Minority/women contracting numbers lag 25% behind ambitious CBA "goals" (sometimes billed as "promises"); results better than WTC, other projects

Update February 3: it turns out that the Empire State Development's statistics are different, with lower numbers.

In building the Barclays Center and other Atlantic Yards construction activities, Forest City Ratner is lagging 25% behind its ambitious plan to devote devoting 20% of construction contract dollars to minority-owned business enterprises (MBEs) and 10% to women-owned firms (WBEs).

According to statistics released last week (see below) by Empire State Development (ESD), the state agency overseeing Atlantic Yards, the MBE awards total $91 million (about 16.3% of total purchases), while the WBE awards total $35.1 million (about 6.3% of total purchases). The total, as of the end of 2011, encompasses work back to 2005.

Thus the combined M/WBE participation is 22.6%, about three-quarters of the way toward the what ESD calls the "program requirement of 30% for M/WBE," which also appears as goals--20% and 10%, respectively--in the Community Benefits Agreement (CBA).

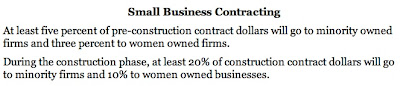

The Atlantic Yards web site, as noted in the screenshot at right, presents the figures as certainties.

While Forest City had previously publicly reported the MWBE percentages for various components of the project, such as at the Atlantic Yards District Service Cabinet meeting last July, it had not done so in the context of the CBA goal of 30%.

At the Atlantic Yards District Service Cabinet meeting January 26, Arana Hankin, Director, Atlantic Yards Project for ESD, said that Forest City is committed to submitting M/WBE reports monthly, as opposed to every other month, and she would then circulate them to elected officials and Community Boards. (I requested the latest copy. I didn't know copies were previously being circulated.)

In perspective

Asked to comment, Forest City spokesman Joe DePlasco said Forest City aims for such a goal in all its projects, and "we endeavor/use best efforts to achieve" it.

He pointed out that the Port Authority announced the milestone of $1 billion in WTC contracts to M/WBEs, representing 17% participation. I'd add that MTA contract goals of M/WBEs or similar DBEs (Disadvantaged Business Enterprises) are typically 15-20%.

Thus, while the Atlantic Yards numbers may outpace such other projects, Atlantic Yards--and the special governmental benefits attached to it--gained support, in part, because of promises to meet the goals of the CBA.

And had Forest City Ratner hired the Independent Compliance Monitor as required by the CBA, we'd have been reminded more often how well they're meeting those promise, including the status of M/WBE initiatives and lists of those M/WBEs selected.

Promises or goals?

The goals have been presented as "promises." For example, the 7/13/07 Brooklyn Daily Eagle presented this press release:

Despite promotional statements (such as in this 2006 brochure) claiming "community commitments" that were "guaranteed by a legally binding Community Benefits Agreement," the CBA (p. 18) presents the targets as aspirational:

It seems that, for certain contracts, it has been easier for Forest City Ratner and its contractors to reach out to MWBEs.

For example, early in the construction activities, in a February 2008 report (below) to the Downtown Brooklyn Advisory & Oversight Committee, Forest City said that MBE awards were 36.7% of total purchases, while WBE awards were 8.8%, for a total of 45.5%. That was well ahead of the 30% goal.

The recent report from ESD suggests that in certain aspects of work, M/WBE totals are well above the goals, while in others they lag.

For example, as the chart at left suggests, the entire $16.7 million (100%) spent on infrastructure has gone to MWBE firms.

On Stage II railyard/Carlton Avenue Bridge work, of the $48.6 million, the MBE total is more than 30%, while the WBE total is nearly 5%

However, of the nearly $392 million spent on the Barclays arena, the MBE total is less than 12%, while the WBE total is less than 6%.

With $52.7 million spent on the transit connection, the MBE total is less than 10%, while the WBE total nudges over 8%.

Some other projects aim for more consistency. The Port Authority press release states:

The new report from ESD describes some borough statistics, surely of interest to local elected officials:

Earlier this month, Merritt & Harris, the real estate consultant to the arena PILOT Bond Trustee reported that about 12.3% and 9.5% of the workforce on the job last month were attributed to MBEs and WBEs. The CBA measurement, however, is contract dollars; after all, minority and women workers may be employed by a variety of companies.

MWBE Contract Awards as of December 2011

Report on the Atlantic Yards Community Benefits Agreement to the Downtown Brooklyn Advisory & Oversight Com...

Atlantic Yards Community Benefits Agreement (CBA)

In building the Barclays Center and other Atlantic Yards construction activities, Forest City Ratner is lagging 25% behind its ambitious plan to devote devoting 20% of construction contract dollars to minority-owned business enterprises (MBEs) and 10% to women-owned firms (WBEs).

According to statistics released last week (see below) by Empire State Development (ESD), the state agency overseeing Atlantic Yards, the MBE awards total $91 million (about 16.3% of total purchases), while the WBE awards total $35.1 million (about 6.3% of total purchases). The total, as of the end of 2011, encompasses work back to 2005.

Thus the combined M/WBE participation is 22.6%, about three-quarters of the way toward the what ESD calls the "program requirement of 30% for M/WBE," which also appears as goals--20% and 10%, respectively--in the Community Benefits Agreement (CBA).

The Atlantic Yards web site, as noted in the screenshot at right, presents the figures as certainties.

