It’s well-known that the 2004 Downtown Brooklyn rezoning resulted in some very different outcomes than expected, given that the hot residential real estate market, coupled with changes in the back-office needs of large companies in Manhattan, made it far more lucrative to build luxury housing (and hotels) than the office space (and jobs) that the rezoning was intended to foster.

A new report, Downtown Brooklyn’s Detour: The Unanticipated Impacts of Rezoning and Development on Residents and Businesses, prepared by the Pratt Center for Community Development for FUREE (Families United for Racial and Economic Equality), points out how much has changed in four years, raising concerns about the displacement of lower-income retail and residential tenants. It doesn’t suggest particular strategies, however. (Solutions aren’t simple; perhaps that’ll be another report.)

A new report, Downtown Brooklyn’s Detour: The Unanticipated Impacts of Rezoning and Development on Residents and Businesses, prepared by the Pratt Center for Community Development for FUREE (Families United for Racial and Economic Equality), points out how much has changed in four years, raising concerns about the displacement of lower-income retail and residential tenants. It doesn’t suggest particular strategies, however. (Solutions aren’t simple; perhaps that’ll be another report.)

The report does remind us that an EIS (environmental impact statement) is hardly infallible, as we’ve also learned in the case of Atlantic Yards, where the EIS anticipated a ten-year project buildout that seems deeply divorced from reality. The report points out that there was too little public input regarding the concerns of FUREE’s constituency, though it doesn’t mention that FUREE, among others, was asleep at the wheel.

It also points out that no affordable housing was required as a trade-off for giving developers vastly increased development rights--clearly an error in retrospect, as the city has learned in rezonings of Fourth Avenue in Park Slope. The unanswered question is how to fairly share the increased wealth created by the rezoning.

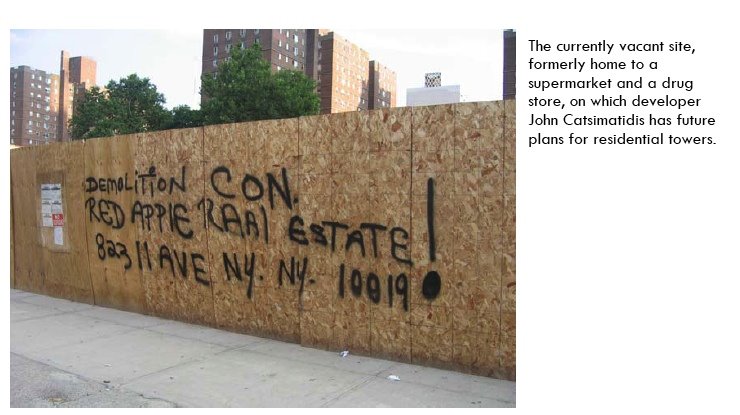

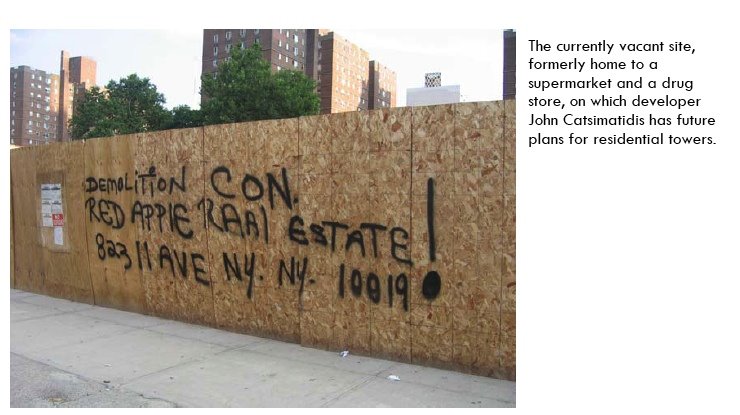

The report was released last week as FUREE members protested the continued absence of neighborhood retail--a well-used supermarket and drug store on Myrtle Avenue just east of Flatbush--demolished by developer John Catsimatidis in anticipation of new development. Here’s a Brownstoner interview with probable mayoral candidate Catsimatidis, who, in his narrow analysis of displacement--none on the blocks he owns--shows himself to be underinformed.

The report was released last week as FUREE members protested the continued absence of neighborhood retail--a well-used supermarket and drug store on Myrtle Avenue just east of Flatbush--demolished by developer John Catsimatidis in anticipation of new development. Here’s a Brownstoner interview with probable mayoral candidate Catsimatidis, who, in his narrow analysis of displacement--none on the blocks he owns--shows himself to be underinformed.

Catsimatidis was not asked about the timetable to replace the retail, though he has said it was coming within a year--though subject to the vagaries of the real estate market, which is a big caveat.

