Uncertainties mount: 421-a changes upend market-rate plans; "affordable" likely contains much leeway

Also see coverage of the explanations for the giant green fence on Dean Street.

Some significant uncertainties about Atlantic Yards/Pacific Park surfaced yesterday at the quarterly meeting (video here) of the Atlantic Yards Community Development Corporation, which drew only a few public observers.

Some significant uncertainties about Atlantic Yards/Pacific Park surfaced yesterday at the quarterly meeting (video here) of the Atlantic Yards Community Development Corporation, which drew only a few public observers.

First, changes in the state's 421-a program mean the developer can't get the tax break for three contemplated 100% market-rate buildings, among 15 (or 16) total towers. (Three other fully market-rate buildings are likely: the B11 condo building, 550 Vanderbilt, is finished and the B12 and B15 sites--one condo, one rental--have the tax-break grandfathered in.)

Second, despite much rhetoric about a broad mix of "affordable" units, as memorialized in the not-so-enforceable Atlantic Yards Community Benefits Agreement (CBA) and the predecessor Affordable Housing Memorandum of Understanding signed with ACORN, that configuration is not guaranteed.

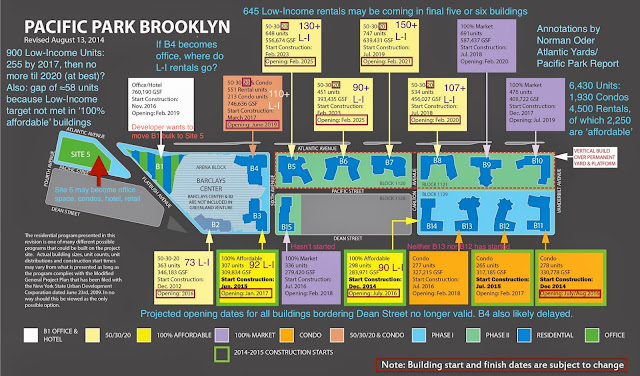

See my annotated site plan, above, from October 2016, indicating that the project was behind the once-projected tentative schedule. In November 2016, citing uncertainties about 421-a, a glut of competing units, and rising construction costs, the developer announced unspecified delays, which might mean that a project recently presumed to be done by 2025--the deadline for affordable units--could last until at least 2033.

"But in the very short term, for buildings that we’re anxiously to see going, and obviously in the long term for the whole buildout," Cotton said, "what’s clear is that the idea of a 100% market building getting 421-a benefits at our project is no longer possible."

The developer, she said, wasn't seeking to change the affordable housing requirements--presumably in number, not income range--or the deadline.

Williams said she understood that the AMI levels haven’t been set, but "we do have to hit a certain number of units at certain AMI levels."

"I don’t remember that in the Development Agreement," said Phillips, softly and a bit quizzically.

"We have government also here," Williams said, referencing the AY CDC's role, suggesting that if the building configurations are skewed, "I think that’s a problem."

"My understanding is that there are some requirements to have certain income bands," she added. "I might have misremembered this." (Maybe not misremembered, just believed--as so many did, including me--that the configurations in the Housing MOU and CBA would be reflected.)

"So, we’re regulated by lots of different things," Cotton said. "Obviously, 421-a, decisions made at the agency that decides to work with us, our relationship with MHANY [nonprofit partner Mutual Housing Association of New York], etc. We have our bottom line regulations, and then our aspirations and goals and that kind of stuff. We’re trying to build a mixed-income community, that’s been the intention of this project from the beginning."

"I understand you," Williams said, noting she was flagging the issue for the rest of the board as well as ESD. "A mixed income community, on a big site, can mean a whole bunch of different things… We’re talking about market rate condos all the way down to apartment units that rent for less than $1,000… My question is where those different units end up concentrated on the site."

Second, despite much rhetoric about a broad mix of "affordable" units, as memorialized in the not-so-enforceable Atlantic Yards Community Benefits Agreement (CBA) and the predecessor Affordable Housing Memorandum of Understanding signed with ACORN, that configuration is not guaranteed.

(Indeed, as I've reported, two "100% affordable" buildings are skewed toward middle-income affordable units, with 50% of the total rather than the 20% as promised in those previous documents.)