While Forest City had previously publicly reported the MWBE percentages for various components of the project, such as at the Atlantic Yards District Service Cabinet meeting last July, it had not done so in the context of the CBA goal of 30%.

At the Atlantic Yards District Service Cabinet meeting January 26, Arana Hankin, Director, Atlantic Yards Project for ESD, said that Forest City is committed to submitting M/WBE reports monthly, as opposed to every other month, and she would then circulate them to elected officials and Community Boards. (I requested the latest copy. I didn't know copies were previously being circulated.)

In perspective

Asked to comment, Forest City spokesman Joe DePlasco said Forest City aims for such a goal in all its projects, and "we endeavor/use best efforts to achieve" it.

He pointed out that the Port Authority announced the milestone of $1 billion in WTC contracts to M/WBEs, representing 17% participation. I'd add that MTA contract goals of M/WBEs or similar DBEs (Disadvantaged Business Enterprises) are typically 15-20%.

Thus, while the Atlantic Yards numbers may outpace such other projects, Atlantic Yards--and the special governmental benefits attached to it--gained support, in part, because of promises to meet the goals of the CBA.

And had Forest City Ratner hired the Independent Compliance Monitor as required by the CBA, we'd have been reminded more often how well they're meeting those promise, including the status of M/WBE initiatives and lists of those M/WBEs selected.

Promises or goals?

The goals have been presented as "promises." For example, the 7/13/07 Brooklyn Daily Eagle presented this press release:

The largest class to date — 57 contractors — has graduated from the Atlantic Yards Community Benefits Agreement (CBA) training program in June. The newest graduates, 57 in all, received certificates at a ceremony at Medgar Evers College School of Business in Brooklyn. Apart from what it might mean to some, the Forest City Ratner Companies (FCRC) Atlantic Yards development means work to minority- and women-owned Brooklyn contractors, because the CBA guarantees that 20 percent of construction dollars will go those that are minority-owned and 10 percent will go to those that are women-owned.(Emphasis added)

Despite promotional statements (such as in this 2006 brochure) claiming "community commitments" that were "guaranteed by a legally binding Community Benefits Agreement," the CBA (p. 18) presents the targets as aspirational:

Developers will seek to award not less than twenty (20%) percent of the total construction contract dollars of each Development Phase to qualified Minority owned firms and not less than ten (10%) percent of the total construction contract dollars for each Development Phase to qualified women owned firms.Even when the numbers were regarded as goals, as in this 10/24/05 press release, issued by the CBA Coalition, the issue was framed in a seeming effort to sway public opinion in favor of the project, which had not yet been officially approved:

McKissack & McKissack, the nation’s oldest minority-owned professional design and construction firm, will be announced as construction manager for the $182 million Atlantic Rail Yards at a press conference on Tuesday, October 25 at 1:00 P.M. at House of the Lord Church in Brooklyn. The Reverend Herbert Daughtry, interim chair of the Community Benefits Agreement Coalition, signatories to the historic Atlantic Yards Community Benefits Agreement (CBA), and other members of the Coalition will join Assemblyman Roger Green and executives from Forest City Ratner Companies (FCRC) to welcome the award-winning firm as a partner in the CBA.Trends over time

It seems that, for certain contracts, it has been easier for Forest City Ratner and its contractors to reach out to MWBEs.

For example, early in the construction activities, in a February 2008 report (below) to the Downtown Brooklyn Advisory & Oversight Committee, Forest City said that MBE awards were 36.7% of total purchases, while WBE awards were 8.8%, for a total of 45.5%. That was well ahead of the 30% goal.

The recent report from ESD suggests that in certain aspects of work, M/WBE totals are well above the goals, while in others they lag.

For example, as the chart at left suggests, the entire $16.7 million (100%) spent on infrastructure has gone to MWBE firms.

On Stage II railyard/Carlton Avenue Bridge work, of the $48.6 million, the MBE total is more than 30%, while the WBE total is nearly 5%

However, of the nearly $392 million spent on the Barclays arena, the MBE total is less than 12%, while the WBE total is less than 6%.

With $52.7 million spent on the transit connection, the MBE total is less than 10%, while the WBE total nudges over 8%.

Some other projects aim for more consistency. The Port Authority press release states:

Each of the World Trade Center contracts has a specific M/WBE goal, typically 17 percent of the total contract amount, which is in line with the agency’s overall contracting goal for such firms.Local MWBEs from Brooklyn

The new report from ESD describes some borough statistics, surely of interest to local elected officials:

The total contract amount for Brooklyn based M/WBEs is $34,416,541 which represents approximately 27.3% of the total M/WBE purchases. The total number of contracts to Brooklyn based MWBEs is 52 or approximately 28.2% of all contracts awarded to MWBEs.Another measure

Earlier this month, Merritt & Harris, the real estate consultant to the arena PILOT Bond Trustee reported that about 12.3% and 9.5% of the workforce on the job last month were attributed to MBEs and WBEs. The CBA measurement, however, is contract dollars; after all, minority and women workers may be employed by a variety of companies.

MWBE Contract Awards as of December 2011

Report on the Atlantic Yards Community Benefits Agreement to the Downtown Brooklyn Advisory & Oversight Com...

Atlantic Yards Community Benefits Agreement (CBA)

Comments

Post a Comment