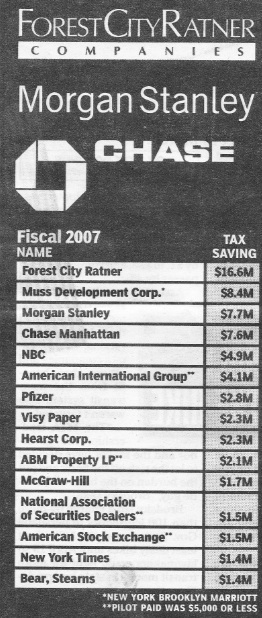

It's a Christmas story, sort of. Daily News columnist Juan Gonzalez, writing last Thursday in a column headlined Deals that lead to lost property taxes, highlighted the city's annual loss of $107 million "in property taxes last year because of privately negotiated deals with some of the world's richest companies." The abatements average "a whopping 60% per company." (Graphic from Daily News)

It's a Christmas story, sort of. Daily News columnist Juan Gonzalez, writing last Thursday in a column headlined Deals that lead to lost property taxes, highlighted the city's annual loss of $107 million "in property taxes last year because of privately negotiated deals with some of the world's richest companies." The abatements average "a whopping 60% per company." (Graphic from Daily News)Well, the deals may have seemed reasonable at the time, but... there's little oversight of PILOT (Payments in Lieu of Taxes), incentive deals to keep jobs in town. Only after a 2005 audit from city Comptroller William Thompson did the City Council require the mayor's office to report to the Council speaker regarding PILOT revenues and expenditures.

Focus on FCR

The report Gonzalez obtained presented Brooklyn's biggest developer as the city's savviest dealmaker. He wrote:

The undisputed king of PILOTs is real estate developer Bruce Ratner. His Forest City/Ratner firm paid the city $9.7 million last year for half a dozen commercial buildings the company owns in downtown Brooklyn. That sounds like a lot of money - until you realize it's only one-third of the company's actual $26.3 million property tax bill.

...Forest City spokesman Loren Riegelhaupt defended the company's success at landing PILOT subsidies.

"A lot of those buildings in MetroTech were constructed when downtown Brooklyn was not what it was today," Riegelhaupt said. "Many businesses were fleeing to New Jersey in the 1990s, and we were willing to invest in that area when others wouldn't."

Others have defended those deals too, though city officials in this and other cases did not anticipate the swiftness of the borough's revival, which makes such deals look questionable in retrospect.

Develop Don't Destroy Brooklyn commented:

Yes, Ratner's folks should be proud of how great they are at feeding at the public trough. Forest City Ratner's defense of their use of PILOTs for Metrotech is that in the 1990s "downtown Brooklyn was not what it was today." Then what, exactly, is their defense for receiving PILOTS for their Atlantic Yards project near that Downtown Brooklyn which is what it is today -- a booming real estate market where many are willing to invest.

Arena PILOTs

Gonzalez's column also included this tantalizing line:

That doesn't even count PILOTs that have yet to kick in for Forest City's Atlantic Yards mega-project.

The numbers rgarding AY remain murky, but the September 2005 Atlantic Yards Fiscal Brief issued by the Independent Budget Office provides some clue. Low-cost financing for construction of the arena and its parking garage will come from tax-exempt private activity bonds issued by a not-for-profit local development corporation (LDC). But they wouldn't be repaid the way most bonds are repaid, the IBO said:

Instead they will be backed by semi-annual payments-in-lieu-of-taxes (PILOTs) from Forest City Ratner Companies to the LDC. The MOU states that the PILOTs may not exceed the property taxes that would be paid if the property was not tax exempt, although the agreement offers no indication as to what if any discount from regular property tax would be used.

In the event that the PILOT payments exceed the debt service, 10 percent will go toward maintenance and capital reserves for the arena and the rest will go to ESDC; the city will receive none of the excess. If the PILOT is too small to cover debt service on the full $555.3 million cost of construction, taxable bonds will be sold to cover the difference and FCRC will pay the debt service on these taxable bonds.

The developer would save in two ways. First, the cost of debt to build the arena via tax-exempt financing is lower than it would be via taxable financing--a savings with a present value of $91 million in 2005 dollars.

Not property tax equivalent

The IBO added:

There is a second source of savings for Forest City Ratner Companies from this financing arrangement. Although FCRC will make what the Memorandum of Understanding refers to as PILOT payments to the LDC, these payments are not the equivalent of city property tax payments. Instead they will cover the construction costs for the arena in the first 30 years—and some arena maintenance if the PILOTs exceed debt service. In a more conventional development model, a developer would need to make both construction financing payments and property tax payments for any property tax liability remaining after applying available abatements and exemptions. In the Atlantic Yards case, while the PILOTs are used to pay financing costs in the first 30 years, FCRC will save the cost of property taxes that would normally be due after as-of-right tax benefits expire. If we assume that the arena would have a market value of approximately $100 per square foot, then the savings have a present value of $14 million in 2005 dollars. In the remaining 69 years, when there is no debt service, 10 percent of the PILOT payment will cover arena maintenance costs stemming from operation of the arena for the private benefit of FCRC, with the balance going to ESDC. The city would get no portion of the PILOT from the arena building.

(Emphasis added)

I'm not sure if I'm reading that right, but it seems that the PILOT payments after 30 years (it's a 99-year lease) would provide further savings, to the developer, with some benefit to the state but none to the city.

IBO’s estimate of new property tax revenue lost to the arena PILOT does not include a loss of property taxes for the MTA land that would be part of the arena building foot print. The city currently receives no tax payment from the MTA for the rail yard because the MTA, like other state entities, is exempt from local property tax. Under the MTA’s Request for Proposals, any developer acquiring the development rights to the site would probably enter into a long-term lease, leaving the MTA in place as the owner. Therefore, the property would likely remain off the city’s tax roll, resulting in no impact on the city budget. Indeed, the MTA has an incentive to make a deal that maintains the tax exemption in order to maximize the price it receives for the development rights.

Times avoidance?

Gonzalez questioned why the PILOTs story hasn't made the New York Times:

So why haven't we heard much about these other tax giveaways in, say, the liberal New York Times? Maybe because the newspaper of record is feeding at the same trough.

The Times paid $219,000 in PILOTs last year for its new printing plant in College Point, Queens, the report said. That's a paltry 13% of the $1.7 million assessed tax on the Times plant.

Now, the Times's business interests are not supposed to affect news coverage and, in general, I don't think they do. Then again, the Times hasn't carefully covered news regarding its own Times Tower, built in partnership with Forest City Ratner. So, the issue can't be dismissed.

Comments

Post a Comment