How much in new revenues would Forest City Ratner's Atlantic Yards project bring, and what costs would it pose?

That's the $3.5 billion (and counting) question, but the Bloomberg administration's response is: trust us. The New York City Economic Development Corporation (NYCEDC) won't release the report it's used as a justification for the development.

At some point after 5/4/04--when NYCEDC president Andrew Alper told a City Council committee that the project was expected to have a positive fiscal impact--the agency apparently produced an analysis of the project. A 3/3/05 press release from the mayor's office stated: According to an economic analysis completed earlier this year for the New York City Economic Development Corporation, the net fiscal benefit to the City and State from the Atlantic Yards project is estimated at $1 billion in present value over the next thirty years. (Present value means the value in current dollars.)

A 3/3/05 press release from the mayor's office stated: According to an economic analysis completed earlier this year for the New York City Economic Development Corporation, the net fiscal benefit to the City and State from the Atlantic Yards project is estimated at $1 billion in present value over the next thirty years. (Present value means the value in current dollars.)

The online version of the press release contains a link to the NYCEDC web site, but there's no report to be found.

I queried NYCEDC spokeswoman Janel Patterson: "There's a link to NYCEDC but I couldn't find the analysis on the web site. Can you point me to it, or send me a copy? And, given that the project has changed significantly, has there been, or will there be, a new analysis?"

Her response: "The analysis referred to in the release was an internal analysis and not made public."

Two press releases

Why was a city agency estimating the fiscal impact on the state? As I've pointed out before, there's strong evidence that the mayor's office, in that 3/3/05 press release, wanted to cite an analysis by a government agency rather than rely on one by the developer.

Similar press releases issued virtually simultaneously by the governor's office and the Empire State Development Corporation both relied on Andrew Zimbalist, the developer's paid consultant, for their fiscal projections.

A different NYCEDC analysis?

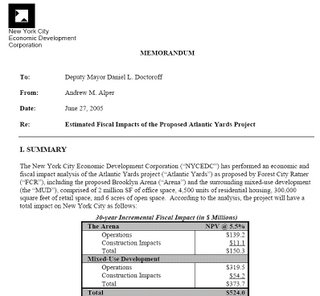

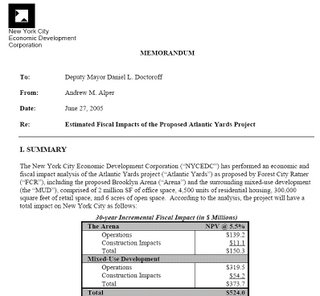

One analysis by the NYCEDC has surfaced. The document, obtained by Develop Don't Destroy Brooklyn and dated 6/27/05, projected the fiscal impact for the city alone. It calculated a return of $524 million in present value--about half of that $1 billion figure estimated for both the city and state

One analysis by the NYCEDC has surfaced. The document, obtained by Develop Don't Destroy Brooklyn and dated 6/27/05, projected the fiscal impact for the city alone. It calculated a return of $524 million in present value--about half of that $1 billion figure estimated for both the city and state

Despite the date, this analysis had likely been completed several months earlier, since it was based on an earlier configuration of the project. At a City Council hearing 5/26/05, Forest City Ratner announced plans to reduce commercial office space and add market-rate condos. This was not incorporated into the NYCEDC analysis made public.

Did NYCEDC produce a second report, the one Patterson cited as an internal analysis"? Possibly. But the agency might have taken the analysis mentioned above and added calculations regarding the fiscal impact on the state. But that's just speculation until we see the report and its methodology.

Huge flaws

More importantly, the NYCEDC document contains a huge omission: while the agency calculated new tax revenues, it made no attempt to factor in increased costs, such as for public safety, schools, and sanitation. The term "net fiscal benefit" used in the city press release suggests that some costs were acknowledged--maybe they were in the report that's under wraps.

