No talk of Atlantic Yards at ESD meeting, but advisory body may meet soon. Foreclosure sale would be part of complicated process to unlock development sites.

Nor was it discussed during the meeting.

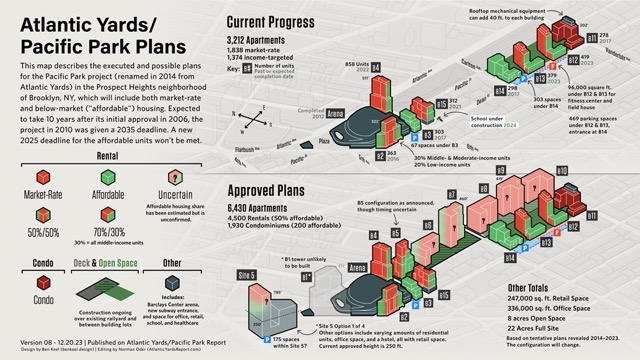

That sets up the possibility that loan collateral, rights to six development sites over the Vanderbilt Yard, nearly all the parcels in the remaining project--might be sold in a foreclosure auction Jan. 11 without any public discussion of conditions on the sale.

Or, perhaps, maybe not.

“Governor Hochul’s highest priority is expanding New York’s housing supply and promoting housing growth, and Empire State Development is focused on the successful buildout and completion of this project. We are currently reviewing the situation and are working to determine the best path forward.”What about the advisory body?

- Reviewing proposed changes to Project plan and agreements, and advising ESD board accordingly in advance of votes;

- Monitoring developer compliance with all public commitments;

- Making recommendations to ESD on ways to improve and expedite developer responsiveness to public obligations and increase transparency of Project deveiopment;

- Developing recommendations related to the Project, including in relation to unanticipated issues

Surely a potential bidder on development rights, owning a share--or a majority?--of the Greenland affiliate that would formally remain master developer, would want to know whether and how that obligation would be imposed.

The foreclosure sale involves the collateral for two separate loans, $249 million and $100 million, made by immigrant investors from China under the EB-5 visa program, which offers green cards in exchange for purportedly job-creating investments.

Air Rights Parcel: to be conveyed after FCR's substantial completion of the Upgraded Yard and only upon payment in full of the price of a Development Parcel. Conveyance is further subject to FCR's entry into an Air Space Parcel Improvements Agreement and a Declaration of Easements acceptable to MTA/LIRR.Each parcel is is conveyable to the developer or ESD only upon payment to MTA of the full Development Parcel Purchase Price.

...The Air Rights Parcel consists of six development sites... A Development Parcel Purchase Price is assigned to each Development Parcel based upon the total ARP Purchase Price and the proportional zoning square footage density associated with the Development Parcel.

The MTA has said that Greenland USA, the successor to Forest City, is current with payments. That means, by my calculation, a cumulative payment of $96 million, with $77 million left to go.

More dealings with the MTA

But that doesn't mean they've acquired the sites. MTA spokesman David Steckel explained:

The auction is not for the direct sale of the air space parcels. None of the MTA air space parcels have been purchased by the developer. We understand that the auction relates to certain interests in the Developer entity that were pledged as security for the loant.What would it take to activate those interests pledged as security? What would any winning bidder have to do to reap any benefits? Steckel responded:

The rights and obligations of developer, AY Phase II Development Company, LLC, are set forth in a series of project agreements with the MTA. The developer will need to satisfy the requirements in the agreements in order to acquire and develop the air space parcels (including constructing the platform) regardless of whether the pledged interests are transferred.

That's a somewhat cryptic answer, but it's clear that any developer would have to come to agreement with the MTA and ESD on the platform, as well as vertical construction.

Future complications

That sets up another potential complication: if the new bidder(s) would now own most of the AY Phase II Development Company, they would have to pass muster with ESD as the new master developer.

They would have to reach agreements with the MTA and ESD on the platform and vertical construction. And they would have to factor in the potential cost of unlocking the value of the development sites, including the platform and extant fines for affordable housing.

If those fines continue to mount, even as interest rates stay high and the lack of a 421-a tax break makes it untenable for now to build and deliver new revenues, what's in it for a bidder?

Surely ESD, "focused on the successful buildout and completion of this project," recognizes that.

And if that means a renegotiation of obligations, and/or a potential greater role for the public sector, that also means a requirement for far more transparency.

Comments

Post a Comment