Forest City Ratner has heavily promoted the 2250 units of subsidized housing in the Atlantic Yards project, and that's been cited as a public use by two courts. However, there's no money available for it right now, more than a half year after a city official cited a "crisis" in the provision of affordable housing bonds.

In arguing for an expedited schedule to hear the appeal in the state lawsuit challenging the AY environmental review, the developer says resolution of the case would dampen uncertainty regarding arena financing and even would help build the project’s affordable housing, according to lawyer Jeffrey Braun.

Yes, the developer must start on the arena block as a whole to build the housing towers that would ring the arena. However, delay may be a silver lining for the housing component of Atlantic Yards. The city and state don’t have nearly enough capacity to allocate bonds for affordable housing projects, an issue highlighted last November by the Independent Budget Office.

Wrote Marc Jahr, president of the New York City Housing Development Corporation (NYC HDC) earlier this month in City Hall News:

It is only February, but over $960 million in private activity bonds are required for affordable housing deals in HDC’s 2008 pipeline alone, while New York State overall has a pipeline of more than $6 billion. Unfortunately, however, New York State’s yearly allocation of cap is only around $1.6 billion.

The AY demand

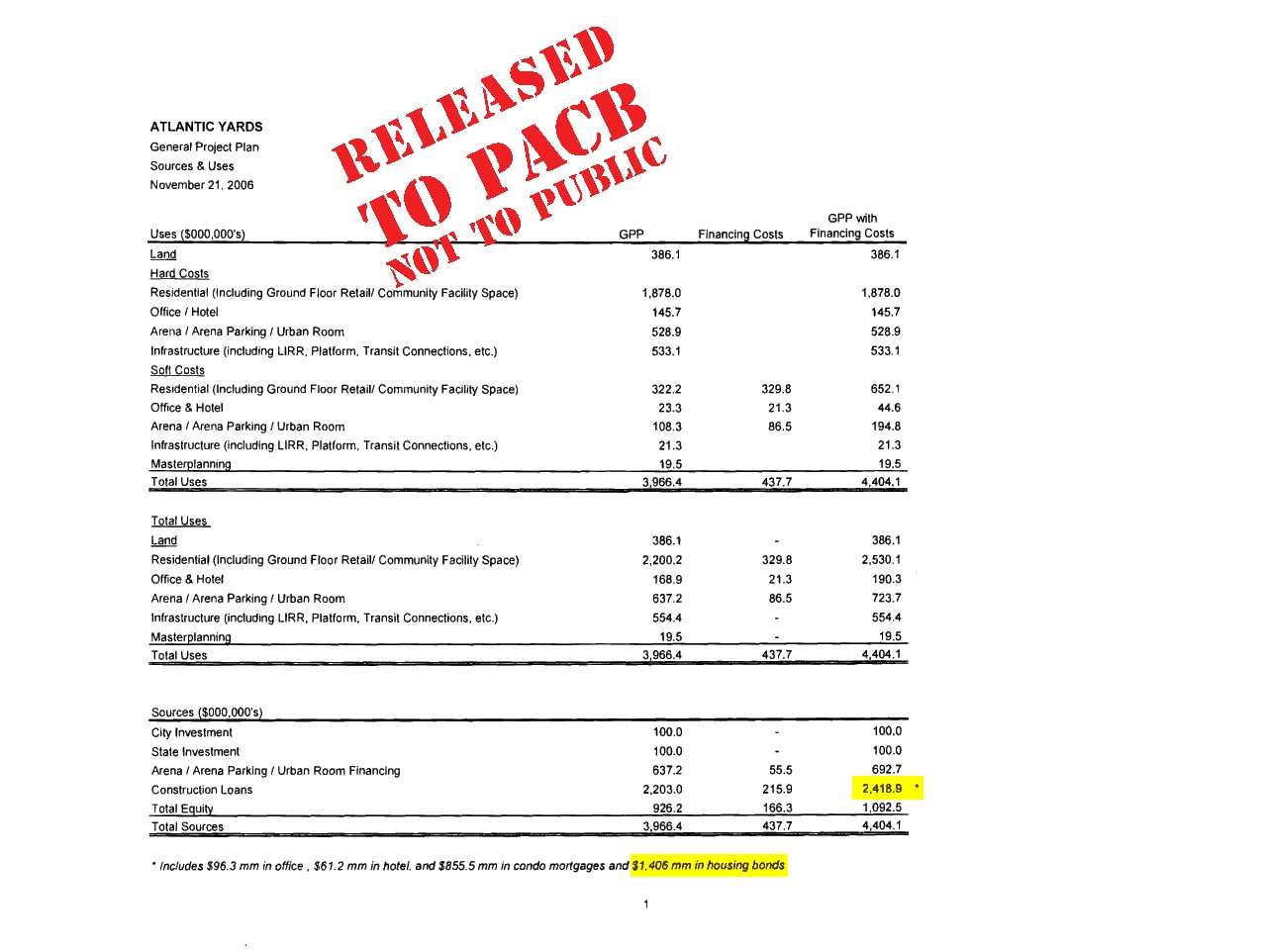

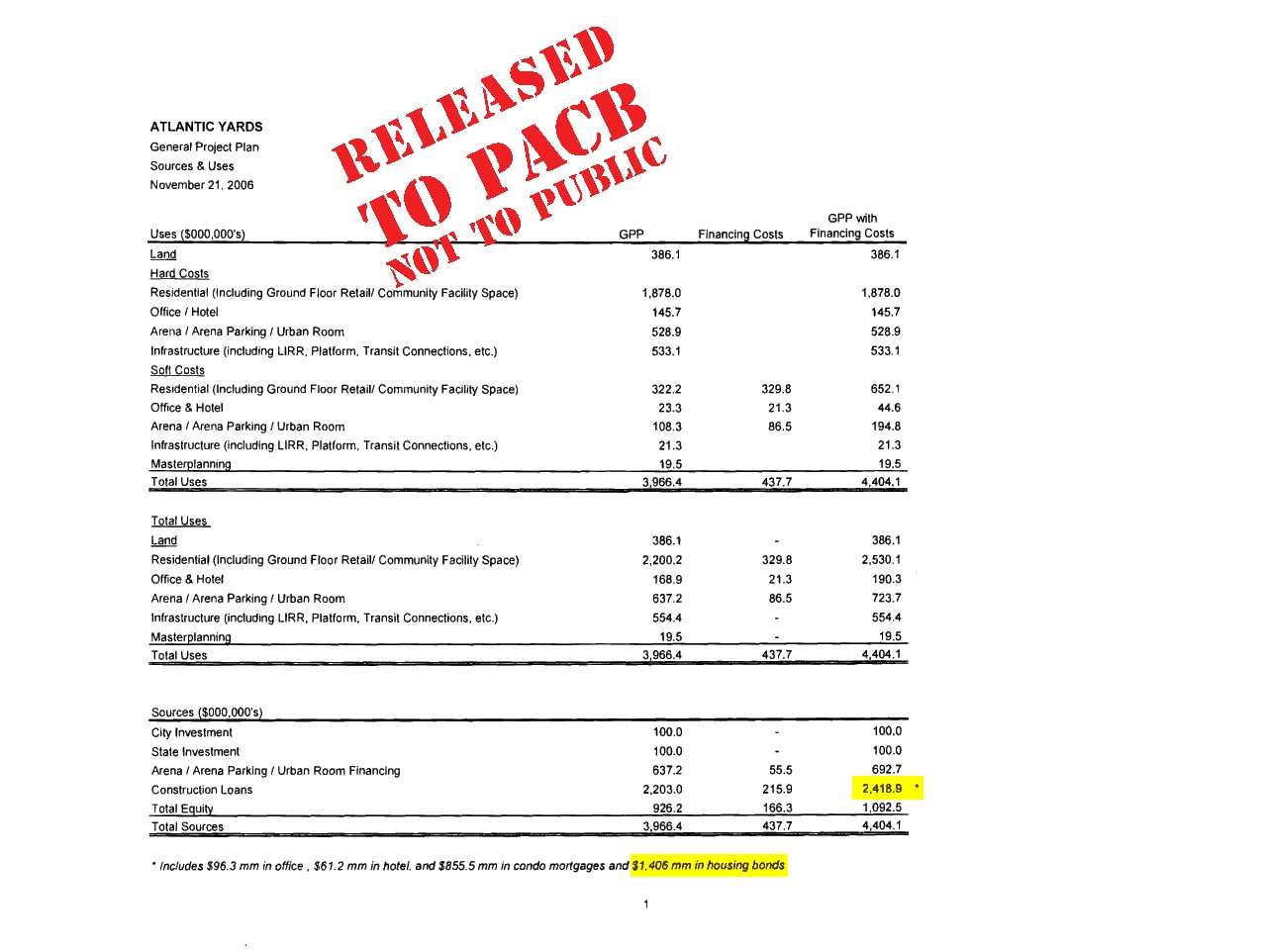

Atlantic Yards would require $1.4 billion in housing bonds, according to information the Empire State Development Corporation disclosed to the Public Authorities Control Board and made public in the lawsuit challenging the AY environmental reviews.

Atlantic Yards would require $1.4 billion in housing bonds, according to information the Empire State Development Corporation disclosed to the Public Authorities Control Board and made public in the lawsuit challenging the AY environmental reviews.

