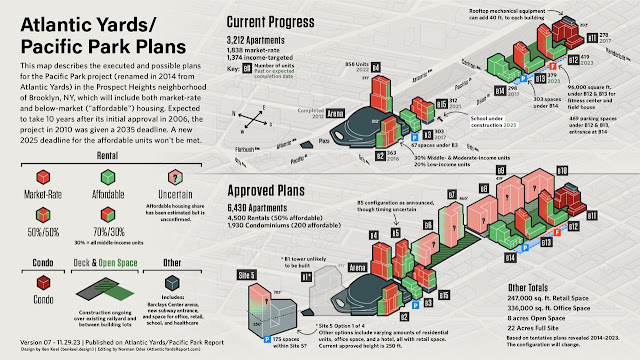

What are the six development sites worth? Huge clouds over sale, given platform & affordable housing (?) obligation. Could only first block get built?

How much are the six development sites over the Vanderilt Yard, scheduled to be sold at a foreclosure auction in January, worth? Would the holders of the debt, incurred by master developer Greenland USA (which owns nearly all of the project going forward) be paid back?

And might it be worth it for a buyer to build on the first block, including only three of the development sites, between Sixth and Carlton avenues?

The answers to those questions are murky, since neither the private parties involved nor the state authority overseeing the project have released any details, though I'll attempt some ballpark estimates below.

|

| Looking west from Vanderbilt Avenue at two railyard blocks needing platform |

One obvious conclusion: the cost of the platform cuts deeply into the value of the sites, and the potential fines for affordable housing cut even further.

As estimated in 2016--and costs surely have risen--the platform over the first block, in two parts (for B5, and B6/B7), would cost $76.2 million, plus $27 million in Long Island Rail Road costs. That's between Sixth and Carlton avenues.

The platform over second railyard block, between Carlton and Vanderbilt avenues, would cost $101 million, plus $50.4 million in LIRR costs.

The totals are $103.2 million and $151.4 million, respectively.

Details needed

The murkiness is because since no public documents have surfaced regarding the obligations of the buyer(s) to construct a two-block platform over the railyard, pay the Metropolitan Transportation Authority for the remaining portion of development rights, and construct open space around the towers.

Though there are two separate debt holders, investment funds of EB-5 immigrant investors from China organized by the U.S. Immigration Fund, it would be complicated for two separate buyers to emerge.

That's because the first fund has rights to buildings B5, B6, and B7, all over the first railyard block, plus B8, over the second block.

To go vertical on the latter site, that owner would have to coordinate with the buyers of the second fund's debt, with rights to B9 and B10, to build a platform together.

Build on only three sites, undermining project?

So it would make sense for a single buyer to emerge--unless the first buyers doesn't care about B8 and the second railyard block.

In fact, it's plausible--I speculate--that the buyer of the first tranche might ignore B8, at least in the short term, and just focus on building B5, B6, and B7.

That block has lower cost to activate, given that existing terra firma means the platform would cover a smaller area. Also, Greenland has already paid the MTA for development rights, as far as I can tell.

|

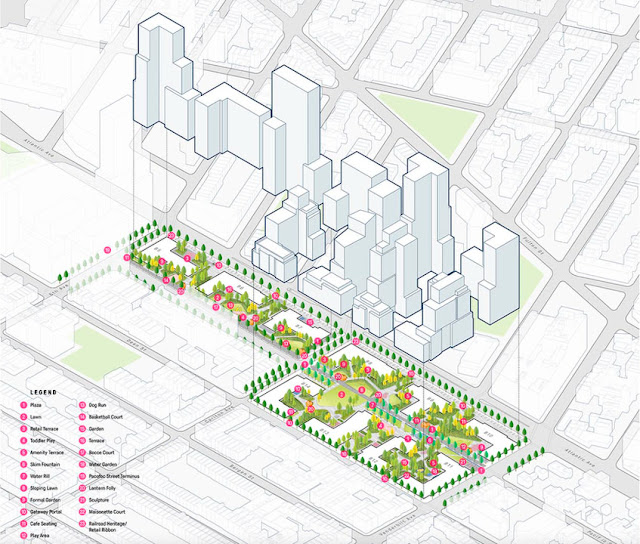

| Projected platform phases |

That said, not building on that northeast block--B8, B9, and B10--would undercut the entire rationale for Atlantic Yards/Pacific Park, which was to cover the railyard and create the largest parcel of open space by using demapped Pacific Street between Carlton and Vanderbilt avenues. See below.

