Can we trust the Empire State Development Corporation's (ESDC) fiscal impact analysis regarding Atlantic Yards? Nope.

For three months, the agency had refused to release the document behind the claim, in the General Project Plan, that the AY project "will generate $1.4 billion in net tax revenues in excess of the public contribution to the Project." In a WNYC TV segment broadcast earlier this month, Chairman Charles Gargano reiterated the refusal.

Today, after queries from the press, Atlantic Yards opponents, and Assemblyman Jim Brennan, the ESDC released the seven-page document.

Today, after queries from the press, Atlantic Yards opponents, and Assemblyman Jim Brennan, the ESDC released the seven-page document.

It's deeply unconvincing. Despite the phrase "public contribution" noted above, there's no reference to public contributions or public costs. In other words, it's a fiscal benefit analysis, not an impact analysis.

[Update: though they're not in the document, some costs are acknowledged by the ESDC.]

The New York City Economic Development Corporation did the same thing, toting up benefits but not costs, while the Independent Budget Office and Andrew Zimbalist, the consultant hired by Forest City Ratner, made some attempt to acknowledge costs, even though they didn't go far enough.

A closer look

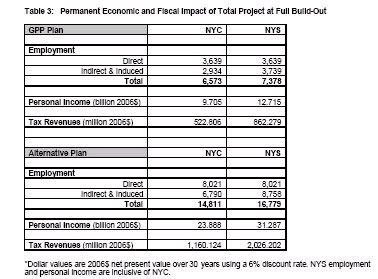

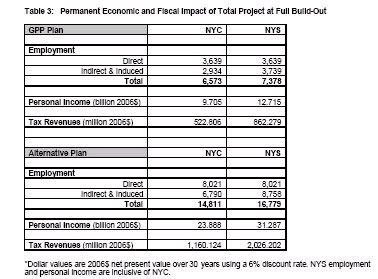

Moreover, it's not at all clear how the agency came up with the $1.4 billion figure, since neither the total tax revenues for the city and state under the General Project Plan (above, in graphic) or the Alternative Plan reach that sum.

It's possible that the $1.4 billion is reached by adding the totals ($1.945.5 billion for the General Project Plan) and then subtracting $200 million in city/state contributions and then some other tax breaks. But it's also clear that significant public costs--sanitation, schools, public safety--weren't included.

[Update: the direct subsidies are not included.]

In other words, we need a more honest accounting.

Moreover, the chart shows even more clearly that the Alternative Plan, which would have more than 1 million more square feet of office space (and thus more than 1000 fewer residential units), would create many more jobs and thus more than double the revenues.

So why is Forest City Ratner planning on building more condos and less office space? Probably because the former are more lucrative. But if a real fiscal impact analysis showed that the benefits would be much, much smaller--because of the additional costs yet unaccounted for--wouldn't that point to the Alternative Plan?

To the ESDC's credit, it should be noted that the agency acknowledges a 7% vacancy rate in the office space, just as did the NYCEDC. In the FCR-sponsored study, Zimbalist calculated no vacancy rate, assuming that office space directly translated into jobs--and Forest City Ratner repeated that.

To the ESDC's credit, it should be noted that the agency acknowledges a 7% vacancy rate in the office space, just as did the NYCEDC. In the FCR-sponsored study, Zimbalist calculated no vacancy rate, assuming that office space directly translated into jobs--and Forest City Ratner repeated that.

(Note that there's a typo regarding the amount of residential space under the Alternative Plan. It should be at least 1 million square feet less. Also note that the memo is from Program Research Specialist Kathy Kazanas to Senior Vice President Ann Hulka.)

Advisory opinion

Coincidentally, less than an hour after the ESDC released the fiscal impact analysis, I got a copy of an advisory opinion from the state Committee on Open Government. I had forwarded the committee my previous correspondence with the ESDC.

The opinion stated, in part:

It is our position that ESDC is not permitted to deny access to the entire analysis and/or to any statistical documentation which would substantiate the figures presented in Section G of the Project Plan. In this regard, we offer the following comments.

First, irrespective of whether ESDC has "prepared" the record "for release to the public", the record is kept by ESDC in its capacity as a governmental entity. Consequently, we believe that any such documents would fall within the scope of the Freedom of Information Law.