Some costs are calculated in the reports by Zimbalist and one by the Independent Budget Office (IBO), but each of those reports have their flaws. Notably, the 2005 IBO report focused on the arena rather than the project as a whole, citing the "methodological limitations in estimating the fiscal impacts of mixed-use developments."

The Zimbalist reports, issued in 2004 and updated in 2005, have numerous flaws, some of which I've outlined. Tomorrow I'll take a longer look.

That's the $3.5 billion (and counting) question, but the Bloomberg administration's response is: trust us. The New York City Economic Development Corporation (NYCEDC) won't release the report it's used as a justification for the development.

At some point after 5/4/04--when NYCEDC president Andrew Alper told a City Council committee that the project was expected to have a positive fiscal impact--the agency apparently produced an analysis of the project.

A 3/3/05 press release from the mayor's office stated: According to an economic analysis completed earlier this year for the New York City Economic Development Corporation, the net fiscal benefit to the City and State from the Atlantic Yards project is estimated at $1 billion in present value over the next thirty years. (Present value means the value in current dollars.)

A 3/3/05 press release from the mayor's office stated: According to an economic analysis completed earlier this year for the New York City Economic Development Corporation, the net fiscal benefit to the City and State from the Atlantic Yards project is estimated at $1 billion in present value over the next thirty years. (Present value means the value in current dollars.)The online version of the press release contains a link to the NYCEDC web site, but there's no report to be found.

I queried NYCEDC spokeswoman Janel Patterson: "There's a link to NYCEDC but I couldn't find the analysis on the web site. Can you point me to it, or send me a copy? And, given that the project has changed significantly, has there been, or will there be, a new analysis?"

Her response: "The analysis referred to in the release was an internal analysis and not made public."

Two press releases

Why was a city agency estimating the fiscal impact on the state? As I've pointed out before, there's strong evidence that the mayor's office, in that 3/3/05 press release, wanted to cite an analysis by a government agency rather than rely on one by the developer.

Similar press releases issued virtually simultaneously by the governor's office and the Empire State Development Corporation both relied on Andrew Zimbalist, the developer's paid consultant, for their fiscal projections.

A different NYCEDC analysis?

One analysis by the NYCEDC has surfaced. The document, obtained by Develop Don't Destroy Brooklyn and dated 6/27/05, projected the fiscal impact for the city alone. It calculated a return of $524 million in present value--about half of that $1 billion figure estimated for both the city and state

One analysis by the NYCEDC has surfaced. The document, obtained by Develop Don't Destroy Brooklyn and dated 6/27/05, projected the fiscal impact for the city alone. It calculated a return of $524 million in present value--about half of that $1 billion figure estimated for both the city and stateDespite the date, this analysis had likely been completed several months earlier, since it was based on an earlier configuration of the project. At a City Council hearing 5/26/05, Forest City Ratner announced plans to reduce commercial office space and add market-rate condos. This was not incorporated into the NYCEDC analysis made public.

Did NYCEDC produce a second report, the one Patterson cited as an internal analysis"? Possibly. But the agency might have taken the analysis mentioned above and added calculations regarding the fiscal impact on the state. But that's just speculation until we see the report and its methodology.

Huge flaws

More importantly, the NYCEDC document contains a huge omission: while the agency calculated new tax revenues, it made no attempt to factor in increased costs, such as for public safety, schools, and sanitation. The term "net fiscal benefit" used in the city press release suggests that some costs were acknowledged--maybe they were in the report that's under wraps.

Some costs are calculated in the reports by Zimbalist and one by the Independent Budget Office (IBO), but each of those reports have their flaws. Notably, the 2005 IBO report focused on the arena rather than the project as a whole, citing the "methodological limitations in estimating the fiscal impacts of mixed-use developments."

The Zimbalist reports, issued in 2004 and updated in 2005, have numerous flaws, some of which I've outlined. Tomorrow I'll take a longer look.

Comments

Post a Comment