Will future of Atlantic Yards/Pacific Park be decided in foreclosure auctions, involving six railyard development sites, announced for today? Clues are elusive.

The future of Atlantic Yards/Pacific Park may get a significant new twist today--or maybe not.

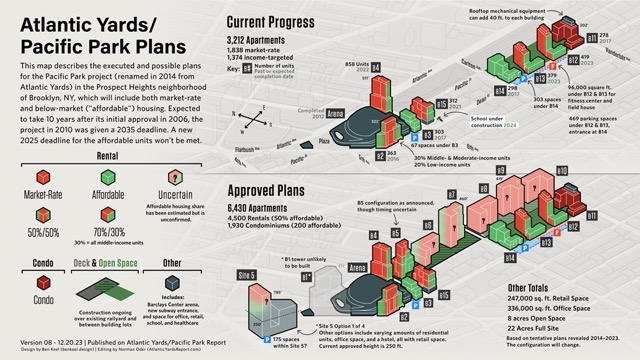

Two paired foreclosure auctions, regarding developer Greenland USA affiliate's interest in six Atlantic Yards/Pacific Park development sites over the Vanderbilt Yard, are scheduled for today, as announced in late November, in news broken by The Real Deal.

Completion of those six large towers, comprising nearly 3.5 million square feet of approved development, could mean more than 3,200 apartments, plus retail and the remaining six acres of open space.

|

| From Wall Street Journal |

What we don't know

To me, at least, the whole thing remains a black box.

Since I wrote about it, no more clues have surfaced, though there has been more discussion--by The Real Deal, by me, by the coalition BrooklynSpeaks--of what went wrong with the project, and how things might proceed.

Somewhat surprisingly, Empire State Development (ESD), the state authority that oversees/shepherds the project, has not publicly discussed its role and the affordable housing (and other) obligations it would require of whatever company (or companies) might take control.

After all, it's a "public-private project," right?

That would include the developer's obligation to pay $2,000 a month in fines for each affordable housing unit not delivered by a May 2025 deadline. Of the 2,250 required units, 876 (or 877) remain.

That report, requested for early October, has not been delivered.

Coordinating with MTA

As I wrote, any winning bidder(s) cannot simply start construction but must coordinate with the Metropolitan Transportation Authority (MTA) to build a platform, in two phases, over the the Vanderbilt Yard.

That implies a significant time horizon as well as major investments, on top of the obligation--assuming it's not waived--to build the affordable housing.

Moreover, the two auctions are not commensurate: one involves four development sites (B5, B6, B7, B8), which means one full platform block and part of another, while the other involves two development sites (B9, B10), over the second platform block.

|

| Graphic by Ben Keel & Norman Oder |

As I wrote, the MTA has said that Greenland USA, the successor to original developer Forest City, is current with payments for railyard development rights (which came after payment for the site occupied by the arena block).

That should be enough to have paid for the Air Rights Parcels B5, B6, and B7, but only partly for B8, much less B9 and B10.

Both are affiliates of the U.S. Immigration Fund, a so-called regional center that serves as a middleman for EB-5 loans, marketing mainly--at least as of 2014--to investors in China. (Its founder has a "tangled past," said Fortune, which could've been even tougher.)

For sale is AYB Funding's Class A limited liability membership interests in AY Phase II Development Company, an affiliate of Greenland USA.

That constitutes collateral for the loan. The principal asset of those membership interests are the parcels identified as B5, B6, B7, and B8 over the railyard.

The collateral will be sold to the highest qualified bidder, though the seller reserves the right to cancel or postpone the sale.

A similar advertisement and sale involves AYB Funding 200, which aggregated $100 million in EB-5 loans, with interest in the B9 and B10 parcels.

In Section 10.2 (p. 27, or the 34th page of the PDF), it states that no transfers of any equity interest in the various development entities will "be permitted without the prior written consent of ESDC" (the former name of ESD), which shall be in the authority's "reasonable discretion," provided that nothing "shall be deemed to restrict or prohibit any "Equity Interest Disposition by a Third Party Owner" as long as that buyer is not a "Prohibited Person," which includes those convicted of felonies.

While the above language suggests relatively relaxed terms regarding such transfers, if the planned auctions come with the obligation to complete the affordable housing--or even a requirement to negotiate with ESD--that implies a huge role for the state authority.

Is this a feint?

As I wrote, the notice states the Secured Party "reserves the right to cancel the sale in its entirety, or to adjourn the sale to a future date by announcement made at the time and place scheduled for the public sale."

That means that any state imposition or renegotiation of terms could significantly change the value of the development sites and thus delay or cancel the sale.

The first pool of investors originally were offered collateral in the B15 development site.

The Real Deal reported that Fortress Investment Group in 2020 "purchased a stake in the [Atlantic Yards] debt"--presumably at a discount. Fortress has partnered with U.S. Immigration Fund founder Nicholas Mastroianni II on other New York area projects.

Comments

Post a Comment