Strategies

The episode suggests that, while the supermarket and drug store may have been profitable serving the working-class and low-income residents nearby, the potential returns from the rezoned land were, to Catsimatidis, much more significant.

How to deal with the mismatch in the market? Here’s a Pratt Center report on some strategies, including commercial rent control, none of which are easy to implement.

How to deal with the mismatch in the market? Here’s a Pratt Center report on some strategies, including commercial rent control, none of which are easy to implement.

And here’s an article in the current issue of City Limits, in which Julia Vitullo-Martin of the Manhattan Institute suggests that street frontage available within the footprint of a public housing project--in Chelsea in this case--could support new retail. It’s an idea that hasn’t been suggested yet in Brooklyn but shouldn’t be dismissed.

The probable solution regarding a supermarket involves construction at the Brooklyn Navy Yard, which, because it involves demolition of houses at Admiral's Row, has turned into a contentious fight that pits a variety of preservationists and neighborhood organizations against local elected officials, tenant groups, and Navy Yard brass. (Is a compromise possible? Maybe. Here's coverage from Brownstoner and the Gowanus Lounge.)

The essential complaint

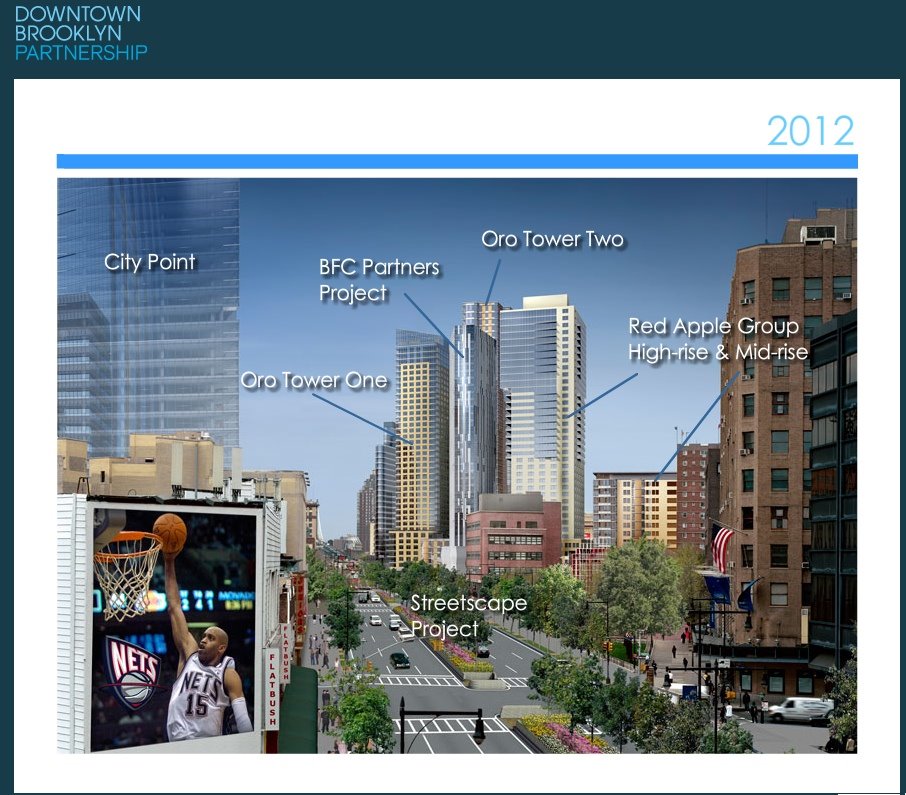

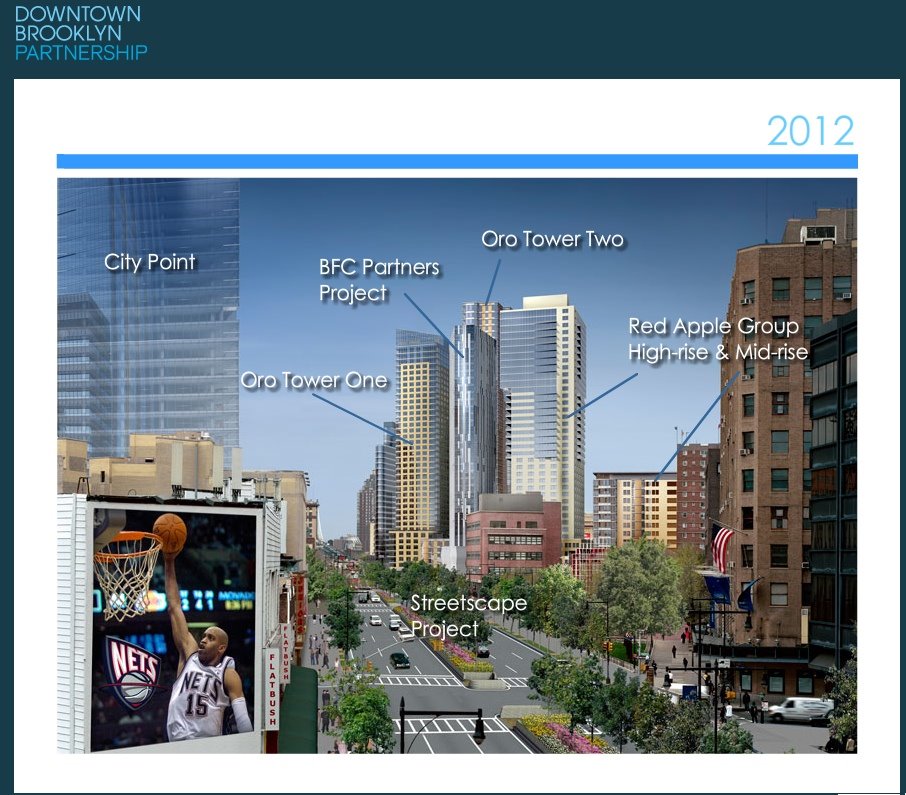

"The papers and the Downtown Brooklyn Partnership keep talking about a renaissance in Downtown Brooklyn,” said Randy Leigh, FUREE Board Member, in a press release. “But none of this reflects what's actually happening to the people who live, work, shop and own businesses here. We did this report because we wanted to show the true story. The city is trying to move out low income and working class people, especially people of color. They're marketing everything to wealthy people who don't even live here yet, and aren't part of the history of this great community.”