|

| Massing model and open space, from landscape architect Thomas Balsley |

Affordable housing fines?

Looming over all this is whether and how the affordable housing obligation would be maintained, with fines. Greenland is obligated to build 2,250 affordable housing units by May 2025, with 876 (or 877) left to go.

Fines of $2,000/month for each missing unit are required--unless they are renegotiated or waived by Empire State Development. That's $1.752 million a month, or $21 million a year.

Return of 421-a?

The value of development rights is also made murky by the absence, as of now, of the 421-a tax break, one reason for Greenland's unwillingness to proceed with the platform work it had said would start in 2020.

Note that Gov. Kathy Hochul, whose previous effort to pass a replacement for 421-a failed, is expected to propose another version in the next legislative session.

Previous development parcels (B15, B12/13) were marketed by Greenland, and leased by other companies, under the expectation that the tax break could be gained by devoting 30% of the units to middle-income "affordable housing," at 130% of Area Median Income--mostly for people earning six figures.

It's likely that any 421-a successor, as with Hochul's previous failed proposal, would require more deeply affordable units and thus lower the market value of the development rights.

Value from past deals

Some recent parcel leases are only a partial guideline for the valuation of the railyard sites, because it's much easier to build on terra firma.

The B15 lease from Greenland to The Brodsky Organization was for $55.83 million, for a maximum of 331,910 square feet. That works out to $168.21/sf.

According to the MTA staff summary, the developer would pay $2 million a year on June 1 of 2012, 2013, 2014 and 2015, then pay 15 annual installments of about $11 million starting on June 1, 2016, through June 1, 2030. That total is $173 million.

The developer is current on those payments, the MTA confirmed. So the developer has paid a total of $96 million, with $77 million left to pay.

Valuation to MTA of Development Parcels

According to the MTA document, the Air Rights Parcel consists of six Development Parcels. A Development Parcel Purchase Price is assigned to each parcel based on the total price and the proportional zoning square footage/ |

| Looking east from Sixth Avenue at first of two railyard blocks |

B5 represents 18.22% of total railyard square footage and thus 18.22% of the $173 million total, or $31.52 million of the air rights payment to the MTA.

B6 is 12.76% of square footage and thus $22.07 million of the air rights payment. B7 is 21.04% of square footage and $36.4 million of the air rights payment.

The three parcels add up to $89.99 million, less than the $96 million paid so far. If those air rights are paid for, that leaves the cost of the platform, and the affordable housing obligation. That should make the first set of sites more attractive.

The remaining parcels

B8 is 15.01% of total square footage, or $25.97 million. So the total cost for MTA air rights for the bidder on the bloc of four sites would be $115.96 million.

Subtract the $96 million paid, and that leaves $19.96 million to the MTA to activate B8--plus the major cost of the platform to cover three sites over that eastern block.

B9 is 19.33% of square footage, and $33.44 million to the MTA. B10 is 13.64% of square footage, and $23.6 million to the MTA. That's a total of $57.04 million to the MTA.

Beyond the cost of the platform for those three sites, estimated in 2016 at $151.4 million and surely more costly today.they also involve a significant amount of open space, as described above.

In other words, it would be a lot easier to build B5, B6, and B7 than the other three parcels. Also, given the presence of terra firma, two parcels jutting south from Atlantic Avenue on what were known as the "bump" building, it would be easier to stage workers, as Greenland had planned. See at right in image below.

Comments

Post a Comment