Second, as a general matter, the Freedom of Information Law is based upon a presumption of access. Stated differently, all records of an agency are available, except to the extent that records or portions thereof fall within one or more grounds for denial...

Finally, and with respect to the ESDC's lack of adherence to the statutory time frames by which it is required to respond to requests and appeals, as noted in the September 29, 2006 article, the Freedom of Information Law provides direction concerning the time and manner in which agencies must respond to requests...

For three months, the agency had refused to release the document behind the claim, in the General Project Plan, that the AY project "will generate $1.4 billion in net tax revenues in excess of the public contribution to the Project." In a WNYC TV segment broadcast earlier this month, Chairman Charles Gargano reiterated the refusal.

Today, after queries from the press, Atlantic Yards opponents, and Assemblyman Jim Brennan, the ESDC released the seven-page document.

Today, after queries from the press, Atlantic Yards opponents, and Assemblyman Jim Brennan, the ESDC released the seven-page document.It's deeply unconvincing. Despite the phrase "public contribution" noted above, there's no reference to public contributions or public costs. In other words, it's a fiscal benefit analysis, not an impact analysis.

[Update: though they're not in the document, some costs are acknowledged by the ESDC.]

The New York City Economic Development Corporation did the same thing, toting up benefits but not costs, while the Independent Budget Office and Andrew Zimbalist, the consultant hired by Forest City Ratner, made some attempt to acknowledge costs, even though they didn't go far enough.

A closer look

Moreover, it's not at all clear how the agency came up with the $1.4 billion figure, since neither the total tax revenues for the city and state under the General Project Plan (above, in graphic) or the Alternative Plan reach that sum.

It's possible that the $1.4 billion is reached by adding the totals ($1.945.5 billion for the General Project Plan) and then subtracting $200 million in city/state contributions and then some other tax breaks. But it's also clear that significant public costs--sanitation, schools, public safety--weren't included.

[Update: the direct subsidies are not included.]

In other words, we need a more honest accounting.

Moreover, the chart shows even more clearly that the Alternative Plan, which would have more than 1 million more square feet of office space (and thus more than 1000 fewer residential units), would create many more jobs and thus more than double the revenues.

So why is Forest City Ratner planning on building more condos and less office space? Probably because the former are more lucrative. But if a real fiscal impact analysis showed that the benefits would be much, much smaller--because of the additional costs yet unaccounted for--wouldn't that point to the Alternative Plan?

To the ESDC's credit, it should be noted that the agency acknowledges a 7% vacancy rate in the office space, just as did the NYCEDC. In the FCR-sponsored study, Zimbalist calculated no vacancy rate, assuming that office space directly translated into jobs--and Forest City Ratner repeated that.

To the ESDC's credit, it should be noted that the agency acknowledges a 7% vacancy rate in the office space, just as did the NYCEDC. In the FCR-sponsored study, Zimbalist calculated no vacancy rate, assuming that office space directly translated into jobs--and Forest City Ratner repeated that.(Note that there's a typo regarding the amount of residential space under the Alternative Plan. It should be at least 1 million square feet less. Also note that the memo is from Program Research Specialist Kathy Kazanas to Senior Vice President Ann Hulka.)

Advisory opinion

Coincidentally, less than an hour after the ESDC released the fiscal impact analysis, I got a copy of an advisory opinion from the state Committee on Open Government. I had forwarded the committee my previous correspondence with the ESDC.

The opinion stated, in part:

It is our position that ESDC is not permitted to deny access to the entire analysis and/or to any statistical documentation which would substantiate the figures presented in Section G of the Project Plan. In this regard, we offer the following comments.

First, irrespective of whether ESDC has "prepared" the record "for release to the public", the record is kept by ESDC in its capacity as a governmental entity. Consequently, we believe that any such documents would fall within the scope of the Freedom of Information Law.

Second, as a general matter, the Freedom of Information Law is based upon a presumption of access. Stated differently, all records of an agency are available, except to the extent that records or portions thereof fall within one or more grounds for denial...

Finally, and with respect to the ESDC's lack of adherence to the statutory time frames by which it is required to respond to requests and appeals, as noted in the September 29, 2006 article, the Freedom of Information Law provides direction concerning the time and manner in which agencies must respond to requests...

Comments

Post a Comment