(The project is officially supposed to take a decade, so it’s not clear what segment of the total bond request would be sought each year. There's no evidence FCR has even applied for the bonds, though HDC officials didn't respond yesterday to a request for confirmation.)

So those bonds would be well behind requests made by many other developers seeking to make use of a very limited pool of affordable housing financing, a situation Shaun Donovan, commissioner of the city’s Department of Housing Preservation and Development (HPD) told Congress last May was a “crisis” threatening 6700 units in the city’s pipeline.

Such bonds allow the developer to borrow money at a lower interest rate, serving, essentially, as a discount mortgage, saving perhaps 15% on a project like Atlantic Yards. Most 80/20 projects, involving 80 percent market-rate and 20 percent low-income, are in Manhattan, and funded by the state agency, HFA.

The NYC HDC, which Donovan chairs, funds projects geared to a greater mix of incomes, such as Atlantic Yards, where the rental units would be 50 percent market-rate, 30 percent middle- and moderate-income, and 20 percent low-income.

Officials hope for the best

Volume cap is allotted nationally on a per capita basis, $85 per person. The federal government limits the amount of bonds a city or state can authorize, because the tax-exemption represents foregone federal revenue. Two weeks ago, I checked with city and state housing officials whether they expected federal help to deal with the “crisis.”

The answers indicated some optimism but great uncertainty.

HPD spokesman Neill Coleman responded, “We continue to pursue both an increase in the volume cap allocation and proposals to recycle bonds used to finance only the construction phase of multi-family rental housing and retired after two or three years. Congressman Charles Rangel, as Chair of the Ways and Means Committee, and Senator [Chuck] Schumer have been much-needed champions in Washington for the City’s affordable housing needs and are assisting us. We are hopeful we will see progress in the next few months.”