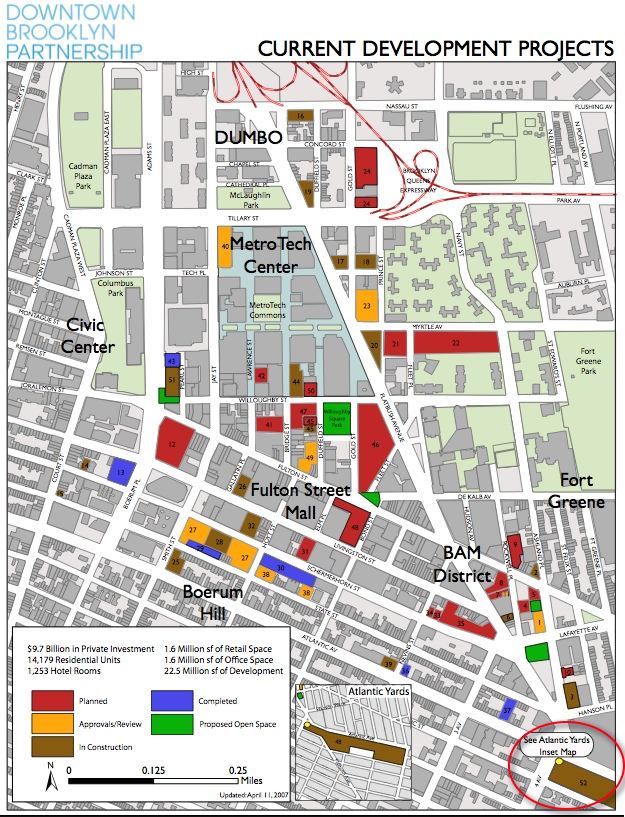

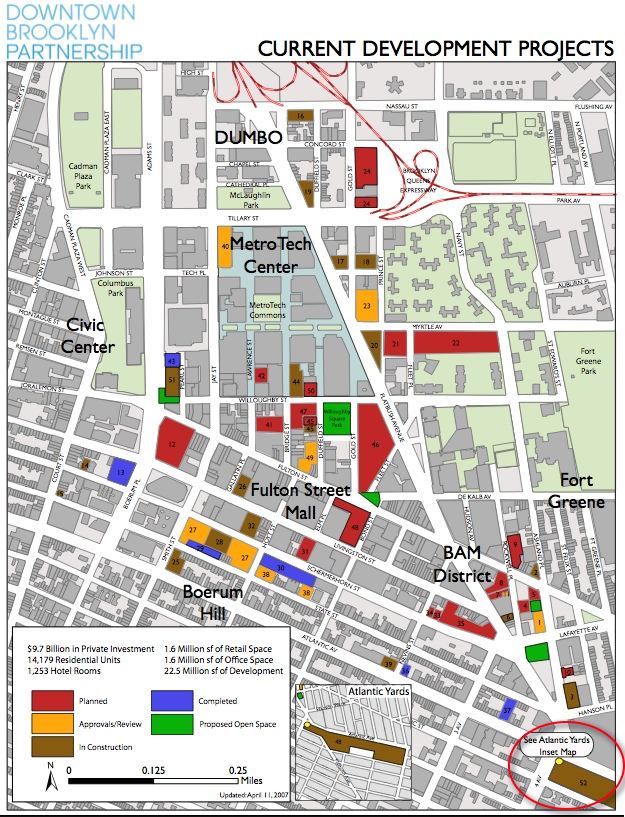

While the marketing, as shown in projects listed on the Downtown Brooklyn Partnership site, is indeed to wealthy people, the displacement issue is more subtle--as is the question of whether Downtown Brooklyn is a "great community." Large housing projects like Ingersoll and Whitman are not going anywhere. The Pratt report notes that the EIS analysis estimated that 386 residents living in about 130 housing units, mostly in rent-stabilized buildings, face displacement.

While the marketing, as shown in projects listed on the Downtown Brooklyn Partnership site, is indeed to wealthy people, the displacement issue is more subtle--as is the question of whether Downtown Brooklyn is a "great community." Large housing projects like Ingersoll and Whitman are not going anywhere. The Pratt report notes that the EIS analysis estimated that 386 residents living in about 130 housing units, mostly in rent-stabilized buildings, face displacement.

“The rezoning included no provisions to create or preserve affordable housing, and fewer than 800 below-market-rate units are being built in downtown Brooklyn,” the report states. While that may seem to be a net gain, it’s hardly clear when those units would be built, or whether they would be affordable to those displaced.

A victory

It also may be possible to preserve the rights of some residents; 40 families living in rent stabilized apartments subject to eminent domain will get “substantial relocation benefits and protections,” including Section 8 subsidies and a preference in all City-supervised affordable developments, according to a FUREE announcement.

A new report, Downtown Brooklyn’s Detour: The Unanticipated Impacts of Rezoning and Development on Residents and Businesses, prepared by the Pratt Center for Community Development for FUREE (Families United for Racial and Economic Equality), points out how much has changed in four years, raising concerns about the displacement of lower-income retail and residential tenants. It doesn’t suggest particular strategies, however. (Solutions aren’t simple; perhaps that’ll be another report.)

