo, as Main points out, galvanized a wide range of opponents concerned that endorsing eminent domain for economic development would advantage the wealthy and political powerful.

Still, I think the book could give more credence to the arguments by municipal officials and urban planners about the importance of eminent domain, still, in repairing certain urban neighborhoods.

For example, New York City officials say it was crucial to the successful—and noncontroversial—Melrose Commons development, achieved with much community input. Another argument is that condemnation is needed for “site assemblage,” to achieve significant mass for major projects.

The legitimacy of that argument deserves more discussion.

What about AY?

And what about Atlantic Yards, which Main in the book erroneously calls an “economic development taking” rather than one justified, according to the Empire State Development Corporation, by several public purposes, including removal of blight, creation of open space, and the building of affordable housing. (Critics argue that some of those public purposes, especially the removal of blight, were only added later to ease the process.)

It’s not easy to assemble land for a sports facility. But whether a sports facility is a public use is in question; in the Atlantic Yards eminent domain case, plaintiffs' attorney Matthew Brinckherhoff, arguing in court 10/9/07, called it "a private, money-making enterprise,” not different from a hotel that offers public access. While the Atlantic Yards arena would be nominally publicly owned, it would be rented to a private owner for $1, who would pay for construction (via tax-advantaged bonds that are repaid as payments in lieu of taxes, or PILOTs) and collect hundreds of millions of dollars in naming rights.

In its dismissal of the appeal February 1, the Second Circuit Court of Appeals noted "a publicly owned (albeit generously leased) stadium."

A twist regarding Kelo

One of the bedrock arguments in the Atlantic Yards eminent domain challenge is that, unlike in the New London case, city and state officials did not create a comprehensive plan but instead anointed developer Forest City Ratner from the start. But Main suggests that the Supreme Court was making a shaky summary.

She writes:

Justice [John Paul] Stevens wrote in essence that the city would not be allowed to “take property under the mere pretext of a public purpose” if its real intent was to benefit a specific private party. But New London, said Justice Stevens, had a “carefully considered development plan.” If only Justice Stevens could have been a fly on the wall at all the city council meeting where the New London Development Corporation and council members were at each other’s throats over the ever-evolving plans, with the NLDC demanding money and the council repeatedly seeking further explanations of what the devil they intended to do.

Indeed, several months after the 2005 Supreme Court decision, the New London Day reported that, despite denials by Pfizer, the main private beneficiary of the redevelopment, that the project wasn't its idea, "the company has been intimately involved in the project since its inception."

So, perhaps any legal challenge based on Kelo—as with the Atlantic Yards eminent domain challenge—is based partly on a chimera. Then again, there's even less evidence that Atlantic Yards was the product of a “carefully considered development plan”

Yes, the Empire State Development Corporation (ESDC) compiled an extensive record. But did state and city officials do sufficient due diligence?

As I noted, former New York City Economic Development Corporation (NYC EDC) President Andrew Alper said that it "is not really up to us then to go out and find to try to a better deal." Also, the ESDC and governor's office both on 3/4/05 issued press releases relying on revenue projections made by the developer’s paid consultant, Andrew Zimbalist, rather than conducting their own analyses. And both the ESDC and the NYC EDC conducted fiscal impact analyses without looking at a range of costs.

AY as poster child

In another mention of Atlantic Yards in the book, one passage suggests that Public Advocate Betsy Gotbaum is a prime example of a politician caught up in contradictory statements about eminent domain.

Main writes:

Not to be outdone by their neighbors across the Hudson, the challengers in the New York City primary race for public advocate, always a slugfest, were also slinging mud over eminent domain. In the post-Kelo world, it seems to be de rigueur for politicians to at least appear as if they despise eminent domain. The incumbent public advocate, Betsy Gotbaum, was attacked for publicly supporting the highly controversial Atlantic Yards redevelopment project on Brooklyn’s waterfront—in which eminent domain had been threatened but not yet deployed—while at the same time insisting she was opposed to such takings. Among Gotbaum’s critics was a city councilwoman who introduced a bill to prevent the use of city funds to facilitate such takings. Gotbaum reasoned that the powerful and well-funded developer was still negotiating buyouts with the holdout residents, and besides, the developer had told her “he didn’t want to use eminent domain.” That’s a bit like saying that robber who puts a gun to a man’s head and takes his wallet did not obtain it by force, since he never actually pulled the trigger.

(Emphases in the original)

The project, of course, is not on the waterfront, but otherwise Main nails the issue. Gotbaum's record, and the failure of major media outlets to hold her accountable, represent a notable mini-chapter in the evolving saga of eminent domain.

Comments

Post a Comment