State Housing Finance Agency (HFA) spokesman Philip Lentz responded, “In Washington, there's not been much progress. Congress did not act on either idea Shaun mentioned in his testimony. There was an effort in the last week to put an amendment in the stimulus package to increase volume cap, but it was not successful. Sen. Schumer was one of the leaders in that effort.”

“Going forward, that means the state has virtually the same allocation of volume cap for '08 as '07 at a time when there is more demand for housing volume cap than there is supply. Making things more difficult this year is that most of the excess volume cap that had built up over the last few years (called "carryforward") was used up last year to meet the tremendous housing demand, which means there will be much less carryforward going into '08.”

New pressures

Because volume cap is in such short supply, Lentz noted, last month HFA announced new allocation criteria for 80/20 projects seeking volume cap financing, including projects that maintain affordable rental units for a longer period, “construction readiness and financing readiness;” and compliance with the city’s planning and development goals.

Michelle de la Uz of the Fifth Avenue Committee, a nonprofit developer, told me, "The fact that we're faced with limited volume cap means we're going have to reevaluate how existing and additional volume cap is used. It's seems to me that we've finally woken up that, whatever the volume cap, we have to ensure that it's used for the maximum public utility."

And that would lead to debates about supporting middle- and moderate-income housing versus low-income housing, as well as the reliance on for-profit developers, who typically charge higher developer fees than nonprofit developers, though the former would argue they have additional capacities to accomplish complex projects.

Also, Crain’s reported this week that the state strictures mean that only two or three of some 30 developers now seeking 80-20 housing bonds will get approval.