A new report, Downtown Brooklyn’s Detour: The Unanticipated Impacts of Rezoning and Development on Residents and Businesses, prepared by the Pratt Center for Community Development for FUREE (Families United for Racial and Economic Equality), points out how much has changed in four years, raising concerns about the displacement of lower-income retail and residential tenants. It doesn’t suggest particular strategies, however. (Solutions aren’t simple; perhaps that’ll be another report.)The report does remind us that an EIS (environmental impact statement) is hardly infallible, as we’ve also learned in the case of Atlantic Yards, where the EIS anticipated a ten-year project buildout that seems deeply divorced from reality. The report points out that there was too little public input regarding the concerns of FUREE’s constituency, though it doesn’t mention that FUREE, among others, was asleep at the wheel.

It also points out that no affordable housing was required as a trade-off for giving developers vastly increased development rights--clearly an error in retrospect, as the city has learned in rezonings of Fourth Avenue in Park Slope. The unanswered question is how to fairly share the increased wealth created by the rezoning.

The report was released last week as FUREE members protested the continued absence of neighborhood retail--a well-used supermarket and drug store on Myrtle Avenue just east of Flatbush--demolished by developer John Catsimatidis in anticipation of new development. Here’s a Brownstoner interview with probable mayoral candidate Catsimatidis, who, in his narrow analysis of displacement--none on the blocks he owns--shows himself to be underinformed.

The report was released last week as FUREE members protested the continued absence of neighborhood retail--a well-used supermarket and drug store on Myrtle Avenue just east of Flatbush--demolished by developer John Catsimatidis in anticipation of new development. Here’s a Brownstoner interview with probable mayoral candidate Catsimatidis, who, in his narrow analysis of displacement--none on the blocks he owns--shows himself to be underinformed.Catsimatidis was not asked about the timetable to replace the retail, though he has said it was coming within a year--though subject to the vagaries of the real estate market, which is a big caveat.

Strategies

The episode suggests that, while the supermarket and drug store may have been profitable serving the working-class and low-income residents nearby, the potential returns from the rezoned land were, to Catsimatidis, much more significant.

How to deal with the mismatch in the market? Here’s a Pratt Center report on some strategies, including commercial rent control, none of which are easy to implement.