Also, though it went unmentioned yesterday, the developer seemingly can't build any condo buildings, even one with affordable units, while getting tax breaks under the new state program, known as Affordable New York, since it's limited to buildings with up to 35 condos. Given the one condo building finished and one grandfathered in, containing some 543 of 1,930 planned condo apartments, that seemingly jeopardizes a significant chunk of units.

Bottom line: the project faces significant headwinds. Expect future changes in the building plan--from condos to rentals, maybe even office space, or perhaps some new twist. Perhaps we'll see lobbying for changes in state law or for extra benefits or revised deals from city housing agencies.

Also, though it went unmentioned yesterday, the developer seemingly can't build any condo buildings, even one with affordable units, while getting tax breaks under the new state program, known as Affordable New York, since it's limited to buildings with up to 35 condos. Given the one condo building finished and one grandfathered in, containing some 543 of 1,930 planned condo apartments, that seemingly jeopardizes a significant chunk of units.

Bottom line: the project faces significant headwinds. Expect future changes in the building plan--from condos to rentals, maybe even office space, or perhaps some new twist. Perhaps we'll see lobbying for changes in state law or for extra benefits or revised deals from city housing agencies.

Starting with obfuscation

The issue first arose at about 48 minutes into the video, when AY CDC Board member Barika Williams, an affordable housing professional, asked about the impact of the 421-a revision on the project. She noted that 421-a was mentioned in notes from the most recent Atlantic Yards Quality of Life meeting run by Empire State Development (ESD), the state authority overseeing/shepherding the project.

"The question that was posed," said Tobi Jaiyesimi, who serves as AY CDC Executive Director and ESD's Atlantic Yards Project manager, "was directed to the developer, and it was in regards to how the changes to the affordable New York would impact their commitment to the affordable housing."

The issue first arose at about 48 minutes into the video, when AY CDC Board member Barika Williams, an affordable housing professional, asked about the impact of the 421-a revision on the project. She noted that 421-a was mentioned in notes from the most recent Atlantic Yards Quality of Life meeting run by Empire State Development (ESD), the state authority overseeing/shepherding the project.

"The question that was posed," said Tobi Jaiyesimi, who serves as AY CDC Executive Director and ESD's Atlantic Yards Project manager, "was directed to the developer, and it was in regards to how the changes to the affordable New York would impact their commitment to the affordable housing."

|

| From left: Tobi Jaiyesimi, Barika Williams (facing), Ashley Cotton |

She said the commitment to 2,250 affordable units (of 6,430 total) remained solid.

Actually, the question that was posed--by me--concerned whether the 421-a revision would apply to condo buildings with more than 35 units. The answer was no, from Forest City New York's Ashley Cotton, who represents the Greenland Forest City Partners joint venture.

Developer's update

At about 1:16 of the video, Cotton provided a more extensive update. "So you may have read, in the report [my report] out on the Quality of Life meeting, the changes to the law no longer include a section that specifically references the Pacific Park project." Known as the "Atlantic Yards carve-out," it extended 421-a benefits to any building in the project, even one fully market-rate, as long as the project met an overall affordability threshold.

"But in the very short term, for buildings that we’re anxiously to see going, and obviously in the long term for the whole buildout," Cotton said, "what’s clear is that the idea of a 100% market building getting 421-a benefits at our project is no longer possible."

"That obviously has consequences," she said.

Cotton noted that Atlantic Yards/Pacific Park, with 35% planned below-market units, has a higher percentage of affordability than the 20% and 25% required under the different iterations of 421-a. (Of course, it also got an override of zoning to build at the bulk the developer thought appropriate.)

The developer, she said, wasn't seeking to change the affordable housing requirements--presumably in number, not income range--or the deadline.

"We’re always trying to juggle how to make a project that’s feasible, economical, and meets all of our requirements," she said, with the latter phrase presumably meaning profit.

Skewing the configuration?

Williams said she was concerned that it might be possible to end up with the south side of the project site with all the low-income affordable units, while the buildings on the north side have only middle-income affordable units.

Skewing the configuration?

Williams said she was concerned that it might be possible to end up with the south side of the project site with all the low-income affordable units, while the buildings on the north side have only middle-income affordable units.

Cotton pushed back on that possibility, and I agree it's less likely, because, of the three yet-to-be built towers below Pacific Street, B12 (615 Dean) would be 100% condos, B15 (664 Pacific) would be 100% market-rate rentals, and B13 would be up for grabs.