There are other pressures on affordable housing finance. The Real Deal reported that there’s a lowered market for Low Income Housing Tax Credits (LIHTC), a fallout from the mortgage crisis. The New York Observer reported that HPD has been lowering its estimates of new affordable housing construction, from 11,587 to 8,568 in the current fiscal year from 11,587 to 8,568, with 7,947 for the next fiscal year, beginning in July.

Movement in DC?

Earlier this month, Schumer raised the issue of volume cap. In his February 4 critique of the Bush administration’s budget proposal, Schumer noted that, while the Bush Administration has proposed a $15 billion increase in private activity bond cap over three years to respond to the subprime mortgage crisis, the plan offers too little money, should offer a permanent increase in the cap, and should finance multi-family housing, not just single-family housing

On January 30, the Senate Finance Committee adopted a key part of a proposal offered by Schumer that would allow state governments to issue more tax-exempt bonds to fund new construction of affordable housing. That measure, as Lentz said, apparently failed. Meanwhile, Schumer supports a more long-term proposal, which would provide a $10 billion-per-year increase nationally in the bond cap for 2008 and 2009 and make a $3 billion increase permanent.

That would serve a lot of projects in New York, so city and state officials are undoubtedly watching the issue closely. And so is Forest City Ratner.

AY not at starting line

Jahr, in his City Hall News article, cited increasing demand for affordable housing, a “rapid run-up in construction costs, the effects of rezonings, and changes in the 421-a tax program, as pressures on demand for housing bonds.

Besides the increase in volume cap, the city would like capacity to “recycle” bonds used to finance only the construction phase of multi-family rental housing, a process currently allowed only for single family homes--a policy “unfair to urban areas like New York City."

Jahr earlier this month told the Bond Buyer, "It's a pity to have good affordable housing projects in a city that desperately needs affordable housing for virtually all income levels, to have them sitting at the starting line with their engines idling.”

Atlantic Yards, apparently, isn’t even at the starting line.

In arguing for an expedited schedule to hear the appeal in the state lawsuit challenging the AY environmental review, the developer says resolution of the case would dampen uncertainty regarding arena financing and even would help build the project’s affordable housing, according to lawyer Jeffrey Braun.

Yes, the developer must start on the arena block as a whole to build the housing towers that would ring the arena. However, delay may be a silver lining for the housing component of Atlantic Yards. The city and state don’t have nearly enough capacity to allocate bonds for affordable housing projects, an issue highlighted last November by the Independent Budget Office.

Wrote Marc Jahr, president of the New York City Housing Development Corporation (NYC HDC) earlier this month in City Hall News:

It is only February, but over $960 million in private activity bonds are required for affordable housing deals in HDC’s 2008 pipeline alone, while New York State overall has a pipeline of more than $6 billion. Unfortunately, however, New York State’s yearly allocation of cap is only around $1.6 billion.

The AY demand

Atlantic Yards would require $1.4 billion in housing bonds, according to information the Empire State Development Corporation disclosed to the Public Authorities Control Board and made public in the lawsuit challenging the AY environmental reviews.

Atlantic Yards would require $1.4 billion in housing bonds, according to information the Empire State Development Corporation disclosed to the Public Authorities Control Board and made public in the lawsuit challenging the AY environmental reviews.(The project is officially supposed to take a decade, so it’s not clear what segment of the total bond request would be sought each year. There's no evidence FCR has even applied for the bonds, though HDC officials didn't respond yesterday to a request for confirmation.)

So those bonds would be well behind requests made by many other developers seeking to make use of a very limited pool of affordable housing financing, a situation Shaun Donovan, commissioner of the city’s Department of Housing Preservation and Development (HPD) told Congress last May was a “crisis” threatening 6700 units in the city’s pipeline.

Such bonds allow the developer to borrow money at a lower interest rate, serving, essentially, as a discount mortgage, saving perhaps 15% on a project like Atlantic Yards. Most 80/20 projects, involving 80 percent market-rate and 20 percent low-income, are in Manhattan, and funded by the state agency, HFA.

The NYC HDC, which Donovan chairs, funds projects geared to a greater mix of incomes, such as Atlantic Yards, where the rental units would be 50 percent market-rate, 30 percent middle- and moderate-income, and 20 percent low-income.

