Forbes: thanks to patch deal and rising NBA tide, Nets/arena company leaping ahead--and now worth $3.2B, about what Tsai paid. Still 7th in league.

The NBA’s Most Valuable Teams 2021-22: New York Knicks Lead A Trio Now Worth Over $5 Billion Each, Forbes reported 10/18/21, with the summary "The average NBA team value has risen 13% since February, to $2.48 billion, behind record sponsorship revenue and high expectations for the league’s next media rights deal."

One key is jersey patch deals, which have particularly boosted the Brooklyn Nets, which remain ranked seventh in the league:

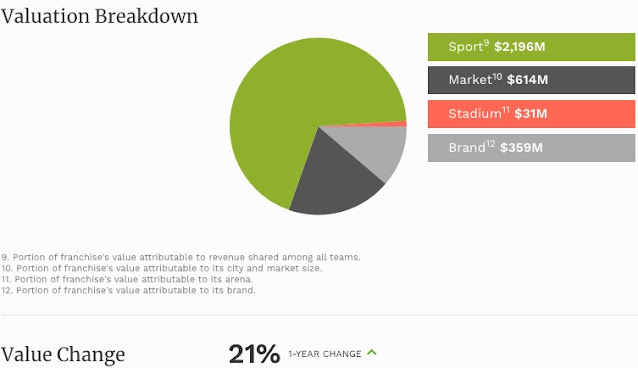

Note that Forbes attributes $2.196 billion of the Nets' value to the sport, a testament to the league's revenue sharing. It also attributes $614 million to the market, $359 million to the brand, and just $31 million to the arena.

I think I missed Forbes' mid-pandemic NBA Team Values 2021: Knicks Keep Top Spot At $5 Billion, While Warriors Seize No. 2 From Lakers, published 2/10/21. From the article:

One key is jersey patch deals, which have particularly boosted the Brooklyn Nets, which remain ranked seventh in the league:

NBA owners booked an estimated $1.46 billion in sponsorships last season—a record—with much of the increase in this category coming from jersey patch deals. First introduced during the 2017-18 season and hovering about $150 million in total for the past couple of years, the agreements are expected to bring in well over $225 million across the league’s 30 teams in 2021-22. What began as nickel-and-dime advertising has rapidly increased into lucrative marketing agreements. For example, last month the Brooklyn Nets landed a jersey patch deal reportedly worth an NBA-record $30 million a year, one reason the value of the Nets rose 21% this year—more than any other team—to $3.2 billion.

From Forbes

They're still well behind their crosstown rival, but the tide is rising--after some stumbles.

Note that Forbes combines the value of the team and their associated arena, so the new figure approximates the value Joe Tsai paid for the Nets and the Barclays Center operating company, which Forbes has suggested was $3.2 billion or $3.3 billion.

(Forbes thought he overpaid, though I think it's more complicated, as explained below.)

The Nets are behind the Knicks ($5.8B), Golden State Warriors ($5.6B), Los Angeles Lakers ($5.5B), Chicago Bulls ($3.65B), Boston Celtics ($3.55B), and Los Angeles Clippers ($3.3B).

So the arena company's losses, which I reported yesterday, contribute to the $80 million in team/arena losses that Forbes reports. (Those losses exclude depreciation and amortization, paper losses that further tax deductions.) So, even as other franchises made a profit during the pandemic year, the Nets' prospects are such that their value leaped.

Consider that Forbes's assessment came before the Nets renegotiate or exit the 20-year naming rights agreement with Barclays, which at this point is clearly undervalued. Stay tuned on that.

Drilling down on the Nets

|

| From Forbes |

That to me is somewhat arbitrary, especially since the arena in previous years was said to contribute $607 million and $577 million to the valuation.

Yes, the arena has not been profitable, especially this past year, but... the fact of an arena in Brooklyn, part of the nation's media capital, gave the Nets an international platform to sell sponsorships, and served as a lure to superstars.