How to deal with the mismatch in the market? Here’s a Pratt Center report on some strategies, including commercial rent control, none of which are easy to implement.And here’s an article in the current issue of City Limits, in which Julia Vitullo-Martin of the Manhattan Institute suggests that street frontage available within the footprint of a public housing project--in Chelsea in this case--could support new retail. It’s an idea that hasn’t been suggested yet in Brooklyn but shouldn’t be dismissed.

The probable solution regarding a supermarket involves construction at the Brooklyn Navy Yard, which, because it involves demolition of houses at Admiral's Row, has turned into a contentious fight that pits a variety of preservationists and neighborhood organizations against local elected officials, tenant groups, and Navy Yard brass. (Is a compromise possible? Maybe. Here's coverage from Brownstoner and the Gowanus Lounge.)

The essential complaint

"The papers and the Downtown Brooklyn Partnership keep talking about a renaissance in Downtown Brooklyn,” said Randy Leigh, FUREE Board Member, in a press release. “But none of this reflects what's actually happening to the people who live, work, shop and own businesses here. We did this report because we wanted to show the true story. The city is trying to move out low income and working class people, especially people of color. They're marketing everything to wealthy people who don't even live here yet, and aren't part of the history of this great community.”

While the marketing, as shown in projects listed on the Downtown Brooklyn Partnership site, is indeed to wealthy people, the displacement issue is more subtle--as is the question of whether Downtown Brooklyn is a "great community." Large housing projects like Ingersoll and Whitman are not going anywhere. The Pratt report notes that the EIS analysis estimated that 386 residents living in about 130 housing units, mostly in rent-stabilized buildings, face displacement.

While the marketing, as shown in projects listed on the Downtown Brooklyn Partnership site, is indeed to wealthy people, the displacement issue is more subtle--as is the question of whether Downtown Brooklyn is a "great community." Large housing projects like Ingersoll and Whitman are not going anywhere. The Pratt report notes that the EIS analysis estimated that 386 residents living in about 130 housing units, mostly in rent-stabilized buildings, face displacement.“The rezoning included no provisions to create or preserve affordable housing, and fewer than 800 below-market-rate units are being built in downtown Brooklyn,” the report states. While that may seem to be a net gain, it’s hardly clear when those units would be built, or whether they would be affordable to those displaced.

A victory

It also may be possible to preserve the rights of some residents; 40 families living in rent stabilized apartments subject to eminent domain will get “substantial relocation benefits and protections,” including Section 8 subsidies and a preference in all City-supervised affordable developments, according to a FUREE announcement.

The settlement was a result of a lawsuit filed South Brooklyn Legal Services and the law office of Candace Carponter (who is also the legal chair of Develop Don’t Destroy Brooklyn).

Slow down for a solution?

FUREE’s Leigh also said, “We hope this report shows it's time to stop the nonsense, slow down the development until the people who live here and know best can be part of the plan."

What exactly that means is another question. Assemblyman Hakeem Jeffries acknowledged in an interview in January that public officials have relatively little leverage, but may be able to use bond financing to nudge developers to create affordable housing.

Unanticipated impacts

The Pratt study notes:

The stated goal of the 2004 Downtown Brooklyn Plan was to stimulate the redevelopment of the area in order to encourage its continued transformation into New York City’s third central business district. The comprehensive development plan has created a set of negative impacts, some of which were outlined in the plan’s Environmental Impact Statement. However, many of the negative impacts that small businesses and households are currently experiencing were not taken into account by the EIS.

