Tsai said to aim for $1 billion in revenue from the Nets, currently generating $343 million. Need to win championships. Could new arena naming rights help?

The new CEO, Sam Zussman, will need to repair the team’s image, fix an arena that’s good for little profit and navigate the Nets out of the joke mill. Tsai, who owns BSE Global, the sports company that operates the Nets, has decreed it.Young's not clear whether that $1 billion figure include the Nets or the umbrella company BSE Global, though another article, cited below, seems to point to the Nets--albeit with an asterisk.

Barclays Center isn’t the worst sports arena in the NBA, but it has problems. Rival executives who spoke with Forbes highlighted the arena’s inept parking, overcrowded entrances, unattractive suites and exterior design.

(Emphases added)

Well, "inept parking" was the plan: to limit parking so that most people travel by public transportation--and they do, at least for Nets games. But events aimed at kids and seniors draw many vehicles.

Overcrowded entrances? The plaza and Dean Street have a lot of space for people to gather, but Atlantic Avenue--not so much.

It's surprising to me that an arena based on previously successful venues would have overcrowded entrances, unless security and/or COVID protocols add too much burden.

Losing $112 million?

From the article:

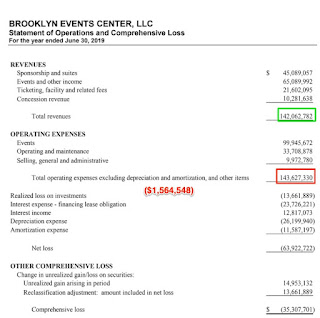

Barclays Center is losing money, too. A September 2021 audit reviewed by Forbes shows Barclays Center had a net loss of $112 million last year. That was likely due to the pandemic. To get a better glimpse of the finances, Forbes reviewed a 2019 audit of holding company Brooklyn Events Center LLC. The audit shows Barclays Center had a net loss of more than $60 million.

I don't think that's a particularly nuanced reading of the documents, excerpted above right.

The key, I believe, is Net Operating Income (NOI), which in FY 2021 should have exceeded $37 million to cover the required Payments in Lieu of Taxes (PILOTs), which include interest expense on the arena's construction bonds. (PILOTs are not cited in the excerpt above, but the interest component is included.)

Instead, in FY 2021, NOI was a $23 million loss. So they're $60 million behind--and that could be attributed to the pandemic's effect on event scheduling and crowds. (No wonder Tsai put $52 million extra in.)The additional $50.8 million in amortization and $19.7 million in depreciation are tax savings and help Tsai offset gains elsewhere.

But they're not serious assessments of the arena performance--otherwise it would be in the red despite solid cash flow.

Moreover, amortization and depreciation were not considered part of the arena's bottom line in projections for the bond offerings.

Losing $60 million?

As for the net loss of $60 million in FY 2019, the document (excerpted at right) indicates a net loss of $63.9 million, counting nearly $38 million in depreciation and amortization--far less than two years later. (Also: accounting adjustments then added more than $28 million in revenue.)

But the key to me is the $1.5 million loss in NOI, which of course could not cover the $37.2 million in required PILOTs. By my calculation, that left them some $39 million in the hole, not $63 million.

Again, I suspect the increased losses help the owner/operator balance out gains elsewhere.

Competition from Nassau?

From the article:

The arena is now squeezed between the famous MSG and the prestigious $1 billion UBS Arena in Elmont, New York. The NHL’s New York Islanders moved there in 2021 after a failed experiment playing at Barclays Center. To lure non-sporting events, BSE Global needs to negotiate favorable terms with promoters, leaving little room for profit.That suggests that the UBS Arena has created a separate market, and that promoters who book Madison Square Garden can go to Nassau County, where costs are lower.

Sportico's JohnWallStreet 6/10/22 wrote Joe Tsai’s Billion-Dollar Revenue Plan for the Brooklyn Nets, suggesting that Tsai wants to get the Nets from $343 million in revenues to $500 million, and then to $500 million in two-to-three years, and then to $1 billion over seven years.

BSE could retrofit Barclays Center in an effort to generate more premium seat inventory, though that would require additional capital investment.Indeed. Right now they're first trying to update the plaza.

Comments

Post a Comment