As I wrote in February 2020, Forbes attributes $929 million of the Nets' value to the sport--less than half the figure than today!--$743 million to the market, $607 million to the arena, and $221 million to the brand.

Last year, as shown in the screenshot at right, Forbes attributed $830 million of the Nets value to the sport, $732 million to the market, $577 million to the arena, and $211 million to the brand.

More from this year's assessment

The chart below, from Forbes, shows a steady increase in value, even as revenue and operating income have fluctuated, influenced by not only rising player expenses but the pandemic pause.

Note that the average ticket price is now $100. Prices have risen since Forbes in February 2020 had reported $90 as the average.

The February 2021 assessment

I think I missed Forbes' mid-pandemic NBA Team Values 2021: Knicks Keep Top Spot At $5 Billion, While Warriors Seize No. 2 From Lakers, published 2/10/21. From the article:

“Those teams in premier markets have tremendous brand value, and that is worth a lot,” says Sal Galatioto, president of GSP Partners, which has handled team transactions for NBA teams, including the Warriors and the Philadelphia 76ers. The economics aren’t bad, either, with concentrations of high-earning fans, corporate offices and valuable media content the primary appeal for multi-billionaires, who keep pushing up values.The article noted that team profits fell only modestly during fan-free games, 12%, "cushioned in part by massive TV contracts that paid in full, as well as a reduction in player salaries per the terms of the collective bargaining agreement."

The article assessed the Nets as seventh in the league, worth (with the arena operating company) only $2.65 billion, up 6% over the previous assessment. The combined income for the team/arena was in the black: $44 million.

From the article:

Our appraisals are what we think the team would sell for. So while Tsai paid $3.2 billion for the Nets, we think the team is worth more like $2.65 billion because he paid around $1 billion for a money-losing arena business. If a team has a new arena, media deal or sponsorship agreement set to kick in after the 2019-20 season, we estimate its impact on the enterprise value. Our estimated income statements and franchise values include revenue that team owners get from non-NBA events at their arena.

Again, I think the interplay between the team/arena is more complex: only the presence of the arena allows for a team in the nation's media capital. Consider: today, the arena is still a money-losing business, but the team is worth much more, so the combination is worth much more.

The February 2020 assessment

As I wrote in February 2020, on NBA Team Values 2020: Lakers And Warriors Join Knicks In Rarefied $4 Billion Club, Forbes reported 2/11/20, that, despite problems like a lousy Knicks team and geopolitical tensions from China, "NBA franchise values continue to soar, up 14% in the past year to an average of $2.12 billion."

Regarding the Nets, ranked seventh:

Alibaba cofounder Joseph Tsai agreed in 2018 to buy the Brooklyn Nets over three years for $2.35 billion, but he accelerated the purchase in August and added the operating rights to the Barclay’s Center in a deal worth $3.3 billion for the team and arena.Forbes stated:

Our appraisals are what we think the team would sell for. So while Tsai paid $3.3 billion for the Nets, we think the team is worth more like $2.5 billion because he paid around $1 ll.

|

| From Forbes |

About the Nets

From Forbes's February 2020 page on the Nets:

From Forbes's February 2020 page on the Nets:

Joseph Tsai bought 49.9% of the Nets from Mikhail Prokhorov in April 2018 with the idea of buying the rest of the team in three years. He accelerated the timeline to buy the team in September 2019. Tsai and also acquired the operating company for the Barclays Center as part of the deal. The total enterprise value for the team and arena business was $3.3 billion. Our valuation for the Nets includes the economics of the Barclays Center, but not the value of the real estate, which is owned by the state of New York... The Nets fortunes should improve after the 2020-21 season when the NHL's New York Islanders, who currently play 20 games at the Barclays Center, move into their own arena. The Nets current deal with the Islanders has been a money-losing proposition for the basketball team because hockey-related revenue at the arena has been less than the $55 million payment the Islanders are guaranteed from the Nets.

Looking at the valuation breakdown

|

| Forbes, 2020 |

Comments

Post a Comment