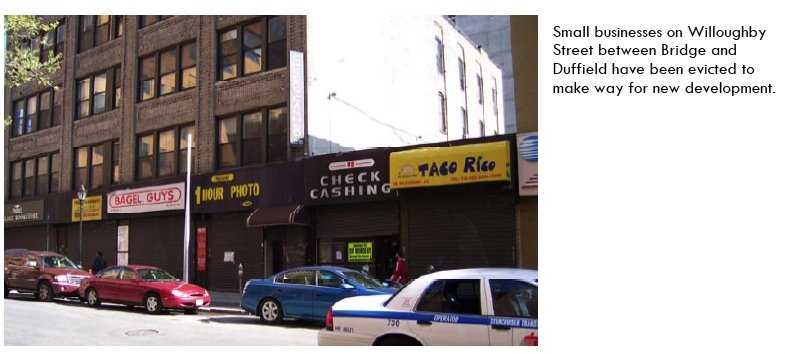

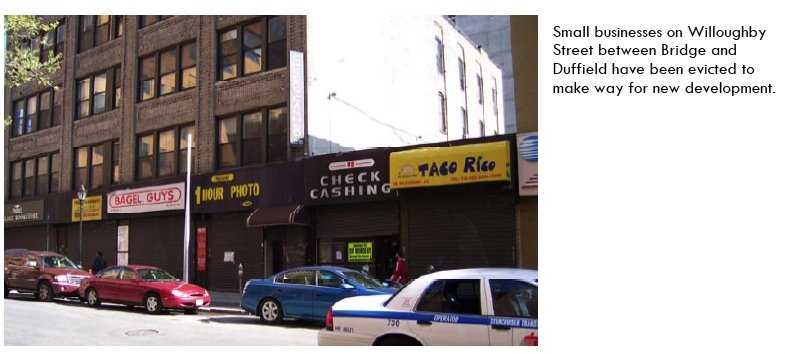

Displaced businesses

While the EIS analysis estimated that 100 businesses—and 1,700 jobs---would be directly displaced by new development, it concluded that this does not constitute a “significant adverse impact,” the Pratt study notes. Already more than 100 businesses in the rezoning area have already been displaced.

While the EIS analysis estimated that 100 businesses—and 1,700 jobs---would be directly displaced by new development, it concluded that this does not constitute a “significant adverse impact,” the Pratt study notes. Already more than 100 businesses in the rezoning area have already been displaced.

The problem, according to Pratt, is that it is very difficult to meet the criteria for establishing a significant adverse impact--there must be a critical mass of unusual retail businesses. (What might be a solution? A relocation fund? Loans to re-establish businesses?)

Further, because the Downtown Brooklyn plan includes existing urban renewal areas, such as the Albee Square Mall with 731 jobs, the potentially lost jobs from those zones are not included because they were already subject to displacement--thus producing an undercount.

A change in character

The report notes:

As landowners clear out small businesses located on future development sites, moderate income office workers find that the shops they have patronized for years are gone. Also, as small businesses get displaced, the character of Downtown Brooklyn—particularly the Fulton Street Mall--as a shopping destination for low and moderate-income households is being threatened.

While the EIS analysis has a very narrow perspective on the neighborhood’s historical significance and character and how they are expected to change, the new residents and workers who are expected to come to the area will create significant impacts.

The report suggests that delis, barbershops, and other convenience retail shops serving moderate-income office workers will be lost, and other businesses—”from an array of small clothing stores to a specialized wig shop”—will be lost that currently serve people from a large area. The report concedes:

The report suggests that delis, barbershops, and other convenience retail shops serving moderate-income office workers will be lost, and other businesses—”from an array of small clothing stores to a specialized wig shop”—will be lost that currently serve people from a large area. The report concedes:

While perhaps it would be difficult to argue that the small businesses in Downtown Brooklyn constitute a critical economic sector in Brooklyn or the city overall, their removal alters the character of Downtown Brooklyn’s thriving shopping district and decreases the number of establishments that offer affordable goods to shoppers.

The report notes that the Downtown Brooklyn EIS “fully acknowledges that the rezoning is very likely to impact the area’s character, but its framework for analysis is much more quantitative than qualitative,” suggesting positive impacts from increased development and demand, but ignoring those who might feel excluded.

Is it the market at work?

Again, this raises a question about the appropriate public policy. Given Downtown Brooklyn’s place as a transit and office hub, shouldn’t there still be a market for working-class shoppers?

And, if not, is Downtown Brooklyn redevelopment a project purely of the market? Not really. The Downtown Brooklyn Partnership has an $8 million annual budget, with $2 million from the city and hundreds of thousands of dollars from local businesses, property owners, and other institutions, according to the Pratt Center blog The Eminent Domain. (That still doesn’t add up to $8 million.)

Sharing the wealth

Change in Downtown Brooklyn was inevitable; the challenge is sharing the wealth created by public action. And it should be noted that the Downtown Brooklyn Partnership (DBP) hasn’t ignored all the concerns raised by FUREE. One critic of the rezoning, speaking at the FUREE convention in May, was the owner of the restaurant Tio Pio.

However, according to the latest Downtown Brooklyn Partnership newsletter, Tio Pio has moved to a new and much larger home, thanks to help from the MetroTech Business Improvement District (BID), a component of the DBP.

Who dropped the ball?

The report notes:

The only way for regular citizens to have participated in this process, at least in theory, would have been to try to influence members of Community Board 2 who had—but ultimately did not use—an opportunity to cast an advisory vote on the plan. Outside of this narrow official review process, there was no on-the-ground constituency group (or a coalition of groups) that pressured the city to ensure that the plan contained provisions to meet the needs of low and moderate-income people and small business owners who had been living and doing business in Downtown Brooklyn for many years.