Officials hope for the best

Volume cap is allotted nationally on a per capita basis, $85 per person. The federal government limits the amount of bonds a city or state can authorize, because the tax-exemption represents foregone federal revenue. Two weeks ago, I checked with city and state housing officials whether they expected federal help to deal with the “crisis.”

The answers indicated some optimism but great uncertainty.

HPD spokesman Neill Coleman responded, “We continue to pursue both an increase in the volume cap allocation and proposals to recycle bonds used to finance only the construction phase of multi-family rental housing and retired after two or three years. Congressman Charles Rangel, as Chair of the Ways and Means Committee, and Senator [Chuck] Schumer have been much-needed champions in Washington for the City’s affordable housing needs and are assisting us. We are hopeful we will see progress in the next few months.”

State Housing Finance Agency (HFA) spokesman Philip Lentz responded, “In Washington, there's not been much progress. Congress did not act on either idea Shaun mentioned in his testimony. There was an effort in the last week to put an amendment in the stimulus package to increase volume cap, but it was not successful. Sen. Schumer was one of the leaders in that effort.”

“Going forward, that means the state has virtually the same allocation of volume cap for '08 as '07 at a time when there is more demand for housing volume cap than there is supply. Making things more difficult this year is that most of the excess volume cap that had built up over the last few years (called "carryforward") was used up last year to meet the tremendous housing demand, which means there will be much less carryforward going into '08.”

New pressures

Because volume cap is in such short supply, Lentz noted, last month HFA announced new allocation criteria for 80/20 projects seeking volume cap financing, including projects that maintain affordable rental units for a longer period, “construction readiness and financing readiness;” and compliance with the city’s planning and development goals.

Michelle de la Uz of the Fifth Avenue Committee, a nonprofit developer, told me, "The fact that we're faced with limited volume cap means we're going have to reevaluate how existing and additional volume cap is used. It's seems to me that we've finally woken up that, whatever the volume cap, we have to ensure that it's used for the maximum public utility."

And that would lead to debates about supporting middle- and moderate-income housing versus low-income housing, as well as the reliance on for-profit developers, who typically charge higher developer fees than nonprofit developers, though the former would argue they have additional capacities to accomplish complex projects.

Also, Crain’s reported this week that the state strictures mean that only two or three of some 30 developers now seeking 80-20 housing bonds will get approval.

There are other pressures on affordable housing finance. The Real Deal reported that there’s a lowered market for Low Income Housing Tax Credits (LIHTC), a fallout from the mortgage crisis. The New York Observer reported that HPD has been lowering its estimates of new affordable housing construction, from 11,587 to 8,568 in the current fiscal year from 11,587 to 8,568, with 7,947 for the next fiscal year, beginning in July.

Movement in DC?

Earlier this month, Schumer raised the issue of volume cap. In his February 4 critique of the Bush administration’s budget proposal, Schumer noted that, while the Bush Administration has proposed a $15 billion increase in private activity bond cap over three years to respond to the subprime mortgage crisis, the plan offers too little money, should offer a permanent increase in the cap, and should finance multi-family housing, not just single-family housing

On January 30, the Senate Finance Committee adopted a key part of a proposal offered by Schumer that would allow state governments to issue more tax-exempt bonds to fund new construction of affordable housing. That measure, as Lentz said, apparently failed. Meanwhile, Schumer supports a more long-term proposal, which would provide a $10 billion-per-year increase nationally in the bond cap for 2008 and 2009 and make a $3 billion increase permanent.

That would serve a lot of projects in New York, so city and state officials are undoubtedly watching the issue closely. And so is Forest City Ratner.

AY not at starting line

Jahr, in his City Hall News article, cited increasing demand for affordable housing, a “rapid run-up in construction costs, the effects of rezonings, and changes in the 421-a tax program, as pressures on demand for housing bonds.

Besides the increase in volume cap, the city would like capacity to “recycle” bonds used to finance only the construction phase of multi-family rental housing, a process currently allowed only for single family homes--a policy “unfair to urban areas like New York City."

Jahr earlier this month told the Bond Buyer, "It's a pity to have good affordable housing projects in a city that desperately needs affordable housing for virtually all income levels, to have them sitting at the starting line with their engines idling.”

Atlantic Yards, apparently, isn’t even at the starting line.

Comments

Post a Comment