Given that two 100% affordable buildings, B14 (535 Carlton) and B3 (38 Sixth), contain a disproportionate amount of middle-income below-market units, it's more likely that the lower-income apartments would be built later, in towers built over the Vanderbilt Yard, which in most part needs a deck.

"The AMIs [Area Median Income levels] haven’t been set for those future buildings," Jaiyesimi said. (See this article for a comparison between once-promised and actual AMI levels.)

"Correct," added Marion Phillips III, the ESD Senior VP who was the top state official in the room.

"Correct," added Marion Phillips III, the ESD Senior VP who was the top state official in the room.

What levels of affordability?

|

| From the Development Agreement |

"I don’t remember that in the Development Agreement," said Phillips, softly and a bit quizzically.

He's right--and that leaves huge wiggle room.

"Each one of these units gets negotiated out with the agency that’s going to give us benefits," Cotton said. "Every single one is treated differently… depending on who the mayor is, who the agency is... They have their policy goals too."

The document--screenshot at right--simply defines affordable units as those "subject to income and rent restrictions" as part of a city or state regulatory agreement, with rents set at no more than 160% of AMI. Unmentioned is that a certain fraction--at least 20% in a building that's not fully affordable--must be low-income units for tax-code purposes.

But that leaves room for a disproportionate amount of middle-income units rather than moderate-income ones.

She said to Williams, "I don’t think we have any plans to do what you described, but we can’t do anything alone, it’s all in partnership with government."

"We have government also here," Williams said, referencing the AY CDC's role, suggesting that if the building configurations are skewed, "I think that’s a problem."

"My understanding is that there are some requirements to have certain income bands," she added. "I might have misremembered this." (Maybe not misremembered, just believed--as so many did, including me--that the configurations in the Housing MOU and CBA would be reflected.)

"So, we’re regulated by lots of different things," Cotton said. "Obviously, 421-a, decisions made at the agency that decides to work with us, our relationship with MHANY [nonprofit partner Mutual Housing Association of New York], etc. We have our bottom line regulations, and then our aspirations and goals and that kind of stuff. We’re trying to build a mixed-income community, that’s been the intention of this project from the beginning."

"I understand you," Williams said, noting she was flagging the issue for the rest of the board as well as ESD. "A mixed income community, on a big site, can mean a whole bunch of different things… We’re talking about market rate condos all the way down to apartment units that rent for less than $1,000… My question is where those different units end up concentrated on the site."

I don't think Greenland Forest City is "regulated" by its relationship with MHANY, which is a contractor of sorts and does not have much more than a bully pulpit, as far as I can tell. MHANY's Ismene Speliotis did point out the disconnect between the huge response in the housing lottery for low-income units and the lesser response for middle-income ones.

Housing lottery statistics

At about 1:07 of the video, Williams asked about affordable housing lottery statistics, saying she'd like to see the numbers of households applying at different income levels and the numbers who fit the qualifications, as well as those ultimately selected.

At about 1:07 of the video, Williams asked about affordable housing lottery statistics, saying she'd like to see the numbers of households applying at different income levels and the numbers who fit the qualifications, as well as those ultimately selected.

That, she said,would allow for understanding the "demand for affordable housing units at each income level."

Nobody mentioned that in April I wrote an article for City Limits about exactly that, showing a deep skewing of demand, with only 2,203 applications for the 148 units in a 297-unit "100% affordable" building, while there were more than 92,000 applications overall.

(As far as I know, no government agency or researcher compiles that information, which I analyzed from a raw spreadsheet of applicants. And I'm not sure we'll ever know how many applicants fit the qualifications because, as far as I know, those selecting applicants stop once they've filled the units rather than analyze the whole cohort for eligibilty.)

Jaiyesimi said they would reach out to city agencies for information.

"If you call me, I can give you all this," Cotton said.

"It's not just a matter of calling, it’s also making it part of the public record," Williams responded. That was an implicit rebuke the the developer's not-uncommon practice of taking things offline.

Jaiyesimi said they would reach out to city agencies for information.

"If you call me, I can give you all this," Cotton said.

"It's not just a matter of calling, it’s also making it part of the public record," Williams responded. That was an implicit rebuke the the developer's not-uncommon practice of taking things offline.

She said she also wanted to learn "whether or not we hit full community preference threshold"--in other words whether 50% of the units go to households from Community Boards 2, 3, 6, and 8. That, I think, would be fairly easy to meet.

Comments

Post a Comment