All true, but unmentioned is that groups like FUREE and ACORN were otherwise engaged, as the New York Observer reported in 2006. According to coverage of that CB2 meeting in the 2/7/04 Brooklyn Paper, the opponents of the plan were worried about eminent domain, traffic impacts, and overdevelopment--not the concerns raised by FUREE.

By contrast, Atlantic Yards developer Forest City Ratner, promising ACORN and Community Benefits Agreement signatories affordable housing, job training, and the hiring/contracting of minorities and women in exchange for, essentially, a private rezoning at the scale the developer required.

Neither process seemed to work too well.

Supplemental EIS needed?

Though the Downtown Brooklyn EIS, under its reasonable worst-case scenario, estimated that only 979 residential units were likely to be created, that was way off. Does that mean there should be more analysis?

No. In July 2007, according to the Pratt Report, a city “technical memorandum” was issued assessing changes proposed for the Albee Square Mall site--from an EIS analysis that assumed more than 1 million square feet of office space and no residential units to a CityPoint project with some 125,000 square feet of office space and more than 1,000 housing units. However, the city concluded that no new significant environmental impacts would be created, so no Supplemental EIS was necessary.

That suggests that changes in the Atlantic Yards plan similarly will not generate a Supplemental EIS, despite a vastly different time frame. (A Supplemental EIS was requested in the lawsuit challenging the Final EIS, as petitioners said a wind study should have been included; Justice Joan Madden disagreed, dismissing the case, which is under appeal.)

Whither the Fulton Street Mall?

The Fulton Street Mall, faces an uncertain future, the report adds, calling the mall “a tremendously successful urban place” “in terms of retail performance and its viability as a social meeting space for a wide array of people.”

While the EIS did not anticipate impacts on the mall, the Pratt report suggests that nearby development may call into question “the prospect of Fulton Mall as an economically and socially vibrant place and a destination for low and moderate-income shoppers.” (Here's a link to a Times article and Brownstoner discussion last December that's a bit less affectionate toward the mall.)

Again, that raises questions about whether the government should intervene to preserve retail or let the market work--and what exactly the market is. Will sneaker stores and discount emporiums stores--some of which pay very high rent, making it up with volume--exist in tandem with upscale shopping? In the near term, it’s likely they will.

So, what next--can FUREE and the Downtown Brooklyn Partnership schedule an open meeting together? That's doubtful, but it would be interesting to watch.

Slow down for a solution?

FUREE’s Leigh also said, “We hope this report shows it's time to stop the nonsense, slow down the development until the people who live here and know best can be part of the plan."

What exactly that means is another question. Assemblyman Hakeem Jeffries acknowledged in an interview in January that public officials have relatively little leverage, but may be able to use bond financing to nudge developers to create affordable housing.

Unanticipated impacts

The Pratt study notes:

The stated goal of the 2004 Downtown Brooklyn Plan was to stimulate the redevelopment of the area in order to encourage its continued transformation into New York City’s third central business district. The comprehensive development plan has created a set of negative impacts, some of which were outlined in the plan’s Environmental Impact Statement. However, many of the negative impacts that small businesses and households are currently experiencing were not taken into account by the EIS.

Displaced businesses

While the EIS analysis estimated that 100 businesses—and 1,700 jobs---would be directly displaced by new development, it concluded that this does not constitute a “significant adverse impact,” the Pratt study notes. Already more than 100 businesses in the rezoning area have already been displaced.

While the EIS analysis estimated that 100 businesses—and 1,700 jobs---would be directly displaced by new development, it concluded that this does not constitute a “significant adverse impact,” the Pratt study notes. Already more than 100 businesses in the rezoning area have already been displaced.The problem, according to Pratt, is that it is very difficult to meet the criteria for establishing a significant adverse impact--there must be a critical mass of unusual retail businesses. (What might be a solution? A relocation fund? Loans to re-establish businesses?)

Further, because the Downtown Brooklyn plan includes existing urban renewal areas, such as the Albee Square Mall with 731 jobs, the potentially lost jobs from those zones are not included because they were already subject to displacement--thus producing an undercount.

A change in character

The report notes:

As landowners clear out small businesses located on future development sites, moderate income office workers find that the shops they have patronized for years are gone. Also, as small businesses get displaced, the character of Downtown Brooklyn—particularly the Fulton Street Mall--as a shopping destination for low and moderate-income households is being threatened.

While the EIS analysis has a very narrow perspective on the neighborhood’s historical significance and character and how they are expected to change, the new residents and workers who are expected to come to the area will create significant impacts.

The report suggests that delis, barbershops, and other convenience retail shops serving moderate-income office workers will be lost, and other businesses—”from an array of small clothing stores to a specialized wig shop”—will be lost that currently serve people from a large area. The report concedes:

The report suggests that delis, barbershops, and other convenience retail shops serving moderate-income office workers will be lost, and other businesses—”from an array of small clothing stores to a specialized wig shop”—will be lost that currently serve people from a large area. The report concedes:While perhaps it would be difficult to argue that the small businesses in Downtown Brooklyn constitute a critical economic sector in Brooklyn or the city overall, their removal alters the character of Downtown Brooklyn’s thriving shopping district and decreases the number of establishments that offer affordable goods to shoppers.

The report notes that the Downtown Brooklyn EIS “fully acknowledges that the rezoning is very likely to impact the area’s character, but its framework for analysis is much more quantitative than qualitative,” suggesting positive impacts from increased development and demand, but ignoring those who might feel excluded.

Is it the market at work?

Again, this raises a question about the appropriate public policy. Given Downtown Brooklyn’s place as a transit and office hub, shouldn’t there still be a market for working-class shoppers?

And, if not, is Downtown Brooklyn redevelopment a project purely of the market? Not really. The Downtown Brooklyn Partnership has an $8 million annual budget, with $2 million from the city and hundreds of thousands of dollars from local businesses, property owners, and other institutions, according to the Pratt Center blog The Eminent Domain. (That still doesn’t add up to $8 million.)

Sharing the wealth

Change in Downtown Brooklyn was inevitable; the challenge is sharing the wealth created by public action. And it should be noted that the Downtown Brooklyn Partnership (DBP) hasn’t ignored all the concerns raised by FUREE. One critic of the rezoning, speaking at the FUREE convention in May, was the owner of the restaurant Tio Pio.

However, according to the latest Downtown Brooklyn Partnership newsletter, Tio Pio has moved to a new and much larger home, thanks to help from the MetroTech Business Improvement District (BID), a component of the DBP.

Who dropped the ball?

The report notes:

The only way for regular citizens to have participated in this process, at least in theory, would have been to try to influence members of Community Board 2 who had—but ultimately did not use—an opportunity to cast an advisory vote on the plan. Outside of this narrow official review process, there was no on-the-ground constituency group (or a coalition of groups) that pressured the city to ensure that the plan contained provisions to meet the needs of low and moderate-income people and small business owners who had been living and doing business in Downtown Brooklyn for many years.

All true, but unmentioned is that groups like FUREE and ACORN were otherwise engaged, as the New York Observer reported in 2006. According to coverage of that CB2 meeting in the 2/7/04 Brooklyn Paper, the opponents of the plan were worried about eminent domain, traffic impacts, and overdevelopment--not the concerns raised by FUREE.

By contrast, Atlantic Yards developer Forest City Ratner, promising ACORN and Community Benefits Agreement signatories affordable housing, job training, and the hiring/contracting of minorities and women in exchange for, essentially, a private rezoning at the scale the developer required.

Neither process seemed to work too well.

Supplemental EIS needed?

Though the Downtown Brooklyn EIS, under its reasonable worst-case scenario, estimated that only 979 residential units were likely to be created, that was way off. Does that mean there should be more analysis?

No. In July 2007, according to the Pratt Report, a city “technical memorandum” was issued assessing changes proposed for the Albee Square Mall site--from an EIS analysis that assumed more than 1 million square feet of office space and no residential units to a CityPoint project with some 125,000 square feet of office space and more than 1,000 housing units. However, the city concluded that no new significant environmental impacts would be created, so no Supplemental EIS was necessary.

That suggests that changes in the Atlantic Yards plan similarly will not generate a Supplemental EIS, despite a vastly different time frame. (A Supplemental EIS was requested in the lawsuit challenging the Final EIS, as petitioners said a wind study should have been included; Justice Joan Madden disagreed, dismissing the case, which is under appeal.)

Whither the Fulton Street Mall?

The Fulton Street Mall, faces an uncertain future, the report adds, calling the mall “a tremendously successful urban place” “in terms of retail performance and its viability as a social meeting space for a wide array of people.”

While the EIS did not anticipate impacts on the mall, the Pratt report suggests that nearby development may call into question “the prospect of Fulton Mall as an economically and socially vibrant place and a destination for low and moderate-income shoppers.” (Here's a link to a Times article and Brownstoner discussion last December that's a bit less affectionate toward the mall.)

Again, that raises questions about whether the government should intervene to preserve retail or let the market work--and what exactly the market is. Will sneaker stores and discount emporiums stores--some of which pay very high rent, making it up with volume--exist in tandem with upscale shopping? In the near term, it’s likely they will.

So, what next--can FUREE and the Downtown Brooklyn Partnership schedule an open meeting together? That's doubtful, but it would be interesting to watch.

Comments

Post a Comment